Will Automakers Embrace "Self-Disruption" by 2025?

![]() 05/27 2025

05/27 2025

![]() 596

596

Original by New Energy Outlook (ID: xinnengyuanqianzhan)

2807 words in full text, 8 minutes reading time

In the past month, automakers such as FAW-Volkswagen, NIO, Geely, and BYD have joined the ranks of restructuring their organizations, wielding the knife towards themselves.

FAW-Volkswagen has seen the most extensive integration, with specific adjustments involving multiple departments such as marketing, service, and user operations. Previously, FAW-Volkswagen had already split and integrated the ID. Operations Center, with product functions returning to the product department and sales functions returning to the sales department.

The main aim of FAW-Volkswagen's reform is to enhance user services and product marketing, both of which are the lifeblood of automakers.

Besides FAW-Volkswagen, Geely suddenly announced the privatization and delisting of Zeekr, NIO merged its half-year-old sub-brand Ledao into its headquarters system, SAIC and GAC restructured their frameworks, and BYD centralized the PR teams of Denza and Equation into the group for unified management...

From joint venture giants to independent brands, this collective reform by automakers seems to be streamlining internal structures and shedding redundant burdens, but in reality, there are hidden currents and premeditated strategies. Because in the midst of industry changes, only automakers that seize the initiative have the capital to advance to the next round.

1. From "Going It Alone" to "Fighting as a Team"

In 2025, the trend in the automotive market is towards "integration".

As early as April 16, SAIC Motor planned to integrate several parts subsidiaries of its Huayu Automobile into a brand-new intelligent chassis architecture company. The integration started in March this year and is expected to be completed in June. The new company will be headed by Lu Yong, the former head of SAIC Motor's Innovation and Research Institute.

Just four days prior, SAIC Motor announced the completion of the integration of its intelligent driving team, with Lingshu Technology and the Research Institute officially merging into one. Except for the two departments of electronic architecture and computing platform development, the rest of the teams have been merged into the Research Institute.

Image/Lingshu Technology and the Research Institute merge into one

Source/Screenshot from New Energy Outlook on the Internet

At the end of April, GAC announced a deep restructuring of its R&D system, splitting GAC Research Institute into three independent research institutes for vehicles, platforms, and styling, all of which were incorporated into GAC Group's product department. The new "large R&D system" will take shape in July.

In early May, according to multiple media reports, NIO's sub-brands Ledao and Firefly were deeply integrated into the NIO system, specifically involving Ledao's brand product R&D, user services, vehicle marketing departments, and the Firefly division.

Almost simultaneously, Geely announced the privatization of Zeekr Technology Group. After the privatization proposal is implemented and completed in the future, Zeekr will be delisted from the New York Stock Exchange.

Coincidentally, BYD also spread news of integration. The PR departments of Denza and Equation were "upgraded" to the group level, uniformly managed by Li Yunfei, General Manager of BYD Group's Brand and Public Relations Department.

It's worth noting that this wave of integration did not suddenly erupt.

As early as last year, many automakers showed their "integration cards". For example, Geely issued the "Taizhou Declaration", merging Geometry into Galaxy, merging Lynk & Co. with Zeekr, and integrating Radar and Yizhen into Geely; Great Wall issued the "ONE GWM" brand strategy, integrating the sales and after-sales channels of Ora into Haval; SAIC allowed Feifan to return to Roewe.

Image/Geely issued the "Taizhou Declaration"

Source/Screenshot from New Energy Outlook on the Internet

Most consumers hold an optimistic attitude towards the integration of automakers. They believe that integration is a good thing, as it will concentrate resources more after integration, allowing automakers to have more funds and energy to develop better technologies and produce higher-quality products.

"When buying cars before, the different brands under the same automaker were confusing, and there were even overlapping products and vague positioning. Now, after integration, automakers can focus their energy on core brands, which may lead to the launch of more competitive models. Moreover, the cost of car manufacturing will decrease, and car prices may become more affordable, which is a benefit for us consumers."

"After the concentration of resources, automakers may invest more in R&D in areas such as intelligent driving and in-car systems, making our car usage experience smarter."

2. Price Wars Have Collapsed, So Can We Only Save Our Own Money?

The "integration tide" among automakers is no coincidence. It may be a chain reaction triggered by multiple rounds of price wars in the automotive market last year. After all, although price wars have preserved market share to a certain extent, they have also brought enormous financial pressure on automakers.

This can be glimpsed from the annual financial reports of various automakers.

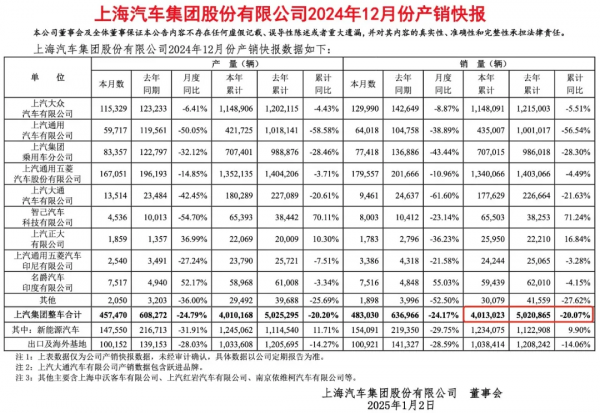

Last year, SAIC Motor sold a total of 4.013 million vehicles, a year-on-year decline of 20%. Except for IM Motors and SAIC Chia Tai, all sub-brands saw a year-on-year decline; total revenue was 627.59 billion yuan, a year-on-year decline of 15.73%, and net profit attributable to shareholders of listed companies was 1.666 billion yuan, a year-on-year decline of 88%.

Image/SAIC Motor's production and sales bulletin for December 2024

Source/Screenshot from New Energy Outlook on the Internet

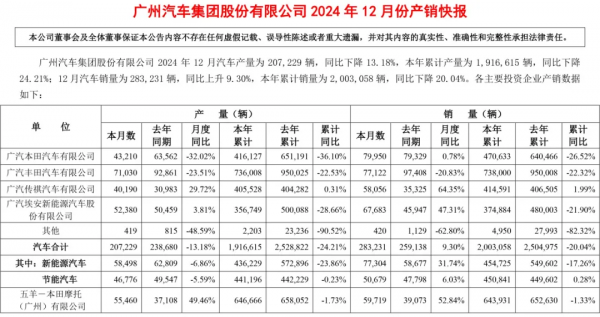

GAC Group sold a total of 2.003 million vehicles, a year-on-year decline of 20.04%. Except for a slight year-on-year increase of 1.99% for GAC Trumpchi, all sub-brands and joint venture brands saw a decline; total revenue was 107.78 billion yuan, a year-on-year decline of 16.9%, and net profit attributable to shareholders of listed companies was 824 million yuan, a year-on-year decline of 81.4%.

Image/GAC Group's production and sales bulletin for December 2024

Source/Screenshot from New Energy Outlook on the Internet

Among them, some automakers have relatively optimistic market conditions. For example, Geely sold a total of 2.17 million vehicles last year, an increase of 32% year-on-year; total revenue was 240.19 billion yuan, an increase of 34% year-on-year, and net profit attributable to shareholders of listed companies was 16.6 billion yuan, an increase of 213% year-on-year. BYD sold a total of 4.27 million vehicles, an increase of 41% year-on-year; total revenue was 777.1 billion yuan, an increase of 29% year-on-year, and net profit attributable to shareholders of listed companies was 40.25 billion yuan, an increase of 34% year-on-year.

Image/Geely's sales in 2024

Source/Screenshot from New Energy Outlook on the Internet

However, after detailed analysis, the sales growth of these two automakers mainly relies on low-priced models below 200,000 yuan, and they still face many challenges in expanding the high-end market. Based on this, in response to the increasingly fierce market competition and the urgent need for premiumization, they have also taken the step of integration.

Besides cost reduction and efficiency enhancement to alleviate the financial pressure brought by "trading price for volume", the deeper reason behind automakers' integration may also lie in considerations of capital operation and brand matrix optimization.

Looking back at history, in the past decade, some automakers have implemented a multi-child strategy and launched multiple sub-brands to seize more market share, but this strategy has gradually exposed its drawbacks. For example, brands like Zeekr and Lynk & Co., Feifan and Roewe, have overlapping product positioning, target customer groups, and technology roadmaps, leading to intensified brand internal friction and user confusion.

Most consumers believe that there are numerous new energy brands on the market, many of which even have vague positioning, making it difficult to distinguish and remember them, often leaving consumers at a loss when making purchases.

At the same time, the operation of multiple brands also distributes resources such as R&D, production, and marketing, resulting in a waste of resources and hindering the improvement of brand competitiveness.

As a result, the once "divide and conquer" strategy has now evolved into a dilemma where "spreading out too much has dragged down the main channel".

Cui Dongshu, secretary-general of the Passenger Car Association, said that automakers are increasingly paying attention to financial health and profit per vehicle, so they choose strategic contraction and brand integration to cope with the fierce competition in the new energy automotive market.

3. Prepare for a More Brutal 2026 in the Best Condition?

Taking a comprehensive view of automakers in the automotive market who are "turning the knife inward", although their current paths of "wielding the knife" are quite different, their goals are obviously convergent—aiming to prepare for the upcoming year of new energy products.

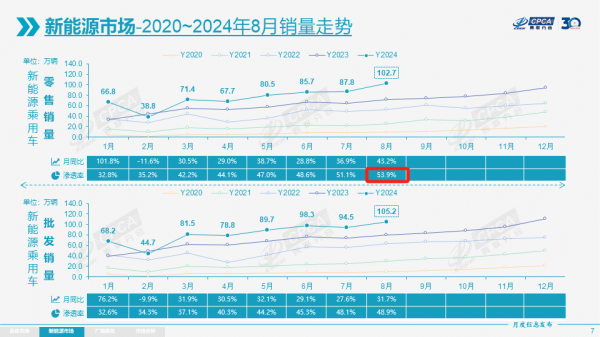

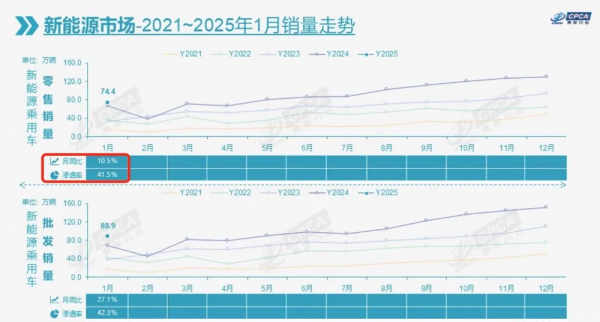

Judging from the current market situation, with the development of the new energy market, market demand seems to be gradually saturating. After reaching a high point of 53.9% in August last year, the domestic new energy retail penetration rate began to decline, falling to 41.5% in January this year. It has warmed up in the past two months, basically stabilizing at around 51%.

Image/Domestic new energy retail penetration rate reached 53.9% in August 2024

Source/Screenshot from New Energy Outlook on the Internet

At the same time, major automakers continue to launch new models to compete for market share. According to incomplete data statistics, there have been dozens of new energy vehicles launched on the market from January this year alone.

In such an environment, the "war" in the new energy automotive market in 2026 is expected to be even tougher.

This seems to be indirectly confirmed by the flags previously set by automakers like NIO and XPeng, stating that they "aim to achieve profitability in the fourth quarter".

However, it is worth noting that the integration path of automakers is not all smooth, and there are many hidden concerns.

At the automaker level, large-scale organizational restructuring involves personnel changes, departmental reorganization, business process reshaping, and other aspects. The teamwork within the company, the collaboration mode between different departments, and the reconstruction of communication mechanisms all require time. Improper handling can easily lead to the intensification of internal conflicts, reduced work efficiency, and further affect the advancement of key businesses such as product R&D and market promotion.

At the consumer level, in contact with many consumers, we can easily find that many of them are concerned about the protection of their rights and interests after the integration of automakers, and choose to wait and see for a while before making a purchase.

Image/Domestic new energy retail penetration rate was 41.5% in January 2025

Source/Screenshot from New Energy Outlook on the Internet

"I'm particularly afraid that the service outlets will also be merged after integration, so won't maintenance and repairs require traveling a long distance? It's too inconvenient, and there's a possibility that the waiting time for car maintenance and repairs may also increase."

"Will brand integration lead to frequent changes in after-sales personnel and unfamiliarity with new employees' business, ultimately affecting us consumers?"

"I'm worried that the quality of service will decline after integration. Will some of the brand's special services that I valued when buying the car disappear?"

Some consumers also have doubts about the speed of new product launches, worrying that after centralized management of multiple brands, automakers may limit technological innovation due to complex management, leading to a slowdown in the iteration and renewal of new models.

Reform is a double-edged sword. If done well, it can enhance brand competitiveness through resource concentration to seize more market share. If done poorly, it may face the risk of shaking the original foundation.

Obviously, automakers that have embarked on the path of reform have already sounded their own "battle for survival".

[The lead image is generated by AI]