BYD and Geely's Price War Escalates, with the Hardest Reality Yet to Come

![]() 05/27 2025

05/27 2025

![]() 634

634

Introduction

Introduction

Price cuts have become a core technology.

Last week, Wei Jianjun of Great Wall Motors said that the automotive industry has already seen potential risks similar to those faced by Evergrande, but they have not yet exploded.

Right after the remark, BYD announced a new round of price adjustments, with a limited-time promotion for a total of 22 intelligent driving models under its Dynasty and Ocean networks, offering subsidies of up to RMB 53,000. Among them, the Qin PLUS DM-i intelligent driving version starts at RMB 63,800, the Seal 06 DM-i intelligent driving version starts at RMB 76,800, and the Seagull intelligent driving version starts at RMB 55,800.

As a leading player in China and the global new energy vehicle market, BYD, which holds the pricing power for new energy vehicles, has once again resorted to the big stick of price wars, aiming to stir up the volatile automotive industry once more.

This round of price cuts has indeed received a positive response from the industry. First, the capital market, with its keen sense of smell, saw its stock prices collapse directly due to the price war, spreading pessimism.

On May 26, the auto sector of both A-shares and Hong Kong stocks fell collectively, with BYD's A-shares falling by more than 6% at one point. Thalys, Great Wall Motors, Changan Automobile, BAIC BluePark, SAIC Motor, and GAC Group all fell by more than 2%. In the Hong Kong stock market, the situation was even bleaker, with both traditional automakers and new forces in carmaking suffering losses. Zero Running, BYD, and Geely fell by more than 8%.

Soon, the trend of price cuts spread throughout the automotive circle. On the afternoon of May 26, Geely Galaxy also announced its participation in the price war, covering multiple popular models with subsidies ranging from RMB 5,000 to RMB 18,000. In particular, the popular model Xingyuan from Geely Galaxy, which originally cost around RMB 70,000, saw its limited-time starting price drop to RMB 59,800. Other models such as the L6, Xingjian 7, and E5 also offered prices of RMB 69,800, RMB 79,800, and RMB 89,800, respectively, essentially going head-to-head with BYD.

If sporadic price wars do not have a significant impact on the industry, they can at most be considered dynamic adjustments. However, with BYD and Geely, the top two players, engaging in fierce competition, it is bound to cause a dramatic shock to the industry, gradually pushing the industry-wide price war into deeper waters. So far, Zero Running, IM Motors, SAIC-GM, and others have also announced their participation, and more companies such as Chery and Changan are expected to be forced to join this battle.

01 Inventory Overflow, Necessitating a Price Cut

The term 'one-price' was originally used by joint venture automakers in the Chinese market to strip away excesses and return to the most authentic terminal transaction price. Unexpectedly, once the use of this term spread, especially when leading automakers flocked to the one-price strategy, it signaled that the Chinese automotive industry was about to enter another stage of fierce competition.

This price war was initiated by BYD and was quickly followed by new force Zero Running.

On May 25, Zero Running Automobile released a poster for the Dragon Boat Festival, announcing a new one-price policy. The Zero Running C16 Extended Range 200 Smart Edition is priced at RMB 111,800, and the Zero Running C11 Extended Range 200 Smart Edition is priced at RMB 103,800.

Both extended-range models are entry-level versions of their respective series. When combined with trade-in or scrapping subsidies, customers can enjoy a maximum subsidy of RMB 20,000. The Zero Running C01 can be purchased for only RMB 94,800, the C16 for RMB 91,800, and the C11 for RMB 83,800. It's worth noting that Zero Running's models have always been on the larger side, meaning that for less than RMB 100,000, one can buy a C-segment car with a length exceeding 5 meters, which is practically a steal.

Following that was Geely, mentioned at the beginning of the article. Standing at the critical juncture of cumulative sales exceeding 1 million units and aiming for annual sales of 1 million units this year, Geely had to reluctantly join the fray to defend its expected market share and space. Especially in the market below RMB 100,000, consumers are particularly price-sensitive, and more consumers without brand preferences may switch to purchasing models from competitors due to a price difference of just RMB 3,000.

In fact, the price war has been underway since the beginning of the year, with BYD having already implemented multiple price cuts. According to statistics, BYD has launched promotions for the third time since March. At the end of March this year, BYD's Ocean Network and Dynasty Network introduced limited-time 'one-price' offers for some entry-level non-intelligent driving versions. The starting price of the Qin L DM-i non-intelligent driving version was reduced by RMB 10,000 to RMB 89,800, and the starting price of the Song L DM-i non-intelligent driving version was reduced by RMB 16,000 to RMB 119,800.

Secondly, starting from May 1, BYD increased the trade-in subsidy standards for some intelligent driving models. For example, the Han EV intelligent driving version, Han DM-i intelligent driving version, and Tang DM-i intelligent driving version received comprehensive subsidies starting at RMB 35,000, including RMB 15,000 from the manufacturer and RMB 20,000 from the government. The scale and scope of this promotion far exceeded the previous two.

The logic behind the price cuts is undoubtedly related to the development pressure faced by the companies themselves. Take BYD as an example; the Dynasty and Ocean series are the core sales drivers for BYD. However, this year, several of its pillar products have faced challenges from competitors, resulting in a decline in market share.

It's worth noting that BYD's highest monthly sales volume previously reached 500,000 units. However, in the first four months of this year, BYD's average monthly sales volume was only over 300,000 units, with domestic sales not even reaching 300,000 units per month. Although it still holds the top spot, it is far from its target, and several previously leading models have been overtaken by more competitive models from competitors like Geely Galaxy, forcing BYD to reduce prices under pressure.

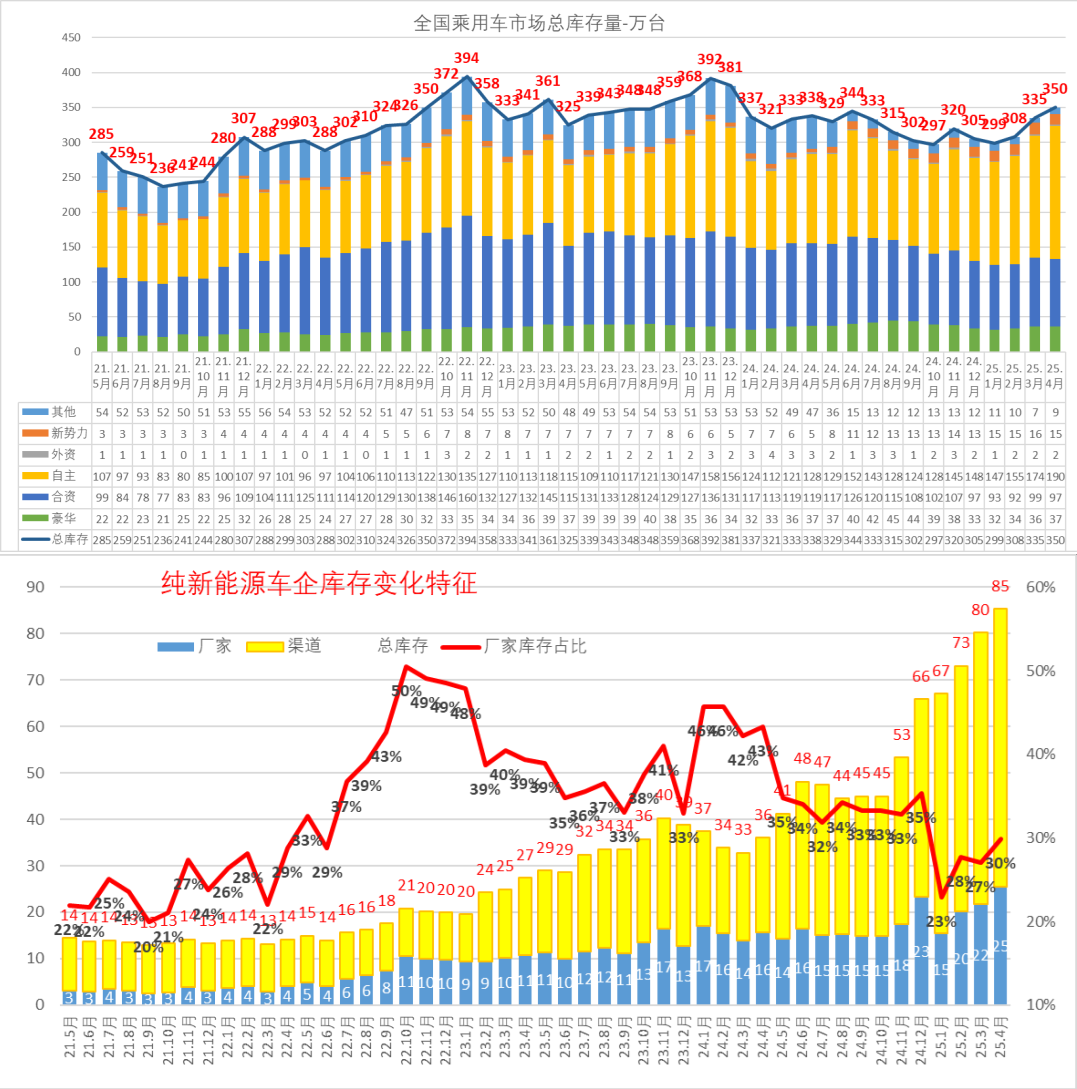

On the other hand, there is the issue of supply and demand balance. A week ago, the China Passenger Car Association (CPCA) released news that passenger vehicle inventory had surpassed the 3.5 million mark, setting a new record for the same period in previous years. Among them, new energy vehicle inventory has reached a historical peak in recent years at 850,000 units, with overall pressure continuing to increase.

What do these inventory figures mean? Just look at the same period in previous years. In 2024, no month reached this level, with the highest inventory that year being only 3.44 million. Even at the end of April 2023, inventory was only 3.25 million, and at the end of April 2022, it was 2.88 million.

According to the CPCA's statistics on inventory over the years, inventory levels must decrease in April because June to August is traditionally a slow season for car sales, and dealers cannot withstand high inventory levels. Considering that the entire automobile market grew by 7.9% from January to April this year, this means that under subsidies, the consumption potential for car upgrades and replacements has been largely released, and subsequent growth will continue to be under pressure.

Another issue is that the new national standard for safer batteries and the new energy subsidy policy are about to decline. If inventory is not reduced in a timely manner, older products will become a hot potato for both manufacturers and dealers. That's why we can see why multiple automakers have announced limited-time promotions, ranging from a week to a month, with the core reason being to help dealers offload inventory.

02 Price Cuts Are a Double-Edged Sword

Behind the inventory backlog lies, on the one hand, the ambition of automakers to operate their production capacity at full capacity, with new energy vehicle production lines running around the clock like dumplings being boiled. On the other hand, some automakers have treated their production lines as money-printing machines in order to boost sales, forgetting that market demand is ultimately limited. It's like a restaurant frantically preparing dishes, but the number of diners is uncertain, ultimately leading to the inevitable discarding of leftovers.

On the dealer side, pressured by inventory and sales, they naturally welcome this official momentum because official promotions can stimulate indecisive customers to make decisions, accelerate sales, and relieve high inventory pressure. Some head brand dealers said that the current inventory coefficient has approached 3.

Of course, there are optimists who believe that this price war will not last too long and is only a dynamic adjustment for the entire system. However, at this pace, whether it's BYD, Geely, or new forces, the price war will inevitably disrupt the original price system order. It will also easily create an impression on social media and among consumers that cars should now be priced at these levels, which will be a significant blow to brand image, reputation, and the ecosystem of existing car owners.

In fact, besides the wave of price cuts brought about by inventory pressure, the downward trend in prices is also an inevitable outcome for automotive consumers in the current economic environment.

Especially since the introduction of trade-in policies, passenger vehicle consumption has shown a deflationary trend of 'increasing volume and decreasing prices,' driven by the increase in demand for mid- and low-end vehicles. Normally speaking, when consumers upgrade or replace their cars, they aim for consumption upgrades. If they originally owned an A-segment sedan, they would upgrade to a B-segment sedan or SUV.

However, with abundant market supply, new energy, intelligence, larger space, and more configurations, consumers can enjoy a better driving experience than their old cars for less money. This undoubtedly pushes the price range of automobile consumption downward.

With large volumes and low prices, the automotive industry has not achieved high-quality upgrades. After rounds of competition, it has been found that industrial value has not been significantly enhanced. One of the key indicators behind value is profit.

According to data from the National Bureau of Statistics, in the first quarter of 2025, the profit rate of the automotive industry was only 3.9%, lower than the average level of downstream industrial enterprises. In the previous year, 2024, China's automobile production and sales both exceeded 31 million units, setting a new record high. At that time, the profit rate of the automotive industry was 4.3%.

Compared with international leading automakers, the profit rate is quite low. The total profit of all listed passenger vehicle companies in China is less than 40% of Toyota's annual profit. In an industry with high investment like automotives, ultra-low profits cannot sustain the industry's continuous and healthy development. Therefore, practitioners share the same feeling: it's intense and exhausting.

For consumers, short-term price cuts can indeed stimulate consumption and provide benefits. However, in the long run, this seemingly lively but intrinsically distorted state will have a severe impact on the entire industry ecosystem.

If car prices drop and manufacturers can still make a profit, and the industry ecosystem can be maintained healthily, then this is indeed a core technology and competitiveness. However, for manufacturers to reduce prices, costs must be shared across the entire supply chain. Payment term pressure and cost pressure make it difficult for the supply chain to maintain a healthy state. This is why Wei Jianjun pointed out sharply: 'What kind of industrial product can reduce its price by RMB 100,000 while still guaranteeing quality? This is absolutely impossible.'

More than a week ago, senior officials from the National Development and Reform Commission stated that 'inward-turning' competition affects the high-quality development of the industry, distorts market mechanisms, and disrupts the order of fair competition, and must be rectified. 'Anti-inward-turning' has been mentioned repeatedly at the national level.

But the most realistic question is, why does the industry become increasingly intense despite repeated calls for 'anti-inward-turning'?

Editor-in-Charge: Cui Liwen, Editor: He Zengrong