Global Layoffs May Not Rescue Volvo's Struggling Future

![]() 05/27 2025

05/27 2025

![]() 451

451

While layoffs might temporarily prolong life, securing a winning future necessitates comprehensive efforts across technology, products, and brands.

Text

Recently, Volvo, a well-established second-tier luxury brand, unexpectedly announced significant news.

Unsurprisingly, it wasn't good news.

Put simply, Volvo unveiled a global cost-reduction plan worth approximately RMB 13.5 billion. The initial step? Global layoffs.

From a financial perspective, Volvo indeed needs to cut costs and boost efficiency.

In the first quarter of this year, Volvo's profit was a mere RMB 1.4 billion. Notably, in the same period last year, it reported a profit of RMB 4.7 billion, marking a steep 70% decline.

This has compelled Volvo to initiate self-rescue measures.

But will it be effective?

For Volvo, the profit plunge is merely a superficial symptom; the strategic imbalance is the fatal wound.

I. Market Collapse: Decline in Fuel Vehicles and Struggles with Electric Vehicles

Let's start with the domestic market.

In 2024, Volvo's sales in China amounted to 156,000 units, a year-on-year decrease of 8.2%, hitting a five-year low.

This downward trend has persisted into the current year.

What's the solution?

Obviously, it's to slash prices. According to third-party data, the terminal discount for the XC60 reached RMB 80,000 to 100,000, and for the S90, it was RMB 60,000 to 80,000, yet these discounts failed to stem the decline.

Of course, the decline in fuel vehicle sales is just one aspect of Volvo's woes; the other is the struggle to establish itself in the electric vehicle market.

The starting price of the high-end pure electric model EM90 is RMB 818,000, deemed excessively high and mocked by netizens as "selling logos and giving away cars." In April 2025, only 28 units were sold.

Though the micro-electric EX30's starting price is over RMB 200,000, it's incompatible with the Chinese market, with only 40 units sold in April.

Such sales figures are dire.

How about Volvo's core European market?

Due to Europe's ban on the sale of fuel vehicles, overall sales of fuel vehicles continue to decline.

However, there's also some good news.

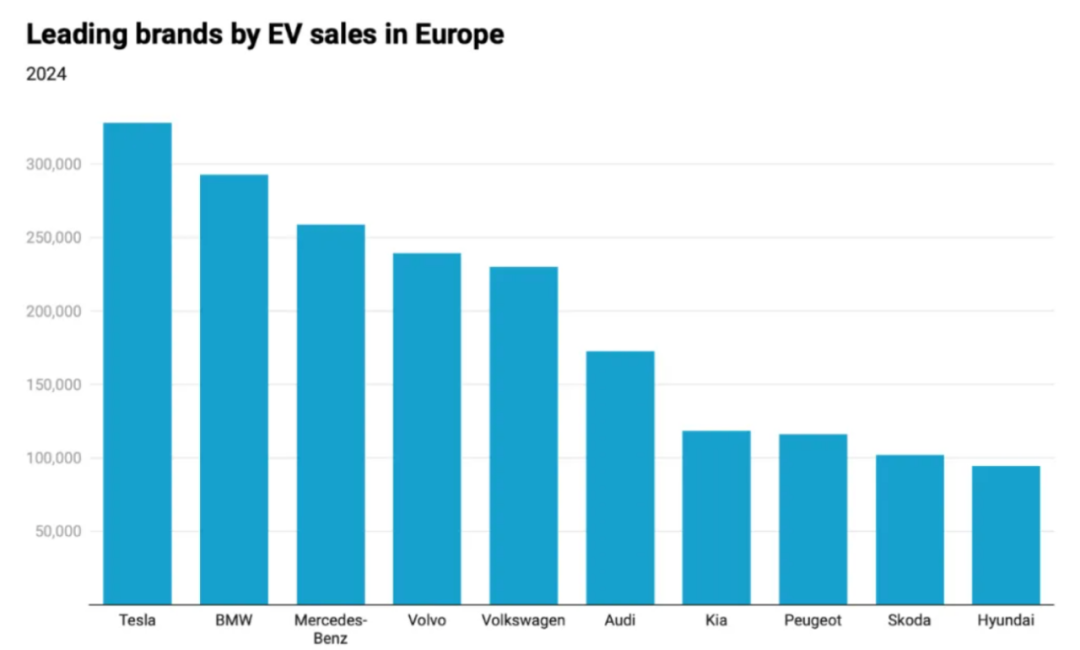

Thanks to Europe's new energy subsidy policies, Volvo's new energy situation is slightly better, with sales exceeding 200,000 units. Yet, globally, this is insignificant.

Industry insiders might ask if this situation stems from a lagging electrification transformation strategy?

No.

Volvo is even a leader in electrification.

II. From 'Leader' to 'Laggard' in Electrification

As early as 2021, Volvo grandly announced its ambition to become the "world's first pure electric luxury brand" and planned to cease selling fuel vehicles by 2030.

Coincidentally, in the same year, BYD also signed a declaration to "stop selling fuel vehicles by 2040" during its participation in the United Nations Climate Change Conference.

The difference lies in action. BYD started in 2022 and completely halted fuel vehicle production in March.

However, Volvo abruptly changed its stance in 2024, with the new goal being to rely on plug-in hybrids and pure electric vehicles for 90% of sales by 2030.

What's more intriguing is that in April 2025, Volvo re-hired its former CEO Hakan Samuelsson, a staunch advocate for electrification who once vowed to "deliver one million electric cars by 2025." This time, he reaffirmed Volvo's commitment to 100% electrification.

It's evident that amidst the electrification wave and market upheaval, Volvo's strategic direction is clear, yet issues persist. It's hard to make the decisive move to abandon fuel vehicles, and its commitment to pure electric vehicles wavers.

Why does Volvo waver so much?

Because it can't generate immediate profits.

Take 2024 as an example. Volvo Cars' R&D investment reached RMB 5 billion, a 17% year-on-year increase, with a focus on pure electric vehicles. However, according to the 2025 first-quarter financial report, Volvo's new energy vehicle sales accounted for 43%, of which pure electric vehicles comprised 19%.

This resulted in a steep drop in Volvo's profit margin from 5% to 2.3%.

Clearly, electrification R&D expenses surged, yet the gross profit margin per vehicle continued to decline, plunging into a vicious cycle of "the more you sell, the more you lose." This financial black hole urgently needs reversing.

Hence, the global cost-reduction plan was unveiled.

But is it too late?

III. Can Cost Reduction and Efficiency Improvement Address the Root Cause?

This cost-reduction plan comprises three sub-plans.

One is to tighten cost control, cling closely to the parent company Geely, and share production materials, plants, and suppliers. The second is global layoffs. The third is to safeguard the profit growth center and enhance operating returns.

It's clear that this round of layoffs is a self-rescue attempt.

However, based on historical precedents, whether it can genuinely alter Volvo's current situation remains uncertain.

Take Volvo's EX30 as an example. Developed on Geely's SEA platform, it was once viewed by the market as a "rebadged" Zeekr X, yet its final sales were abysmal.

Volvo's tighter grip on Geely might not necessarily lead to a breakthrough.

In the view of "E-Motion," Volvo's excessive cost expenditure today is merely a superficial issue. The fundamental problem is that Volvo lags behind comprehensively, from products to intelligent technology.

Today, Volvo's defensive stance against competitive lag appears more like a strategic retreat, or, more colloquially, a bid to prolong life.

At least in the Chinese market, the tale of once-arrogant overseas brands, from complacency to eventual disappearance, has been repeated countless times.

Whether Volvo will join this narrative, and its path towards intelligentization and product development post-layoffs, will provide the true answer.