China's Car Prices Plunge, Contrasting Sharply with Skyrocketing Prices in the US

![]() 05/27 2025

05/27 2025

![]() 527

527

Introduction

Both markets are engaging in a "price war," yet they exhibit vastly different scenarios.

After the drama of high tariffs subsided, the panic they triggered continues to ripple. Both markets are locked in a "price war," but the domestic and US markets offer two starkly contrasting pictures.

In China, price reductions have become the norm, with once unimaginable prices now commonplace. Conversely, in the US, a towering tariff wall is blocking the market, causing car prices to soar.

For the same model, prices in China and the US typically differ by RMB 40,000 to 50,000 or more. This familiar situation invariably sparks rampant speculation, but this time, the roles of the two giants have been completely reversed.

01 Buying Cars in China: A Bargain

"Buy with confidence, it's all good. The Civic starts at RMB 94,900."

With concise and powerful slogans and significant discounts, the 2025 Civic, which has been on the market for just two months, dipped below RMB 100,000 in May.

Meanwhile, across the ocean, a different story unfolds. According to CarsDirect, a US new and used car information platform, the starting price of the 2025 Honda Civic is USD 25,400, equivalent to RMB 183,400 at an exchange rate of 7.22, surpassing the domestic manufacturer's suggested retail price of RMB 129,900 by over RMB 50,000.

If comparing the 2.0L engine of the US Civic with the 1.5T engine of the Chinese Civic seems unfair for the gasoline version, the hybrid version with fewer differences is more convincing. Data shows that the starting price of the 2025 Civic Hybrid is RMB 139,900, and after discounts, the dealer's quoted price also falls into the RMB 100,000 range.

In the US, the price range of this model's hybrid version is USD 30,100-34,300, equivalent to RMB 217,300-247,600, exceeding the domestic guidance price by over RMB 70,000. Considering the actual quoted price, the money spent on buying one car in the US could buy two of the same cars in China.

Not just the Civic, but nearly all models are priced significantly higher in the US than in China.

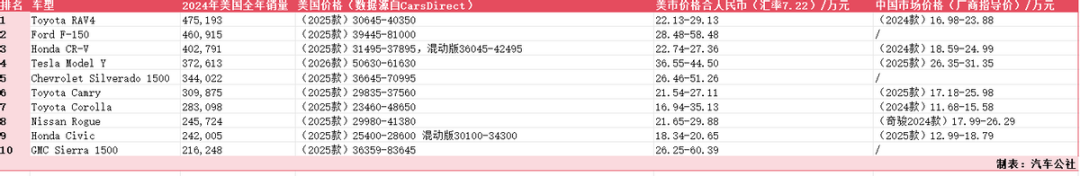

Taking the top 10 selling models in the US in 2024 as an example, except for the three pickup trucks for which sales comparisons are not feasible, the remaining models are all priced higher in the US without exception.

Although automakers make minor adjustments to products based on each market segment, there are minimal differences in crucial parameters. It can even be argued that for the same model, the domestic configuration is often superior. Additionally, style differences can be considered, but the premium space offered by upgraded configurations is limited and cannot bridge the substantial price gap between the two markets.

Figure | Price Comparison of the Top 10 Selling Models in the US in 2024 between China and the US

Undoubtedly, as a former price trough, the US market has now been forced into a price highland due to tariff pressures. The prediction by the Peterson Institute for International Economics in the US is coming true. In April, the institute forecasted that tariffs could lead to an average increase of about USD 10,000 in new car prices in the US, causing US car sales to shift from a 1% annual increase to a 3% decline.

Currently, not just new cars but also used car prices are on the rise.

According to data from Kelley Blue Book, a car data research institution, new car prices in the US exhibited significant growth in April, with a year-on-year increase of 2.5% in a single month, far surpassing the usual level of 1.1% over the same period in recent years.

The response in the used car market was even more pronounced. The Manheim Used Car Value Index released by Cox Automotive surged to 208.2 points in April, the highest level since October 2023.

Statistics from the automotive industry website CarGurus show that the average price of used cars in the US rose from USD 26,900 to USD 27,600 in just two months from February to April, an increase of USD 673. The only exception is Tesla, led by Musk, who has a "complicated" relationship with Trump, with its used car prices dipping slightly by 1.21%.

In contrast, data released by the China Automobile Dealers Association indicates that in the first quarter of this year, the cumulative transaction volume of used cars was 4.6074 million, a year-on-year increase of 0.15%, and the cumulative transaction amount was RMB 303.216 billion. Thus, the average transaction price of used cars in China in the first quarter was approximately RMB 65,800, significantly lower than the average price of used cars in the US.

It is ironic and darkly humorous that the tariff rock lifted by the government is the first to hit the feet of its own people and "closest allies".

Even more terrifying is the continuous rise in car prices in the US.

Since the announcement of the tariff policy, sensitive citizens have embarked on panic buying: rushing to supermarkets to stockpile drinking water, soap, and other daily necessities, crowding Apple stores to inquire about price hikes, and even car dealerships, usually bustling with bulk commodity trading, are filled with panicked customers carrying large amounts of cash, demanding transactions to be completed on the same day.

Worries fueled sales growth. In March, US car sales increased by 9.1% year-on-year to 1.59 million. According to The New York Times, after the announcement of the auto tariff news, a Subaru dealership in Illinois experienced its busiest day since opening. Its manager said, "It's crazy. Customers keep talking about tariffs. Usually, our store sells 15 cars by Saturday, but that day, we sold 32 cars."

Tariff panic, panic buying of cars, supply shortage due to reduced inventory, price increases, intensified panic... Under the dual catalysis of tariffs and emotions, the increment and price increase of US cars are progressing in tandem. Market analysis believes that the combination of three factors—consumer panic buying, supply chain issues, and inventory declines—may lead to continued increases in car prices in the coming months.

02 Tariffs Cannot Revive American Cars, but Going Overseas Can Glorify Chinese Cars

The heavy swing of the tariff stick at the auto industry chain has increased the burden on the people but cannot restore the glory of American cars.

Although car sales in the US market surged significantly in the first quarter, financial reports reveal that Ford, an American automaker, saw a year-on-year decline of 7% in sales and a 5% drop in operating revenue of USD 40.7 billion in the first quarter. Net profit was even halved, down 65% to USD 471 million.

Moreover, Ford anticipates that the rising car prices due to the implementation of the tariff policy will drag down the company's car sales in the second half of the year, resulting in a reduction of USD 1.5 billion in profits for the company in 2025.

General Motors, which also released financial reports, is in a difficult situation. Although its market share in the US has increased and its net revenue has grown, its net profit has fallen by 6.6% year-on-year. Under the tariff policy, GM has also revised downward its 2025 earnings before interest and taxes and stated that the company is currently facing a tariff impact of USD 4-5 billion.

While American automakers are facing problems in their home market, Chinese automakers are firmly rooted in the domestic market and making aggressive overseas deployments. Chery's overseas exports remain robust, and BYD, Geely, Great Wall, Changan, and others are accelerating their overseas expansions. The momentum of Chinese cars is unstoppable in the Middle East, Southeast Asia, South America, and even Europe. Just last week, several automakers once again stepped up their overseas deployments.

Furthermore, at the first-quarter earnings conference, Gui Shengyue, CEO of Geely Automobile, seriously reflected on why Geely's export growth was not as strong as that of its competitors, despite a 263.6% year-on-year increase in net profit attributable to shareholders of listed companies in the first quarter but only a slight 2% increase in total exports.

In contrast, the situations of the Chinese and American auto industries are starkly different. However, if we rewind a few years, a similar scenario played out on a different stage.

"The difference between the US version of the Civic and the domestic version is that it's stripped down to the point of insanity." In a 2018 post, Chinese car owners expressed great dissatisfaction with the prices and configurations of different versions of the Civic.

Amid complaints about reduced configurations of key components such as engines and bumper beams in the domestic Civic while being more expensive, there were not a few replies such as "(stripped down) routine operation" and "don't blame it, every car is stripped down when it comes to China." It is evident that at that time, domestic consumers were accustomed to foreign cars simplifying configurations and increasing prices, and some didn't mind the issue.

The tables have turned. The surpassing of Chinese cars is definitely not achieved through government-led trade protectionism and tariff deficits. It is the two-legged walking path of traditional manufacturers opening up markets to cooperate with foreign brands and independent brands increasing investment in electrification and intelligent layout that has led to the rise of Chinese cars today.

Undoubtedly, in the auto industry, which is the most typical example of globalization, the rigid means of introducing industrial chains by drawing lines on the ground will only lead to an embarrassing situation of mutual loss.

Once the tariff policy fails, the high price wall built by American cars will either collapse under the onslaught of Chinese cars, and the people trapped in the information cocoon will also launch a fierce counterattack; or to maintain domestic market stability, prices will continue to rise, handing over the profits spit out to Chinese brands.

What's more detrimental is that while local American automakers are struggling with the tariff policy, Chinese automakers have already embarked on a strategic shift from price wars to value wars. When BYD, Geely, Chery, and other automakers emerge victorious from the long and bloody battle in the domestic market, facing a weaker overseas market, they are bound to fight fiercely under the banner of Chinese cars.

The precedent in the Thai market has already hinted at this. The Thai market, once regarded as the backyard of Japanese car brands, has seen its market share of Japanese brands greatly threatened since the entry of Chinese cars.

In 2024, the market share of Chinese brands in the Thai market reached 12%, and in January 2025, it was as high as 20.5%. In the new energy market, the market share of Chinese brands in January was even as high as 88.0%, exhibiting excellent long-term development potential.

A small clue gives a clear indication of the whole situation. The trend in the Thai market is being replicated in the Middle East, South America, and even Europe.

The script of history keeps repeating, but the seats of the protagonists have quietly rotated. While the US tries to defend its market by constructing high walls with tariffs, Chinese cars are leveraging the gear of globalization with an open posture.

When Chinese automakers stab the sharp knife tempered by the "hellish" domestic competition into the global market, one has to ask, what can stop the momentum of Chinese cars?

Editor in Charge: Cui Liwen Editor: He Zengrong