Asian Auto Market | Thailand April 2025: Electrification Gains Momentum, Traditional Pickups Decline

![]() 05/27 2025

05/27 2025

![]() 677

677

Thailand's auto market in April 2025 exhibited a clear trend of "electric ascendancy and traditional decline." While overall sales registered a slight year-on-year increase, they witnessed a notable month-on-month drop, underscoring the complexity of the current automotive consumption landscape in the country.

Amidst this backdrop, sales of pickup trucks stagnated, while new energy vehicles, particularly pure electric models, experienced exponential growth.

Remarkably, Chinese brands made significant inroads during this electrification wave. BYD's new model debuted in the top five sales rankings for the first time since its launch, signaling a shift in the domestic sales landscape of the Thai market.

01

Decline of Traditional Models

Weak Consumer Confidence Hampers Market Momentum

In April 2025, the Thai auto market sold 47,193 new vehicles, marking a 0.97% year-on-year increase but a 15.42% month-on-month decline. Despite a superficial recovery, the market's overall performance remained subdued.

The continuous decline in sales of light commercial vehicles, such as pickups and PPVs, which have traditionally dominated half of the Thai market, indicated a weakening of market pillars.

High household debt levels and conservative lending practices by banks constrained consumers' purchasing power. Additionally, declining domestic industrial output, weak private sector investment, and high living costs contributed to a decline in consumer, business, and industrial confidence.

Amid unstable economic fundamentals, willingness for major consumption remained sluggish, and the auto market continued to oscillate at the bottom.

● Production performance was equally unimpressive. In April, Thailand's total auto production amounted to 104,250 units, registering a slight year-on-year decline of 0.4% but a significant month-on-month drop of 19.75%.

Excluding the growth contribution from electric models, it was evident that production of traditional fuel models, especially those oriented towards exports, declined sharply. Notably, traditional fuel passenger cars fell by 33.6% year-on-year, and export-oriented fuel car production plummeted by 36.93%.

This trend was influenced by international environmental regulations and indicated that Thailand's export-oriented automotive industry was facing challenges.

● In terms of exports, Thailand exported 65,730 complete vehicles in April, marking a year-on-year decrease of 6.31%. This decline was attributed to the model change cycle in overseas markets and reflected the adaptation bottleneck faced by Thailand's main products under the upgrading of international regulations.

As European, American, and Asia-Pacific countries tightened regulations on intelligent assistance and emission standards, the competitiveness of traditional models in the global market waned.

In stark contrast to the downturn of traditional models, new energy vehicles witnessed accelerated growth in the Thai market in April.

The surge in electric vehicle sales not only bolstered overall sales but also revealed that the local manufacturing system was swiftly adjusting its direction.

◎ Pure electric vehicles (BEVs) emerged as the biggest highlight. In April, BEV sales reached 10,901 units, accounting for 23.1% of total sales, with a year-on-year surge of 179.5%.

◎ Plug-in hybrid electric vehicles (PHEVs) also grew rapidly, with sales increasing by an astonishing 720.45% year-on-year.

◎ Conversely, hybrid electric vehicles (HEVs) declined by 23.18% year-on-year, indicating a swift shift in market focus towards pure electric models.

Electric vehicle production also increased significantly, with local production of BEVs, PHEVs, and HEVs rising by 639.75%, 319.11%, and 35.31%, respectively, year-on-year.

For the first time, electric vehicles were exported, albeit in a small quantity of 660 units, which holds symbolic significance—Thailand is striving to transform itself into a Southeast Asian electric vehicle manufacturing and export hub.

02

Electrification Accelerates, "Overtaking" Traditional Models

Chinese Brands Make Strong Breakthroughs

Chinese brands have begun to shine brightly in this process.

BYD's new model, the Sealion 6, debuted in the market in April and immediately ranked fourth with sales of 2,640 units, outperforming Japanese stalwarts like the Honda City and HR-V. This achievement not only attests to its product strength but also highlights the rapidly increasing acceptance of Chinese electric vehicle brands among Thai consumers.

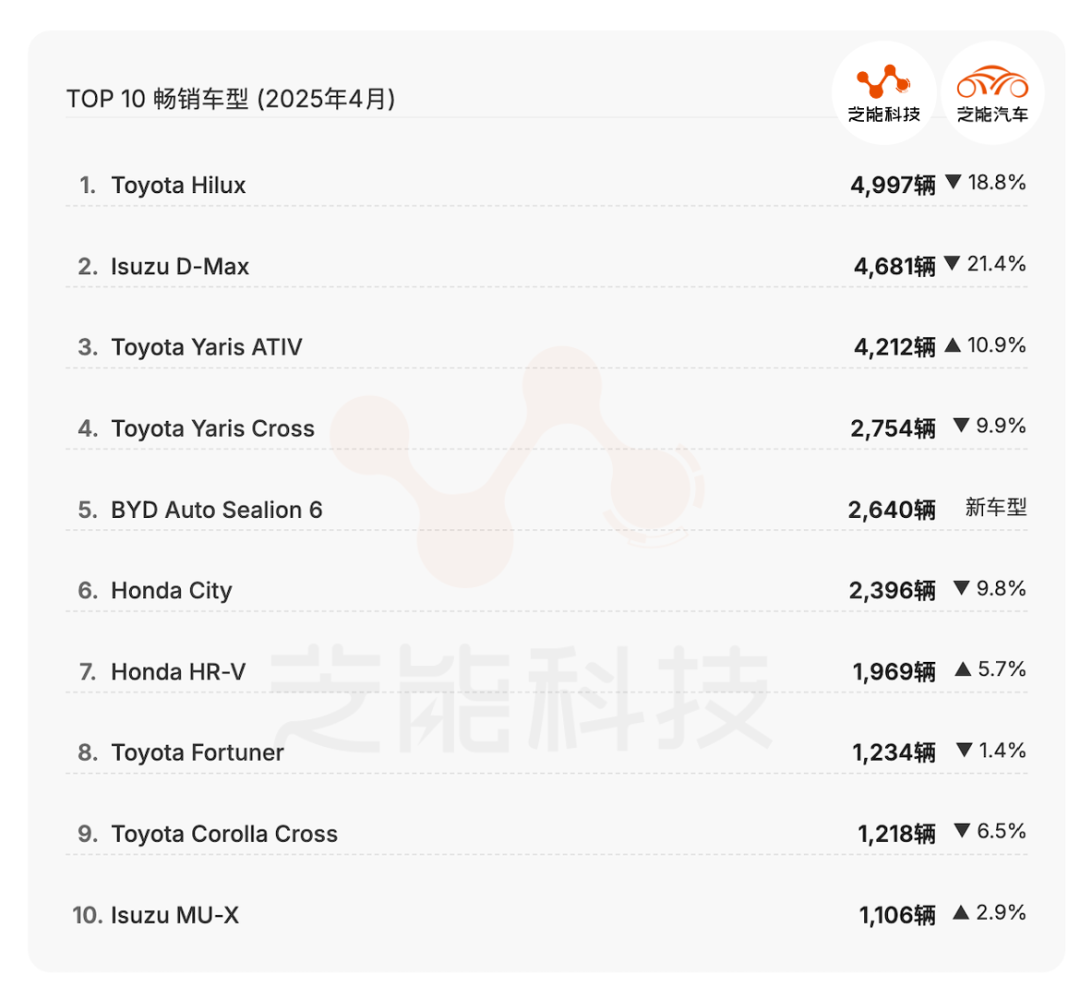

Among the top ten best-selling models, while Toyota and Isuzu still maintained their dominance, their sales significantly declined compared to the same period last year. Toyota Hilux sales fell by 18.8% year-on-year, and Isuzu D-Max sales declined by 21.4%, reaffirming the structural weakness in the pickup market.

Apart from BYD, most of the other models on the list were A-segment sedans and urban SUVs, indicating a consumer preference for economical and practical vehicles with a focus on new energy.

Summary

In April 2025, Thailand's auto market saw traditional fuel vehicles, particularly export-oriented pickups and commercial models, gradually stepping aside due to multiple pressures from credit, economic factors, and regulations. New energy vehicles, fueled by policy incentives, technological advancements, and the robust promotion of foreign brands (especially Chinese brands), accelerated their penetration and reshaped the consumption landscape.