Xpeng and Leapmotor Rise Against the Trend: Will Li Auto Continue to Shun the 'Affordable Route'?

![]() 05/28 2025

05/28 2025

![]() 643

643

Transitioning from 'high-end exploration' to 'mainstream adoption'.

Wu Wei, Investor Network

Li Auto (02015.HK), once renowned for its weekly sales updates solidifying its position as a 'sales champion among new forces,' experienced a significant decline in sales ranking in April 2025. According to company announcements and industry data, Li Auto delivered 33,900 vehicles that month, a 31.6% year-on-year increase, placing it third among new energy vehicle manufacturers, behind Xpeng Motors (09860.HK) with 35,000 vehicles and Leapmotor (09863.HK) with 41,000 vehicles.

Behind the surge of Xpeng and Leapmotor lies a profound shift in the market landscape. Both companies have targeted the mainstream family market with models priced around RMB 200,000, while Li Auto's high-end strategy, focusing on vehicles priced above RMB 300,000, is encountering a growth ceiling. Simultaneously, the company's annualized return on investment, current asset turnover ratio, and total asset turnover ratio have all declined. Additionally, Li Auto is increasingly reliant on 'squeezing' profits from suppliers. As of the end of 2024, Li Auto's book balance of accounts payable and notes payable reached RMB 53.6 billion, accounting for 58.88% of the company's total liabilities, and the company generated interest income and investment income of RMB 1.82 billion during the same period.

As the 'weekly chart king' encounters the 'affordable surge,' how long can Li Auto, which has shunned the affordable market, maintain its sales champion status?

Intensifying Competition in the High-End Market

Positioned as a 'high-end new energy vehicle for family users,' Li Auto's L series (L7/L8/L9) covers the price range of RMB 300,000 to 500,000, featuring six-seat space, extended-range technology, and the concept of a 'mobile living room.' This strategy peaked in 2023, with 500,300 vehicles delivered, a 33.1% year-on-year increase, and a net profit of RMB 11.7 billion, making Li Auto the first new energy vehicle manufacturer to achieve annual profitability.

However, structural contradictions in the high-end market have gradually emerged, and the delivery of Li Auto's high-end MVP, the MEGA, has sparked controversy. Consequently, in 2024, Li Auto's revenue growth rate plummeted to 16.6%, with net profit declining by 31.37% year-on-year to RMB 8.032 billion. The average price per vehicle fell from RMB 320,000 to RMB 276,800, and the gross margin decreased from 22.2% to 20.53%.

Not everyone opts for high-end models. In 2024, the penetration rate of the domestic new energy SUV market above RMB 300,000 was only 8.7%, and the growth rate slowed from 120% in 2023 to 45%. Li Auto's main models, the L8 (starting at RMB 339,800) and the L9 (starting at RMB 429,800), also face competition from models like the AITO M9 and NIO ES8. Moreover, the pricing strategy could not be sustained due to opposition from existing car owners and a decline in gross margin.

Li Auto's previous frequent announcement of weekly sales was once regarded as 'market confidence management,' which also sparked considerable controversy within the industry. Regulatory authorities even issued a document specifically to regulate the announcement of weekly sales charts to avoid inefficient competition. Li Auto's sales performance in April 2025 further exposed the limitations of this data strategy.

In April 2025, Li Auto delivered 33,900 vehicles, a 31.6% year-on-year increase, ranking third among new energy vehicle manufacturers, behind Xpeng Motors (09860.HK) with 35,000 vehicles and Leapmotor (09863.HK) with 41,000 vehicles. This development has somewhat shattered the company's previously established image as the 'sales champion among new forces.'

Li Auto's decline in sales ranking may be linked to the company's untimely strategic transformation. As automakers like Huawei and AITO compete to capture the extended-range market, and Tesla initiates a price war, market competition has intensified. On the product front, Tesla's Model Y, priced at RMB 249,900, directly intercepts potential users of Li Auto's L6. The AITO M7, with the 'Huawei Smart Selection' label and a starting price of RMB 249,800, also attracts some family users away from Li Auto.

On the technology front, Xpeng G6's 800V fast charging and urban NOA functions, and Leapmotor C11's fully self-developed electric drive, have created differentiated barriers in the RMB 200,000 market. In contrast, Li Auto's product iterations lag behind its competitors, leading to a decline in recognition of its 'technological configuration' among high-end users.

More critically, the 'stock battle' in the high-end market has evolved into ecological competition. NIO is building user barriers through its battery swapping network, while AITO is connecting vehicle-machine interconnection through the HarmonyOS ecosystem. Although Li Auto's innovation in the 'family scenario' has gained market recognition, it struggles to form an exclusive advantage.

The Rapid Rise of Affordable Forces

The successes of Xpeng and Leapmotor are primarily attributed to their low-priced affordable strategies. Xpeng Motors has achieved a sales turnaround by taking 'the intelligent ceiling of the RMB 200,000 level' as a breakthrough. Its G6 model, equipped with the XNGP intelligent driving system and an 800V silicon carbide platform, has a starting price of RMB 209,900. In April, it delivered 15,000 vehicles, accounting for 43% of total sales. The MONA M03, a pure electric car priced around RMB 100,000, sold over 10,000 units per month, driving Xpeng to deliver over 30,000 vehicles for six consecutive months.

The underlying logic of this strategy is 'technology decentralization + cost averaging.' Xpeng adapts the XNGP system originally used in the G9 to models priced around RMB 200,000, reducing the cost of core components like lidar and computing chips through mass production. In the first quarter of 2025, Xpeng Motors' revenue increased by 141.45% year-on-year, with a gross margin of 15.56%, an increase of 2.87 percentage points compared to the same period in 2024.

Known as the 'small Li Auto,' Leapmotor's turnaround is even more disruptive. The company's deliveries in April increased by 173% year-on-year, topping the list of new energy vehicle manufacturers. Its core weapon is 'vertical integration + affordable pricing.' Taking the C11 model as an example, it comes standard with a Qualcomm 8155 chip, L2-level assisted driving, and a triple-screen display at a price of RMB 150,000, while the same configuration on Li Auto's L6 requires an additional RMB 80,000. This cost advantage stems from Leapmotor's self-developed 'Four-Leaf Clover' central integrated electronic and electrical architecture, which reduces hardware costs by 30% by simplifying the more than 200 ECUs traditional automakers need into four domain controllers.

In terms of market strategy, Leapmotor adopts a two-pronged approach of 'domestic sinking + overseas expansion.' Domestically, it covers third- and fourth-tier cities through its B series models, with sales in sinking markets accounting for 58% from January to April. Overseas, it relies on its factory in Thailand, exporting 13,600 vehicles from January to April, becoming the brand with the largest export volume among new energy vehicle manufacturers. Its gross margin in Q1 2025 reached 14.9%, close to Li Auto's 20.53% at the end of 2024, but its average price per vehicle is 40% lower, demonstrating the sustainability of the 'affordable route.' In 2024, Leapmotor's net loss rate was 8.77%, a decrease of 16.41 percentage points from 2023, indicating the company's impending turnaround.

Even NIO (09866.HK), known for its high-end positioning, is accelerating its layout in the RMB 200,000-300,000 market. Its first model from the Alpine brand, the LeDao L60, delivered over 10,000 units in December 2024, although sales fell back to 4,000 units in January 2025. However, NIO is building differentiated competitiveness with 'high-end services + mainstream prices' through its shared battery swapping network and BaaS battery leasing solution. Additionally, NIO has launched the Firefly to capture the high-end compact car market.

According to reports from Xinhua Finance and other media, Li Auto internally adjusted its annual production target for this year to 640,000 vehicles, including 520,000 for the extended-range L series and 120,000 for pure electric products. However, as of April 2025, the company had delivered a cumulative total of 126,800 vehicles, with a target completion rate of only 19.81%. While the upgrading of Li Auto's old models and the successive launch of new models are expected to boost sales in the next eight months, the company still faces considerable sales pressure.

As its competitors break through with affordable pricing, Li Auto's profitability has also weakened. In 2024, Li Auto's revenue growth rate fell to 16.6%, with net profit declining by 31.37% year-on-year to RMB 8.032 billion. Among the company's net profit of RMB 8.032 billion, RMB 1.82 billion was interest income and investment income. The book balance of accounts payable and notes payable for the period reached RMB 53.6 billion, while the book balance of cash and cash equivalents is only RMB 65.9 billion.

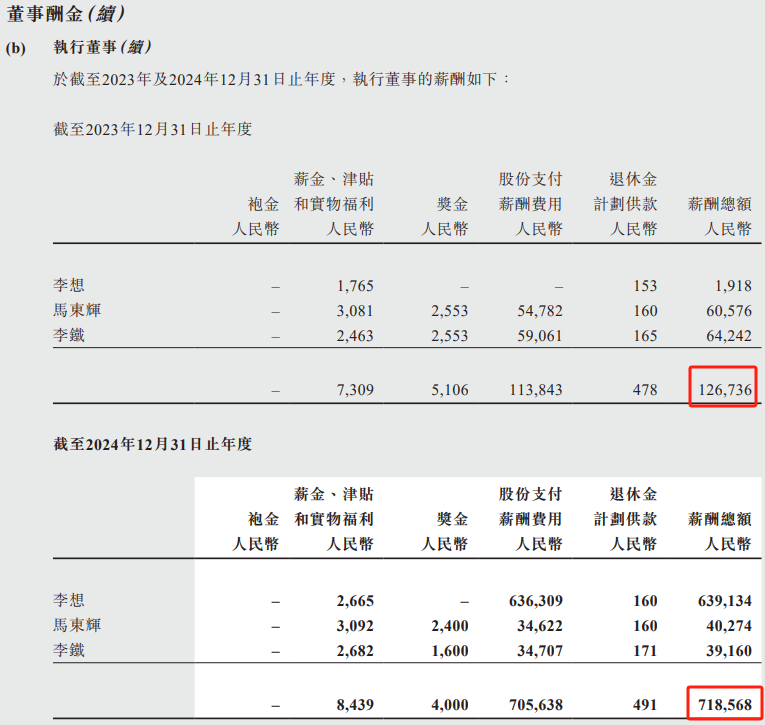

It's noteworthy that in 2024, when the company's revenue growth slowed down and net profit declined, the total compensation of Li Auto's five highest-paid employees who are not directors decreased from RMB 123 million in 2023 to RMB 48.764 million, a drop of over 60%. However, the total compensation of executive directors like Li Xiang, Ma Donghui, and Li Tie increased by 4.67 times to RMB 719 million. Of course, according to company feedback, the share-based compensation for directors like Li Xiang has not been actually paid.

Data Source: Company Annual Report

The change in the April sales ranking is essentially a microcosm of the transformation of the new energy vehicle market from 'high-end exploration' to 'mainstream adoption.' Li Auto's dilemma reflects the common challenges faced by all high-end brands. As the high-end market becomes saturated, the growth engine shifts from high-net-worth individuals to ordinary families, and the simple formula of 'high price = high-end' no longer holds. Instead, it is replaced by a comprehensive competition of 'technological inclusiveness + cost control ability + user operation ability.'

Li Auto is currently experiencing challenges such as declining sales ranking and a growth bottleneck in the high-end market, and its profitability is also under pressure. However, it still has accumulations in areas like family scenario innovation and extended-range technology, and its brand recognition remains. The Chinese automotive industry is transitioning from high-end to mainstream markets, and there are numerous examples of transformation in the century-old history of the automotive industry. If Li Auto takes technology as its foundation and flexibly adjusts its strategy, it may regain high-growth momentum amidst industry changes. (Produced by Siwei Finance) ■

Source: Investor Network