Xiaomi's Momentum Soars with Auto Business, Lu Weibing Asserts Dominance

![]() 05/29 2025

05/29 2025

![]() 595

595

YU7 Unaffected by SU7 Sales

Author | Wang Lei

Editor | Qin Zhangyong

Xiaomi Captures the Spotlight.

On May 27, Xiaomi Group released its first-quarter 2025 financial report, revealing impressive figures. According to Lu Weibing, President of Xiaomi Group, this is another of Xiaomi's strongest single-quarter financial reports in history.

Not only did revenues and profits reach new highs, but it marked the second time that quarterly revenue exceeded 100 billion yuan, following the fourth quarter of 2024.

Moreover, Lu Weibing holds an optimistic view of Xiaomi's future growth, stating that today marks the beginning of Xiaomi's current round of rapid growth. "For this phase of upward momentum, I believe we are far from reaching the peak."

His remarks at the financial report meeting were bold and assertive. Let's delve further.

01

SU7 Unmatched in the Market

Putting aside Xiaomi's impressive quarterly performance, what piques the public's interest is what Xiaomi had to say at the first-quarter financial report meeting.

In recent months, Xiaomi has faced numerous controversies, from car accident incidents to OTA horsepower modifications, "digging holes" in the front hood, and even some car owners organizing group refunds, generating waves of negative public opinion.

Even Lu Weibing acknowledged at the earnings meeting that the recent public opinion environment has not been favorable towards Xiaomi. Has all this affected Xiaomi?

During the financial report meeting, an unequivocal answer was given: There has been no impact whatsoever.

Lu Weibing boldly declared at the meeting that there is no competition. He stated that since the launch of Xiaomi SU7 on March 28 last year, it has been nearly 14 months, and to date, no product on the market can compete with Xiaomi SU7, not even one.

Responding to questions about market competition, Lu Weibing also stated directly, "Frankly speaking, I haven't really felt much impact from our competitors' price reductions."

"I think everyone has seen this. Countless competitors have tried to compete with us using various means, but up to now, you will find that none of them can compete. The sales volume of many products is not even one-tenth, or even 5% of SU7's sales volume. This is the fact."

In the past, this might have sounded arrogant or presumptuous, but when one looks at Xiaomi SU7's sales data for the first quarter, it becomes clear that this is not an empty boast but a well-founded truth.

The Xiaomi SU7 series delivered 76,000 vehicles in the first quarter alone, with a cumulative delivery volume reaching 258,000 vehicles. Since its launch, it has quickly occupied the top spot in sales of new energy vehicles priced above 200,000 yuan. Additionally, Xiaomi SU7 Ultra has received 23,000 confirmed orders, far exceeding expectations.

The confidence behind Lu Weibing's bold statement stems from the strong competitiveness of the product.

In his view, if a product's competitiveness is strong enough, profitability is not an issue. Strong product competitiveness translates to no competition, which in turn ensures pricing power, thereby guaranteeing a reasonable profit margin.

The same applies to Xiaomi YU7. Lu Weibing stated that after the Xiaomi YU7 technology conference, the number of users leaving their contact information was three times that of the Xiaomi SU7 technology conference, with 60% being first-time users. "This means that YU7 has a larger user audience than SU7, so we are very confident in YU7."

Furthermore, Lu Weibing stated at the meeting that despite YU7 coming standard with a LiDAR, panoramic sky screen, long battery life, and strong product capabilities of the 800V platform, he is not concerned that Xiaomi SU7's sales will be affected. SU7 currently has no plans to reduce its price because Xiaomi's current auto sales are primarily constrained by severely insufficient production capacity.

He also referenced Tesla's Model 3 and Model Y, implying that Xiaomi SU7 and YU7 will have the same market-dominating capabilities as these two models.

Regarding the price of Xiaomi YU7, which is of utmost concern to the outside world, Lu Weibing frankly stated, "It has not been finalized yet, so I cannot disclose much."

It is worth mentioning that Lu Weibing also responded to the question of whether the "Mystic Ring Chip" would be applied beyond mobile phones and IoT. Although he did not answer directly, he hinted that it would be gradual.

He stated that in the short term, it will only be supplied for flagship mobile phone SoCs because this is the most challenging, but immediately mentioned that a chip is essentially a platform capability. Once you possess this platform capability, it becomes less difficult to develop other chips.

In other words, there won't be any in the short term, but in the longer term, it is possible that self-developed chips will appear in automobiles.

Moreover, Lu Weibing believes that Xiaomi is currently in a stage of "making investments without considering costs too much" in self-developed chips. It is not overly concerned with financial performance but rather focuses more on whether the product can be made well. As for when the harvest can be seen, Lu Weibing said it will take five to ten years.

02

Another Historic Peak in Financial Performance

From a data perspective, it is not an exaggeration to say that Xiaomi's momentum is surging ahead, especially in the auto business.

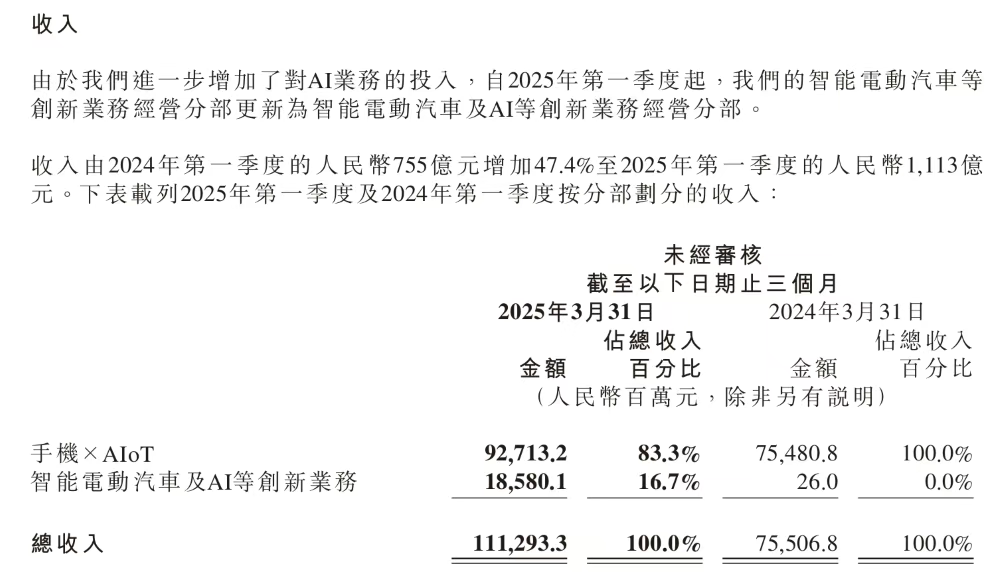

According to the financial report, Xiaomi Group's revenue for the first quarter of 2025 was 111.293 billion yuan, representing a year-on-year increase of 47.4% compared to 75.48 billion yuan in the first quarter of 2024, marking the second consecutive quarter with revenue exceeding 100 billion yuan.

Total operating profit was 13.125 billion yuan, a staggering 256.4% increase from 3.683 billion yuan in the same period last year; profit for the period was 10.893 billion yuan, a 161% surge from 4.173 billion yuan in the same period last year.

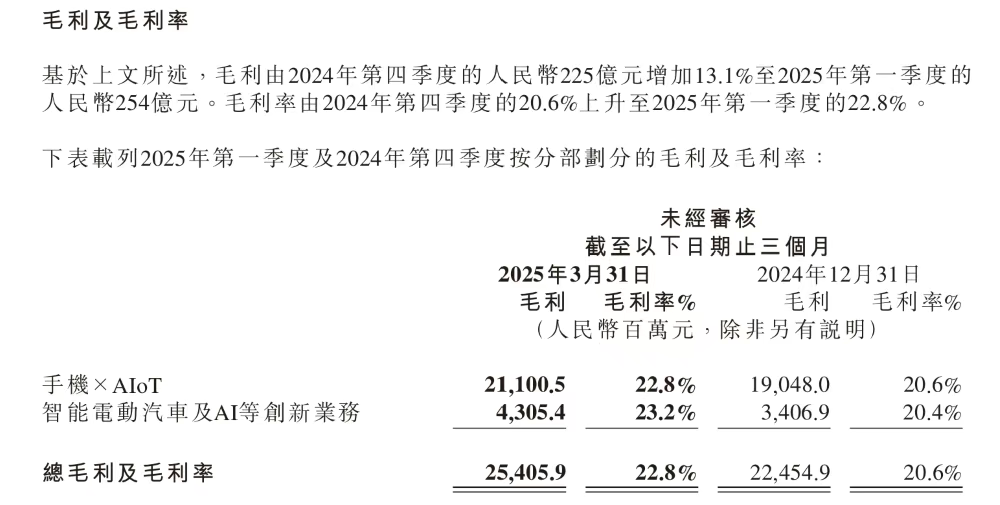

Adjusted net profit for the first quarter also exceeded 10 billion yuan for the first time, reaching 10.676 billion yuan, representing a significant increase from 6.491 billion yuan in the same period last year. Gross profit reached 25.4 billion yuan, a 51% increase from 16.83 billion yuan in the same period last year, and gross margin also increased to 22.8%, setting a new record high.

Smartphones and home appliances continue to be the cornerstone of Xiaomi and an important source of revenue, accounting for 83.3% of Xiaomi's total revenue in the first quarter, contributing 92.7 billion yuan, a 22.8% increase from 75.481 billion yuan in the same period last year.

The core among the cores is the mobile phone business, with a total revenue of 50.6 billion yuan, an 8.9% increase from 46.48 billion yuan in the same period last year, accounting for 45.5% of revenue.

Next are IoT and consumer lifestyle products, with revenue reaching 32.339 billion yuan, a 58.7% increase from 20.373 billion yuan in the same period last year, accounting for 29.1% of revenue, an increase of 2.1 percentage points from 27% in the same period last year.

But the most outstanding performance has to be in smart cars. Although the volume is small, the growth trend is quite fierce.

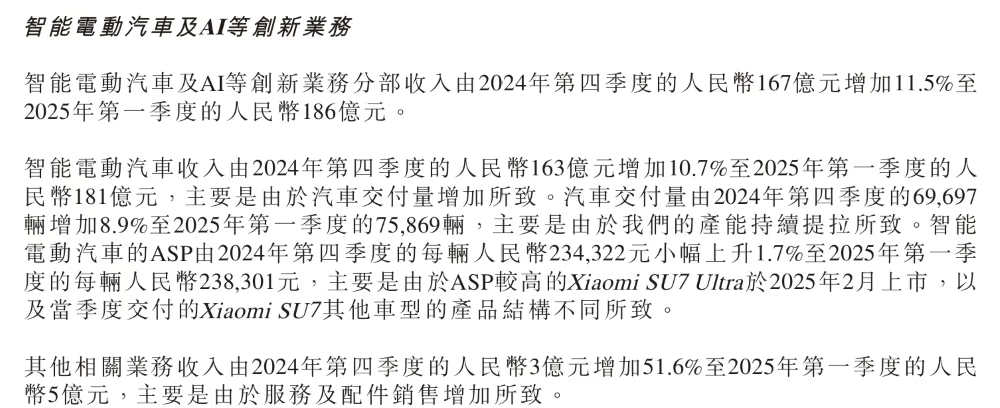

In the first quarter of 2025, Xiaomi Group's smart electric vehicles and AI and other innovative business segments generated revenue of 18.6 billion yuan, accounting for 16.7% of Xiaomi Group's total revenue for the first quarter of 2025.

However, compared to the 2.6 billion yuan in the first quarter of 2024, this represents geometric growth. Specifically, for the smart electric vehicle segment alone, it increased from 18.4 million yuan in the same period last year to 18.1 billion yuan, accounting for 97% of the entire smart electric vehicle and AI and other innovative businesses. Even compared to the 16.7 billion yuan in the fourth quarter of last year, there was an 11% quarter-on-quarter increase.

However, it is still in a loss state.

Xiaomi did not disclose the separate gross margin of the auto business, including the loss situation, which is calculated as a whole department.

The financial report shows that Xiaomi's smart electric vehicle and AI and other innovative business segments, in which Xiaomi's auto business is located, incurred a loss of 500 million yuan in the first quarter of 2025, but the gross margin has exceeded the overall group level, reaching 23.2%.

Compared to the previous quarter, the loss narrowed to 700 million yuan, and the gross margin also significantly increased from 20%.

It is worth mentioning that although the gross margin of the auto business is not disclosed separately, given that the electric vehicle business accounts for 97% of the segment, this gross margin level can basically be regarded as Xiaomi's auto gross margin level.

As of the first quarter of 2025, Xiaomi has disclosed the auto gross margin for four quarters. The second quarter of last year was the first time it disclosed the auto gross margin, with the first time being 15.4%, the second time being 17.1%, the third time being 20.4%, and the fourth time being 23.2%.

It is evident that Xiaomi's auto gross margin is steadily increasing. Lu Weibing also provided several reasons for this during the financial report meeting.

First, since the launch of Xiaomi SU7, the pricing has not been adjusted once. Some products will quickly adjust their prices after launch due to insufficient capabilities, which will inevitably affect the product's gross margin.

Second, the effect of a single popular model will undoubtedly bring about very good cost optimization. Simply put, as delivery volumes increase, the amortization efficiency of fixed costs becomes higher and higher. Additionally, SU7 Ultra has also begun deliveries, and as a product with higher gross margins, it has a certain driving effect on the improvement of gross margins.

Third, Lu Weibing mentioned that Xiaomi's auto management and channel efficiency are both very high, with channel efficiency possibly being 2-3 times that of traditional automakers. These factors combined have increased Xiaomi's auto gross margin.

Moreover, it is evident from the financial report meeting that Xiaomi Group's senior executives are quite confident in Xiaomi Group as a whole and its auto business segment.

Even facing the increasingly competitive electric vehicle market ahead, Lu Weibing said he "feels good." In the short term, he believes there will not be too much impact. Currently, Xiaomi's most important task is to deliver orders in a timely manner and get users behind the wheel.

SU7 has made a strong start, and now it's up to YU7 to perform.