Revolutionizing Tech Asset Valuation: Xiaomi's Bold Ambitions and Chip Innovations

![]() 05/30 2025

05/30 2025

![]() 830

830

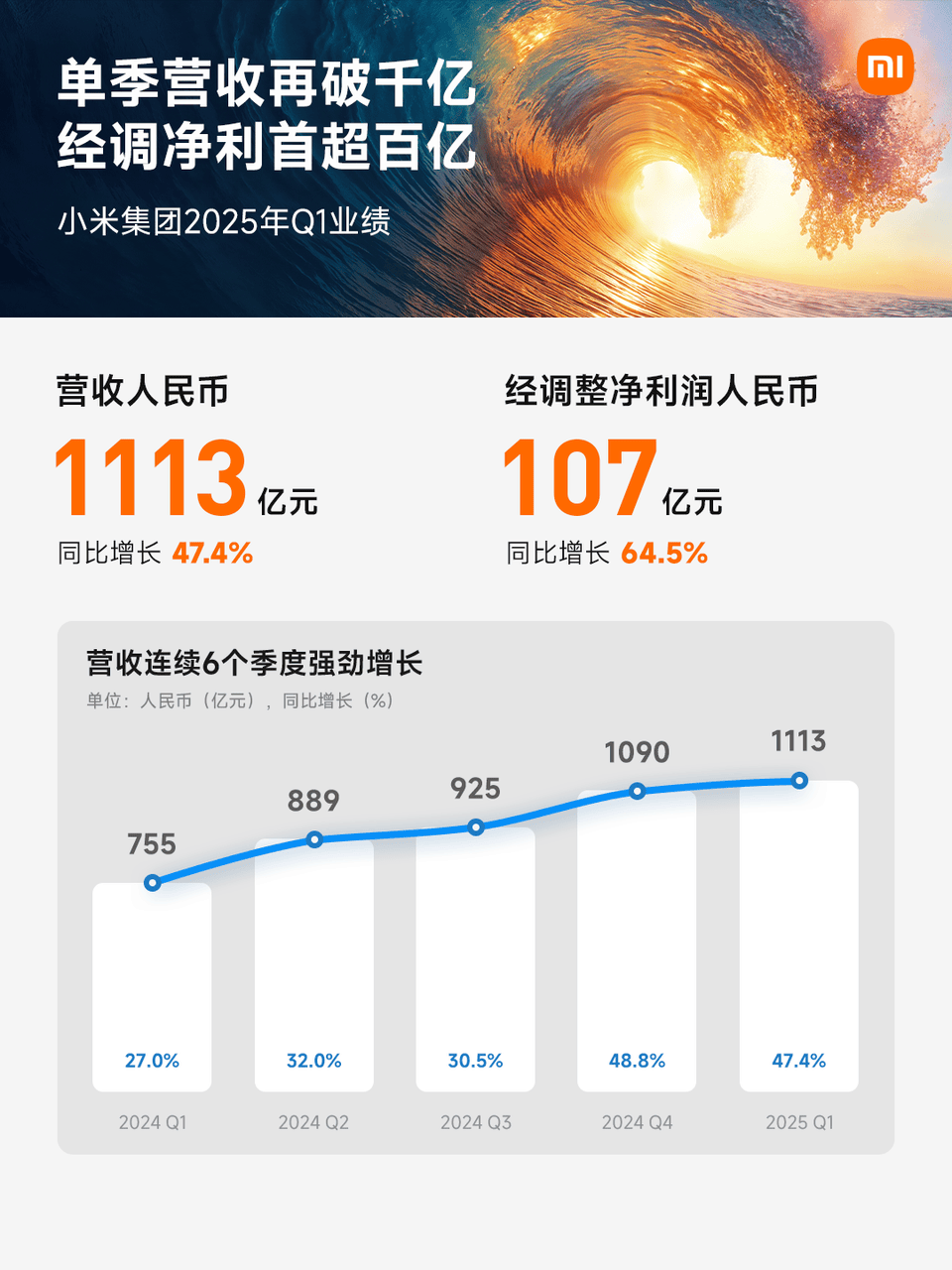

Introduction: Xiaomi's Q1 financial report ignites the fire of revaluing China's technology assets.

Looking back at the global capital market over the past decade, the U.S.-led "Magnificent 7" in technology has driven a prolonged bull market in American stocks. Today, Chinese technology titans, epitomized by Xiaomi, are spearheading a narrative to revalue China's technology assets.

The concept of "revaluing China's technology assets" emerged in early 2025. At that time, DeepSeek unexpectedly emerged, prompting global hedge funds to pour into the Chinese stock market at their fastest pace in months. Shares of Chinese tech companies like Xiaomi (01810.HK) soared, with Xiaomi's share price surging over 52% in less than five months.

These high returns attracted top global investment institutions to increase their holdings in Xiaomi. In April this year, BlackRock raised its stake in Xiaomi from 4.90% to 5.06%.

On May 27, Xiaomi released its Q1 financial report, further fueling the momentum for revaluing China's technology assets.

The financial report revealed that Xiaomi's revenue for Q1 2025 surged 47.4% year-on-year to 111.3 billion yuan, breaking the 100 billion yuan mark again after Q4 2024; adjusted net profit exceeded 10 billion yuan for the first time, reaching 10.7 billion yuan, with a year-on-year increase of 64.5%.

What does a 47.4% revenue growth signify? In Q4 2021, Apple, which reclaimed the top spot in the Chinese market after six years, once "achieved the best single-quarter sales performance." However, its revenue growth was only 11%.

Today, double-digit growth is a challenge for most tech giants; in Q1 2025, Tesla's revenue even declined by 9%, and EPS (earnings per share) was nearly 40% lower than analysts' expectations.

Times have changed, with the rise of the East and the decline of the West. Chinese technology assets, represented by Xiaomi, are rapidly ascending with the renowned "China speed" and regaining their voice.

01 Xiaomi: Ascending to Higher Ground

For a long time, there has been a misconception about China in the market: the world's factory is adept at manufacturing and OEM but lacks innovation and branding.

This misconception stems from the consistent low-profile approach of Chinese tech enterprises. Since 2010, China has emerged as one of the fastest-growing economies in global innovation capabilities. Substantial R&D investments and profound technical accumulation have enabled Chinese enterprises to take the lead in multiple key areas.

However, compared to technological innovation itself, the returns of Chinese tech enterprises in terms of market, brand, and pricing power have not been fully realized. Technology is indeed valuable, but high-end products leveraging technology are even more so.

Fortunately, this trend is shifting.

The Q1 2025 financial report shows that Xiaomi has not only entered the high-end product market but has also achieved full-category high-end products in mobile phones, automobiles, and home appliances.

Among them, mobile phones have seen the most significant growth in the high-end category. Xiaomi's global smartphone ASP (average selling price) reached 1,211 yuan in Q1, a record high, with a year-on-year increase of 5.8%. The high-end flagship phones also performed well in the market: Xiaomi's market share in China's 4,000 yuan and above price segment reached 9.6%. Compared to the previous generation, the monthly sales volume of the high-end flagship Xiaomi 15 Ultra increased by over 90% during its first sales month, and the proportion of high-end smartphone shipments reached 25%, an increase of 3.3 percentage points.

Product image of Xiaomi 15 Ultra, image source: Xiaomi Mall

As mobile phone high-endization progresses, the high-end automobile product matrix is also accelerating its formation.

The Xiaomi SU7 Ultra received over 19,000 large orders and over 10,000 locked orders within just three days of its launch, setting a new sales record for Chinese models priced above 500,000 yuan. After establishing a firm footing in the market with the SU7 Ultra, Xiaomi will further expand the high-end boundaries of new energy vehicles with its first luxury high-performance SUV, the Xiaomi YU7.

Product image of Xiaomi SU7 Ultra, image source: Xiaomi official website

In the field of smart home appliances, Xiaomi's high-end new products such as the Ultra series of central air conditioners and dual-zone washing machines are also popular in the market. The central air conditioner, priced at up to 30,000 yuan, completed its annual sales target in advance within less than two months of its launch. Xiaomi has achieved a "lane change overtaking" in the high-end market that many traditional home appliance brands have failed to conquer for years.

Five years ago, few could have foreseen that Xiaomi would swiftly carve out a path to high-end products. Looking back at the key decisions made in these five years, Lu Weibing, partner and president of Xiaomi Group, summarized them as a series of "right decisions": "We started high-endization five years ago, which was the right decision; using the Xiaomi brand for high-endization instead of creating a new one was also the right decision; taking mobile phones and automobiles as the pioneers to enter the high-end market, while other products first hone their capabilities, this order is also right."

Starting from familiar tracks, not blindly expanding, but focusing on capability building; leveraging precise insights as a fulcrum, combined with high-intensity R&D investment, to create hit products that truly impress users; supplemented by an efficient new retail system to optimize full-link sales and services - this "Xiaomi methodology" not only opens up high-end channels for itself but also provides a replicable and referential upgrade paradigm for more Chinese brands.

Image source: Xiaomi official website

02 Why the Ecosystem is a Must-Win Territory

This performance report, hailed by Lu Weibing as "Xiaomi's strongest single-quarter financial report in history," actually had early signs.

Before the financial report was released, a set of data from Counterpoint had already provided clues: In Q1 2025, the Chinese smartphone market underwent drastic changes, with Xiaomi's market share jumping from 13% to 19%, while Apple's market share declined from 21% to 15%.

Mobile phone market share is often an essential signal that "the duck knows the water is warm first." In the vast ecosystem of "people, cars, and homes," mobile phones are the most critical super entry point. A 6-percentage-point increase in market share means that Xiaomi's speed towards the "people, cars, and homes" ecosystem far exceeds market expectations.

Previously, tech giants like Apple had ambitions to dominate the giant "people, cars, and homes" ecosystem. However, most of them eventually retreated and gave up in frustration.

The positive signals of Xiaomi's ecosystem released in Q1 undoubtedly add considerable weight to the position of China's technology assets in the world.

Why are both mobile phone manufacturers and automobile manufacturers ambitious about the "ecosystem"? In other words, why is building an ecosystem so crucial for the valuation of technology assets?

The reason is simple: the ecosystem represents the certainty of growth for the next 5 to 10 years or even longer.

Whether running a company or making investments, the underlying logic is compound interest: in sustainable and cumulative business growth or financial returns, the snowball keeps rolling and eventually achieves exponential growth.

The "people, cars, and homes" ecosystem, which can connect various devices and unleash the "multiplier effect" in multiple scenarios, happens to be the path that best fits the logic of long-term compound interest.

Image source: Xiaomi official website

Understanding the principle is easy, but putting it into practice is challenging. Against the backdrop of some players investing billions of dollars over a decade and still choosing to retreat, why can Xiaomi achieve a comeback as a latecomer?

The Q1 financial report reveals several pieces of information worthy of in-depth investigation.

Firstly, Xiaomi's mobile phone business has grown extremely fast, giving Xiaomi a significant advantage in the ecosystem entry. In the Chinese market, Xiaomi's mobile phone shipments returned to the top spot after a decade, with a market share of 19%, and it has achieved growth for five consecutive quarters; in the global market, Xiaomi has consistently ranked among the top three globally for 19 consecutive quarters, building a solid and extensive domestic and international foundation.

In the full-scene layout of "people, cars, and homes," mobile phones are often the only center that can control all devices simultaneously. The saying that "whoever controls mobile phones controls users, and whoever controls users controls the ecosystem" is not empty talk.

Secondly, Xiaomi has achieved "no loss of position" in smart homes, home appliances, automobiles, wearables, travel, and other terminals, firmly grasping the vast market of the 3 trillion "people, cars, and homes" ecosystem.

Over the past 15 years, Xiaomi has deployed in multiple technological fields and nearly a hundred segmented tracks. Nowadays, many excellent products have emerged from these complex products and services, and years of continuous investment have borne fruit one after another.

During Q1, Xiaomi's revenue from innovative businesses such as smart electric vehicles and AI reached 18.6 billion yuan. Xiaomi delivered 75,869 SU7 series vehicles in the first quarter, with monthly deliveries exceeding 20,000 for six consecutive months.

The revenue of the IoT and consumer goods business reached 32.3 billion yuan. The number of IoT devices connected to the AIoT platform has reached 944 million, with significant growth in tablets, wearables, and other categories.

Revenue from major home appliance businesses still doubled during the off-season, with shipments of air conditioners and refrigerators exceeding 1.1 million and 880,000 units, respectively, both increasing by 65% year-on-year.

The key to Xiaomi's success lies in establishing an ecosystem with almost no weaknesses. This ecosystem has more living scenarios than Tesla, stronger car-making capabilities than Apple, and stronger synergy than Google.

Behind this is a systematic capability that integrates technology, users, and marketing: from core technologies that can be reused across categories to a highly sticky and active user ecosystem, to Xiaomi's retail system that has no off-season throughout the year and integrates online and offline, jointly supporting the breadth and depth of the ecosystem.

Xiaomi Home offline store, image source: Xiaomi official website

03 Technology as the Paddle, Product as the Boat

In 2010, Xiaomi embarked on its journey to the forefront of China's technology wave from a small office near Baofu Temple Bridge in Zhongguancun.

"Dare to dream and dare to be the first" - this is Lei Jun's definition of the Zhongguancun spirit. This "daring" stems from a keen perception of "change." From PC internet to mobile internet and then to today's AI era, Xiaomi has always been present at every leap in technological paradigms, never absent.

Now, standing at the critical juncture of AI restructuring the landscape, Xiaomi is moving towards a deeper level of transformation: accelerating the scenario-based landing of China's technological innovation.

This goal determines that Xiaomi's focus in the next decade will inevitably involve investing substantial funds in scientific research. In Q1 2025, Xiaomi's R&D expenditure reached 6.7 billion yuan, a year-on-year increase of 30.1%, and it is expected to reach 30 billion yuan for the full year. At Xiaomi's 15th-anniversary strategic new product launch event, Lei Jun, the founder, chairman, and CEO of Xiaomi Group, announced that Xiaomi will also invest 200 billion yuan as R&D expenses for the next five years.

As the core direction of R&D investment, 13.5 billion yuan has flowed into the chip business over the past four years. This strategy has also enabled Xiaomi's chips to achieve a significant breakthrough in Q1 2025: the debut of the first self-developed 3nm flagship SoC chip "Mystic Ring O1." Based on the second-generation 3nm advanced process, this chip integrates a 10-core CPU and a 16-core GPU, with performance and experience ranking among the top globally, laying a solid moat for differentiated product experiences.

Flagship SoC chip "Mystic Ring O1," image source: Xiaomi Mall

In the field of AI, Xiaomi has also continuously deepened its technological accumulation and advanced research on large models. In April 2025, Xiaomi officially announced the open source of its first inference large model, Xiaomi MiMo, demonstrating an efficient, lightweight, and usable technical path.

Zooming out, we find that Xiaomi's focus on scientific research and its efforts to overcome challenges in chips and large models precisely reflect the core reasons why global investment institutions are bullish on China's technology assets.

With the explosion of AI in China, global funds/asset allocation is shifting towards China, especially favoring China's technology assets.

The result of this is that investment institutions are more willing to be bullish on enterprises that deeply cultivate medium- and long-term industries. These enterprises have greater potential, higher cost-effectiveness, and better safety margins.

The cornerstone of this phenomenon lies in the technological prowess and execution capabilities of Chinese tech enterprises, which other nations struggle to match, bolstered by advantageous policies, funding, and market conditions.

Recognizing this, technology research and development are no longer seen as "negative valuation" costs but rather as assets propelling future growth.

Xiaomi's 15-year journey exemplifies this technology-driven value investment. Recently, research assessments from Goldman Sachs and Morgan Stanley have reaffirmed the market's anticipation for Xiaomi's future expansion: Goldman Sachs is optimistic about Xiaomi's establishment of the world's largest ecosystem in the AIoT sector, while Morgan Stanley views the SU7 Ultra as the inception of Xiaomi's luxury car venture, with the arrival of the YU7 potentially serving as the next pivotal catalyst.

Amid the revaluation of China's technology assets, Xiaomi's Q1 financial report transcends mere data points; it serves as a directional statement, indicating a synergetic resonance among technology accumulation, industrial penetration, and capital validation.

The pertinent question now shifts from "whether Xiaomi can succeed" to the myriad surprises this seemingly well-known "Xiaomi" still holds in store for the future.