Why Does Li Auto Sell More Cars but Earn Relatively Less Money?

![]() 06/03 2025

06/03 2025

![]() 637

637

Original by New Energy Insights (ID: xinnengyuanqianzhan)

3028 words, 9-minute read

On May 29, Li Auto released its less-than-stellar Q1 2025 financial report.

Revenue and profit showed modest year-over-year growth but significant quarter-over-quarter declines. Amid intensifying market competition and escalating "price wars," Li Auto, once renowned for its industry-leading gross margin, is now teetering on the brink of the "health line."

Behind this phenomenon lies the challenge faced by Li Auto, once a bright star in the extended-range technology segment, of increasing competition from homogenization. Competitors like AITO and Leapmotor have encroached on the market share of extended-range vehicles through differentiated strategies, eroding Li Auto's advantages.

Faced with market pressure, Li Auto is attempting to achieve a "second leap" in corporate development by accelerating the deployment of its pure electric product matrix and increasing investment in the Vision-Language-Action (VLA) Model.

However, in the current context of a saturated pure electric market and rising consumer demands, can Li Auto break through the brand growth bottleneck and重塑its market competitiveness?

1. Year-over-Year Net Profit Declines, Q2 Delivery Outlook Falls Short of Expectations

The financial report reveals that in Q1 2025, Li Auto achieved total revenue of 25.9 billion yuan, a modest year-over-year increase of 1.1% but a significant quarter-over-quarter drop of 41.4%. Net profit stood at 650 million yuan, a year-over-year increase of 9.4% but a quarter-over-quarter plunge of 81.7%.

Figure/Partial data from Li Auto's Q1 2025 financial report

Source/Screenshot from New Energy Insights

Industry insiders point out that while the domestic new energy vehicle market showed overall growth in the first quarter, competition among leading enterprises intensified, leading to fierce battles for market share. Li Auto's poor performance in revenue and profit highlights challenges in cost management, market strategy, and other aspects.

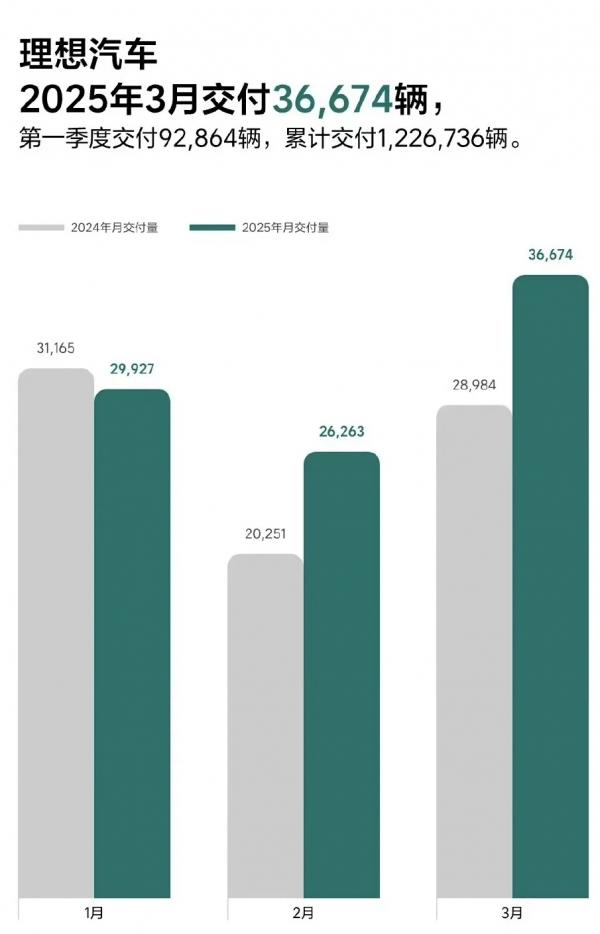

Despite the disappointing revenue and profit data, Li Auto's new vehicle delivery volume in Q1 2025 showed relatively bright year-over-year figures.

During the reporting period, Li Auto delivered a total of 92,864 new vehicles, achieving a double-digit year-over-year increase of 15.5% amidst fierce competition in the domestic new energy vehicle market.

Figure/Li Auto's Q1 2025 delivery data

Source/Screenshot from New Energy Insights

This raises a question: why didn't the increase in car sales translate into a corresponding increase in profit for Li Auto? Behind this lies the decline in Li Auto's average vehicle price and the increase in sales expenses, resulting in a gross margin of 20.5% in Q1, a year-over-year decrease of 0.1 percentage points, hovering on the edge of the "20% gross margin required to ensure the long-term healthy development of the enterprise" mentioned by Li Xiang, chairman and CEO of Li Auto.

Based on the less-than-ideal financial data for Q1, Li Auto's delivery forecast for Q2 is 123,000 to 128,000 vehicles, falling short of the market estimate of 128,852 vehicles.

Industry insiders are not surprised by Li Auto's "answer sheet" for Q1 2025.

"Under the wave of rapid technological iteration in the new energy vehicle industry, the advantages of extended-range technology are gradually weakening; Li Auto's high vehicle prices make it difficult to compete with rivals in terms of cost-effectiveness; meanwhile, the iteration speed of new models is slower than expected, lacking sufficient market competitiveness. These are all important factors leading to the decline in Li Auto's overall growth rate," said an automotive industry observer.

In fact, the trend of slowing down in Li Auto's performance growth could have been predicted from its 2024 annual financial report, which showed "increased revenue but not profit".

In 2024, Li Auto once again achieved revenue exceeding 100 billion yuan, reaching 144.5 billion yuan, a year-over-year increase of 16.6%. However, during the same period, net profit declined by 31.9%, earning 3.81 billion yuan less than in 2023.

Figure/Partial data from Li Auto's 2024 financial report

Source/Screenshot from New Energy Insights

Now, the performance figures for Q1 2025 further confirm the deep-seated issues faced by Li Auto during its development.

2. Is Li Auto Tired?

There was a time when Li Auto shone brightly in the new energy vehicle market with its extended-range technology route, even becoming a benchmark automaker in the extended-range sector.

In 2023, Li Auto, which had been established for eight years, achieved revenue exceeding 100 billion yuan for the first time, reaching 123.85 billion yuan, and also achieved full-year profitability for the first time, becoming the first new force automaker in China to announce annual profitability. Li Auto is also the third new energy automaker globally to achieve profitability after Tesla and BYD.

At that time, Li Auto, which was thriving, set a target of delivering 800,000 vehicles in 2024, and some institutions even predicted that Li Auto could enter the million-vehicle club by 2025.

However, as the new energy vehicle market continues to evolve, a large number of competitors have entered the extended-range sector. AITO quickly broke through with its intelligent cockpit and Huawei brand support, launching the AITO M7 and AITO M9, becoming a major competitor to Li Auto in the mid-to-high-end market. Leapmotor is eroding Li Auto's lower-end market with its "low-price" strategy.

Figure/AITO M7-AITO M9

Source/Screenshot from New Energy Insights

In addition, automakers such as Avita and XPeng, which once unequivocally stated that they would not produce extended-range vehicles, have successively launched or will soon launch extended-range models.

The encirclement and interception of competitors are directly reflected in Li Auto's business trajectory.

In 2024, Li Auto repeatedly lowered its target delivery figures. Although the final annual delivery figure of 500,500 vehicles was still "far ahead" among new automaking brands, it fell far short of the previously set target of 800,000 vehicles. In January 2025, after 24 consecutive months as the sales champion among new forces, Li Auto was replaced by XPeng.

In the following three months, XPeng and Leapmotor alternately became the monthly sales champions among new force brands, with Li Auto slipping to third place.

Previously, Li Auto lowered its 2025 sales target from the 700,000 vehicles set at the beginning of the year to 640,000 vehicles. Among them, the target for the extended-range L series was reduced from 560,000 to 520,000 vehicles, while the target for the pure electric product line was significantly increased from 50,000 to 120,000 vehicles.

Figure/Li Auto lowers sales targets

Source/Screenshot from New Energy Insights

The change in the sales ratio of different power forms, on the one hand, shows the decline of Li Auto's advantages in extended-range vehicles, and on the other hand, indicates that under market pressure, Li Auto has to vigorously develop pure electric products.

The decline in sales is also directly reflected in market volume and attention.

A consumer who attended last year's Beijing Auto Show and this year's Shanghai Auto Show said that compared to the 2024 Beijing Auto Show, although Li Auto's aura was still there, it had indeed dimmed a lot.

"Last year, I felt that every car from Li Auto was full of surprises. This year, although the products are still excellent, they lack that eye-catching feeling. Among the many new models, it is no longer the most dazzling one," the consumer said frankly.

Various signs indicate that compared to the glory of the 2024 Beijing Auto Show, Li Auto's aura, although still present, has indeed dimmed a lot.

In addition, Li Auto itself is also showing signs of fatigue. The first-mover advantage of its extended-range technology is accelerating dilution amid homogenization competition, and the ceiling for brand upward breakthrough and the bottleneck of user growth need to be resolved urgently.

Standing at a critical juncture of industry transformation, the competitive barriers that Li Auto once relied on with its extended-range technology are now facing double pressure from "falling behind the pacesetters and being closely pursued by competitors".

3. Is Li Auto, Ten Years Old, Making a Second Leap?

Founded in 2015, Li Auto will celebrate its 10th anniversary in July this year.

From focusing on family users since its inception and entering the market with extended-range electric technology to gradually building a rich product matrix, Li Auto has achieved remarkable results in the past decade. However, now, although Li Auto has taken the lead in achieving profitability, its road will not be easy in the upcoming second decade.

Market competition is becoming increasingly fierce, and the new energy vehicle sector is rapidly transforming from a blue ocean into a red ocean. Many automakers are making great efforts, whether it is the electrification transformation of traditional fuel vehicle giants or the rise of emerging automaking forces, both of which have brought tremendous competitive pressure on Li Auto.

At the same time, consumer demand for new energy vehicles is constantly changing, with higher requirements for product quality, performance, intelligence, and other aspects.

Obviously, Li Auto has long been aware of this.

Based on this, Li Auto finally brought its long-delayed pure electric products to the "stage" in 2025. In July, the second pure electric model, Li Auto i8, will be officially launched after Li Auto MEGA. According to previously disclosed information, Li Auto's first pure electric SUV, the i8, is equipped with the VLA intelligent architecture and 5C supercharging technology, attempting to reshape the high-end pure electric market with the concept of "family AI space".

Figure/Li Auto i8

Source/Screenshot from New Energy Insights

In addition, Li Auto will also launch another high-volume pure electric model, the i6, in the second half of the year, priced in the most fiercely competitive range of 200,000 to 300,000 yuan.

Figure/Li Auto i6

Source/Screenshot from New Energy Insights

Compared to the bold statements made when Li Auto MEGA was launched, Li Auto is much more low-key this time.

Liu Jie, president of Li Auto's product line, mentioned in an interview with reporters during the 2025 Shanghai Auto Show, "In 2024, we announced the sales target for MEGA very early, which actually has no value to users; it's just the company's own target. Therefore, for the Li i series, we hope to focus more on user value."

Liu Jie also emphasized, "Internally, we hope to become a first-tier brand in pure electric vehicles within three years, focusing on pure electric products, pure electric experience, and pure electric services, and doing them step by step."

To achieve this goal and make a second leap, Li Auto has chosen a different path from its competitors - ALL IN on the VLA driver model amid the wave of artificial intelligence.

In May, Li Xiang mentioned at the "Li Auto AI Talk Season 2" that the VLA architecture is seen as an inevitable outcome of the development of assisted driving, "The VLA model is the most effective method to solve the interaction challenges between AI and assisted driving."

A more direct understanding of this statement is that "the future VLA will be a driver model that works like a human driver."

Figure/Standards for Li Auto's VLA driver model

Source/Screenshot from New Energy Insights

But just like how humans need to accumulate rich driving experience to become skilled drivers, it is not easy for VLA to become a "VLA driver model." It needs to go through four stages of training and reasoning: VL (Vision-Language) base pre-training, assisted driving post-training, assisted driving reinforcement learning, and driver Agent (intelligent agent), so that users can communicate with the driver Agent through natural language, realizing "speaking to the driver Agent just as you would to a human driver".

In addition to enhancing professional capabilities, the VLA driver model needs to address the issues of safety and model black boxes to ensure it can achieve the safety and comfort of a professional driver and avoid learning improper behaviors such as cutting in line.

Obviously, neither the deployment of pure electric products nor the investment in VLA can be accomplished overnight for Li Auto. It will take time to verify whether Li Auto can achieve a second leap.