Investing Heavily in a "Mobile Power Bank": The Feasibility of New Energy Vehicles Selling Electricity Back to the Grid

![]() 06/03 2025

06/03 2025

![]() 475

475

Introduction

The answer is just around the corner.

In May, with the introduction of another citizen-benefiting policy in Guangzhou, V2G technology, or Vehicle-to-Grid, once again captured public attention.

It is understood that over the next three years, Guangzhou will allocate an annual special financial support of up to 20 million yuan for vehicle-grid interaction pilots, encouraging new energy vehicles to supply power back to the grid, with a maximum reward of 5 yuan per kWh.

This new policy is not without foundation.

In March, the National Development and Reform Commission and the National Energy Administration issued the "Guiding Opinions on Accelerating the Development of Virtual Power Plants," proposing that by 2027 and 2030, the national virtual power plant regulation capacity should reach over 20 million kW and 50 million kW, respectively.

In April, the National Development and Reform Commission and four other ministries and commissions jointly issued the "Notice on Announcing the First Batch of Pilot Projects for Large-scale Application of Vehicle-Grid Interaction" (hereinafter referred to as the "Notice"), listing Shanghai, Guangzhou, Shenzhen, and seven other cities as the first batch of pilot cities for large-scale vehicle-grid interaction applications.

Despite the recent surge in initiatives, the concept of V2G and its potential business models were already proposed as early as 2015. Given the enormous energy storage potential of new energy vehicles, major automakers have begun deploying V2G in recent years.

In 2020, Audi announced a collaboration with Germany's Hager Group to research a bidirectional charging innovation project using Audi e-tron models, aiming to integrate electric vehicles into the home grid. In 2021, Volkswagen stated that it would introduce V2G bidirectional charging technology for all pure electric vehicle models from the group's MEB platform starting in 2022, aiming to become the first European automaker to commercialize V2G. BMW's V2G testing has been ongoing since 2015.

Domestic automakers are not far behind. As early as 2020, Dongfeng Motor Corporation partnered with State Grid Corporation of China, the world's largest power company, to integrate electric vehicle infrastructure into green power transactions and promote the application of vehicle-grid interaction technology.

In 2021, BYD and Levo Mobility announced a cooperation, with Levo committing to purchasing up to 5,000 BYD commercial vehicles with vehicle-grid interaction capabilities within the next five years.

While the concept has been around for over a decade and the topic has been revisited several times, V2G has yet to be truly implemented.

With the implementation of new battery regulations for new energy vehicles and government financial support, can V2G technology truly be popularized, making new energy vehicles supplying power back to the grid the next profitable opportunity for car owners or enterprises?

01 The Business Model Conundrum Remains

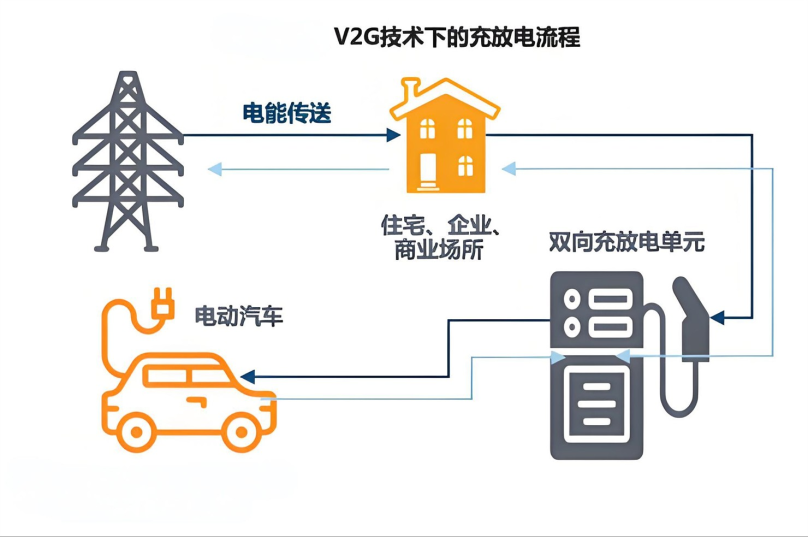

Before delving into this issue, let's explain V2G technology in detail. It refers to the bidirectional flow of electricity between new energy vehicles and the grid. A large number of new energy vehicles can serve as a buffer between the grid and renewable energy, functioning as a dynamic power balance reservoir.

During off-peak, low-cost electricity periods, electric vehicles charge from the grid, and during peak electricity periods, they can sell electricity back to the grid.

In simpler terms, it allows new energy vehicles to transform into "mobile power banks," where they can both charge from the grid and discharge during peak grid loads, achieving bidirectional energy flow through "charging during off-peak periods and discharging during peak periods."

Taking the typical V2G urban networking pilot project for heavy-duty truck charging and swapping stations in Shanghai mentioned in the "Notice" as an example, the project operationalized five intelligent bidirectional new energy electric heavy-duty truck swapping stations with a total equipment capacity of nearly 9,000 kW, supporting the rapid swapping of over 20 electric heavy-duty trucks simultaneously.

The 500 connected new energy electric heavy-duty trucks are all equipped with CTB-400 vehicle-storage shared batteries, with a cumulative battery capacity of 200,000 kWh and an annual discharge capacity of 260,000 kWh, equivalent to providing one year's electricity consumption for 500 households.

For owners of new energy vehicles, the idea of earning money through V2G has feasible potential. During the provincial vehicle-grid interaction conducted by China Southern Power Grid in March, with a subsidy of 3.5 yuan per kWh of electricity, a new energy vehicle owner discharged 25.76 kWh of electricity and earned a profit of 90.16 yuan.

From a macro perspective, the potential of the V2G market is also immense. Economically, data from the Energy Storage Leaders Alliance (EESA) shows that the V2G market is growing rapidly, expected to grow from $3.78 billion in 2023 to $45.09 billion in 2033, with a compound annual growth rate of 57.6%. Socially, V2G can not only help the grid reduce peak loads and fill valleys but also enhance the utilization of clean energy such as wind and solar through macro-control, reducing dependence on non-renewable energy sources like oil, coal, and natural gas.

Amidst the impact of huge economic growth potential and transformation of the energy ecosystem, countries have begun competing to lay out their strategies. However, under this grand blueprint, the dilemma of its commercialization model has proven challenging to overcome.

While it may seem as simple as reverse power supply, it involves vehicles, charging piles, and the grid. Vehicles need to have reverse discharging functionality, which has almost become a standard feature of new energy vehicles in recent years.

Charging piles require bidirectional power transmission upgrades. It is understood that the current price of charging and discharging piles is basically twice that of ordinary charging piles, leading to high input costs and a certain distance from large-scale popularization. The grid must coordinate with vehicles and piles to build a complete vehicle-pile communication protocol and a unified electricity price settlement mechanism.

Beyond infrastructure, a more pressing issue is the low enthusiasm of car owners to participate. During this year's Two Sessions, a deputy to the National People's Congress proposed an initiative to turn new energy vehicles into "power banks," but public reaction was mostly skeptical, especially concerning frequent charging and discharging causing battery degradation, and the earnings from discharging not being sufficient to replace the battery.

"Frequent charging and discharging significantly impact battery life, and the price difference is not enough to compensate for battery loss."

"Isn't it equivalent to spending hundreds of thousands to buy a mobile power bank?"

Regarding this, some industry insiders stated that the lithium iron phosphate batteries used in new energy vehicles can be charged and discharged about 3,000 times, which is within the normal life of the battery even if charged and discharged once a day.

However, the China Association of Automobile Manufacturers previously released a report on the health assessment of new energy vehicle batteries, which showed that after driving 116,000 kilometers, the battery health of the 2019 Tesla Model 3 was 89.3%; while after driving 103,000 kilometers, the battery health of the 2020 Ideal ONE was only 75.6%, with a decrease of nearly 25% in battery health over four years. The higher battery degradation of extended-range vehicles may be related to the repeated charging and discharging of the battery due to frequent use of pure electric mode.

Apart from doubts about battery degradation, the income from car owners discharging is not substantial. In the first case of reverse power supply or subsidy for new energy vehicles in Sichuan, the car owner discharged for 10 minutes, with the vehicle discharging 5.2 kWh of electricity, resulting in a discharge income of only 5.2 yuan.

Car owners have also done their own calculations: "The battery capacity of the car is about 40 kWh. If 80% of the power in the car is sold through V2G, with a charging price of about 0.2 yuan per kWh during off-peak periods and a discharge price of 1 yuan per kWh during peak periods, each transaction can yield a profit of about 25 yuan from the price difference." "25 yuan may seem like a decent amount, but this requires car owners to drive to charge during off-peak periods and discharge during peak electricity usage. The time and distance spent traveling back and forth, plus the time spent charging and discharging, reduce its cost-effectiveness."

Moreover, only a few private charging piles have V2G capabilities, and most operations need to be completed at public charging piles, which may also impact car owners who need to charge during peak periods. "In that case, the charging stations will be occupied, and more people will want to charge but have no place!" "Everyone wants to charge at a low price, and no one wants to charge at a high price. When everyone charges at night, the electricity price will still rise at night."

02 New National Standard and Battery Swapping Bonus: A Turning Point

For now, V2G technology still lacks fertile soil for deep implantation. However, this situation may change with the implementation of the new national standard for power batteries next year and the popularization of the battery swapping model.

On the one hand, the "Safety Requirements for Traction Batteries for Electric Vehicles" will be officially implemented in July next year. The upgraded new national standard has introduced new regulations on fast charging cycles, which will reduce battery degradation.

In the field of commercial electricity use, the mode of external power discharge from new energy sources has been affirmed. Some netizens stated that the used energy vehicle they purchased for 30,000 yuan in 2022, equipped with a 50 kWh battery, can be fully charged at home for 0.3 yuan per kWh after a 7.5 kW external power discharge modification, and then used as an external power source to supply power to the store.

With the store using 30 kWh of electricity per day and a commercial electricity cost of 1.5 yuan per kWh, using a new energy vehicle as an external power source can save 11,000 yuan in electricity bills per year.

This also proves that using new energy vehicles as external power banks has certain feasibility.

On the other hand, the battery swapping track is gradually maturing. After NIO, battery giant CATL has also entered the market with strength. Against the backdrop of fast charging and ultra-fast charging gradually becoming standard, and the advantages of battery swapping weakening, the battery swapping model is shifting from a mere promotional tool to tapping into the full life cycle value of batteries as core assets. And V2G is a key path to realizing this value.

With the bonus of the battery swapping model, the idea of earning profits by swapping fully charged batteries for low-charged batteries can significantly reduce the required time, and car owners do not need to worry about battery degradation, maximizing battery utilization. Additionally, through battery swapping stations and V2G technology, the recycling process will be simplified after the battery health declines.

Beyond individual car owners, fast charging, ultra-fast charging, and battery swapping have broader development potential in the B-end market. Commercial vehicles have larger battery sizes and scales, and unified management facilitates coordination. Centralized charging and discharging can not only expand corporate profit channels but also greatly balance grid coordination.

For automakers and battery enterprises, relying on their natural advantages in resource controllability, large-scale aggregation, and connection with the electricity market, they demonstrate huge potential to become the main drivers of V2G commercialization.

With the orderly operation of multiple pilot projects and strong policy support, along with the promotion of the battery swapping model and the implementation of the new battery regulations next year, it will soon be known whether V2G technology can be rolled out on a large scale, becoming another means of increasing income for private car owners and enterprises.

Even if the desired results are not achieved, V2G has already pointed out a new path for distributed energy storage and brought a new possibility for grid coordination.

Its significance is bound to be highlighted at a certain point in the future.

Responsible Editor: Cui Liwen | Editor: Chen Xinnan