From CATL to Momenta: How Audi is Reinventing Itself in China

![]() 06/03 2025

06/03 2025

![]() 571

571

Winning the Chinese market means winning the future. Author|Wang Bin

Winning the Chinese market means winning the future. Author|Wang Bin

At the Greater Bay Area Auto Show, which opened at the end of May, the waning fortunes of traditional luxury automakers like BBA in the Chinese market became more apparent. Media outlets repeatedly reported on the rise of Chinese luxury automakers, bluntly stating that "Chinese luxury cars have conquered the Greater Bay Area Auto Show".

For BBA, China's automotive industry in 2024 is no longer the market they once knew. While their global sales decline, the situation in China is even more dire. BMW and Mercedes-Benz experienced the steepest drops in global sales, with sales declining by 13% and 7% year-on-year, respectively, while Audi's sales in China fell by about 11% year-on-year.

This transformation occurred almost overnight. At the Shanghai Auto Show over a month ago, nearly all foreign automakers began collectively learning from the Chinese market, with more and more local Chinese suppliers appearing on their PPTs. CATL in the battery sector, Momenta in intelligent driving, and even DeepSeek in the large model market, these Chinese companies jointly support the intelligent transformation of foreign brands.

But none of the adjustments have been more intense than Audi's. Besides actively embracing electrification, they also launched the new AUDI brand in China, signaling their determination to transform the Chinese market with a more decisive approach. The AUDI E concept car was officially unveiled in November last year, and less than six months later, the first mass-produced model, the E5 Sportback, was launched on the eve of the Shanghai Auto Show, an astonishingly swift pace.

At the Greater Bay Area Auto Show, several new Audi models, including the AUDI E5 Sportback, were also showcased. Stefan Poetzl, General Manager of the Marketing Business Unit of FAW-Volkswagen Audi, said they aim to comprehensively cover various segments of the luxury market through differentiated brand positioning.

Unlike past locally produced foreign brand models, the AUDI brand has the German side responsible for design and chassis tuning, while the Chinese side handles electric and intelligent technology and vehicle production. For the core areas of new energy vehicles—namely, the three electrics and intelligent driving—Audi chose to collaborate with CATL and Momenta, both of which will provide the E5 Sportback with a power battery system and intelligent driving solutions.

For Audi, the AUDI brand represents a fresh start in the Chinese market, and they hope to win over more young Chinese consumers through it.

But the question remains: what will AUDI rely on to capture the hearts of this new generation of young consumers?

Luxury Standards are Being Rewritten

Over the past decade, the transformation of China's automotive market has not only been marked by the rise of new energy vehicles. Another less noticeable change is that while China has become the world's largest single automotive market, sales growth in the high-end segment has been even more rapid.

From 2018 to 2024, the passenger vehicle market in the 50,000-100,000 yuan price range in China shrank rapidly, but the market in the 200,000-300,000 yuan price range grew swiftly. In 2018, domestic sales of passenger vehicles in the 200,000-300,000 yuan price range were only 1.982 million, but by 2024, they had reached 3.822 million, a 92% increase over seven years.

More and more independent brands are beginning to step into the spotlight. According to data from the China Association of Automobile Manufacturers, in 2024, sales of domestically produced high-end brand passenger vehicles reached 4.738 million, an increase of 2.3% year-on-year. The association stated that the transformation towards intelligence and new energy has brought opportunities for Chinese automotive brands to enter the high-end market.

In the past, China's high-end automotive market was almost entirely dominated by BBA, but in the face of the wave of intelligence, the technical advantages accumulated by traditional luxury brands in the past cannot be sustained.

It's hard to say that BBA didn't realize the market was changing. Over the past few years, BBA have all announced plans to increase investment in China, collaborate with local suppliers, and produce the latest pure electric models locally.

At this Greater Bay Area Auto Show, Audi's AUDI E5 Sportback was one of the most prominent examples of BBA learning from Chinese automakers. The most significant difference between this model and Audi's traditional four-ring logo models is that there is almost no trace of the fuel vehicle era, instead being specifically redesigned for the Chinese market with more technological attributes.

AUDI E5 Sportback

The AUDI E5 Sportback boasts almost all the intelligent configurations found in China's automotive market. It features the latest Qualcomm 8295 chip, a CLTC range of 770 kilometers, 800V super-fast charging, and a new interior with a significant reduction in physical buttons.

The strength of traditional automakers lies in chassis tuning, and Audi's driving genes from the past are continued in this model. The E5 Sportback's dual-motor system still incorporates Audi's prized quattro all-wheel drive and adaptive air suspension technologies.

However, in the most crucial areas of new energy vehicles—namely, the three electrics and intelligent driving—Audi's advantages are not evident, so they chose to directly collaborate with top local Chinese suppliers. The 100 kWh ternary lithium battery equipped in the AUDI E5 Sportback is provided by CATL, and the Audi panoramic assistance driving system based on lidar is supported by the domestic intelligent driving company Momenta.

AUDI E5 Sportback is supported by Momenta in intelligent driving

This is also the common choice of most foreign automakers currently. Similar to Audi, Mercedes-Benz's newly announced L2++ high-order intelligent assisted driving system, also developed by the Chinese R&D team and optimized for Chinese road conditions in collaboration with Momenta, will be first equipped on Mercedes-Benz's latest pure electric model, the CLA. BMW's upcoming new-generation models have also reached a collaboration with Alibaba in the field of intelligent cockpits.

It can be said that in the face of the wave of automotive intelligence, BBA have begun to fully embrace Chinese intelligent automotive solutions, and they are attempting to reshape consumers' perception of luxury with the aid of Chinese intelligent technology.

At the Greater Bay Area Auto Show, Audi specially invited Rao Qing, Chief Architect of Global Solutions at Momenta, to give a speech. Rao Qing quoted the concept of "new luxury," believing that new luxury should be a fusion of luxury and intelligence. "This is not just a definition but a fact that is happening."

This is also Audi's future transformation direction. At the Shanghai Auto Show earlier, Audi AG Chairman Markus Duesmann stated that Audi's transformation strategy is clear and will focus on software-defined vehicles and advanced driver assistance technologies in the future. He believes that collaborating with outstanding Chinese suppliers can not only help Audi integrate global top technologies but also accurately meet the unique needs of the Chinese market.

Chinese Suppliers Support BBA's Intelligence

Even though BBA have begun to swiftly embrace Chinese intelligent automotive solutions, this process did not happen overnight.

Taking power batteries as an example, earlier, European automakers had attempted to build their own electric vehicle industry chain in Europe and support local power battery manufacturer Northvolt. This European battery manufacturer, which has received investments from Volkswagen, Volvo, BMW, and other automakers, was once valued at up to $20 billion, but after several years of persistence, it still failed to solve the capacity problem. In June last year, BMW had to cancel a $2 billion battery order with Northvolt. In March this year, Northvolt announced that it had filed for bankruptcy in Sweden.

The same is true for the development of future intelligent driving technology. BBA were once the representatives of global automakers that were among the first to initiate projects for intelligent driving research and development, but over the past 20 years, due to technological routes or strategic swings, they have failed to achieve large-scale mass production. It was Tesla that came from behind and opened the door to intelligent driving with FSD.

After repeated setbacks in China's new energy vehicle market, BBA finally realized that merely making localized adjustments in China is insufficient, and they must fully embrace Chinese intelligent automotive solutions. Not only German BBA but also Japanese "Big Three" Toyota, Honda, Nissan, and American brands such as Cadillac and Buick have begun to announce collaborations with Chinese suppliers.

However, this does not mean that any Chinese supplier can easily enter the supply chain of these global automakers. For these automotive brands with up to a hundred years of history, they are more cautious and have stricter standards when choosing partners.

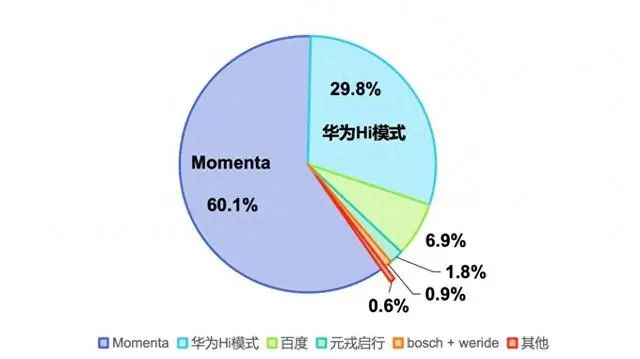

Looking at the partners chosen by BBA, they are almost all top companies in their respective fields. For example, in the AUDI brand, Audi chose CATL, which has the highest market share in power batteries, and Momenta, which has the highest market share in the domestic urban NOA third-party intelligent driving market.

2024 Urban NOA Production Research Report released by ZoZo Research

Even so, entering the supply chain of global automakers still requires long-term preparation. Cao Xudong, founder of Momenta, recently said in an interview with Tencent Auto that the cycle from establishing contact with joint venture or foreign brands to final mass production collaboration generally takes two years or even longer.

International clients are even more challenging. For an international client they previously collaborated with, they first exchanged online for two years from 2020 to 2022. When the other party needed to make major decisions in 2023, 40 waves of technical inspection and research groups were sent from overseas within half a year to continuously conduct technical research and scenario verification before finally reaching a collaboration.

As early as 2017, CATL took the first place in the global market share of power batteries, but it was not until 2020 that CATL finally reached a collaboration with Tesla, realizing the first entry of a domestic supplier into Tesla's core segment. Zeng Yuqun said in a podcast interview last year that it took them 12 years to increase their market share from zero to 37.5%, and the important thing is not just these 12 years but their 25 years of accumulation in the industry.

BBA is just a small part of foreign brands embracing China's intelligence. Taking Momenta as an example, currently, Momenta has collaborated on more than 130 mass-produced models, and more than 15 global automakers or Tier 1s have established collaborations with Momenta. Most global automakers from Japan, Germany, the United States, and other countries have almost all started collaborating with Chinese intelligent driving companies.

Automotive brands collaborating with Momenta

From last year to this year, BMW, Mercedes-Benz, and Audi have all announced their largest new car launch plans in China in the past few years. BMW's future-oriented new-generation models will be produced in China as early as 2026. Mercedes-Benz announced a $14 billion investment plan in China and will launch 7 exclusive models in China within the next two years. In addition to the upcoming launch of the first model, the E5 Sportback, Audi's new AUDI brand will also launch multiple new pure electric models covering the B-segment and C-segment markets.

But without exception, in this unprecedented pure electric counterattack by BBA, the figures of a large number of local Chinese suppliers can be seen. Chinese technology companies represented by Momenta have begun to support the intelligent banner of BBA.

Winning China Means Winning the Future

In 2023, China surpassed Japan for the first time to become the world's largest automotive exporter. Last year, this leading edge continued to expand. According to data from the General Administration of Customs, China exported 6.41 million vehicles in 2024, a year-on-year increase of 23%, continuing to rank as the world's largest automotive exporter.

At the same time, the market penetration rate of new energy vehicles in China has exceeded 50% for consecutive months. The market generally believes that the first half of the competition for electrification in China's new energy vehicles has ended and has entered the second half of intelligent competition. The competition for intelligent driving has intensified, with high-order intelligent assisted driving functions being continuously deployed to lower-priced models, and the level of competition far exceeds that in other regions of the world.

Cao Xudong, CEO of Momenta, said in an interview with Tencent News that China's smart electric vehicles are three years ahead of foreign countries in terms of the speed of intelligence and the development speed of urban NOA. He judged that international markets such as Europe, Japan, Korea, the Middle East, and Asia may not enter an era of explosion in automotive intelligence until 2027.

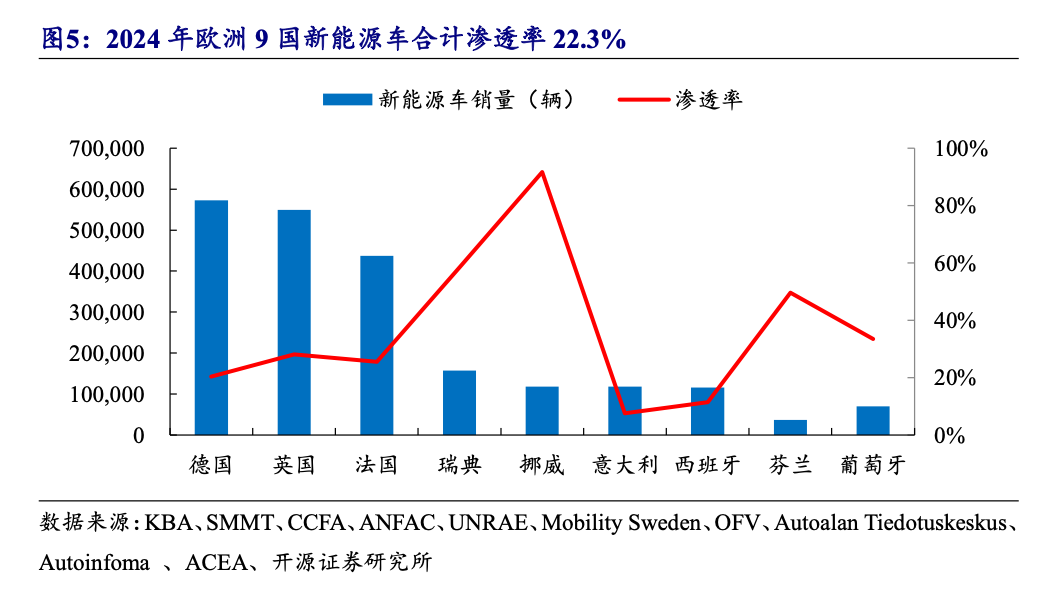

Market data further substantiates this viewpoint. Last year, due to the reduction in subsidy policies, the combined penetration rate of new energy vehicles in nine European countries dipped slightly to approximately 22.3%. Research from EVTank indicates that in 2024, new energy vehicle sales in Europe and the United States witnessed year-on-year growth rates of merely -2.0% and 7.2%, respectively, paling in comparison to the robust growth in the Chinese market.

Screenshot from Kaiyuan Securities Research Report

Screenshot from Kaiyuan Securities Research Report

This may explain why traditional luxury automakers such as BBA are more aggressively embracing intelligence in the Chinese market. China's new energy vehicle market is progressing at a significantly faster pace than other regions globally. Securing a foothold in the Chinese market signifies securing a position in the future.

Ola Källenius, Chairman of the Board of Mercedes-Benz, emphasized that the Chinese market is not only the cornerstone of Mercedes-Benz's global sales but also the hub of its technological innovation and future endeavors. Starting in 2025, Mercedes-Benz will position China as the epicenter of the next generation of electric vehicle advancements, unveiling new models based on the MB.EA platform. He believes that Mercedes-Benz's local R&D in China has evolved from a strategy of "in China, for China" to "in China, for the world".

BMW has established its largest R&D team outside Germany in China, encompassing four major R&D and innovation hubs and three software companies. Milan Nedeljković, a BMW Group Board Member responsible for production, recently stated to the media that China's innovation achievements not only cater to the local market but are also promoted globally.

Fermín Soneira, CEO of the Audi-SAIC collaboration, noted that China's market boasts the fastest and most decisive development and transformation in new energy vehicles and intelligent connected vehicles. Audi is eager to capitalize on the opportunities presented by the Chinese market. Any issues faced by the AUDI brand are promptly reported to Audi's global CEO Bram Schot, who also convenes weekly meetings to discuss projects. From Audi's perspective, success in China is synonymous with global success.

As BBA continues to escalate its investments in the Chinese market, China's intelligent automobile solutions are gradually making their mark on the global stage. In fact, some luxury automakers have already begun integrating Chinese intelligent solutions into their global models. Cadillac, a General Motors brand, has collaborated with Momenta for its latest globally launched pure electric model, VISTIQ, which will pioneer the use of a one-stage end-to-end large model.

Analogous to Audi's decision to reintroduce the AUDI brand in the Chinese market, AUDI holds significant historical value for Audi. Some market analysts believe that Audi's relaunch of AUDI in China signifies a strategic bet on China's future.

©Shanshang. All rights reserved. Unauthorized reproduction is prohibited.