Big Players Dominate as Small Brands Fade Away

![]() 06/04 2025

06/04 2025

![]() 513

513

Introduction

Amid accelerating technological advancements and diversifying consumer needs, resources are increasingly concentrating in the hands of leading enterprises.

From mini electric vehicles and boxy SUVs to MPVs and large six-seater SUVs, niche markets in China's automotive industry have seen intense competition. When a niche market shows potential, major automakers swiftly respond, launching similar products within a short timeframe.

From the craze for mini electric vehicles sparked by Wuling Hongguang MINIEV to the popularity of rugged boxy SUVs driven by Tank 300, and the clustered launch of MPVs like Sienna and Grandia, it appears to be fierce competition on the surface, but in reality, it's a strategic battle for dominance in niche markets. Whoever can capture the hearts of consumers first is likely to secure a larger share of this blue ocean.

However, the survival of the fittest rule applies here as well. In the long run, not all models in the same niche market can thrive. Most sustainable sales come from leading players. While some small brands entered earlier, their market share is increasingly squeezed for various reasons, leading to their eventual exit.

This is a common trend across industries, with the entire market eventually revolving around leading enterprises. Amid the transformation in the automotive industry, only enterprises with strong brand power, robust R&D capabilities, and a comprehensive service system can gain a foothold in niche markets and earn consumers' long-term trust.

01 Market Opportunities for All

The mini electric vehicle market, represented by Wuling Hongguang MINIEV, can be considered the most dynamic niche segment in China's automotive industry. When Wuling Hongguang MINIEV emerged in 2020 with an affordable price of 28,800 yuan, it quickly sparked demand for economical and practical electric vehicles in lower-tier markets, positioning itself as a "people's commuting car".

Achieving over 50,000 unit sales in a single month not only created an industry milestone but also attracted numerous capital and enterprises to enter the market. Unfamiliar brands like Jimai, Hongrui, Lingtu, Huazi, Leiding, and Punk emerged, with many "old man's joy" enterprises attempting to transform by slightly modifying their low-speed electric vehicles and pushing them into the market.

These small brands initially rode the wave of market dividends, sharing a piece of the pie in third- and fourth-tier cities and township markets with lower prices and rapid distribution strategies. However, as major players like Changan, Geely, and Chery swiftly responded, leveraging their deep technical expertise to rapidly iterate and upgrade products, crises for small brands ensued.

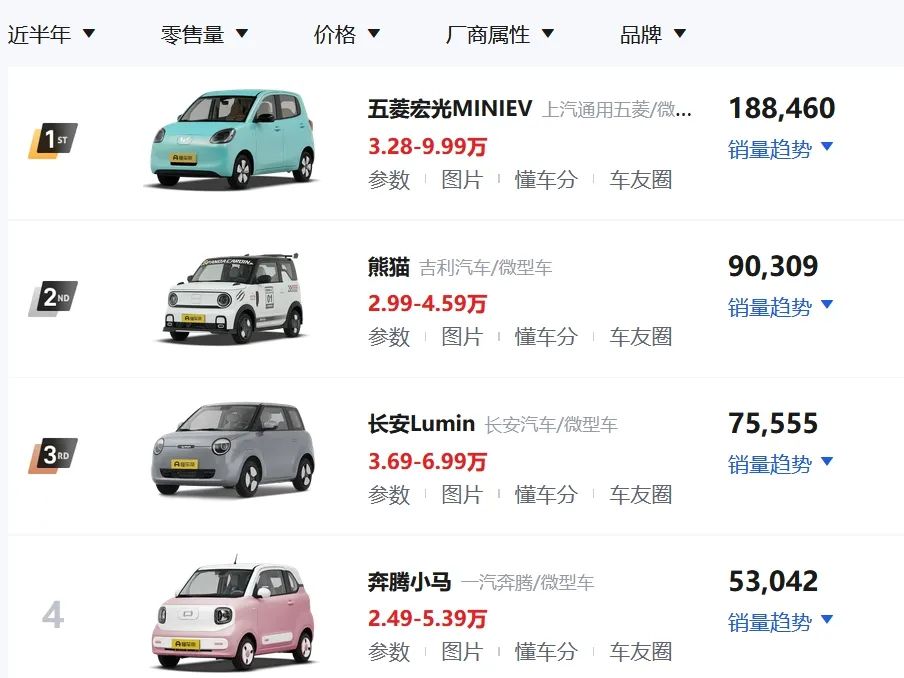

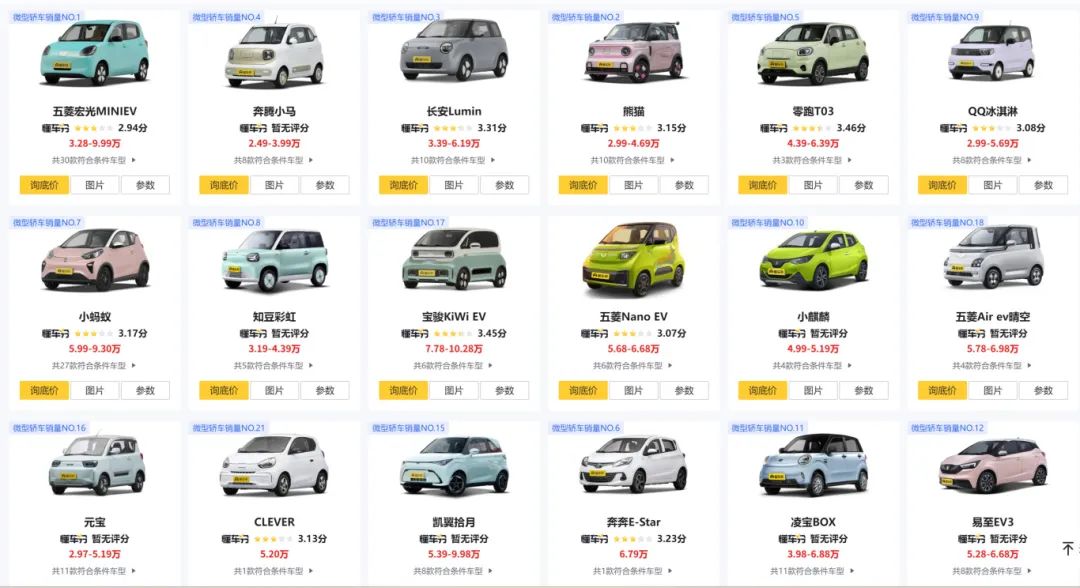

Data shows that in the mini electric vehicle market over the past six months, Wuling Hongguang MINIEV, Geely Panda, and Changan Lumin have a combined market share exceeding 50%. While Chery QQ Ice Cream and Besturn Pony hold a certain share due to their brand influence, their market performance lags behind leading products.

Those once noisy small brands, lacking core technology and hit by the dimensionality reduction attack of major players, have collectively withdrawn from the market within just two or three years, becoming a footnote in China's fiercely competitive automotive market. This game confirms that in the rapidly evolving new energy sector, only technology and quality are the fundamentals for victory.

Who remembers which MPV first adopted the 800V platform? The answer might surprise many: it's the Hozon V09, officially launched on October 13, 2023. As the first MPV in China equipped with 800V+SiC+4C ultra-fast charging+lidar, it featured all the top hardware of new-force intelligent vehicles at the time.

But is Hozon's name still relevant in the MPV market today? Even the Chinese auto market has forgotten this name. The MPV market, once dominated by joint venture brands like Buick GL8 and Honda Odyssey, has seen its potential stimulated by the growth of family travel needs and consumption upgrades. BYD entered the market with its Denza D9, and sales have soared since its launch.

Meanwhile, major players like Hovo Auto, Zeekr, and GAC Motor have also launched or enriched their MPV models, occupying the majority of the market share with their advantages in brand, technology, and quality. In contrast, some MPVs launched by small brands, such as Maxus, Roewe, and even Hyundai and Kia, have been powerless against competition from major players and gradually disappeared from the market.

This year, the large six-seater mid-to-large SUV market has been bustling with activity. This market not only boasts high sales and substantial profits but also attracts domestic "9-series" models to enter in clusters due to its ability to showcase a brand's strength in technology, design, quality control, and other dimensions, such as Denza N9, Lynk & Co 900, Deepal S09, Hyper HL, and Ledo L90.

Initially, AITO M9 leveraged Huawei's strong technological backing to showcase its advantages in intelligent driving and cockpit areas. With its luxurious interior and spacious six-seat layout, it was favored by high-end consumers, easily surpassing 10,000 unit sales per month. Li Auto L9 precisely targeted family users, offering an exceptionally comfortable driving and riding experience, and sales have soared since its launch.

These two models successfully opened up this blue ocean market, attracting many small brands and new forces to follow suit. As major players entered the market with resources and technology, the market landscape quickly changed.

Taking Deepal S09 as an example, it offers affordable pricing with sincere configurations, standard equipped with Huawei's Kunlun Intelligence Driving System ADS3.3 and its exclusive HarmonyOS cockpit. Looking at Lynk & Co 900, it adheres to the concept of equal rights for all six seats, featuring unique designs such as electric rotating second-row seats and a "heaven and earth door" split tailgate. It can be said that almost every model has its own specialty.

Currently, these new models have only just begun to be delivered, and their final sales performance will be tested by the market. However, it can be predicted that the launch of these models means small brands no longer have the opportunity to compete in this market.

02 An Inevitable Outcome

In the wave of China's automotive industry transitioning to new energy and intelligence, the phenomenon of "races" in niche markets such as electric cars, boxy SUVs, MPVs, and large six-seater SUVs is essentially a microcosm of the industry transitioning from wild growth to mature competition.

Behind this shift is a structural change in industrial resources concentrating on leading enterprises. Major players are reshaping the competition rules in niche markets with their combined advantages of brand power, technological barriers, and service ecosystems, while small brands are gradually marginalized due to scattered resources, lagging technology, and weak systemic capabilities. This phenomenon is not only the result of market competition but also an inevitability of industrial upgrading.

Brand power is the "first key" to competition in niche markets. Taking Wuling Hongguang MINIEV as an example, its label as a "national wonder car" doesn't solely rely on low prices but also on the trust accumulated through SAIC-GM-Wuling's 30 years of microcar manufacturing experience and the brand value of "whatever the people need, Wuling will make it", elevating mini electric vehicles from "commuting tools" to "cultural symbols".

In contrast, small brands like Lingbao BOX, although entering the market with lower prices, are limited by low brand recognition and insufficient 4S store networks, with users bearing hidden costs such as "difficult repairs" and "low resale value". The gap in brand power is particularly evident in the MPV market: Sienna relies on Toyota's reputation for "not breaking down" to secure the top spot in the 300,000 yuan market segment.

The emergence of Denza D9 and Hovo Auto Dreamer, on the other hand, has successfully gained a foothold in the high-end MPV market through their excellent space layout, intelligent technology configuration, and comfortable driving and riding experience. Small or weak brands find it difficult to break through the "face consumption" barrier in business reception scenarios or meet the comfort needs of family users, ultimately leading to their downfall.

Therefore, unlike product strength that focuses on hardware parameters and functional configurations, brand power essentially lies in the reliability formed through long-term quality control, the convenience shaped by service experiences, and the trust accumulated through user reputation, all of which together precipitate into intangible assets. Major players build an uncopyable competitive moat through large-scale production to reduce costs and improve quality, as well as standardized services to ensure experiences.

From a technological R&D perspective, major players have incomparable advantages. Taking BYD's Denza D9 launched in the MPV market as an example, relying on BYD's years of technological accumulation in the new energy sector, it is equipped with DM-i super hybrid technology and e-platform 3.0 pure electric technology, addressing consumers' concerns about range and energy consumption.

In contrast, small brands struggle to make breakthroughs in core technology R&D due to limited funds and technical reserves, with product performance and reliability far inferior to those of major players. This is particularly evident in the boxy SUV market, where Great Wall Motors has long occupied the top position, with only Jetu Motor standing out, and even Beiqi Motor and FANGCHENGBAO needing time to mature.

The essence of the technology barrier lies in the gap in R&D systems and data accumulation: Major players invest tens of billions of yuan in R&D expenses annually, optimizing algorithms through tens of millions of driving data, while small brands are limited by their fund size and find it difficult to make breakthroughs in core technologies. Of course, many boxy SUV products are merely shaped like boxy SUVs, but even so, they still test the design prowess of each automaker.

Overall, in the wave of market competition, leading enterprises continue to consolidate their market position with advantages in technology, brand, supply chain, and other aspects. If small brands want to survive in the fierce competition, they must find differentiated competition paths, strengthen technological innovation and brand building, and enhance their core competitiveness.

Otherwise, under the general trend of automotive industry transformation, small brands will face increasingly severe survival challenges.

Editor-in-Chief: Cao Jiadong, Editor: He Zengrong