Navigating the Saturated Ride-Sharing Market: A Pathway Through AI

![]() 06/04 2025

06/04 2025

![]() 657

657

Article | AI Relative Theory

As the smoke from JD.com's foray into local retail distribution begins to clear, a new horn sounds, heralding a fresh frontier.

According to the China Trademark Network, JD.com's subsidiary, "Beijing JD 360 Degrees E-commerce Co., Ltd.," filed for the "Joyrobotaxi" trademark in April, suggesting the internet giant's intent to enter the Robotaxi market, aiming directly at the ride-sharing sector.

While JD.com's strategy has yet to manifest in the market, it mirrors a broader trend within the ride-sharing industry: competition centered on AI-driven autonomous driving and smart travel technologies. Recently, Enjoyway Mobility secured over 1.3 billion yuan in C-round funding to bolster the application of big data, AI, and other technologies, accelerating the commercial rollout of autonomous Robotaxi services.

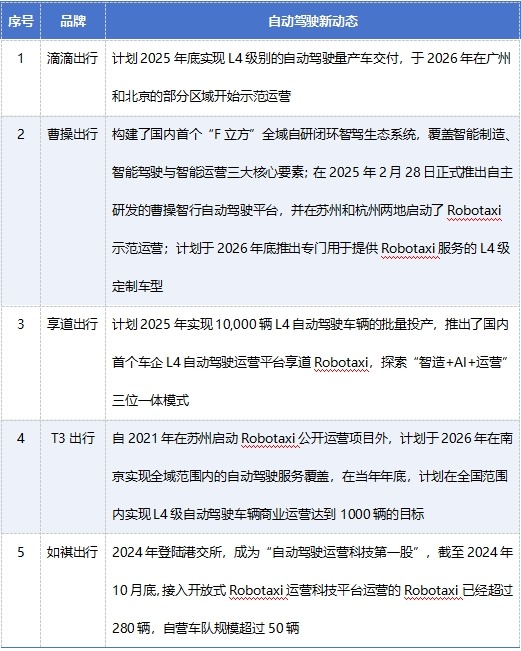

This capital influx further solidifies the market's transformational trajectory. Today's major ride-sharing brands, including Didi Chuxing, Cao Cao Chuxing, T3 Mobility, and Ruqi Chuxing, are all experimenting and planning around autonomous driving and smart travel, seeking new avenues through AI.

Illustration by AI Relative Theory

The Autonomous Driving Battle in Ride-Sharing: A Saturated Market and Dimensional Reduction

Mainstream ride-sharing brands are now all deploying autonomous driving, making it the next must-win battleground.

On one hand, the traditional ride-sharing market is nearing saturation. In the first quarter of this year, transportation authorities across the country issued risk warnings for the online car-hailing market, clearly indicating severe market saturation and a prominent issue of excess capacity.

Illustration by AI Relative Theory

As the online car-hailing market saturates, traditional business models for ride-sharing brands have also entered a phase of sluggish growth. Seeking a second growth curve through technological advancements is the only path for survival. Autonomous driving is seen as the new racetrack for future ride-sharing. By enabling unmanned and large-scale operations, ride-sharing brands can potentially eliminate labor and management costs, significantly reducing expenditures and boosting profit margins.

Take Baidu's "Luobo Kuaipao" project as an example. As of May 2025, the cost per kilometer of service has dropped to 1.2 yuan, with multiple cities expected to achieve profitability. Specifically, Wuhan's "Luobo Kuaipao" project is planned to reach full profitability by the end of 2025. If realized, this would be a game-changer, revolutionizing the ride-sharing market.

On the other hand, similar to Baidu's "Luobo Kuaipao" project, third-party autonomous driving brands have entered the ride-sharing sector, posing as direct challengers and competitors to established ride-sharing brands, including (potentially) JD.com, WeRide, Pony.ai, and others.

In this realm, the market is in a relatively chaotic competitive stage. For instance, the international travel giant Uber is both cooperating strategically with WeRide and Pony.ai (with an additional 100 million USD equity investment in WeRide, the largest single autonomous driving investment globally) to expand its Robotaxi fleet through third-party technology, and actively integrating Robotaxi services from brands like Tesla and Waymo to strengthen its platform position in the autonomous driving era.

This approach has also been attempted in China. In 2024, Ruqi Chuxing, having successfully listed on the Hong Kong Stock Exchange and promoted as the "first stock of autonomous driving operation technology," launched an open Robotaxi operation technology platform alongside its own Robotaxi fleet. This platform is compatible with various autonomous driving technologies and models, enabling remote management of Robotaxi services.

Furthermore, Ruqi Chuxing has independently developed an autonomous driving solution encompassing three key segments: the data annotation platform ONTIME Data Encoder, the high-precision map toolchain ONTIME MapNet, and the intelligent driving simulation platform ONTIME NexSim. These tools comprehensively aid the industry in enhancing autonomous driving capabilities and accelerating the maturity of Robotaxi services.

Interestingly, a complex interplay of competition and cooperation exists between ride-sharing brands and autonomous driving technology companies. In this seesaw relationship, there lies a hidden battle for the future of ride-sharing. The first to successfully deploy and maturely apply autonomous driving will achieve a dimensional reduction strike in this saturated market, opening a new frontier and fostering the brand's second growth.

A Brand-New Battleground: Who Will Break Through First?

Autonomous driving is steering the future of the ride-sharing market. Amidst the layout and competition of numerous brands, who will emerge as the pioneer? Currently, all participants are still in the nascent stages, testing the waters in major cities across the country, and have yet to enter a period of genuine competition.

That said, the direction for future competition is already clear:

1. Pursuing Large-Scale Deployment: Balancing efficiency, safety, and reliability. The success of Robotaxi heavily relies on economies of scale, necessitating not only the rapid and large-scale replication of a brand's self-operated fleet but also the stability and safety of autonomous driving as a product. Any mishap could spark strong negative public sentiment, as Xiaomi's automotive endeavors have already demonstrated society's sensitive stance towards autonomous driving.

In this regard, Enjoyway Mobility has collaborated deeply with the autonomous driving unicorn Momenta, adopting Momenta's first robotaxi technical solution based on the SAIC IM Intelligence ls6 pre-installed hardware platform. Leveraging mass-produced hardware as the foundation, this technology offers greater stability and cost control, laying the groundwork for large-scale and rapid replication.

Currently, most market Robotaxi rely on aftermarket retrofitting models, which, while quick to replicate, still require verification of safety and stability. Whether they can truly support the large-scale popularization of future ride-sharing remains to be seen.

2. Exploring Ecological Operation Modes: Being both competitors and partners. The commercial development of Robotaxi cannot be dominated by a single player. The collaborative growth of various brands and technologies will be the norm for the market for the foreseeable future. In this process, ride-sharing brands must explore paths of ecological operation, integrating the resources and vehicles of different companies to expand the market together.

Judging by the practices of Uber and Ruqi Chuxing, both domestic and international platforms, this will be a mainstream approach. Based on its open Robotaxi operation technology platform, Ruqi Chuxing has established deep ties with multiple autonomous driving companies, successfully expanding from cities in the Greater Bay Area like Guangzhou, Foshan, Zhuhai, Shenzhen, Dongguan, and Zhongshan, and beginning to advance towards central cities like Changsha, embarking on a journey out of the "newbie village."

3. Building a Full-Stack Capability Layout: Covering the entire industrial process of autonomous driving. The development of Robotaxi is inherently asset-heavy. True popularization involves not just vehicles but also considerations of manufacturing, supply chains, platform operations, algorithms, data, and a host of other issues. Solving these complex problems is not simple, and the brands that do so will establish a systematic Robotaxi solution.

It is noteworthy that brands like Cao Cao Chuxing and Enjoyway Mobility are striving to achieve this, creating a full-stack model that integrates intelligent manufacturing, intelligent driving, and intelligent operations, addressing every aspect of Robotaxi meticulously.

In Cao Cao Chuxing's perspective, autonomous driving technology determines the feasibility of the model, deeply customized vehicles underpin basic capabilities, and platform efficiency drives commercial success. These three elements complement each other, jointly propelling the advancement of the Robotaxi industry.

Final Thoughts

Ride-sharing brands' focus on autonomous driving is essentially a response to industry bottlenecks through technological innovation, seeking breakthroughs amidst multiple pressures related to cost, efficiency, policy, and competition. In the short term, autonomous driving can optimize operations and reduce costs. In the long run, it will reshape the travel industry ecosystem, propelling the transformation of urban transportation towards intelligence and unmanned operations. Despite the challenges, this trend is irreversible, and the coming years will be crucial for the large-scale implementation of Robotaxi.

The current layouts by these ride-sharing brands lay the groundwork for the public to better enjoy Robotaxi services in the future. This is not merely a market battle but also a societal evolution.

*All images in this article are sourced from the internet