Vehicle Prices Plunge by 40,000 Yuan! NIO Faces Critical Juncture, Can 2025 Be a Turning Point?

![]() 06/05 2025

06/05 2025

![]() 549

549

Time is ticking for NIO.

Since late May, numerous listed automakers have unveiled their Q1 financial reports. Among them, NIO's report stands out, warranting closer scrutiny compared to those of Xpeng Motors and Li Auto, which have already reported.

Li Auto has achieved profitability, Xpeng's net loss in Q1 narrowed to 660 million yuan, while NIO's net loss for the entire year of 2024 soared to an astonishing 22.4 billion yuan. Against this backdrop, Li Bin has set a target to achieve profitability by the end of this year.

Without exaggeration, if NIO truly meets this goal, it would mark a significant milestone in the automotive industry's history.

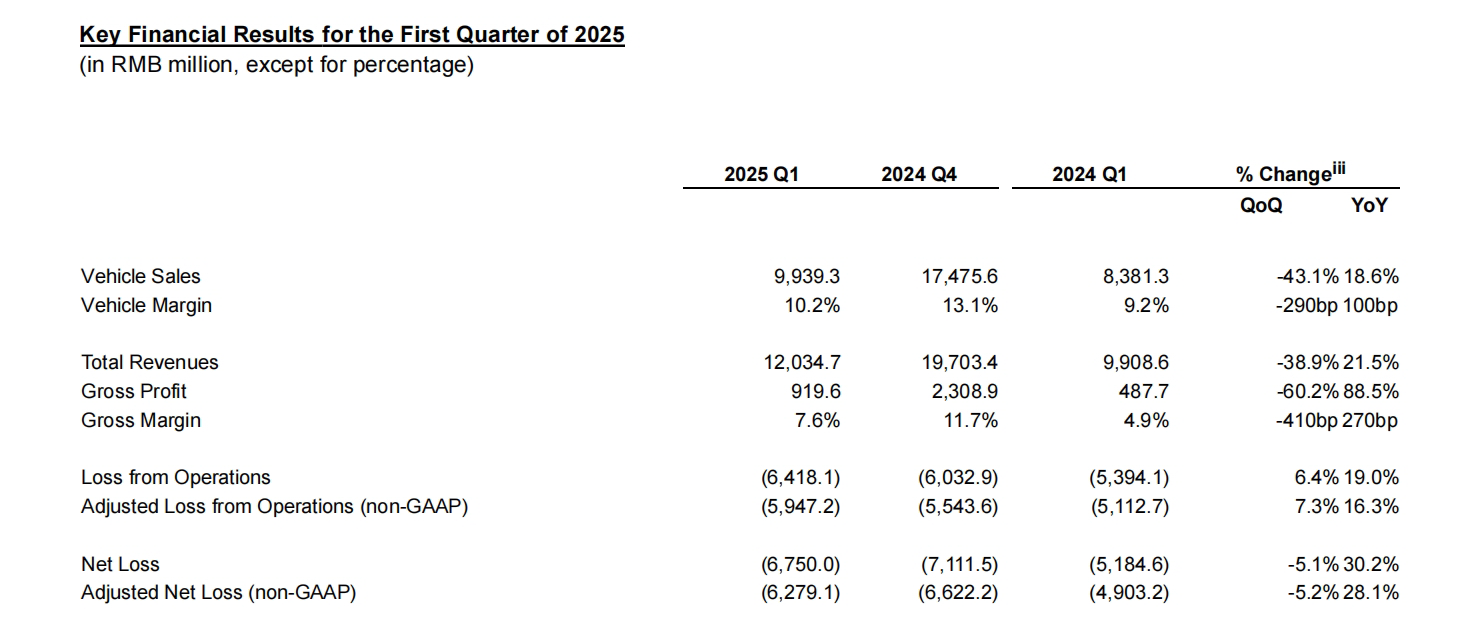

Screenshot: NIO Financial Report

According to the financial report, NIO delivered a total of 42,094 new vehicles in Q1 2025, with total revenue reaching 12.0347 billion yuan, a year-on-year increase of 21.5%. The gross margin on vehicle sales was 10.2%, and parameters such as total revenue and gross margin on vehicle sales were notably higher than those in Q1 of last year.

However, the net loss in Q1 this year still stood at 6.2791 billion yuan, significantly higher than the same period last year, and there was no remarkable narrowing compared to Q4 last year.

Thus, during NIO's Q1 earnings call, 'profitability' and 'cost reduction' were inevitable keywords. Li Bin, the founder of NIO, and Qu Yu, NIO's CFO, appeared under considerable pressure.

NIO Must Demonstrate a Turnaround in Q2

Compared to Q1 last year, NIO did make progress in Q1 this year. Sales data shows that out of the 42,094 new vehicles delivered in Q1, 27,313 were under the NIO brand and 14,781 under the Ledao brand.

The total deliveries and revenue in Q1 this year were naturally lower than those in Q4 last year, but it's worth noting that only 30,100 vehicles were delivered in Q1 last year. The introduction of the new Ledao brand did indeed boost sales figures substantially.

However, the result of increased sales was a rapid decline in the average price per vehicle.

Combining revenue and sales data, the average price per vehicle for NIO in Q1 last year was 278,500 yuan, while it was only 236,100 yuan in Q1 this year, a drop of over 40,000 yuan, slowing down revenue growth.

Source: NIO Official Website

There are essentially three ways for a company to achieve profitability: 1) Increase the average price per vehicle; 2) Significantly increase overall sales data; 3) Effectively control losses.

Since NIO has already launched Ledao and Firefly, it's unlikely to adopt the first approach to achieve profitability. The problem now is that the latter two approaches have yet to have a significant impact.

The Ledao L60 was designed to capture the Tesla Model Y market, but in fact, the cumulative deliveries for the entire Q1 were less than 15,000 vehicles.

As a strategic model to stimulate overall brand sales, the performance of the Ledao L60 is far from satisfactory. With the inevitable decline in the average price per vehicle, Ledao has not truly taken on the mantle of boosting sales, and there is still a long way to go before it can help NIO turn losses into profits.

Source: Dianchetong

A noteworthy data point is that NIO brand sales in Q1 were actually lower than those in Q1 last year, either indicating a decline in the market competitiveness of the NIO brand itself or suggesting that some consumers who originally opted for NIO's entry-level models are now considering the Ledao L60.

NIO's product advantages lie in battery swapping and intelligent experience. Even though NIO did not launch any new models in Q1 this year, these two advantages should not have caused a rapid decline in the brand's market competitiveness. Therefore, according to Dianchetong, the main reason for the decline in NIO brand sales is the latter scenario.

In terms of loss control, Li Bin revealed that significant investments have been made in brand building, infrastructure, and sales networks over the past few years. The quarterly losses are controllable, and since March this year, NIO has taken a series of cost control and efficiency enhancement measures.

This explains why NIO's net loss in Q1 this year narrowed compared to Q4 last year, but since these measures have only been in place for one month, the narrowing of net losses was not significant. The effectiveness of these cost control measures will depend on the Q2 financial report data.

Source: NIO Official Website

For Q2 financial report data, the company has provided guidance: the gross margin per vehicle will return to around 15%, the overall gross margin will exceed 10%, and the expected delivery volume will be between 72,000 and 75,000 vehicles, with revenue guidance ranging from 19.513 to 20.068 billion yuan.

NIO brand generally delivers around 20,000 vehicles per month. To achieve this expectation, not only will Ledao and Firefly need to take more crucial steps, but cost control measures must also play a bigger role. Both are indispensable.

Can Ledao's Foray into Online Car-Hailing Help NIO Achieve Profitability in Q4?

Li Bin is firm in his goal of achieving profitability in Q4 this year and has proposed two ways to achieve it:

1) Reduce investments, with R&D expenses accounting for 6%-7% of revenue and selling expenses accounting for 10% of revenue.

2) By Q4 this year, NIO plans to maintain a monthly sales volume of over 50,000 vehicles, with 25,000 deliveries by NIO, 25,000 by Ledao, and over 1,000 by Firefly.

Li Bin believes that as long as both paths are viable, NIO can achieve profitability in Q4.

Regarding the first point, NIO's R&D expenses in Q1 were 3.1814 billion yuan, down from Q4 last year but still accounting for 26.44% of total revenue in Q1; NIO's selling, general, and administrative expenses in Q1 were 4.4007 billion yuan, accounting for 36.57% of total revenue in Q1.

Now that all three NIO brands have been launched, investments in R&D expenses, selling expenses, etc., will decline. Moreover, according to previous reports by 36Kr Auto, NIO has adjusted the organizational structure of multiple departments within Ledao and Firefly to inhibit the expansion of the company's losses by integrating resources.

Furthermore, Li Bin plans to use battery swapping stations in some third- and fourth-tier cities to replace dealerships for promotional and marketing activities, allowing energy replenishment facilities to serve other functions, effectively reducing some costs.

Source: Firefly

On the crucial promotional front, based on Q4 last year's performance, it is not difficult for NIO to reach a monthly sales level of 20,000 vehicles. For Firefly to exceed 1,000 vehicles in monthly sales, it can try to explore overseas markets or increase promotional efforts in the domestic market. The challenge lies in delivering 25,000 Ledao vehicles per month.

The Ledao L60 has been on the market for 9 months, and consumers are well aware of this model. Without a new generation or significant discounts, it will be difficult for the Ledao L60 alone to help the brand achieve a monthly sales target of 25,000 vehicles.

It should be noted that Ledao has begun to explore more possibilities in the online car-hailing market to stimulate sales. According to blogger 'Xiaoteshu', Ledao L60 is cooperating with Didi's dedicated car service, targeting the BYD Han, which is priced around 200,000 yuan.

This move may affect Ledao's brand image, but given Ledao L60's current market performance, tapping into the online car-hailing market is not necessarily a bad thing for Ledao.

Source: Weibo @Xiaoteshu

Li Bin emphasized that Ledao will launch two new models targeting the household market in the second half of this year. The already announced Ledao L90 will be launched in Q3, and the slightly smaller Ledao L80 will be launched in Q4.

It is clear that Ledao will continue to strengthen its presence in the pure electric SUV market for household use and rely on the higher-end Ledao L90 and Ledao L80 to tap into more markets.

It is too early to evaluate the market prospects of these two new SUVs, as most of their configuration information has not yet been fully announced, and their market competitiveness remains unclear. However, it is evident that NIO still has high expectations for the Ledao brand.

Will 2025 Be a Life-or-Death Line for NIO?

NIO did show growth momentum in Q1, but losses have not yet been effectively controlled, and sales need a greater boost. NIO's firm goal of achieving profitability in Q4 this year indeed demonstrates its boldness.

However, NIO started its cost control measures and new vehicle strategy a bit late. Almost half of 2025 has passed, and the results of NIO's cost control measures have not yet been fully realized. The two new Ledao models will be released in the second half of the year, and NIO also aims to achieve the 'county-level charging network coverage' plan in most regions of the country this year, which will inevitably increase investments in infrastructure. This makes NIO's goal of achieving profitability in Q4 less convincing.

Screenshot: NIO Live Stream

Looking at sales data, since the beginning of 2025, NIO's monthly sales have been 13,863, 13,192, 15,039, 23,900, and 23,231 vehicles, ranking around eighth in the new energy vehicle market, surpassed by products emphasizing cost-effectiveness such as Xpeng, Leaping Auto, and Deep Blue.

With limited market demand, NIO now needs to find effective ways to accelerate sales growth as soon as possible. To achieve profitability in Q4, NIO has set very clear targets. If these targets are not met, NIO, which has already fallen out of the first tier of new energy vehicle sales, will have even less say in the market next year.

It is worth mentioning that Li Bin also stated, 'The monthly cost of water armies attacking NIO is about 30-50 million yuan, but we don't know who is paying for it.' He explained that the operation of water armies is complex, with a huge industrial chain behind it. Offensive and defensive actions often come from the same group of people, similar to telecom fraud. Although it is difficult to manage, he hopes to intensify crackdowns to alleviate the problem. To prevent interference from water armies, NIO's live streams sometimes incur high costs, even exceeding the cost of the live stream itself, eventually leading to the closure of comment sections. Li Bin even revealed that 'the monthly funds used by water armies to attack NIO are about 30-50 million yuan, but the specific sponsors are unknown.'

Dianchetong hereby declares that this article is an objective interpretation and does not belong to the 'cost of water armies attacking NIO'. We look forward to NIO overcoming its difficulties, achieving profitability in Q4, and bringing more possibilities to the Chinese automotive industry.

(Cover image source: NIO Official Website)

Source: Leitech