New Energy Vehicles Return to the Countryside: Do Villagers Truly Desire a Switch from Gasoline Cars?

![]() 06/05 2025

06/05 2025

![]() 522

522

Introduction

124 new energy vehicles are set to enter rural areas, where market potential and challenges coexist.

A fresh wave of the automobile countryside campaign is upon us!

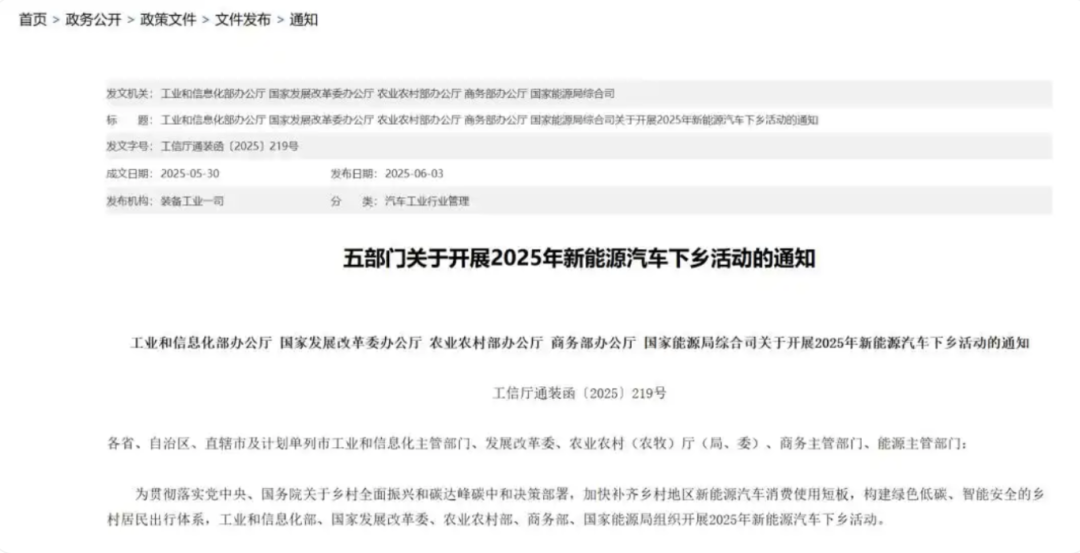

On June 3, the Ministry of Industry and Information Technology, alongside four other departments, jointly issued a notice announcing the 2025 New Energy Vehicle Countryside Campaign. The notice emphasizes the need to address shortcomings in the consumption and usage of new energy vehicles in rural areas and establish a green, low-carbon, intelligent, and safe transportation system for rural residents. To achieve this, the Ministry of Industry and Information Technology and other departments will organize the 2025 New Energy Vehicle Countryside Campaign.

China's automobile industry is now facing fierce internal competition following rapid growth. Despite annual production and sales exceeding 30 million units and significant progress in the new energy market, issues such as slowing market growth, overcapacity, and intensified homogenization competition, leading to insufficient innovation, continue to hamper the industry's healthy development.

The introduction of the new energy vehicle countryside policy undoubtedly opens up new avenues for growth within the industry.

Since China launched the new energy vehicle countryside campaign in 2020, a total of 24 special events have been held in 10 provinces (cities) from 2020 to 2024. Participating automobile enterprises have cumulatively released nearly 270 countryside models, driving cumulative sales of new energy vehicles to exceed 7 million units. As of June this year, more than ten provinces, municipalities, and autonomous regions have successively held nearly 30 events and hundreds of parade and exhibition activities, with over 400 new energy vehicle models (excluding trucks) participating in the new energy vehicle countryside campaign.

Behind these numbers lies the long-suppressed consumer potential in third- and fourth-tier cities and rural areas, now erupting.

On one hand, policy support continues to increase, and on the other, consumer enthusiasm intensifies. With the successive rounds of new energy vehicle countryside campaigns, a profound transformation in the future structure of China's automobile market is accelerating in counties and below.

01 Growth or Further Growth

In 2009, the automobile countryside campaign first emerged on the market. Amid the financial crisis, China's automobile sales growth rate declined from nearly 22% in 2007 to 6.7% in 2008. To stimulate automobile consumption, the "Automotive Industry Adjustment and Revitalization Plan" issued by the State Council proposed policies benefiting farmers.

At the time, subsidies were primarily offered for the purchase of light passenger vehicles and light trucks, with the purchase tax exempted. Despite issues with outdated models, tangible benefits were provided, and automobile enterprises seized this opportunity to clear inventory, achieving a win-win situation.

Stimulated by the policy, the domestic mini-car market grew by 1 million units in 2009. In the year the automobile countryside policy was implemented, China's automobile sales surged by 46.1%, marking a significant stimulus effect. Building on this success, the automobile countryside policy was extended for another year. Coupled with the rise of the entrepreneurial class and the opportunity presented by low per capita car ownership in the rural automobile market, the automobile countryside policy also created sales miracles for a batch of microvan models, such as the "miracle car" Wuling Hongguang.

Ten years later, in 2019, the National Development and Reform Commission and nine other departments jointly issued a plan to promote consumption, reviving the automobile countryside policy after a decade-long hiatus. From the issuance of the 2019 plan to the official launch in 2020 and then to the continuous "New Energy Vehicle Countryside" initiative in 2021, this wave of policy stimuli has been quite fruitful.

Relevant statistical data shows that since July 2020, over 60 models from more than 20 automobile enterprises have participated in the "New Energy Vehicle Countryside" campaign, with sales of these models exceeding 180,000 units in the following four months. Simultaneously, the additional increment in the rural market alleviated the downturn in the automobile market due to the epidemic in 2020 to a certain extent.

Since the automobile countryside campaign began in 2009, policy stimuli have consistently bolstered consumer confidence in automobiles, whether during economic downturns, declines in the automobile market, or impacts from the epidemic, with most initiatives achieving positive results.

With the rapid progress of the new energy market, the automobile countryside campaign has also introduced new strategies in the new energy sector. The new energy countryside campaign has continuously expanded and upgraded in scale and quality, entering the rural market.

The theme of this new energy vehicle countryside campaign is "Green, Low-Carbon, Intelligent, Safe - Empowering New Countryside, Enjoying New Travel".

The campaign's emphasis on "new countryside" underscores its objective: to leverage the hundred billion-level blue ocean market of rural automobile consumption. Notably, a number of typical county-level cities with a low proportion of new energy vehicle adoption and significant market potential have been selected to host special events, which will radiate to surrounding townships as their center.

Activities include selecting new energy vehicle models that meet rural usage needs, have a good reputation, and are reliable in quality, followed by exhibition displays, test drives, and other activities. Especially regarding the number and quality of models, the expansion and upgrade of this countryside campaign have injected strong momentum into the county market and sent a stronger signal.

In terms of specific models, the 2025 New Energy Vehicle Countryside Campaign involves 124 models, an increase of 25 models compared to 99 in 2024, with further expanded coverage. The campaign selects new energy vehicle models that cater to rural usage needs, have a solid reputation, and are reliable in quality, offering services such as purchase discounts, tax and fee exemptions, compatible incentives, and after-sales service guarantees.

It is noteworthy that Tesla is participating in the new energy vehicle countryside campaign for the first time, and its benchmarking effect will significantly enhance the overall appeal of countryside models and drive the conversion of observers. Additionally, Tesla's entry represents a landmark event in the penetration of high-end brands into rural markets.

Led by BYD, 11 models are comprehensively deployed, ranging from Seagull to Tang DM-i, covering microcars to mid-to-high-end SUVs. The richness of supply is catching up with first- and second-tier markets, achieving a "saturation attack" on the diverse needs of counties and forming precise coverage of market segments and specific consumer demands alongside multiple domestic brands.

Based on past campaign experiences, the official start date of the new energy vehicle countryside campaign varies by region, with differences in campaign methods and subsidy intensity. In some economically developed areas, the subsidy amount is relatively higher. For instance, last year's Xichang Station in Xiangyang offered a subsidy of 3,000 yuan for going to the countryside. As for other implementation details this year, they have not been announced yet.

02 Growth Engine and Consumption Challenges

As mentioned earlier, a hundred billion-level consumption market lies hidden behind the automobile countryside campaign. Driving cumulative sales of over 7 million new energy vehicles over four years narrates the story of the long-suppressed consumer potential in the rural market erupting. Therefore, the country's efforts to intensify the new energy vehicle countryside campaign hold immense potential for exploitation.

Among these efforts, the increase in rural residents' per capita disposable income has laid an increasingly solid foundation for car purchases. Especially in recent years, due to policy dividends, expanded employment channels, and comprehensive rural revitalization, the growth rate of rural residents' income has "outpaced" that of urban residents, further unleashing the consumption momentum of the rural market and providing a new fulcrum for domestic demand growth.

Simultaneously, the current car ownership per 100 households in rural areas is still significantly lower than that in urban areas, and the process of new energy vehicles replacing gasoline vehicles has just begun, also implying enormous potential. Data shows that the current car ownership per 100 households in rural areas is approximately 42 units (2024), compared to approximately 81 units per 100 households in urban areas, which is roughly twice as much. Moreover, the penetration rate of new energy vehicles in rural areas is only 33.8%, while it reaches 38.5% in urban areas.

This means there are over 20 million gasoline vehicles in rural areas. If calculated based on an annual new energy replacement rate of 5%, the potential replacement demand can reach millions of units per year. Additionally, the proportion of first-time car purchases by rural residents is high, and income growth is expected to directly translate into new car purchase demand. When combined with local subsidies and automaker discounts, prices decrease, and policy leverage has a greater opportunity to drive incremental sales.

However, in leveraging the hundred billion blue ocean market of rural areas through the new energy countryside campaign, there are also numerous challenges that need urgent resolution.

The first is charging anxiety, which has become a "stumbling block" for rural automobile consumption.

It is reported that the current density of public charging piles in counties is only one-fifth that of core cities, and the installation rate of private piles in residential areas is less than 15%. An owner in a county town candidly stated, "I bought a new energy vehicle half a year ago, and I have to drive to the township power supply station every time I charge, which is more than ten kilometers round trip." This pain point has persistently plagued consumer enthusiasm in counties and below.

At the same time, due to the priority layout of service networks of new energy automobile enterprises in popular cities, their authorized after-sales service outlets are mostly concentrated in city and county centers. Owners in remote townships face the dilemma of "repairing cars is harder than buying cars," with maintenance being time-consuming and labor-intensive, causing considerable inconvenience to consumers. When the service network of new energy brands can be scaled down, it will directly impact the conversion effectiveness of the new energy vehicle countryside campaign.

Furthermore, when new energy vehicles enter rural areas, product adaptability needs continuous improvement.

Because rural consumers' car purchases are not akin to refrigerators, TVs, and large sofas, and they even have limited demand for the extreme intelligence that current automobile enterprises are pursuing. If some models feature complex intelligent functions that do not align with the habits of middle-aged and elderly users, and practical needs such as durability and cargo space are not fully met, it will also dissuade many consumers.

Overall, the new energy vehicle countryside campaign has entered the "deep water zone." Tesla's participation and the expansion of model numbers confirm the persistent policy efforts, and the increase in county purchasing power will also unleash more incremental space. However, charging shortcomings and service blind spots are like two sides of a coin, restricting the full release of market potential. Therefore, policy support needs to further tilt towards charging infrastructure, and automobile enterprises should "squat down" to study the genuine needs of rural areas. All parties must collaborate to ensure the successful implementation of the new energy vehicle countryside campaign.

Fortunately, this new energy vehicle countryside campaign further addresses the pain points of new energy vehicle consumption in rural markets. The notice states that this campaign will also organize new energy vehicle after-sales maintenance and service enterprises, charging and swapping service enterprises, insurance, credit, and other financial service enterprises to collaborate in entering rural areas, continuously optimizing the supporting environment for the application of new energy vehicles in rural areas.

Simultaneously, the campaign promotes the application of vehicle-grid interaction technology in rural areas and enhances the level of green development in these regions. It implements policies such as vehicle purchase tax and vehicle and vessel tax exemptions, car trade-ins, and addressing shortcomings in county charging and swapping facilities, encouraging automobile enterprises to enrich product supply, improve service levels, and actively expand new energy vehicle consumption in rural areas.

In terms of organization, a collaborative effort is encouraged among diverse market entities across new energy vehicle production, sales, finance, charging and swapping services, and after-sales service. By integrating policy tools such as trade-ins and addressing deficiencies in county-level charging and swapping facilities, a tailored, integrated promotion strategy of "purchase discounts + energy support + service guarantees" is devised. This approach enhances the after-sales service network, ensuring comprehensive coverage throughout the lifecycle of car purchase, usage, and maintenance.

Furthermore, a blend of "online + offline" methods is employed to foster a seamless service loop encompassing online ordering, offline delivery, and subsequent after-sales follow-up.

Clearly, the journey of new energy vehicles into the lower-tier markets signifies not merely an expansion of sales but also a testament to operational efficiency. As charging concerns diminish and the service system bridges the final mile, new energy vehicles are poised to venture into even broader territories, reaching the heart of rural areas.

Editor-in-Charge: Cao Jiadong, Editor: He Zengrong