Losses Reduced by 5.1%: Is NIO's Cost-Saving Strategy Working?

![]() 06/05 2025

06/05 2025

![]() 509

509

Before the release of NIO's second-quarter financial report, speculating on the survival prospects of Li Bin and NIO is more akin to idle chatter.

Perceptions vary, leading to inevitable disagreements. If we look at empirical evidence, companies like XPeng and Wenjie have also experienced turnarounds after facing criticism. Similarly, many automotive brands that have long dominated the market have also seen sharp declines. For instance, some current Japanese joint venture brands.

In essence, facts speak louder than words. Therefore, after meticulously dissecting NIO's recently released first-quarter 2025 financial report, although it fell short of many analysts' expectations, it was within the expectations of many. Concurrently, some valuable data points emerged.

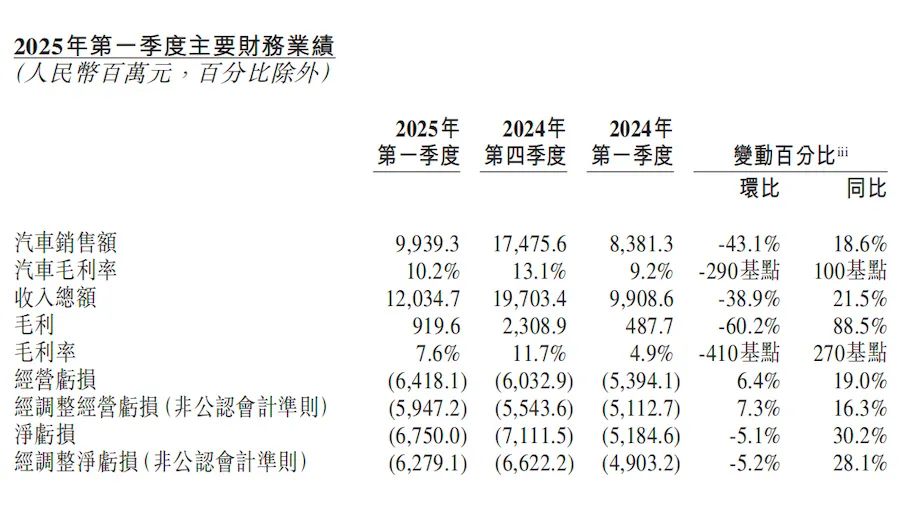

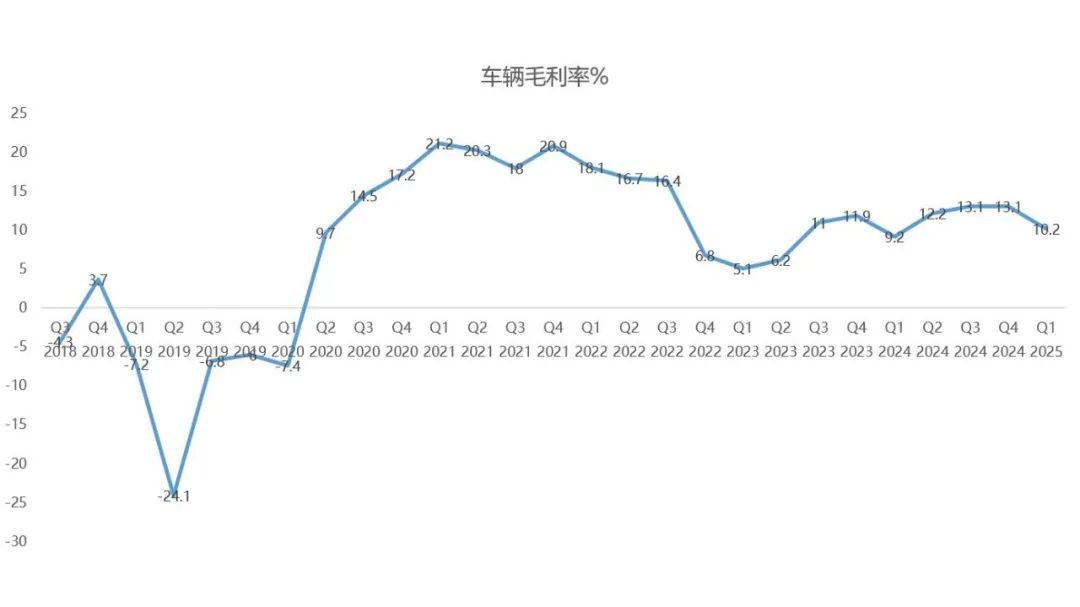

In summary, NIO's key financial data for the first quarter includes: 42,000 new vehicles delivered, a year-on-year increase of 40.1% but a quarter-on-quarter decrease of 42.1% compared to the fourth quarter of 2024; revenue of 12.034 billion yuan, a year-on-year increase of 21.5% but a quarter-on-quarter decrease of 38.9%. After clearing inventory through price reductions and promotions, the average price was lower than the same period in 2024 but slightly better than the fourth quarter; sales costs were 11.115 billion yuan, a year-on-year increase of 18% but a quarter-on-quarter decrease of 36.1%, indicating cost dilution with increased sales; vehicle profit margin was still inadequate at 10.2%, compared to 9.2% in the first quarter of 2024 and 13.1% in the fourth quarter of 2024, while Lixiang's vehicle profit margin was 20.5%; net loss was 6.75 billion yuan, a year-on-year increase of 30.2% but a quarter-on-quarter decrease of 5.1%.

Is Li Bin's cost-saving strategy effective?

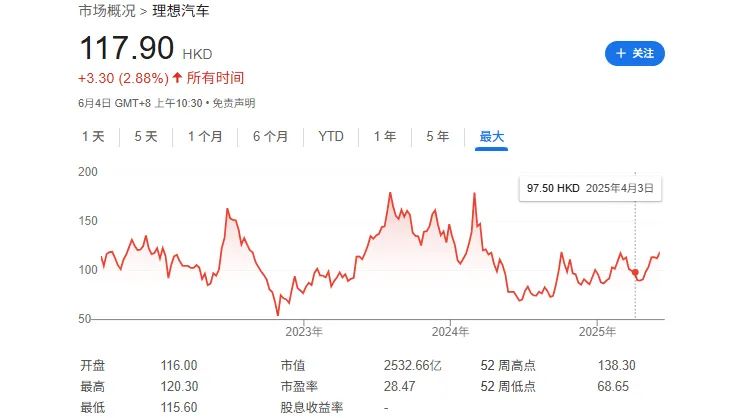

The capital market isn't overly interested in this financial report. However, the current automotive industry has proven that there won't be another Tesla—a company relying on continuous hot money injections from the capital market to sustain long-term losses before entering a period of explosive growth.

Thus, the situation facing NIO and Li Bin is clear: first, sustained sales growth ensures NIO's survival; second, the subsequent battery business will operate independently, avoiding horizontal competition and successively partnering with automakers like FAW, Changan, GAC, Geely, and Chery to generate cash flow.

In summary, NIO's first-quarter financial report conveys the following signals: points worth discussing, points needing questioning, and positive points:

1. Worthy of discussion: During the Q&A session with analysts after the financial report's release, when Tim Hsiao inquired about how cost reductions in the second quarter would bring about changes, Qu Yu responded that R&D expenses in the second quarter would increase by 15% compared to the first quarter. The debate lies in whether Li Bin's cost-saving model is stringent enough given this figure.

NIO will launch three new vehicles in the second half of the year: the third-generation NIO ES8, Ledo L80, and Ledo L90. R&D expenses will reflect the reuse and versatility of technology, and the 15% figure will be put to the test.

2. Points needing questioning: First, the delivery guidance for the second quarter is 72,000 to 75,000 vehicles. As of now, sales in April were 23,900 vehicles, and May was 23,231 vehicles, implying an expected delivery volume of 25,000 to 28,000 vehicles in June. This reflects Li Bin's reluctance to use conventional industry methods like price reductions or reduced configurations to boost sales, instead opting for steady growth.

Another example is that NIO held 26 billion yuan in cash in the first quarter of 2025, a decrease of 15.9 billion yuan compared to the fourth quarter of 2024, suggesting a push for the fourth quarter. The good news is that NIO raised 4 billion Hong Kong dollars from Hong Kong stocks in the second quarter. The challenge is that NIO must achieve profitability in the fourth quarter, as the current net cash level won't sustain another year if the trend continues.

3. Positive points: The second-quarter vehicle price is expected to rebound by 3,000 yuan to 239,000 yuan, making NIO a rare industry representative that doesn't lose money in exchange for sales. Losses also decreased by 5.1% quarter-on-quarter compared to the fourth quarter of 2024, naturally due to the difference between the number of new battery swap stations built in the fourth quarter (exceeding 570) and the first quarter of 2025 (410).

Additionally, the sales volume in the fourth quarter of 2024 was 72,600 vehicles, and the sales volume in the first quarter of 2025 was 42,000 vehicles, showing a difference. Notably, NIO's quarterly losses have been continuously expanding year-on-year and quarter-on-quarter for a long time before this, but now there are signs of narrowing.

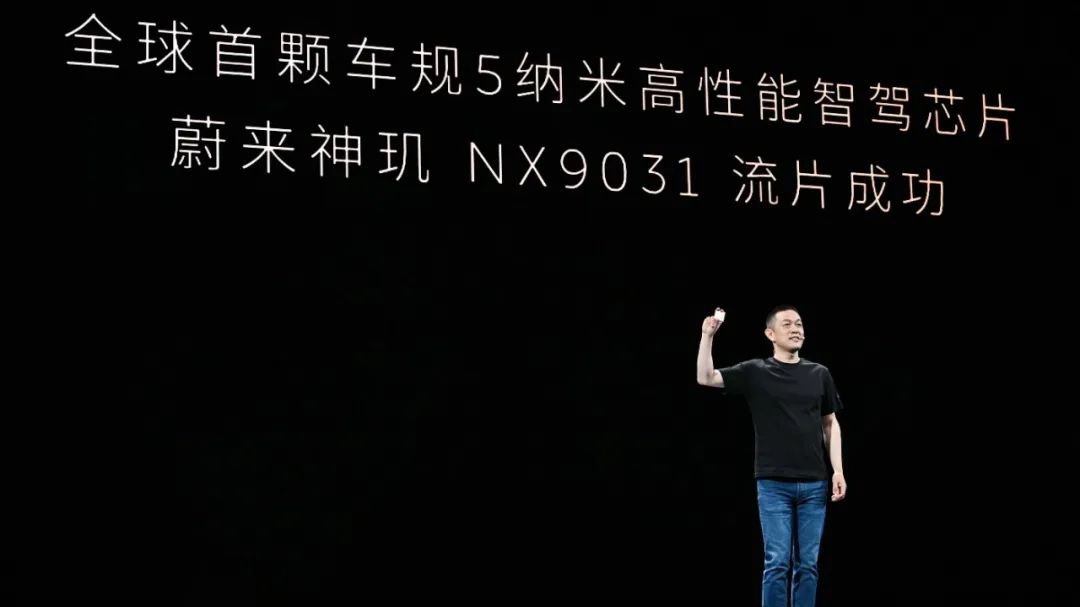

Beyond these points, it's evident that switching from the NVIDIA Orin-X chip to a self-developed chip can optimize vehicle costs by around 10,000 yuan. This will bring about a more significant change: the gross profit margin per vehicle in the second quarter is expected to increase to around 15%, with the goal for the fourth quarter being 20%, similar to Lixiang. In this regard, there's a clear difference between NIO and XPeng, which currently has soaring sales. Roughly calculated, XPeng's gross profit margin per vehicle is around 10.5%, following a strategy of exchanging price for volume and making small profits but quick turnover.

After hitting bottom, how many cards do NIO and Li Bin have left to play?

The first-quarter financial report concludes that NIO's operating conditions have improved to a certain extent. Considering that it only started truly promoting internal reforms from March 2025, the changes in the second-quarter figures will be crucial.

Some key indicators include NIO's organizational structure adjustment in the second quarter of 2025, involving around 5,000 people across departments like R&D, sales, and services. The sales channels of Ledo and NIO have begun to further integrate, and it was confirmed in previous communication meetings that a partnership system would be adopted for subsequent channel expansion, neither direct sales nor the traditional 4S store agency model. In short, it operates in a light capital model.

Given the current acceptable sales performance of the Firefly, with 3,680 vehicles sold in May, in the Chinese perception, small cars are often deemed less valuable. A series of best-selling models of the same size include Geely Xingyuan, BYD Seagull, BYD Dolphin, etc., with an average price of less than 100,000 yuan. The sales results of the Firefly announced in May were 3,680 vehicles, basically on par with SAIC Volkswagen ID.3 at the same price point. Of course, new vehicles tend to have a rapid growth trend after being launched, and performance during the flat sales period will be the next focus. However, another observable change is that NIO's internal production capacity has begun to improve, with no longer a situation where the production capacity of Ledo L60 and NIO ET5 slowly ramps up after being launched.

Whether the future is life or death, NIO's next profit formula is clear. The key information in Li Bin's response to analysts is that in the fourth quarter of 2025, the total monthly sales of the three brands will be around 50,000 vehicles, the gross profit margin per vehicle will be controlled at 17-18%, sales and administrative expenses will be controlled at around 10%, and R&D expenses will account for 10%.

Of course, this logic wasn't conjured up by Li Bin out of thin air. His exact words were, "Some peers have achieved profitability with a similar scale, so I think we can certainly achieve profitability too. This is currently our basic plan in terms of operations."

There's an internet saying, "He chose the play with the highest traffic," like the recent Jiangsu Super Football Match, where Changzhou's own goal was frequently mentioned with this saying. As for Li Bin, he has also chosen a different path from the industry. Whether it's good or bad will only be answered when looking back a few years later.

The current issue with NIO is that hot money from the capital market has shifted to areas like AI, and the new force model can no longer attract significant influxes. Therefore, the high-investment model of developing three brands together is unsustainable, and automakers in the industry that have achieved profitability have basically embarked on a path of large-scale reuse. For instance, XPeng's MONA was originally defined as an independent second brand but was eventually reduced to within the system.

Moreover, in terms of technology application, new developments have been abandoned in favor of reuse. The reason why XPeng P7+ could enter the market at a low price is that it reused many technologies from XPeng G6 on a large scale, and XPeng MONA M03 uses the XPeng G9 platform with deep simplifications.

Lixiang follows the same model. The Lixiang L series has large-scale reuse in platforms and three-electric systems, maximizing cost control. For NIO, it doesn't use such a model. From 2018 to 2022, NIO used the NT1.0 platform, and the intelligent driving assistance system was a product redeveloped based on Mobileye. From 2022 to 2024, NIO began switching its technology platform to the NT2.0 platform. At the end of 2024, with the launch of NIO ET9, it entered the NT3.0 era. The all-new NIO ES8, to be launched in the second half of 2025, will be equipped with NT3.0, and it's expected that starting from 2026, the current main sales models will also be gradually equipped with it. Consequently, the resulting switch between old and new models will impact sales and costs, respectively.

Additionally, Ledo L80 and Ledo L90 have undergone significant redevelopment. Furthermore, the NIO Firefly cannot directly reuse the previous large vehicle platform, presenting corresponding costs and operational challenges.

However, for Li Bin, it's not a situation where there are no cards left to play.