Q1 2025: Li Auto Deploys Four Strategic Moves

![]() 06/05 2025

06/05 2025

![]() 463

463

Amid rapid advancements in new energy, autonomous driving, artificial intelligence, and chip technology, the automotive industry is undergoing unprecedented transformation. Zero-State LT introduces the "Auto Circle" column to track the latest developments in the global automotive industry, new product launches, technological innovations, and market performance of major automakers. Through in-depth analysis, the column uncovers underlying business logic and market rules, highlighting how these factors reshape the automotive landscape and impact human mobility. This is the 19th article in the series, exploring how Li Auto embarks on a new journey of intelligentization with four strategic moves in the fiercely competitive new energy market.

Author | Gao Xinchi

Editor | He Kun

Operations | Chen Jiahui

Produced by | Zero-State LT (ID: LingTai_LT)

Cover image | Li Auto official Weibo

On May 29, Li Auto released its financial report for the first quarter of 2025, showcasing impressive profitability data and marking ten consecutive quarters of profitability. Financial report data reveals a net profit of 647 million yuan and a non-GAAP net profit of 1 billion yuan. Simultaneously, Li Auto's sales and revenue both increased, painting a picture of stable performance.

In contrast, the automotive market in the first quarter was turbulent. Traditional automakers like BYD and Geely intensified competition early this year by enhancing intelligent driving capabilities and engaging in price wars. Meanwhile, brands like Deepal and Leapmotor continued to focus on products that "replace Li Auto" at a lower price. Deepal S09 even directly mentioned Li Auto in its promotions. Despite Li Auto's stable development, industry competition necessitates vigilance.

Notably, Li Auto's management revealed a strategic shift around the release of its first-quarter financial report, likely an adjustment to respond to market changes. To cope with these changes, Li Auto has prepared four strategic moves focusing on both markets and products: pure electric vehicles, intelligent driving, lower-tier markets, and overseas expansion. These four moves will be the main highlights of Li Auto's future and key factors influencing its ability to reach new heights.

Strategic Moves in Products and Markets

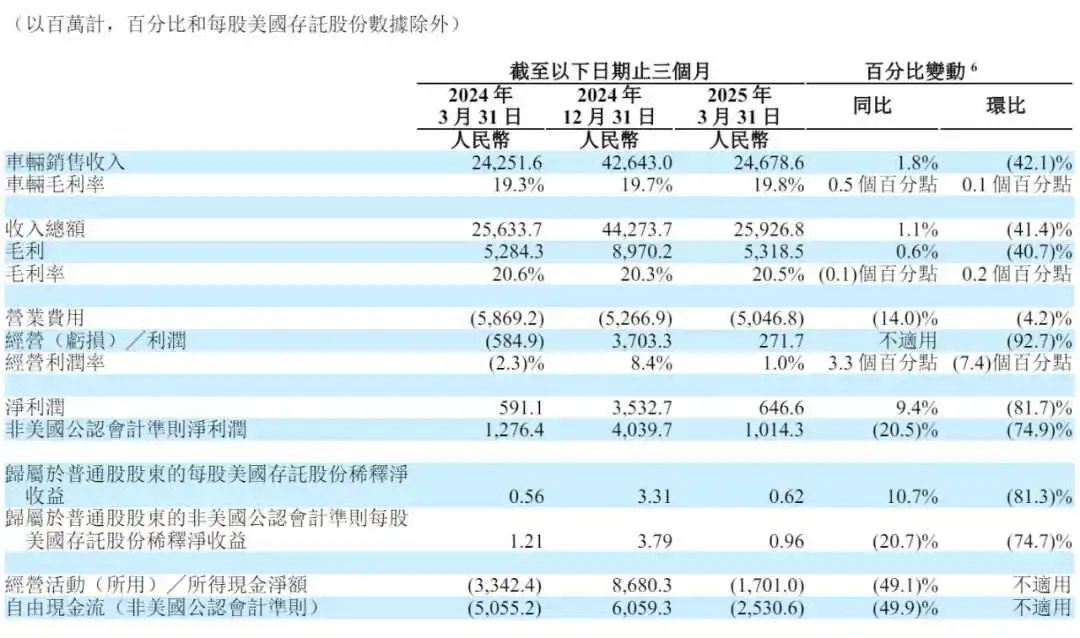

According to public data from Tianyancha and financial report data, Li Auto's revenue for the first quarter of this year was 25.9 billion yuan (RMB, the same below), a year-on-year increase of 1.1%. Currently, Li Auto's revenue comes from two main parts: automobile sales and other sales and service businesses, with the former being the mainstay of its income. In the first quarter, revenue from automobile sales was 24.7 billion yuan, a year-on-year increase of 1.8%, benefiting from increased sales volume. Li Auto sold 92,864 vehicles in the first quarter, a year-on-year increase of 15.5%. In May of this year, Li Auto sold 40,856 vehicles, a year-on-year increase of 16.7%, with a total sales volume of 167,660 vehicles from January to May. Revenue from other sales and service businesses was 1.2 billion yuan, a year-on-year decrease of 9.7%.

In terms of profit, it's crucial to focus not only on the profit scale but also on the gross profit margin level, which is a critical indicator when observing new forces in automobile manufacturing. Tesla's gross profit margin has long been maintained above 20%, and a "20% gross profit margin" is also regarded as a watershed for new forces in automobile manufacturing, dividing them into profitable and unprofitable camps.

In the first quarter, Li Auto's gross profit margin remained relatively stable at 20.5%, compared to 20.6% in the same period last year and 20.3% in the previous quarter. Specifically for the automobile sales business, its gross profit margin was also stable at 19.8% in the first quarter, compared to 19.3% in the same period last year and 19.7% in the previous quarter. In terms of expenses, Li Auto's operating expenses in the first quarter were 5 billion yuan, a year-on-year decrease of 14.0% and a quarter-on-quarter decrease of 4.2%.

▲ Figure: Li Auto Financial Report

In 2018, Li Auto emerged with the concept of a "mobile home." No one expected that with the launch of the Li ONE, this automaker focusing on extended-range electric vehicles would become the sales champion among new forces in automobile manufacturing. In 2024, Li Auto topped the list with its first annual sales exceeding 500,000 units, and its annual revenue exceeded 144.5 billion yuan. In the first quarter, Li Auto continued to use its previous strategy, but based on its official statements and actions in recent months, Li Auto's strategy will undergo significant changes in the second half of this year.

Specifically, to further enhance its position and cope with increasingly fierce market competition, Li Auto has prepared four strategic moves.

The first is to enter the pure electric market, a strategy that began in March 2024 with the release and launch of its first pure electric model, the "Li MEGA." In the second half of this year, Li Auto will update its pure electric products by launching the Li i8 and Li i6. Li Xiang mentioned at the financial report conference that these two models are currently undergoing road tests across the country for optimization before mass production.

The second is intelligent driving. Thanks to its large models, Li Auto's intelligent driving solution has become one of the industry's first-tier solutions, making intelligent driving one of the main selling points of its products. It is reasonable for Li Auto to continue strengthening its intelligent driving capabilities in all aspects. According to the plan, Li Auto's new-generation assisted driving solution VLA will be mass-produced and installed in vehicles in the second half of this year, serving as an important weapon for Li Auto.

The above two points are adjustments made at the product level. In addition, Li Auto has also made adjustments at the market level.

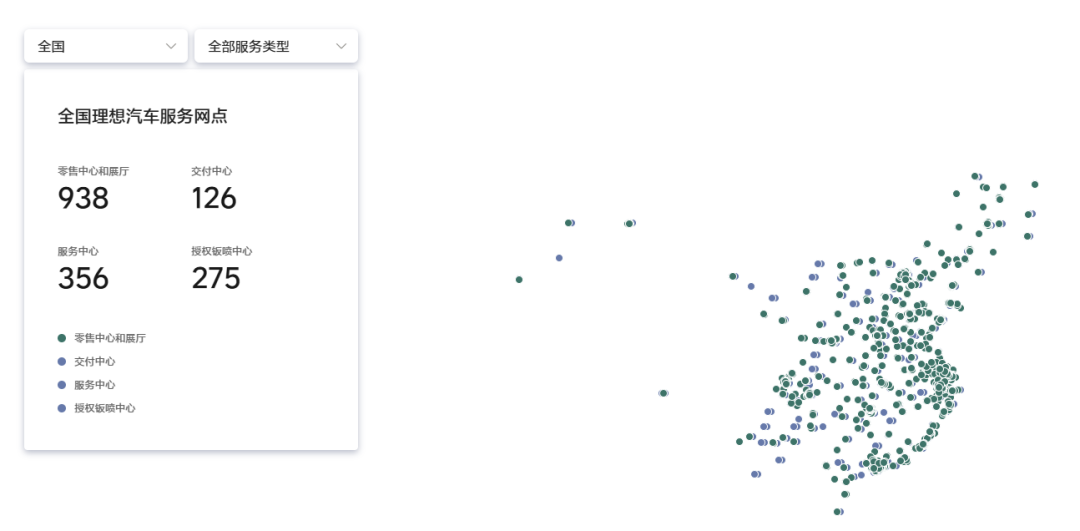

On the one hand, Li Auto will enter lower-tier markets through the "Hundred Cities, Countless Stars Plan" this year. According to Tang Jing, head of Li Auto's product line, the first batch of locations includes 18 cities such as Jiamusi, Mudanjiang, and Zhangjiakou. On the other hand, Li Auto has also listed overseas expansion as one of the company's core strategies this year.

Revitalizing the Pure Electric Market with Li i8 Leading the Way

This year is a significant product year for Li Auto. In the first half of the year, Li Auto released refreshed models of the L series, and in the second half, it will launch two new pure electric SUVs. These two series of products will achieve sales growth targets in different ways.

The refreshed L series models generally belong to the category of "increment without price increase." Their selling prices remain unchanged from the previous models but come with added intelligent driving and comfort configurations. For example, the ADMax version has been upgraded with NVIDIA's latest Thor-U chip, and the ADPro version has been upgraded with the new generation Horizon Journey® 6M chip. The Li Auto L9 is equipped with a dual-chamber dual-valve magic carpet air suspension, making it the first Chinese brand SUV to feature dual-chamber air springs and dual-valve shock absorbers. This means that the task of the refreshed L series models should be to help Li Auto maintain its core market, i.e., attracting users from the fuel vehicle market.

In contrast, the pure electric models have a heavier task, as they need to help Li Auto expand its reach into the pure electric market and shed the label of "only extended-range" and the shadow cast by the MEGA. Li Auto will release the Li i8 in July and the Li i6 in the second half of the year. The tasks of these two models are also different. The Li i8 aims to maintain Li Auto's positioning as a luxury vehicle in the pure electric market, while the Li i6 shares the same task as its sibling, the Li L6, which is to increase sales volume.

▲ Figure: Li Auto official website

Neither of these two models is Li Auto's first pure electric vehicle. The previously launched MEGA was once assigned the tasks of both the i8 and i6. Initially, the sales performance of the MEGA was not good, but the situation has improved, with monthly sales reaching around 1,000 units. Considering its price exceeding 500,000 yuan, it is sufficient to say that it has fulfilled its task of establishing a high-end brand image for Li Auto in the pure electric market.

The Li i8, which takes the lead, marks Li Auto's renewed challenge to the pure electric market. This time, the challenge is more difficult, but the chances of success are also greater.

The challenge lies in the fact that, referring to the pricing of the Li L8, the selling price of the Li i8 should also be above 300,000 yuan. Currently, the pure electric model with the highest sales volume in this price range is the NIO ES6, which sold 6,866 units in April. If the Li i8 wants to accomplish the above task, its sales volume must exceed that of the NIO ES6, which means facing a top competitor right from its debut, adding significant pressure.

To help the Li i8 achieve its goals, Li Auto has provided it with two safeguards.

For pure electric vehicles, range anxiety has always been the number one enemy for both car owners and automakers. In this regard, Li Auto planned to invest more than 6 billion yuan to build over 5,000 direct-operated 5C charging stations covering 95% of highways and important national roads nationwide when it launched the MEGA. However, at that time, Li Auto's charging station scale was the smallest among NIO, Xpeng, and Li Auto. After the launch of the MEGA, Li Auto accelerated the construction of charging stations. As of June this year, Li Auto has built a total of 2,421 charging stations and 13,200 charging piles. In comparison, Xpeng currently has 2,200 charging stations and 11,700 charging piles.

▲ Figure: Li Auto official website

The second safeguard Li Auto provides for the i8 is fast charging.

Li Xiang previously stated that for pure electric vehicles, a full charge in 30 minutes is passable, while 15 minutes is satisfactory. Li Xiang's basis for this is that the psychological safety boundary for family users on long-distance trips is that a single charge must exceed 500 kilometers. The process of filling up a tank of gas for Li Auto at a service area takes approximately 15 minutes (including using the restroom). Therefore, the Li MEGA is equipped with CATL's Kirin 5C battery and an 800V high-voltage platform. With a 102.7 kWh battery, the MEGA can achieve a charging speed of "500 kilometers in 12 minutes." Compared to other energy replenishment methods on the market, this speed is slightly slower than battery swapping (which can be done in less than 5 minutes) but is still fast enough. According to information publicly released by the Ministry of Industry and Information Technology, the i8 will also be equipped with a battery that supports 5C supercharging and an 800V high-voltage platform.

Overall, compared to the previous Li MEGA, the Li i8 is better prepared. The two safeguards provided by Li Auto ensure that it will not have obvious shortcomings.

Dual Approach of Lower-Tier Markets and Overseas Expansion: Li Auto Aims for Broader Market Space

If pure electric models are Li Auto's attempt to break through the extended-range bottleneck in product form, then focusing on lower-tier markets and overseas expansion are Li Auto's quest for scale expansion in target user groups, pricing strategies, and market space.

Li Auto targets lower-tier markets because the penetration rate of new energy vehicles in these markets is growing rapidly, creating huge market demand. Multiple third-party data support this point. According to public data from Tianyancha, the China Electric Vehicle Hundred People Forum, and RDI Strategic Consulting, in 2024, the sales growth rate of new energy vehicles in third-tier and below cities reached 63%, 1.6 times that of first- and second-tier cities, accounting for 40% of the new energy vehicle market. Insurance data from the China Banking and Insurance Regulatory Commission shows that sales of pure electric vehicles with medium to high ranges of 300 to 500 kilometers in third- and fourth-tier cities and township markets have been continuously climbing, while the proportion of models with ranges exceeding 500 kilometers has increased significantly.

▲ Figure: Li Auto official website

These data indicate that automakers must accelerate their channel expansion into lower-tier markets to compete for market share. Other new forces in the industry have also made layouts in this regard. Taking Xpeng as an example, it implemented the "Jupiter Plan" in 2024, introducing more than 160 dealers covering 40 lower-tier cities. Li Auto's layout is the "Hundred Cities, Countless Stars Plan," which is generally similar to Xpeng's "Jupiter Plan" but differs in that Li Auto still chooses to operate its own channels, while Xpeng introduces third-party dealers.

To understand Li Auto's push into lower-tier markets, we must consider both its channels and product offerings. Historically positioned as a luxury brand with an average selling price exceeding 300,000 yuan, Li Auto has made strides with the introduction of the Li L6. Launched last year at a price approximately 100,000 yuan lower than the L7, the Li L6 represents Li Auto's foray into the lower-tier market. Since its launch, the Li L6 has become a best-seller, consistently ranking as Li Auto's top-selling model for several months. In April of this year, the L6 accounted for 49.4% of Li Auto's total sales. If trends continue, the Li L6, with its extended range and the lowest price in its series, will likely become Li Auto's primary sales model in third- and fourth-tier cities.

Should Li Auto successfully penetrate and establish a presence in lower-tier markets, it will free itself from its reliance on the over-300,000-yuan market segment, opening up more development opportunities and a buffer to navigate competition. This strategic move will also bring Li Auto closer to its goals. With a target of 640,000 vehicles by 2025, Li Auto has sold 167,600 vehicles in the first five months of this year, implying a need to sell over 60,000 vehicles per month for the next seven months. The support of the lower-tier market could significantly enhance the likelihood of achieving this target.

On the market front, Li Auto is not only planning to tap into the lower-tier market but is also gearing up for overseas expansion. To effectively execute this strategy, Li Auto has made two key preparations: establishing an independent overseas market expansion department earlier this year and accelerating its overseas market layout. Beyond the traditional Asia-Pacific market, investments in Latin America, the Middle East, and European markets will increase this year.

In summary, Li Auto has devised a four-pronged strategy—pure electric vehicles, market penetration into lower-tier cities, intelligent driving, and overseas expansion—to achieve its objectives and compete effectively. Given the actions of other emerging players and traditional automakers, these four strategies are virtually indispensable for all automakers, indicating that Li Auto has indeed identified the right path forward.