China's electric vehicles conquer Southeast Asia, breaking through the defense line of Japanese cars

![]() 06/06 2025

06/06 2025

![]() 624

624

China's new energy vehicles are not only aggressive domestically but also in Southeast Asia.

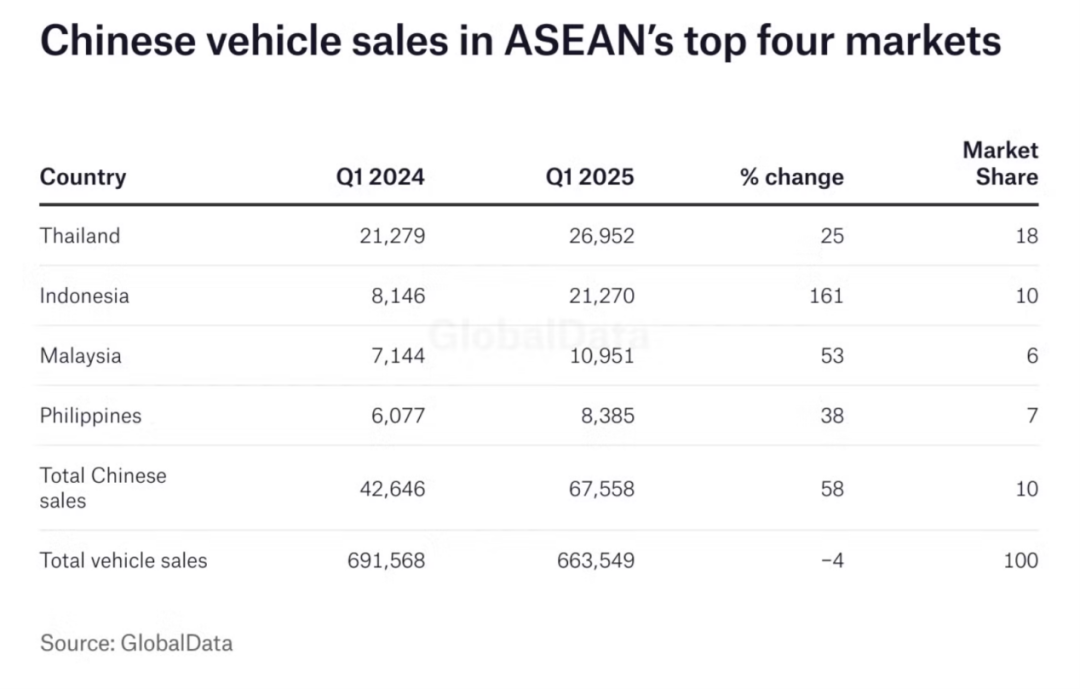

In the first quarter of 2025, sales of Chinese brand cars in the four major Southeast Asian markets of Indonesia, Malaysia, Thailand, and the Philippines increased by more than 58% year-on-year compared to the previous year.

In stark contrast, Japanese brand cars have been declining continuously in Southeast Asia. According to Bloomberg, since 2019, Japanese car sales have declined by 5% in Malaysia, 6% in Indonesia, 12% in Thailand, and a steep 18% in Singapore.

It is no exaggeration to say that new energy vehicles are launching a strategic offensive against Japanese automakers in the Southeast Asian market. Statistics from Bitauto also show that in the Thai new energy vehicle market in Southeast Asia, Chinese brands represented by BYD dominate the top five, and 80% of the sales in the top ten are contributed by Chinese brands.

And this is just a historical snapshot of China's electric vehicles going overseas to Southeast Asia and breaking through the defense line of Japanese cars.

I. Breaking through Southeast Asia

The Southeast Asian market is a major economic regional entity in the Asia-Pacific region, with a total population of over 600 million, making it a globally significant automobile consumer market. However, this market has been firmly dominated by Japanese car brands for decades.

In 1963, Toyota Motor Corporation established its first overseas plant in Thailand, marking the beginning of Japanese brands' domination of the Southeast Asian market. Over time, Japanese cars have almost become the most frequently purchased brand by consumers in Southeast Asian countries.

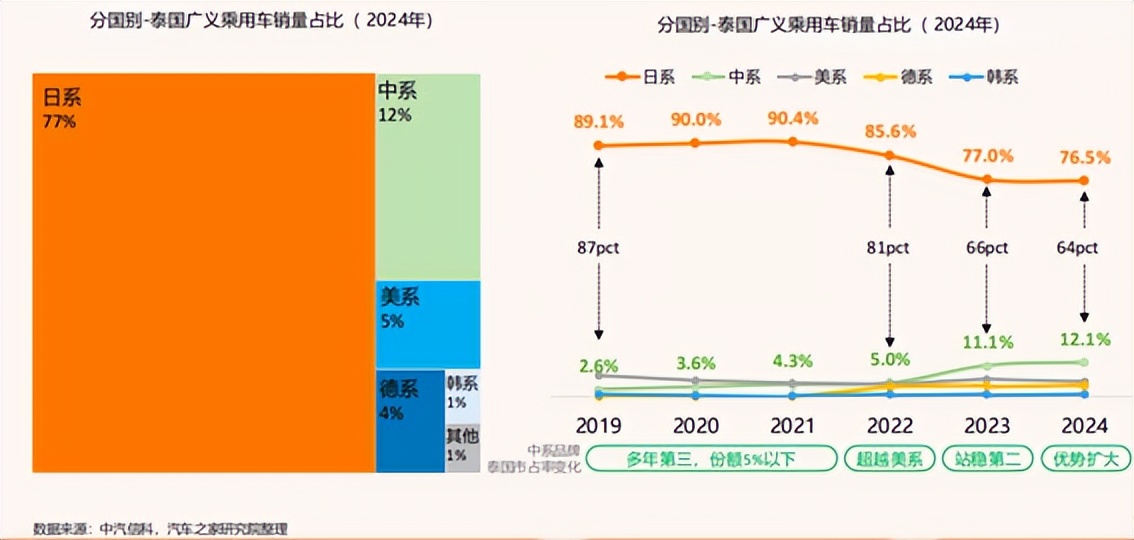

Taking Thailand, a major hub for automobile production and sales in Southeast Asia, as an example, Japanese cars have accounted for more than 70% of new car sales in the past five years, with Toyota and Honda alone accounting for over 50%. In 2022, Toyota occupied nearly 45% of the market share with sales of 282,700 units, ranking first. In other words, almost one out of every two new cars sold in Thailand in 2022 was a Toyota.

However, with the advancement of China's new energy vehicle technology and products, Chinese brand cars going overseas are gradually rising in Southeast Asia, becoming a "Chinese car" camp that rivals Japanese cars.

The best example is also in Thailand. Data from the Federation of Thai Industries shows that among the top 10 car brands in sales from January to October 2024, three Chinese brands—BYD, SAIC MG, and Changan Automobile—appeared. Among them, BYD squeezed into the top 4 automakers with a market share of 4.9%, marking a significant improvement from the previous year.

Looking back, Chinese automakers' layout in Southeast Asia has not been achieved overnight but has gone through a long process. Among them, SAIC was the first to take the lead, entering the local market as early as 2012 in collaboration with Charoen Pokphand Group in Thailand.

In the following years, traditional OEMs such as Great Wall, BYD, and Changan, as well as a host of new forces, successively ventured into the Southeast Asian market. For example, on July 5, 2022, Great Wall Motors' Malaysian subsidiary officially opened; Changan Avita 11 ranked first in luxury new energy SUV deliveries for two consecutive months within three months of entering the Thai market; at the 2025 Bangkok International Motor Show held in April this year, Deep Blue Automobile received over 6,589 orders; and new forces such as Xpeng and Nezha have also made their layouts.

China's new energy vehicles going overseas to Southeast Asia have a profound background of global industrial trends.

The International Energy Agency's (IEA) recently released annual "Global Electric Vehicle Outlook" report shows that global electric vehicle sales exceeded 17 million in 2024, with market share exceeding 20% for the first time. In the first quarter of this year, global electric vehicle sales surged by 35% year-on-year, with electric vehicle sales in the Southeast Asian market growing by nearly 50% and market share reaching 9%.

Against this backdrop, Thailand often becomes the first stop for most domestic brands to layout the Southeast Asian market. This is mainly due to the local area's solid foundation in the automotive industry and the government's emphasis and support for new energy vehicles.

For example, since the 1960s, Thailand has gradually developed into an automobile producer and exporter. In recent years, the Thai government has provided facilitated investment incentives and tax concessions for foreign-invested enterprises. From January to October 2024, China exported 97,400 new energy vehicles to Thailand.

Of course, most other Southeast Asian countries also hold a supportive attitude towards new energy vehicles. Among them, the Indonesian government has clearly proposed a development goal of owning 13 million electric two-wheelers and 2.2 million electric vehicles by 2030 and has implemented a series of vehicle purchase subsidies since August 2023.

Coupled with the visible continuous improvement of Chinese brands in vehicle manufacturing processes, technological heritage, and brand momentum in recent years, various factors have interwoven, resulting in a significant increase in the market share of Chinese automobile brands in Southeast Asian countries. Especially in Thailand, in 2022, Chinese automobile brands officially surpassed American brands and took a firm second place in the market, changing the local brand competition landscape that had remained unchanged for many years.

In the Indonesian market, the market share of Japanese cars in 2024 declined by 6% compared to 2019, and in Malaysia, it declined by 4 percentage points. In stark contrast, the penetration rate of Chinese cars has climbed. Even according to Reuters, Honda plans to cease automobile production at its factory in Ayutthaya, Thailand, by 2025. Previously, Suzuki and Subaru both announced the closure of their Thai factories.

As a result, domestic brands have gradually gained a firm footing in the Southeast Asian market, building strong brand competitiveness.

II. Saturation Offensive

The rooting of Chinese automobile brands in Southeast Asia is shifting from early sales to in-depth supply chain construction, that is, by procuring raw materials, building factories, etc., to streamline the entire manufacturing and production process, achieving simultaneous improvements in operational efficiency and large-scale mass production.

Unlike the CKD production mode adopted by Japanese cars in the local area, Chinese automakers mostly adopt a full-chain vehicle production and manufacturing mode in Southeast Asian countries.

For example, Geely's investment in Proton's Malaysian production base and Great Wall's production base in Rayong, Thailand, both form end-to-end process closed loops in vehicle production and manufacturing, becoming important supports for their respective brands to quickly penetrate the local terminal market and radiate the overall region. Currently, most automakers such as Changan, SAIC, Great Wall, Nezha, and BYD have also built factories in Southeast Asia.

Looking deeper, the reason why European and American automakers have struggled to gain a foothold in the Southeast Asian market and form competition against Japanese cars in the past lies largely in their lack of local parts and components support. However, the overseas expansion of Chinese new energy vehicle brands is different. A large number of upstream and downstream enterprises in China's automobile industry chain are continuously settling down locally.

As early as April 15, 2023, Contemporary Amperex Technology Co. Limited (CATL), the world's leading power battery manufacturer, announced its plan to invest nearly US$4 billion through its subsidiary to build a power battery industrial chain project in Indonesia.

According to data from Thailand's Ministry of Industry, the number of Chinese auto parts enterprises registered in Thailand in the first quarter of 2025 reached 420, a threefold increase from 2020, and the proportion of foreign-invested enterprises jumped from 7% to 22%, forming a tripartite confrontation with the 1,400 traditional suppliers dominated by Japanese enterprises.

Currently, governments of Southeast Asian countries have a strong willingness to attract Chinese enterprises to invest and build factories. The logic is that foreign supply chains can bring more advanced technology, capital, and employment, which also conforms to the market economy law of comparative price advantage and plays an important role in promoting the development of the local new energy automobile industry. At the same time, this has also become an important factor for Chinese new energy automobile brands to gain a foothold in the local market.

However, compared to building factories and constructing supply chains, the more comprehensive offensive posture of Chinese new energy vehicle brands lies in deep localization.

Chinese automakers in Southeast Asia mostly prefer to recruit talents who understand the local language and culture and have insights into the trends of the new energy industry, thereby forming local teams responsible for full lifecycle management including marketing, technology, delivery, and after-sales; on the marketing side, Chinese automakers also try to deeply integrate brand perception and user experience into the hearts of local consumers to better adapt to local market competition.

Various indications show that Chinese new energy vehicle brands have achieved phased victories in the Southeast Asian market, but there are also hidden concerns behind their achievements.

III. Prolonged Battle

A fact that cannot be ignored is that Southeast Asia, like China, still belongs to a gradually penetrating market for new energy vehicles. However, compared to China's nearly 50% penetration rate, it is much smaller, and fuel vehicles are still the mainstream model in the local area.

But this is not the main challenge faced by Chinese new energy vehicle brands. Driven by governments of various countries, the transition from fuel vehicles to new energy vehicles is just a matter of time, and the decline of Japanese cars has become an unstoppable trend.

The real challenge lies in the impact of industrial policies brought by traditional brands. Market barriers caused by industrial policies and other factors are indeed much greater than commercial competition.

An automotive industry insider once told the media, "To what extent has Toyota penetrated Southeast Asian countries? To give a specific example, many retired Japanese diplomats in Southeast Asian countries do not return to their homelands for positions but become local consultants for Japanese automakers, which can influence the industrial policies of these countries.

For instance, in Thailand, they can decide which car models can receive relatively low taxes; these Japanese automakers have many such operations that can directly establish product competitive advantages at the legislative level. In addition, their influence on local media and public opinion is quite profound. It is unrealistic for new brands to overturn public recognition of Toyota in a short period of time."

This means that Chinese new energy vehicle brands need to not only create ultimate product experiences but also break through shackles in industrial policies and market rules, at least winning first in public opinion to gain the recognition of more users.

In addition, the impact of price wars cannot be ignored, and even some brands have already started internal competition. For example, BYD reduced the price of its newly revised 2024 ATTO 3 (BYD Yuan PLUS) in Thailand to 899,900 Thai baht (approximately RMB 180,000), a decrease of nearly 20%; Nezha, Wuling, Toyota, Suzuki, and Nissan have also started offering various forms of price discounts or promotional activities...

Automakers have already been battered by price wars domestically, and if this phenomenon repeats and continues to ferment in the Southeast Asian market, it will not only affect the profitability of brands but also be detrimental to the upward breakthrough of domestic brands in the local area.

For automakers, the true value should be to promote the continuous upgrading of Chinese automotive industrial products in terms of technological advancement and brand upgrading. Even overseas, this should become an unspoken contract among automakers.

In the long run, the strategic counterattack launched by Chinese new energy vehicle brands against Japanese cars is still ongoing, and the story of conquering the Southeast Asian market is far from over.