Can Central Enterprise Integration Solve the Profitability Dilemma of New Energy Vehicles?

![]() 06/06 2025

06/06 2025

![]() 441

441

The long-anticipated merger of Dongfeng and Changan, two central automobile enterprises, has taken a significant step forward. Prior to the opening on June 5, both Dongfeng Automobile and Changan Automobile issued announcements. China South Industries Group Corporation, the indirect controlling shareholder of Changan Automobile, spun off its automobile business into an independent central enterprise, with Dongfeng Automobile temporarily not involved in the relevant asset and business reorganization.

This signifies that Changan Automobile, previously a second-tier subsidiary of China South Industries Group Corporation, will elevate its status to a new central automobile enterprise upon participating in the integration.

Prior to the release of the reorganization plan, Zhu Huarong, the head of Changan Automobile, repeatedly stated in public that Deep Blue Automobile is the first state-owned enterprise's new energy brand to achieve phased profitability. At the recent 2024 Changan Automobile shareholders' meeting, officials revealed that the break-even point for Deep Blue Automobile is approximately 30,000 monthly sales, with an expectation of achieving overall break-even this year.

On the other hand, Deep Blue's pioneering profitability underscores that the new energy automobile businesses under other state-owned enterprises and central enterprises are currently incurring losses. This state is not an isolated incident.

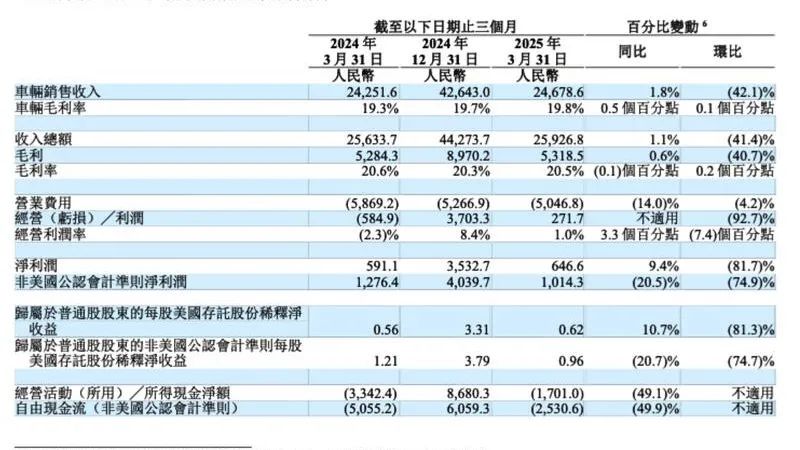

On June 3, Lei Jun, the founder of Xiaomi, stated at the Xiaomi investor conference that the losses of Xiaomi's automobile business are gradually narrowing and are anticipated to achieve profitability in the second half of the year. That same evening, NIO released its first-quarter financial report, reporting a year-on-year increase of 30.19% in net losses. Even Zero-Run Automobile, which announced profitability at the end of last year, experienced a year-on-year expansion of its net loss in the first quarter.

Human joys and sorrows are not interconnected. Xiaomi, which has been making cars for less than five years, may achieve profitability faster than NIO and XPeng.

In summary, whether it's a new force, a central enterprise, or a state-owned enterprise, the pain points of profitability challenges are similar. According to the financial report data of five listed automobile state-owned enterprises, from 2019 to 2024, net profit shrank by nearly 35.7 billion yuan.

When can we "generate blood" through selling cars?

Li Bin, during the financial report conference, expressed his belief that the lowest trough has passed in the first quarter of this year, with the second quarter expected to return to an upward channel. The next day, in an interview, Li Bin stated that the company can only rely on its management to overcome the current predicament, indirectly indicating that obtaining new financing in the short term will be difficult.

Over the past decade, Tesla has pioneered the overturning of traditional valuation logic, with global hot money continuously flowing in. Before achieving economies of scale, they rely on external financing to sustain company operations, compromising on operating losses for market share. After all, it took Tesla ten years to achieve profitability. However, with the emergence of a reference like Xiaomi Automobile, the rationale for "long-termism" quickly loses credibility with investors.

Recently, XPeng Automobile released its first-quarter financial report, with significant sales growth driving revenue increases and net losses narrowing considerably. XPeng Automobile officials noted that behind the impressive Q1 results lies enhanced self-hematopoietic capacity and the support of the major product cycle. In fact, behind the notable improvement in profitability is also the presence of Volkswagen's strategic investment of $700 million.

In the first quarter of this year, Volkswagen paid XPeng 1.44 billion yuan in technical service fees. While this accounted for less than 10% of total revenue, the gross profit contribution was close to 40%, directly boosting the overall gross profit margin performance.

The same applies to Zero-Run Automobile. In the first quarter, Zero-Run received a technical service fee of 300 million yuan, with a gross profit margin of 60%-70% for this revenue, significantly improving the financial performance in the first quarter.

Even XPeng, a standout among the new forces, had an average vehicle price of nearly 280,000 yuan in the first quarter, with a gross profit margin of around 20% per vehicle. It's evident that selling technology or services is a much faster path to profitability than selling cars.

Lixiang, one of the few new energy automobile enterprises currently capable of achieving self-hematopoiesis, still saw revenue and delivery volumes increase in the first quarter of this year, but net profit declined by 20% year-on-year. The average vehicle price fell from 302,000 yuan in the same period last year to 265,700 yuan in the first quarter.

Besides Xiaomi, the new forces must also face the control group of traditional forces such as BYD and Geely. "Not entering the market below 200,000 yuan" Lixiang had a profit per vehicle of around 7,000 yuan in the first quarter, while BYD's profit per vehicle was around 9,000 yuan.

Lei Jun's confidence that the automobile business will be profitable this year stems from the fact that in the first-quarter financial report, the gross profit margin of the automobile business was as high as 23.2%, with an operating loss of only 500 million yuan. Unfortunately, both BYD and Xiaomi have non-repeatable elements in their business models. Most players can only rely on selling cars to make money honestly.

If the big river has no water, the small river will dry up

At the beginning of last year, at the 2024 Global Partner Conference of Changan Automobile, Zhu Huarong's strong statements sparked widespread public discussion. He mentioned that the new energy business is generally losing money, and if supplier partners only focus on their own profits, the entire industry cannot sustain itself for long. This remark led to various misconceptions on the internet, such as "automobile suppliers should not make money".

If the big river has no water, the small river will dry up. As the chain master of the entire industrial chain, if automakers cannot make money, the profit margins of suppliers will be even more limited.

This is indeed the case in reality. At the first-quarter financial report conference, Li Bin pointed out when explaining accounts payable that NIO has always set a payment term of around 90 days for suppliers. However, some suppliers only accept cash payments within 60 days, while others will accept 100% check payments, with 90 days being an average account period.

Not long ago, Li Yunfei pointed out in his public theory of "Evergrande in the automotive circle" that BYD's average account period is 127 days, which is shorter than that of mainstream automakers such as Geely, Great Wall, and SAIC.

In fact, the account period is just one aspect. On top of this, automakers use non-cash payment methods (such as acceptance bills) to make payments. The combination of these two factors can extend the real payment cycle sufficiently and keep the capital cost low enough. This has become a well-known "secret" in the supply chain, causing numerous small and medium-sized suppliers to suffer.

"The conventional practice of automakers is to pay part of the money, such as 50%, when the payment time arrives. For the remaining money, they will issue a bank acceptance that matures in a few months. This is still considered good. Many of them directly issue an acceptance bill when the payment time arrives. After calculating inside and outside, it's equivalent to only being able to receive the money after a year," said Li Hong (pseudonym), a supplier from Guangdong, helplessly.

"When some new forces launch new cars, they often claim that initial production capacity is insufficient or something similar. In reality, insiders are well aware that this usually happens when they can't handle suppliers. The reason for not being able to handle it is quite simple: the procurement volume is small, the price is low, and there are numerous issues to deal with. The most critical aspect is that payments are not timely. In such circumstances, who would be willing to cooperate with them to increase production capacity?" Li Hong further explained.

Another well-known rule is that powerful suppliers like NVIDIA and CATL even demand advance payment before delivery. When some account periods are far less than the average, it implies that the collection cycles of most suppliers are much longer than the average.

For this reason, Guo Chuan, chairman of Konghui Technology, issued an open letter on Children's Day, appealing that "telegraphic transfer is the only way to collect payments." Despite Konghui Technology taking the lead in breaking through high-end shock absorber systems and becoming the leader in domestic automobile air suspension, it has also deeply suffered from long account periods and acceptance bills. The survival status of other small and medium-sized suppliers can be imagined.

"If you don't sell new energy vehicles, you won't have a share. If you sell new energy vehicles, you won't make a profit." A practitioner in the automobile circulation field has hit the nail on the head.

In fact, in recent years of fierce competition and price wars, most of the money that automakers have lost has not flowed to supply chain enterprises; instead, the pressure of capital turnover has been transferred to suppliers to the greatest extent...

Written at the end

Another variable that new energy automobile enterprises need to face is the direction of subsidy policies. XPeng pointed out in its first-quarter financial report that other income, which has a significant impact on net profit, increased to 540 million yuan, primarily due to the receipt of new energy subsidies.

A few years ago, Tesla was often criticized every time it released financial reports for making money by selling carbon emission credits. Domestic new energy automobile enterprises also need to consider what their true hematopoietic capacity will be like when the tide recedes.