Insightful View of Volkswagen's Current Situation Beyond Financial Reports

![]() 06/06 2025

06/06 2025

![]() 508

508

Amidst cyclical mismatches, Volkswagen is leveraging technological platform transitions, decentralized software strategies, and the co-construction of the Chinese ecosystem to drive a profound transformation. This shift aims to move from individual breakthroughs to the reconstruction of systemic capabilities, ultimately reshaping Volkswagen's competitive edge in the new industrial landscape.

"We must focus on what we can control," said Arno Antlitz, CFO of the Volkswagen Group, at the Q1 2025 financial report conference. As the wave of electrification rolls in, geopolitics become increasingly complex, and global consumption trends towards prudence, this German manufacturing giant, once renowned for its scale and engineering systems, is entering a challenging yet necessary phase of self-reinvention.

Volkswagen's electric vehicle sales are accelerating in core markets, with the pure electric penetration rate in Western Europe continuously rising, and the popularity of the ID series significantly increasing. However, the electric business has yet to establish sufficiently robust profit support, with an operating profit margin of only 3.2% in the first quarter, reflecting a fragile profit foundation despite rapid growth.

Beyond financial reports, the bigger picture reveals multifaceted challenges for Volkswagen in updating platform technology, restructuring cost structures, choosing intelligent paths, and coordinating regional markets. These challenges are more critical than fluctuations in single-quarter financial data.

Not New, But Pragmatic Platform Technology

Volkswagen's profitability in the electric transition has significantly contracted compared to the double-digit profit margins of the gasoline vehicle era. This reality is forcing the group to re-examine the internal logic of its electric vehicle platform strategy and cost structure.

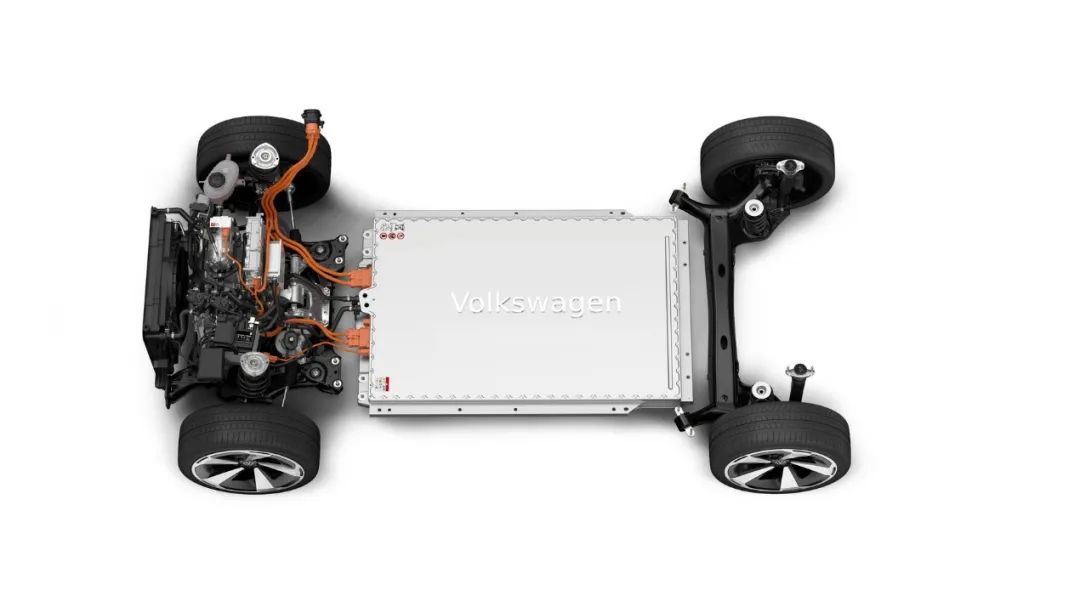

Currently, most of Volkswagen's electric vehicle models are based on the MEB platform launched in 2019. Once a strategic pillar for the electric transition, MEB's technical limitations are becoming apparent: slow electrical architecture updates, low software adaptation efficiency, and difficulties in further compressing vehicle integration costs. This makes it difficult to compete with new-generation platforms in key areas like centralized control logic and battery integration efficiency.

To maintain the stable rhythm of the ID product line and buy time for the new-generation SSP platform, Volkswagen has launched the MEB+ platform as a "buffer architecture." While not a brand-new platform, MEB+'s key upgrades focus on introducing lithium iron phosphate (LFP) batteries with a cell-to-pack (CTP) packaging structure and optimizing the vehicle's electronic architecture.

Volkswagen's MEB platform being produced at the Emden plant in Germany.

While MEB+ extends the platform's lifecycle and accelerates new technology deployment, its investment rationality remains controversial. According to a 2024 report by Manager Magazin, Volkswagen once considered cutting its medium-term investment budget by up to 20 billion euros, with the MEB platform upgrade plan listed on the "compressible projects" list. From an external perspective, while MEB+ had transitional value, its technological advancement lagged behind new-generation electric architectures like Tesla's centralized control platform, BYD's e-platform 3.0, and Xpeng's X-EEA 3.0. As a phased solution, MEB+ primarily serves a strategic buffering function rather than driving technological leapfrogging.

Nevertheless, MEB+ embodies Volkswagen's pragmatic approach. Ralf Brandstätter, CEO of the Volkswagen brand, called it a "major breakthrough in Volkswagen's electric strategy" – effectively reducing the BOM cost of the entire vehicle while optimizing platform performance and delivery efficiency. MEB+ will be first introduced with the ID.2 model and gradually cover mainstream models like ID.3, ID.4, and ID.7, aiming to establish a price competitive advantage within the 20,000 to 25,000 euro range.

Among the Volkswagen ID series, the ID.2 and ID.EVERY 1 are the most anticipated electric vehicle models, targeting the European and global entry-level markets, respectively. The latter, jointly developed with Rivian, is expected to launch by 2027 with a starting price within 20,000 euros. This model will not only be Volkswagen's cheapest pure electric product but also the first to feature Rivian's centralized central computing architecture, marking a significant step in the group's evolution towards "hardware and software integration." This collaborative path aims to solve the "heavy platform burden" and "low software efficiency" dilemmas.

Essentially, this linked strategy of platform and battery embodies a cost optimization combination of "de-noble metalization + structural simplification." Compared to nickel-cobalt-manganese (NMC) ternary lithium batteries, LFP batteries offer advantages in safety, raw material stability, and price control, making them suitable for urban commuting and compact models. The CTP structure further compresses packaging volume and component count, supporting Volkswagen's large-scale vehicle price reduction.

To support this transition, Volkswagen has initiated capacity deployment on the battery supply side. Its battery factory in Salzgitter, Germany, is responsible for the technical integration and manufacturing of the group's transition to LFP batteries, enabling "dual-line supply during the transition period." This factory is not only critical for advancing the MEB+ platform but also a key resource base for future SSP platform implementation.

From MEB to MEB+, from NMC to LFP batteries, and from traditional single-platform development to software-hardware layering and multi-path collaboration, Volkswagen is advancing a substantive restructuring of its electric ecosystem. This restructuring aims to seize the tactical time difference between platform efficiency and profit rhythm in a new industry phase characterized by conceptual maturity and profitability pressure.

Long-term Software Dilemma, Turning to Local Adaptation

While electrification marks a fundamental shift in automotive power forms, "Software-Defined Vehicles (SDV)" represents an underlying reconstruction of competition logic in the intelligent era. For Volkswagen, the challenge is no longer launching enough electric vehicles but building an efficient, unified, stable, and scalable electronic and software architecture system.

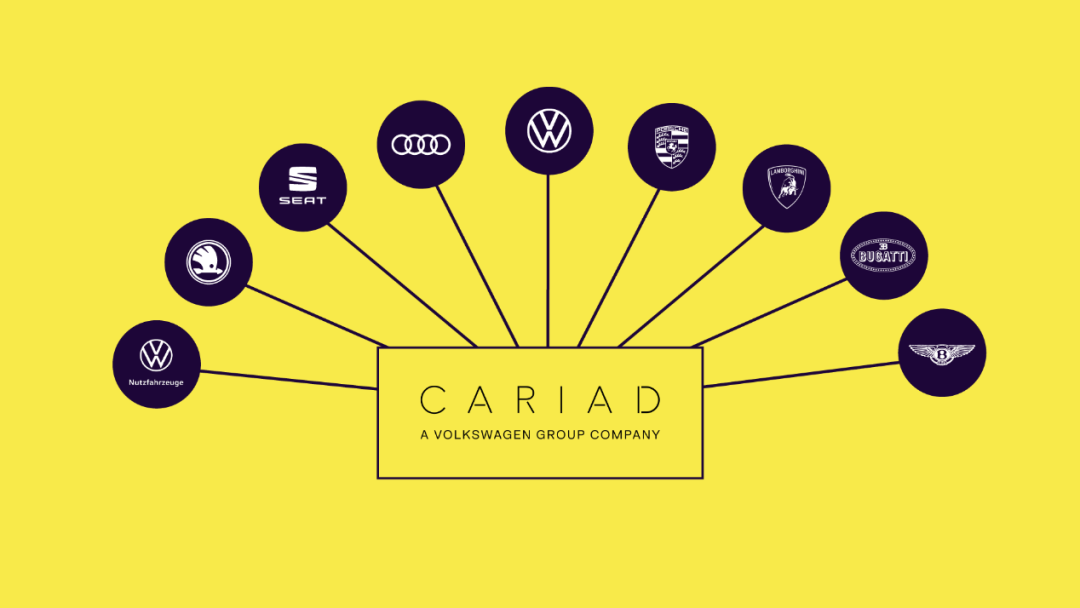

In 2020, Volkswagen Group established the group-level software subsidiary CARIAD to break historical legacies of brand fragmentation, code redundancy, and system fragmentation. CARIAD aimed to create an "E³ Architecture" (End-to-End Electronics Architecture) common to brands like Volkswagen, Audi, and Porsche, unifying key modules like OTA updates, domain controllers, intelligent driving, and vehicle-cloud communication.

CARIAD's initial goal was to provide a unified software foundation for Volkswagen Group models.

However, CARIAD encountered bottlenecks: a bloated organizational structure, platform design ahead of vehicle mass production rhythms, and difficulties collaborating with brand engineering teams, leading to repeated software development delays. Projects like Audi Artemis and Porsche Macan EV were severely hindered, marking setbacks in Volkswagen's internal transformation.

In 2022, under the leadership of current Group CEO Oliver Blume, Volkswagen initiated a structural reorganization. Software functions began to be decentralized regionally: CARIAD at the German headquarters continued developing the high-end E³ 2.0 architecture for brands like Audi and Porsche, while the CARIAD China team accelerated its "shedding" process, independently establishing a software development system suited to the local market rhythm and promoting deep integration with local technology enterprises. This "geographic layering" strategy reflects Volkswagen's abandonment of a "one-size-fits-all global software platform," instead acknowledging regional differences and emphasizing local adaptation.

The China path is particularly noteworthy. Volkswagen jointly established CARIZON with the Chinese intelligent chip enterprise Horizon Robotics. As of 2024, the joint venture had a team of over 500 algorithm and engineering professionals focused on developing advanced driver assistance systems. This team uses the algorithm training platform based on the artificial intelligence system GAIA, aiming for mass production by 2025 and evolving towards higher-level intelligent driving assistance systems.

In contrast to the "deeply embedded collaboration" with China, Volkswagen adopts a "cooperation for efficiency" approach in the North American market. In 2023, Volkswagen announced a joint venture with American electric vehicle newcomer Rivian to develop the next-generation electronic and electrical architecture and vehicle software platform, with a committed investment of over 5 billion euros. The joint venture is jointly led by senior executives from both parties, and its first achievement will be the upcoming ID.EVERY 1, scheduled for launch in 2027. This model will adopt a centralized architecture design led by Rivian, featuring simpler overall control logic, more concentrated computing power distribution, and a significant reduction in hardware components, thereby improving system integration efficiency and reducing complexity.

Volkswagen holds high hopes for the entry-level electric vehicle model ID.EVERY1.

Wasim Bensaid, Rivian's Software Director, believes, "Cheapness should not equate to low technology. Our goal is to achieve extreme simplicity in the technical structure to win manufacturing efficiency." This approach directly addresses Volkswagen's CARIAD-era dilemmas: an excessively long development cycle and redundant system architecture with high integration complexity and low iteration efficiency. By leveraging Rivian's native centralized platform, Volkswagen can jump out of the "patching logic" of the old architecture and directly switch to a future-oriented control mode.

Volkswagen's software strategy is gradually revealing a unique evolution path. Unlike Tesla's "single platform + self-developed chip" model, Volkswagen prefers a composite ecosystem of "core self-control + external collaboration + regional adaptation." Compared to the "hardware and software integration, system closure" strategies emphasized by new forces like Xpeng and AITO, Volkswagen's approach emphasizes a flexible combination of platform dominance and technology absorption capabilities, a structural reality as a multi-brand, cross-regional, and asset-intensive enterprise.

Transformation is never smooth. CARIAD has been continuously losing money over the past three years, some brand projects still face delivery adjustments, and the reality of "multi-line operation" of software architectures is difficult to unify in the short term. Moreover, whether the Rivian cooperation path can quickly achieve technology implementation and efficient resource integration still needs time to verify, especially when high-end models like the Audi A6 e-tron and Porsche Macan EV are still constrained by the original CARIAD architecture (i.e., the PPE platform), platform fragmentation will continue to exist in the short term.

However, Volkswagen's software strategy has evolved from a "full-stack in-house R&D approach" to a new era of "multi-directional collaboration." CFO Antlitz emphasized at an internal meeting that software capabilities should serve as an accelerator for organizational evolution rather than a burden on the group's transformation. Adhering to this principle, Volkswagen's software strategy for the coming years will center on three key pathways: Firstly, localized technological breakthroughs led by the Chinese team to expedite the integration of high-level ADAS into vehicles and strengthen the responsiveness to the needs of mainstream Chinese users; secondly, leveraging the Rivian technology path to implement a centralized intelligent architecture on entry-level vehicle platforms and accelerate the development of an "economical intelligent chassis"; thirdly, narrowing the scope of CARIAD's functions at the German headquarters to focus on the deep control system of the integrated platform for premium brands and minimize redundant resource allocation.

Overall, Volkswagen is exploring a more pragmatic and resilient path for intelligent evolution through "regional leadership + nested cooperation." Rather than aiming to build a global super platform with unified brands and systems, the company now emphasizes local adaptability, modularity, and iteration efficiency. Driven by the times and market dynamics, Volkswagen is undergoing a systematic recovery to reconstruct its software capabilities.

Declining Traditional Advantages, Toward Local Reconstruction

Among all overseas markets, China has always held a unique and significant strategic position for Volkswagen. Over the past four decades, Volkswagen has sold over 50 million vehicles in China, established more than 30 vehicle and component factories, employed over 80,000 individuals, and developed a component supply system with a localization rate exceeding 95%. In the era of gasoline vehicles, Volkswagen has long been regarded as a "model foreign investor in China."

Nonetheless, as the era of electrification and intelligence progresses in parallel, this traditional advantage is facing profound challenges.

The most notable change stems from China's redefinition of the "technological cycle." Unlike the European and American markets, which are still transitioning slowly due to policy subsidies and regulations, the Chinese electric vehicle market has entered an "acceleration phase" characterized by proactive demand upgrades, price structure reshaping, and user experience restandardization. New players such as BYD, AITO, Xpeng, and Li Auto are reshaping consumers' car-buying logic through the concept of hardware and software integration and intelligent experience drive, putting traditional automakers under unprecedented pressure in terms of architectural responsiveness, product rhythm, and cost efficiency.

It is against this backdrop that Volkswagen is embarking on a self-reconstruction journey, driving a structural leap from "in China" to "for China." It is no longer merely reliant on the localized launch of global products but is instead reconstructing a system of "local R&D + rapid verification + collaborative research" to build a local technological capability that genuinely meets the demands of the Chinese market.

In this system narrative, Hefei's role has become increasingly prominent. In 2023, Volkswagen announced an investment of 1 billion euros in Hefei to establish Volkswagen (China) Technology Co., Ltd. (VCTC), making it the largest R&D center outside of the German headquarters. Unlike traditional overseas technology centers that support headquarters functions, VCTC directly leads the development of vehicle architectures, undertakes the construction tasks of the two core platforms – CMP (China Compact Platform) and CEA (China Electronic Architecture) – from scratch, and possesses cross-brand coordination and integration authority.

The CMP platform is primarily targeted at mainstream compact pure electric vehicles in China, benchmarking the BYD e-platform and Geely SEA architecture in terms of battery layout, thermal management, space utilization, and cost control. Meanwhile, the CEA electronic architecture focuses on centralized control, domain controller reuse, and OTA update efficiency. Together, they form the system foundation of the "Volkswagen China Smart Vehicle System," which will not only serve the Volkswagen brand in the future but may also extend its application to related brands such as Škoda and Jetta.

More importantly, the establishment of this system marks the first time that China has leapfrogged from a "platform adaptation site" to an "architecture export site" – from "local following" to "local leadership," Volkswagen's global product organization logic is being profoundly rewritten.

In terms of joint venture strategy, Volkswagen has also shifted from past "technology import" cooperation to "capability exchange" collaborative research. Its strategic cooperation with XPeng Motors covers platform architecture, central control logic, and software systems, especially in the direction of "intelligent chassis + central architecture" integration. This fully leverages XPeng's technical accumulation in domain fusion and data closed-loop aspects of the X-EEA platform to accelerate the evolution of Volkswagen's local platform towards a centralized control system.

The first model jointly developed by the two parties is expected to go into mass production in 2026. XPeng will provide the electronic architecture and control system solutions, while Volkswagen will lead the vehicle engineering development and production management, forming a complementary path of "platform logic + engineering system." This joint venture model has become a reference example for "deep collaborative research" cooperation in China's intelligent electric era, not only helping Volkswagen quickly access China's smart vehicle ecosystem but also allowing XPeng to accumulate value and scale dividends in technology exports, constructing a win-win structure.

At the level of perception and computing power, CARIZON, a joint venture between Volkswagen and Horizon Robotics, is also playing a pivotal accelerating role. Based on the "Journey" series of chips, CARIZON has built a comprehensive GAIA algorithm platform covering perception fusion, behavior decision-making, and data closed-loop training, suitable for complex urban driving scenarios.

Simultaneously, behind the restructuring of platforms and technology structures lies a profound adjustment of Volkswagen's organizational structure and decision-making system in China. Zhang Lan, Vice President of Volkswagen China, has publicly stated that since 2022, VCTC has achieved closed-loop decision-making capabilities of "Discuss-Decide-Deliver," meaning that new products in the Chinese market are no longer "reliant on headquarters approval" but rather "defined locally, verified locally, and put into production locally."

In contrast, Toyota's ONE R&D system in China, although gradually enhancing local R&D functions, started relatively late. Meanwhile, Stellantis is in a state of "marginal operation" due to insufficient early investments, scattered brand positioning, and fragmented sales channels. In contrast, Volkswagen has natural advantages in local foundations, organizational synergy, and market discourse power. However, whether these potential advantages can truly be converted into "systemic dividends" depends on its continuously open cooperation attitude and internal strategic unity.

Furthermore, a noteworthy trend is that the Chinese path is being assigned a new mission of "global module output." According to Germany's "Handelsblatt," Oliver Blume explicitly stated during the Group's first-quarter meeting in 2024, "Research and development achievements in China will feedback into global platforms." In other words, CMP and CEA are no longer merely localized attempts aimed at the Chinese market but are also expected to extend their output to emerging markets, entry-level platforms, and even Volkswagen's global intelligent architecture system.

Under this logic, Volkswagen's re-leap in China is far from merely a recovery in sales. If the systematic template of "platform + partners + local research and production synergy" can be successfully implemented in China first, its demonstration effect and strategic feedback capabilities will not only impact China but will also inversely shape Volkswagen's global electrification and intelligence trends.

Reshaping Oneself Amidst Cyclical Dislocations

The transformation challenges faced by Volkswagen are not merely about product line replacements or energy power form switches. Its decades-long growth model of "German engineering + global manufacturing" is undergoing shocks from multiple rounds of dislocation impacts: The MEB platform has yet to deliver capital efficiency but has already faced a comprehensive reshuffle from the wave of centralized architectures and AI chips; after massive investments in the electric business, profit margins have been compressed due to the continuous decline in terminal prices, forcing the investment return cycle to be postponed; geopolitics and globalization paths are tending towards fragmentation, with industrial chain decoupling and regional barriers being rebuilt, forcing Volkswagen to accelerate its shift towards a flexible layout of "nested re-globalization."

Volkswagen is not the only traditional automaker caught in these dislocations, but due to its huge size, complex brand system, and deep organizational inertia, it often becomes the most tangible "elephant in the room" in the context of transformation.

However, Volkswagen's true challenge is not just about cost reduction and efficiency improvement or technological catch-up. It must find a sustainable path for rebuilding vehicle value amidst the convergence of new variables such as AI indigenization, localized regulation, diversified user aesthetics, and converging hardware performance.

In this process, new players are redefining vehicle forms through computing power structures, intelligent experiences, and software logic. For a manufacturing giant like Volkswagen, which emerged in the traditional industrial era, to avoid being marginalized in the new era, it must complete a comprehensive reconstruction from platform architecture, organizational form, to global strategy.

This path is destined to be challenging. It requires the enterprise to accept the coexistence of multi-center, multi-rhythm, and multi-path strategies internally and also necessitates managers to make precise and intuitive judgments amidst fluctuations: what must be retained, what should be decisively abandoned, what can be postponed, and what must be accelerated.

In an interview with Germany's "Auto Zeitung," when asked whether Germany could still produce economically profitable cars, Oliver Blume candidly said, "Germany is our home base, and we have an obligation to ensure its success. We have an excellent training system, motivated employees, strong innovation capabilities, and a consistent tradition of high-quality manufacturing. These are our core strengths. Our weakness lies in costs, and we must continue to work hard."

And when asked whether Wolfsburg, the spiritual symbol of Volkswagen, would change, his answer was equally calm, "Wolfsburg is our home, and we don't want to change that. But now, everyone realizes that we must take on our responsibilities."

These answers also seem to reflect Volkswagen's deepest cultural characteristics: facing reality, respecting the past, taking responsibility, and gradually finding living space through systematic accumulation amidst drastic changes with a "slow and deep" logic.

This attitude also provides a different reference coordinate for current corporate transformations. As we repeatedly consider how enterprises should respond to the new era dominated by AI and new energy from the perspectives of capital efficiency, platform organization efficiency, and other indicators, Volkswagen's choice reminds us that while it is important to be faster, it is equally important to live long enough and transform steadily without deviating from one's roots.

Future competition will not necessarily belong solely to the most well-prepared companies but also to those enterprises that find a new balance between reality and ideals and complete a systematic self-reconstruction.

Note: This article was originally published in the "Auto Review" section of the June 2025 issue of "Auto Review" magazine. Please stay tuned.

Images: From the Internet

Article: Auto Review

Typesetting: Auto Review