Car Companies Embrace Internal Transformation, Taking Bold Steps Against Themselves

![]() 06/06 2025

06/06 2025

![]() 611

611

Admittedly, scale and profitability pose significant challenges for car companies, but when considering the long-term horizon of the new energy vehicle industry, we are still at its nascent stages.

"The Evergrande of China's automotive industry already exists." Recently, Wei Jianjun, Chairman of Great Wall Motors, made waves in the automotive circle with his statement targeting the price wars that have raged over the past two years.

In an interview, Wei Jianjun emphasized that pure electric vehicles incur substantial losses, making it difficult to sustain a viable business model. He bluntly asked, "How can any industrial product reduce its price by 100,000 yuan while maintaining quality assurance?"

In recent years, Wei Jianjun has repeatedly called for an end to "internal competition," believing that excessive price wars lead to a vicious cycle, and for enterprises to develop normally, reasonable profits are essential.

In the business world, no company enters the market without aiming for "profitability." However, over the past two years, dozens of car companies have collapsed amidst intensifying market competition. "Price wars" have become an inevitable strategy for car companies seeking to capture limited market share and alleviate inventory pressures.

Yet, as all companies adopt the "low-price weapon," keeping pace with market dynamics becomes paramount rather than calling for a halt.

1

Mandating Profitability

Wei Jianjun is not alone in grappling with the automotive industry's price wars. Recently, He Xiaopeng, Chairman of Xpeng Motors, also discussed the price wars, stating that current competition is not yet fierce and will intensify within the next five years. He emphasized that competing solely on price is insufficient for corporate development; instead, competition should focus on technology and international expansion.

In 2023, Xpeng Motors faced critical challenges but subsequently adjusted its business strategy. Last year, it launched two popular models, the MONA M03 and P7+, with the MONA M03 helping Xpeng Motors stage a comeback due to its ultra-high cost-effectiveness.

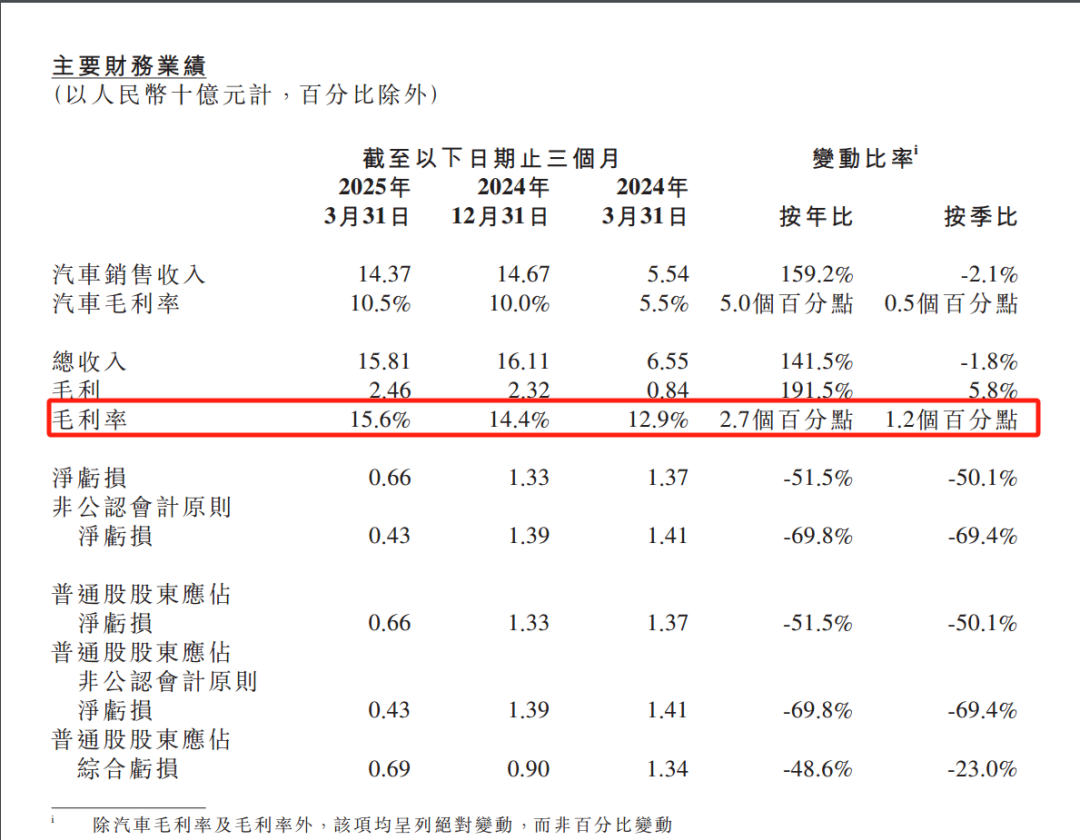

According to Xpeng Motors' 2025 first-quarter report, in addition to a significant sales increase, the company's net loss narrowed by 51.5% year-on-year to 660 million yuan, the lowest quarterly loss in the past five quarters, and its gross margin climbed to 15.6%. He Xiaopeng even set a goal for the company to become profitable in the fourth quarter.

He attributed this performance to the company's comprehensive improvement in systematic capabilities across products, marketing, technology, and operations, including the introduction of Wang Fengying to reshape the supply chain, enhancing internal communication efficiency through AI, and cost reduction solutions led by technological upgrades.

Xpeng Motors is not the only new force prioritizing cost reduction and efficiency improvements. NIO also initiated a major organizational restructuring at the beginning of the year, with Li Bin directly participating in supply chain price negotiations. Subsequently, Li Bin set another target, aiming for the company to achieve profitability in the fourth quarter of this year.

In recent years, both Xpeng Motors and NIO, which have loudly proclaimed their desire to "be profitable," have coincidentally targeted the "cost-effectiveness" route, launching new products at lower prices compared to their previous best-sellers. Simultaneously, they have also turned inward, striving to minimize the cost per vehicle to cope with price wars.

It is evident that the automotive industry's price wars will not abate soon, and car companies need more confidence to handle continued competitive pressures. However, this confidence stems not only from capital but also from continuously optimizing operational efficiency to enhance profitability.

On one hand, as Wei Jianjun noted, the commercialization prospects for new energy vehicles are grim. Early capital participants have lost patience, with some exiting with profits, making it increasingly difficult to secure continuous capital injections.

Official data shows that China's automotive industry's profit margin fell to 4.3% in 2024. Considering the manufacturing industry's profit margin range of 5% to 15%, the automotive industry can be described as "losing money to make a noise," let alone new forces that have accumulated losses of tens of billions or even hundreds of billions of yuan.

Therefore, compared to continuously "painting the pie," new forces' ability to achieve self-sufficiency is the best way to demonstrate their development potential and investment value.

On the other hand, the model of burning money to exchange for market share is gradually failing. When Tesla and BYD, the industry's "profit kings," initiated price wars, the industry believed they could absorb costs through economies of scale.

However, reality shows that while these two car companies' sales have increased yearly in the Chinese market, their gross margins have fluctuated significantly. Taking Tesla as an example, its gross margin declined from 21.0% in 2020 to 17.9% in 2024, and its market share in China also dropped from approximately 22% to around 6%.

This indicates that price wars do not necessarily lead to market loyalty, and unilaterally pursuing volume through price reductions is not the sole logic in the automotive industry. In the current automotive landscape, no one can achieve a quick victory, and they can only strive to compensate for shortcomings and strengthen their strengths.

"Self-sufficiency" is crucial for car companies to replenish their capital pools. Beyond price advantages, car companies must invest stable and sufficient funds in research and development to build competitiveness in core dimensions such as technology, brand, and service.

2

Seeking Breakthroughs Through Internal Transformation

Therefore, besides Xpeng Motors and NIO, more traditional car companies are attempting to launch a new round of "efficiency revolution" by further integrating internal resources to offset the cost pressure brought about by price wars.

Last year, Geely issued the "Taizhou Declaration," announcing a shift from its previous large expansion model of multi-brand development to integration and focus. Gui Shengyue, CEO of Geely, stated that the market does not allow for error space, and Geely must change its past "small and scattered brands, scattered and chaotic" phenomenon to win in fierce market competition.

SAIC Motor has formed a "large passenger vehicle sector." Additionally, it is considering integrating parts and components enterprises into two major entities based on "upper body" and "lower body" to strengthen synergy with internal vehicle enterprises.

GAC Group has split GAC Research Institute into three independent research institutes for vehicles, platforms, and styling, all incorporated into GAC Group's Product Headquarters, forming a brand-new "large R&D system."

If new forces like Xpeng Motors and NIO struggled with not understanding traditional automobile manufacturing, traditional car companies like Geely and SAIC Motor are accelerating internal integration to avoid the "big factory disease" of high internal friction.

Taking Geely as an example, it has pursued a "multi-brand strategy" for the past decade. Yang Xueliang, then-Director of Public Relations of Geely Group, once said that Geely's solid foundation in R&D capabilities, product quality, and brand building could support the group's multi-brand strategy.

However, the automotive market's competitive landscape has far surpassed the past, and the organizational structure that once supported corporate development may no longer suffice in the current "era of efficiency." For instance, Geely's sub-brands like Lotus, Volvo, and Lynk & Co. all have their own R&D teams, inevitably leading to resource overlap and waste.

Moreover, the automotive industry's "more children are a blessing" mindset is no longer suitable for new market changes. In the past, the automotive market was dominated by a few mainstream brands, and consumers' brand perceptions were relatively firm. However, now numerous new energy vehicle brands exist, offering consumers more diverse choices, which has gradually highlighted the drawbacks of the multi-brand strategy.

Finally, when there is ample room for market development, car companies have more leeway for errors and can allow some sub-brands to make mistakes through the "horse racing mechanism." Even if individual brands perform poorly, they will not fatally impact the entire automotive group.

However, the automotive industry's "encircling land and running fiercely" era has passed, and the "horse racing mechanism" may not be effective in rapidly iterative competition. Spreading too thin is detrimental to the main brand's development.

Realizing this, car companies have turned inward and taken bold steps against themselves, making efficiency the new keyword, replacing scale. Currently, accelerated organizational integration among car companies has yielded significant results.

Geely Automobile's net profit attributable to shareholders for the first quarter of this year was 5.67 billion yuan, a year-on-year increase of 264%. Gan Jiayue, CEO of Geely Automobile Group, pointed out that after integration, the group will achieve an overall benefit of over 5%, with R&D efficiency, management efficiency, and marketing efficiency reaching 15%-20%.

SAIC Motor's net profit for the first quarter of this year also surged 1.8 times to 3.02 billion yuan, nearly 1.8 times the net profit for the entire year of last year. It is reported that after SAIC Motor integrated into the "large passenger vehicle sector," it set hard targets of reducing costs by 30% and shortening the development cycle by 40%.

It is evident that the automotive industry is undergoing a top-down self-transformation, preparing for intense competition by enhancing organizational efficiency in technology research and development, supply chain optimization, and marketing services.

3

Preparing for More Brutal Knockout Competitions

Just as Wei Jianjun again called for an end to "internal competition," a new round of price wars has begun in the automotive circle. BYD announced a summer one-price deal for 22 models, followed by brands like Geely Auto, GAC Aion, Changan Deep Blue, and Leap Motor.

Industry insiders pointed out that behind this round of price wars lies not only car companies' desire to seize the market but also their need to address high inventory and cash flow issues. According to official data, at the end of April this year, the national passenger vehicle industry's inventory reached 3.5 million units, the highest level since December 2023.

Therefore, this year's automotive price wars exhibit "high frequency and strong targeting" characteristics. For example, BYD, Geely, and Leap Motor have intensified efforts in "intelligent driving for all," with BYD's "Sky Eye" even lowering the price of intelligent driving to just over 50,000 yuan.

Admittedly, from a market penetration perspective, new energy vehicles' market penetration has stabilized at around 50%. Compared to developed countries like the US, which had 850 vehicles per 1,000 people in 2023, and China's 250, China's automotive industry is still in the stage of filling vehicle ownership and is far from saturation.

However, it cannot be ignored that the new energy vehicle industry has rapidly developed over the past three years. After a period of rapid growth, consumer demand inevitably begins to weaken, and the market growth driver has shifted from "whether there are cars" to "whether they are good to use." Consumers now pay more attention to product capabilities like intelligent driving and battery life, as well as core dimensions like brand and service, intensifying competition's complexity.

Therefore, whether it's "striving for profitability" or "improving organizational efficiency," the essence is to strengthen car companies' ecological capabilities, such as BYD, Great Wall Motors, and Geely's full automotive energy chain layout, and Xpeng Motors, Li Auto, and Xiaomi's investments in AI large models and intelligent hardware. Ecological chain collaboration can further enhance car companies' anti-risk capabilities and organizational efficiency.

Admittedly, scale and profitability are significant challenges for car companies, but considering the long-term horizon of the new energy vehicle industry, we are still at its nascent stages. Rather than blindly pursuing speed, laying a solid foundation at the starting point is crucial. In the long run, the automotive industry's organizational capabilities will ultimately replace price tags and become the deciding factor in knockout competitions.