NIO, XPeng, and Li Auto Q1 2025: Predicting the Winner of the Second Half's 'Future Weapon'

![]() 06/06 2025

06/06 2025

![]() 544

544

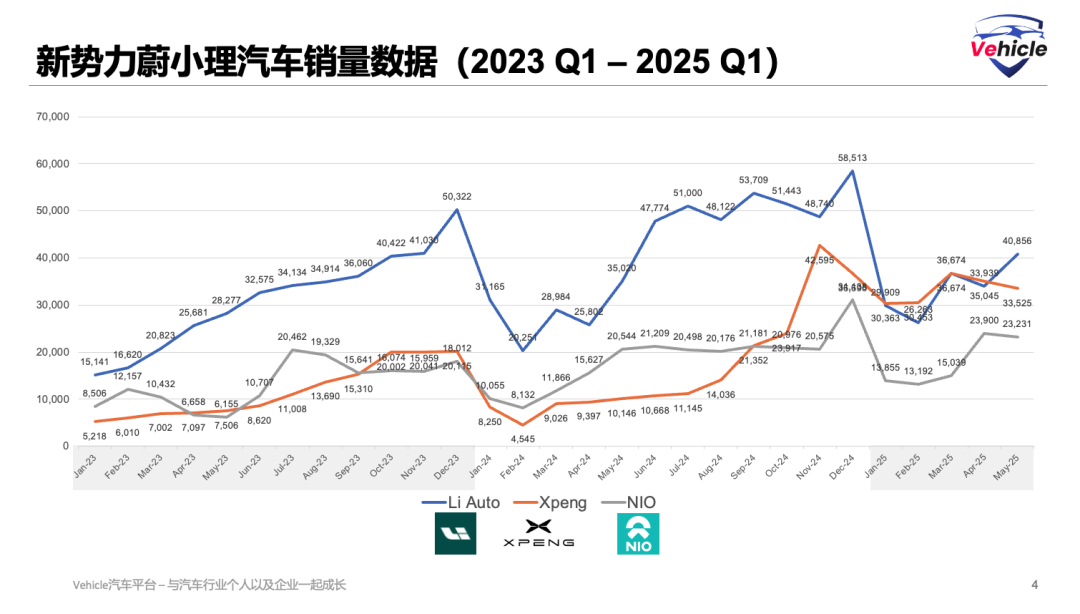

The competition in China's new energy vehicle market has transformed from a straightforward product rivalry to a multifaceted war encompassing technology routes, global export strategies, ecosystem construction, and cost efficiency. The Q1 2025 financial reports of NIO, XPeng, and Li Auto, the three emerging forces, distinctly outline the strategic decisions of China's new energy vehicle industry amidst a period of profound adjustment. NIO is striving to establish brand stratification and battery swapping; XPeng leverages intelligent technology as a 'hard currency' to secure external funding and accelerate exports; Li Auto resolutely turns towards paving the way for high-end pure electric vehicles.

Their choices not only determine their individual fates but also profoundly shape the future landscape and direction of China's automotive industry.

This article interprets their product technology directions and development strategies through financial reports and relevant industry information, aiming to provide valuable insights. At the end of the article, you can vote, discuss, and predict: among NIO, XPeng, and Li Auto, whose 'future weapon' will triumph in the second half? NIO - Making a Last-Ditch Effort for Brand Stratification and Battery Swapping

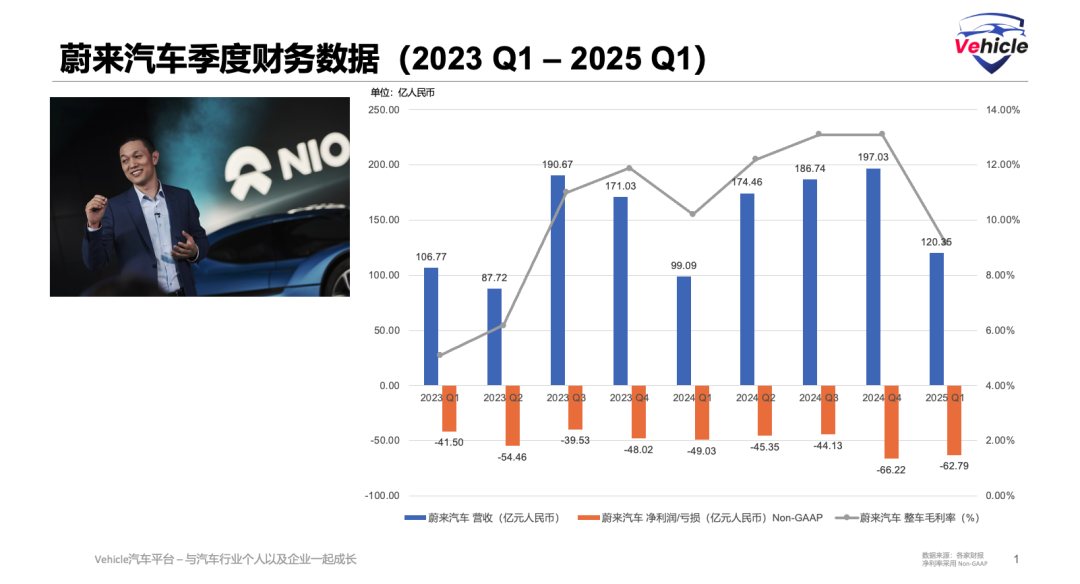

NIO's financial data has always been a concern, with quarterly losses hovering around 4-5 billion yuan over the past two years. In Q1 2025, NIO delivered 42,094 vehicles and generated over 12 billion yuan in sales, yet the loss exceeded 6 billion yuan, half of the revenue from car sales.

Despite these worrying figures, Li Bin has consistently managed to raise funds, likely due to NIO's excellence in refinement, quality, technology, and service, along with a commendable work atmosphere for employees. NIO's upcoming strategies include:

- Product Rhythm: Launching the new ES8 in the fourth quarter, along with higher-volume models ES6, EC6, ET5, and ET5T, aiming for a total monthly sales volume of 25,000 units for the NIO brand. The Lido brand expects to sell 25,000 units per month for its three models in the fourth quarter of 2025. The Firefly brand, targeting the Chinese and European markets, will start deliveries in late April of the second quarter.

- R&D, Operations, and Sales: Merging middle and back-office functions, including R&D, to enhance efficiency. However, to ensure brand differentiation, NIO (NIO and Firefly brands) and Lido will maintain their independence. Focusing on cost reduction and efficiency enhancement.

- Intelligence: Deploying the NX9031 intelligent driving chip, which NIO estimates will save 10,000 yuan per vehicle. Developing the SkyOS vehicle operating system and the NIO World Model (NWM) for intelligent driving, to be deployed by the end of May.

- Electrification and Charging Network: Continuing to focus on the battery swapping network, such as the 'Power Up' plan to increase county-level coverage. Battery swapping stations will serve as a window to engage with users and promote sales.

- Overseas Exports: Focusing on the UK and EU regions, transitioning from a direct sales model to local partnerships. The Firefly brand will primarily export to Europe, while NIO and Lido will expand to other countries, likely the Middle East.

NIO is essentially playing all its cards due to the intense competition in China. Investors are closely watching NIO's payment terms, which typically involve 90-day payments (half cash, half check), but with actual payments handled on a case-by-case basis.

XPeng - MONA Boosts Popularity, Services and Subsidies Support Financial Reports

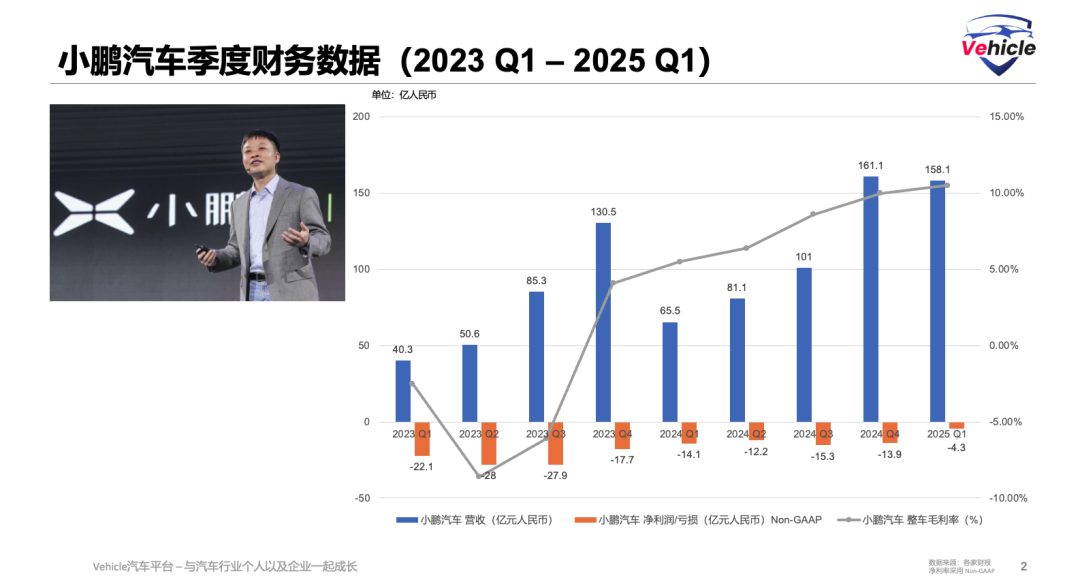

XPeng's financial data appears impressive, with revenue increasing even during the first quarter (including the Spring Festival) and losses gradually narrowing. In Q1 2025, XPeng sold 94,008 vehicles, generated 15.8 billion yuan in revenue, and narrowed its loss to 430 million yuan.

However, closer inspection reveals that sales are primarily driven by the low-priced Mona, with a significant portion of revenue coming from service fees from Volkswagen and government subsidies since late 2023. XPeng's next steps include:

- New Product Rhythm: Launching the SUV G7 in June, priced in the 250,000 yuan market. Introducing the new-generation P7 in the third quarter, positioned as a 300,000 yuan luxury sports sedan. Gradually starting mass production of the Kunpeng super electric vehicle model in the fourth quarter.

- Intelligence: Accelerating research and development from L2+ assisted driving to L3 and L4 autonomous driving technologies. Launching an industry-leading humanoid robot in 2026 for industrial and commercial applications.

- Overseas Exports: Defining exports as its second growth curve, currently focusing on Europe, the Middle East, and Southeast Asia, with plans to expand into Latin America and other Asian countries in the future.

While XPeng's intelligent self-development is paying off through Volkswagen and subsidies, its overseas expansion is gaining momentum. However, it still faces risks such as product sustainability, Tesla's market performance, and questions about its intelligent driving leadership.

Li Auto - Under Pressure from Extended-Range Models, Advancing Towards High-End Pure Electric Vehicles

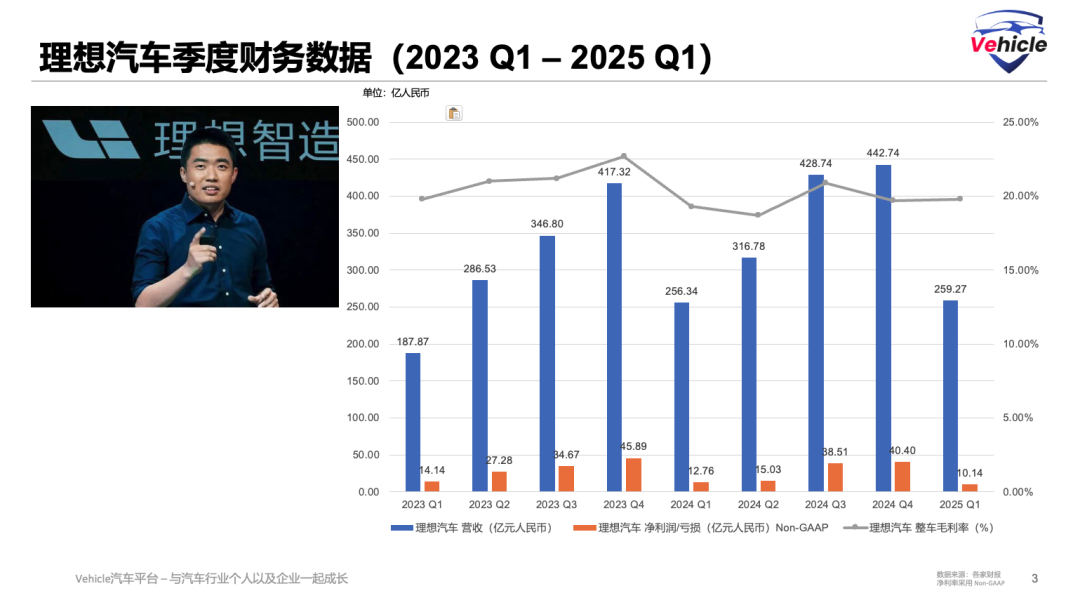

Li Auto's financial data has been favored by investors, with stable gross margins of 20% and seasonal sales fluctuations. In Q1 2025, Li Auto sold 92,864 vehicles, but profits declined sharply to 1.01 billion yuan, down 20% year-on-year and 81.7% quarter-on-quarter.

Li Auto's extended-range product line is facing pricing challenges due to fierce competition and economic downturn. Therefore, Li Auto urgently needs to establish a second label beyond being a leader in extended-range vehicles. Li Auto's upcoming strategies include:

- New Product Rhythm: The Li Auto MEGA, with an estimated monthly delivery volume of 2,500 to 3,000 units by July. The high-end pure electric Li Auto i-series, featuring innovative styling and exterior design optimized for maximum interior space and low drag coefficient. The i8 and Li Auto i6 are scheduled to be launched in July and September, respectively.

- Intelligence: Developing the VLA model to realize Driver agent and build a cloud world model. Launching the VLA intelligent driving system alongside the i8 in July, using a combination of vision and custom LiDAR from Hesai as sensors.

- Charging and Energy Replenishment: Enhancing the charging experience by operating 2,350 supercharging stations with over 12,800 charging spots, with plans to deploy over 2,500 stations by June and reach 4,000 stations by the end of the year.

Li Auto's intelligentization efforts have been relatively successful over the past year, with many investors ranking its intelligent driving ahead of XPeng's. The company is poised to make significant strides in the high-end pure electric vehicle market.

As of April 30, 2025, Li Auto boasted a robust presence with 500 retail stores spanning 151 cities nationwide and 500 service centers, along with Li Auto-authorized body and paint shops operating in 223 cities. To bolster the rollout of new models, Li Auto aims to further extend its network in key automotive hubs and shopping centers across the country in the latter half of the year. Concurrently, it will leverage the Star Plan to penetrate deeper into lower-tier cities (fourth and fifth-tier), enhancing overall coverage efficiency. The objective is to expand into 100 fourth- and fifth-tier cities this year, anticipating an incremental sales volume of 100,000 units by 2026. Regarding overseas expansion, Li Auto is currently in the talent recruitment phase, with a medium- to long-term aspiration to achieve 30% of total sales from international markets. This expansion will primarily target the Asian and European regions, adopting a local distributor model. Li Auto is actively seeking a new growth trajectory beyond its established leadership in extended-range vehicles, recognizing the impending heightened competition in this segment. The strategic pivot is to establish a forefront position in intelligence and cultivate a high-end, family-oriented pure electric vehicle brand. Li Auto confronts risks such as the current economic slowdown and the competitive landscape of selling high-end pure electric vehicles, a challenge already navigated by NIO. Furthermore, an influx of lower-priced, spacious SUVs is fiercely encroaching on Li Auto's core market. Nonetheless, Li Auto retains a promising avenue for growth through its overseas expansion. The battleground remains dynamic and full of potential. In conclusion, NIO is making a decisive push for an ecological gamble, XPeng is striving to monetize technological advancements, while Li Auto advances steadily while exploring new frontiers. These three emerging players each possess distinct 'future weapons', undergoing rigorous testing in China's fierce 'multi-dimensional war' for new energy vehicles.

The battlefield is ablaze with intense competition, and the outcome is far from certain. Who will you cast your vote for? What are your underlying reasons? We invite you to share your perspectives in the comments section and join us in dissecting this 'multi-dimensional war' that will shape the future!

Reference Articles and Images

NIO Q1 2025 Financial Report and English Transcript of Earnings Call PDF

XPeng Q1 2025 Financial Report and English Transcript of Earnings Call PDF

Li Auto Q1 2025 Financial Report and English Transcript of Earnings Call PDF

*Reproduction and excerpts are strictly prohibited without permission. To obtain the reference materials for this article:

Join our knowledge community to download a vast array of reference materials from our public platform, including the aforementioned references.