"Tema" Rift: Tesla's Market Value Drops by Trillions, Musk Remarks "I Loved It"

![]() 06/09 2025

06/09 2025

![]() 570

570

Sales Concerns Loom Large

Author: Wang Lei

Editor: Qin Zhangyong

Two prominent figures have now parted ways completely.

Not long ago, they were inseparable, like twins attending various events together. Musk's visibility in American politics skyrocketed, but love, like a tornado, comes and goes swiftly.

After a period of ambiguity, a "Big and Beautiful" bill sparked an online spat between the two, showcasing to the global internet audience that there are no permanent friends, only permanent interests.

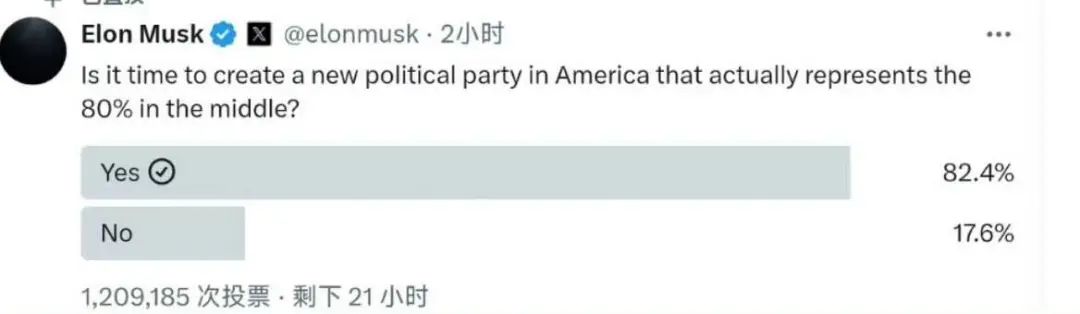

For instance, Musk unleashed his full firepower, stating that without him, Trump would have lost the election, and also hinted at Trump's impeachment.

Trump, on the other hand, labeled Musk as crazy and expressed "deep disappointment" in him.

Until now, both sides continue to tear each other down. Musk even joked that Trump was mentioned in Epstein's files, a headline that also dominated trending topics.

Their public spat has provided ample material for the media to report on. Based on the current trend, it seems inevitable that one side will emerge as the loser, with many spectators eagerly watching the drama unfold. However, the capital market has already reacted strongly.

In this round, Tesla is clearly the most affected party:

Its stock price plummeted by over 14% overnight, erasing $152 billion (RMB 1091.9 billion) in market value, marking the largest single-day decline in four years.

01

Tesla's Stock Price Takes a Hit

This scenario feels eerily familiar. Tesla has experienced multiple similar stock price plunges recently.

However, previous stock price crashes were primarily due to Musk's deep involvement in politics, neglecting Tesla, which led to the stock price plummeting.

Now that Musk has distanced himself from government affairs and fully returned to Tesla, Trump's complete "breakup" has once again dragged Tesla down.

Regardless of whether relations with Trump were good or bad, the stock price continued to fall.

It's worth noting that Tesla's stock price had risen cumulatively by 22% in May, and this rebound occurred after Musk ended his term in the "Department of Government Efficiency" within the Trump administration.

Reviewing Tesla's stock performance over the past six months, it presents a rollercoaster trend, with both surges and plunges in just over half a year.

Earlier, during the acquisition of Twitter in 2022, concerns about Musk's divided attention caused Tesla's market value to evaporate by $250 billion. In 2020, a single comment by Musk that "Tesla's stock price is too high" directly triggered the evaporation of $100 billion in market value.

The volatile trend of Tesla's stock price, which rises and falls at will, also indirectly indicates that its stock price is heavily reliant on Musk personally.

Wall Street has also expressed that Tesla is extremely reliant on Musk's personal image, and its stock price movement has deviated from fundamentals with a high valuation. Investing in it now is "simply gambling".

Previously, many believed that Musk's "withdrawal" from politics would be beneficial to Tesla. However, analysts quickly doused this notion with cold water. Seth Goldstein, an analyst at Morningstar, said that Musk's departure from the Department of Government Efficiency is expected to boost market sentiment, but he doesn't believe it will bring substantive changes to Tesla.

Wayne Kaufman, chief market analyst at Phoenix Financial Services, also stated that a significant problem for Tesla is that you cannot separate the company's value from Musk.

"Tesla's value is inseparable from Musk. When he is seen as a visionary, the stock price soars; when he is involved in controversy, the stock price crashes. Now that Musk has become the problem itself, it's not surprising that the stock price has plummeted."

This analyst also criticized the "Tema spat", describing the entire incident as utterly foolish. People in such high positions should understand not to act like middle school students.

Moreover, most analysts are not optimistic about Tesla's future performance. First, Musk's politically controversial behavior has caused some consumers to resent the brand. The electric vehicle business has been weakening, and disagreements with Trump may directly impact the government subsidies and contracts that Tesla relies on, further compressing profit margins.

Ryan Brinkman, an analyst at JPMorgan Chase, wrote in a report that the "Big and Beautiful" bill threatens more than half of Tesla's profits in 2025. For example, the $7,500 tax credit accounts for about 19% of Tesla's 2024 EBIT, and its cancellation poses a risk of $1.2 billion in profit loss. Terminating California's Zero-Emission Vehicle Credit Sales Program could potentially result in an additional $2 billion loss.

Dan Ives, a technology analyst at Wedbush Securities, also believes that the electric vehicle tax credit is not the main factor behind Tesla's stock price decline, but rather that "Trump will not be friendly on regulatory issues." He added that the dispute between the two "is definitely not what Tesla shareholders want to see."

Adam Sarhan, CEO of 50 Park Investments, said that when Musk and Trump are no longer aligned, it is unclear what consequences this will bring. However, if the situation escalates, Trump will ultimately emerge victorious, and the impact on Tesla's stock price remains unknown. "I believe it does have the potential to hurt Tesla's earnings, which is why people are selling," he said.

Ross Gerber, CEO of Gerber Kawasaki Wealth and Investment Management, also stated, "This is a disaster for Musk. I can't imagine a rational businessman turning Trump into an enemy. The Tesla board has no intention of protecting shareholders, and the only way to protect oneself is to sell stocks. I sold some Tesla stocks today, and we have been reducing our holdings for years."

Therefore, in the view of most analysts, directly confronting Trump is not a wise move, and the stock price alone can directly demonstrate the pros and cons.

02

Sales Also Surrounded by "Ambushes"

Compared to the "fallout" with its best ally, Musk should be more concerned about Tesla's sales issues.

After all, sales performance is Tesla's foundation. However, the current situation is that Tesla's sales in China and multiple European countries have begun to plummet.

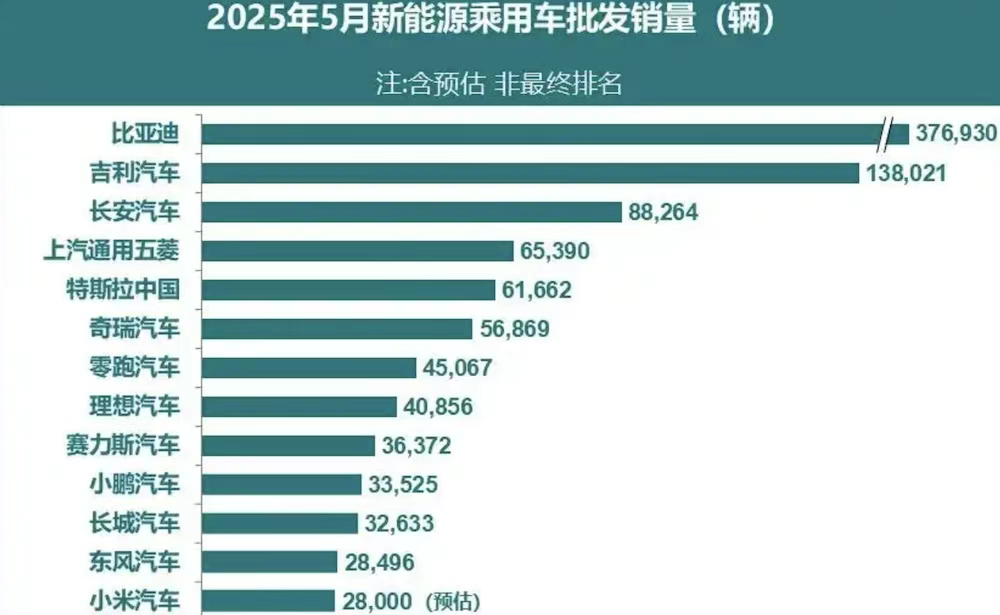

Data from the China Passenger Car Association shows that in May, deliveries of Tesla's Model 3 and Model Y vehicles manufactured in China were only 61,662 units, a year-on-year drop of 15%. This marks the eighth consecutive month of year-on-year decline in Tesla China's sales since October 2024.

Looking solely at this year, as of May, Tesla's cumulative sales in the Chinese market were 292,875 units, down 17.64% from the same period last year. Last month, Tesla's market share in China fell to 3.2%.

Not only in the Chinese market, but Tesla's electric vehicle sales have also suffered a significant blow in most parts of Europe. According to data from the European Automobile Manufacturers Association (ACEA), Tesla's overall sales in Europe plummeted by 49% year-on-year in April.

Breaking it down by specific markets, in Germany, where overall sales of pure electric vehicles surged by 44.9%, Tesla only sold 1,210 vehicles in May, a year-on-year drop of 36.2%.

In the UK, the largest electric vehicle market in Europe, Tesla's sales fell by more than 45% in May, while the overall electric vehicle market in the UK grew by 28%. Moreover, data from research firm New AutoMotive shows that Tesla has been squeezed out of the top four, falling to fifth place in UK electric vehicle sales.

In addition, Tesla's sales in Italy fell by 20% in May, while overall electric vehicle sales in Italy rose by 40.8% during the same period. In Spain, Tesla's new car sales fell by 29% year-on-year to 794 units in May. In France, sales were only 721 units, a year-on-year drop of 67%.

Amid sluggish sales, Musk also announced that he was shedding his "political burden" and returning to full-time corporate governance.

He further stated that he would "return to working seven days a week, around the clock, sleeping in meeting rooms, server rooms, and factories" and emphasized, "We must be super focused on X, xAI, and Tesla, as well as Starship launches. The company has key technologies that are being launched successively."

Shortly after, on May 29, Musk indeed dropped a bombshell, announcing that Tesla plans to deliver its autonomous driving Model Y to customers for the first time in June 2025.

Moreover, spy shots of a new model taken at Tesla's US factory were recently exposed online. The shape is similar to the current Model Y, and it is highly likely to be Tesla's next affordable model.

Although Reuters reported that Tesla may have canceled its previously planned $25,000 affordable electric vehicle project, Model 2, it is being replaced by "lite" versions of the Model 3 and Model Y, which will also lower the current models' prices.

When affordable models and autonomous driving are finally realized, can Musk turn the current situation around?