Empowering AITO: The Impact of Changan's "Independent Central Enterprise" Status

![]() 06/09 2025

06/09 2025

![]() 714

714

Lead

While the prestigious status of "independent central enterprise" promises AITO resources and brand endorsement, it also presents significant challenges. AITO must adeptly balance the integration of "central enterprise resources" with its inherent "market genes" to leverage these advantages effectively.

Produced by | Heyan Yueche Studio

Written by | Qian Lei

Edited by | He Zi

Total words: 2654

Reading time: 4 minutes

On June 7, the 27th Chongqing International Auto Exhibition kicked off, marking AITO's debut with its full lineup. The brand announced a milestone achievement of over 150,000 cumulative sales, with an average selling price exceeding 270,000 yuan. This announcement, following just two days after Changan Automobile's designation as an "independent central enterprise," holds profound implications.

AITO Embarks on a New Historical Chapter

On June 5, the State Council approved the strategic separation and reorganization of China South Industries Group Corporation (CSGC), making its automotive business an independent central enterprise. This institutional reform not only signifies a significant restructuring of China's automotive industry's "national team" but also puts an end to rumors of a merger between Dongfeng Motor Corporation and Changan Automobile. It points to a new development direction for the reform of central enterprises in the automotive sector. Consequently, Changan Automobile now carries the prominent label of "independent central enterprise," which will inevitably have multidimensional strategic impacts on AITO, the high-end smart electric vehicle brand jointly developed by Changan, Contemporary Amperex Technology Co. Limited (CATL), and Huawei.

"At this new historical juncture, AITO will continue to leverage globally original design and China's top technology to create a world-class new luxury brand, offering a futuristic travel experience to users worldwide," said Chen Zhuo, CEO of AITO Technology. "Having surpassed 150,000 cumulative deliveries, AITO has gained recognition and trust from an increasing number of users, marking a new milestone in our brand journey. Now, with a more solid backing, we enjoy stronger support and guarantees in terms of talent, funds, and technology. AITO will continue to build an independent team, brand, and operational capabilities aligned with market-oriented paths, honing our skills in the market and growing through competition."

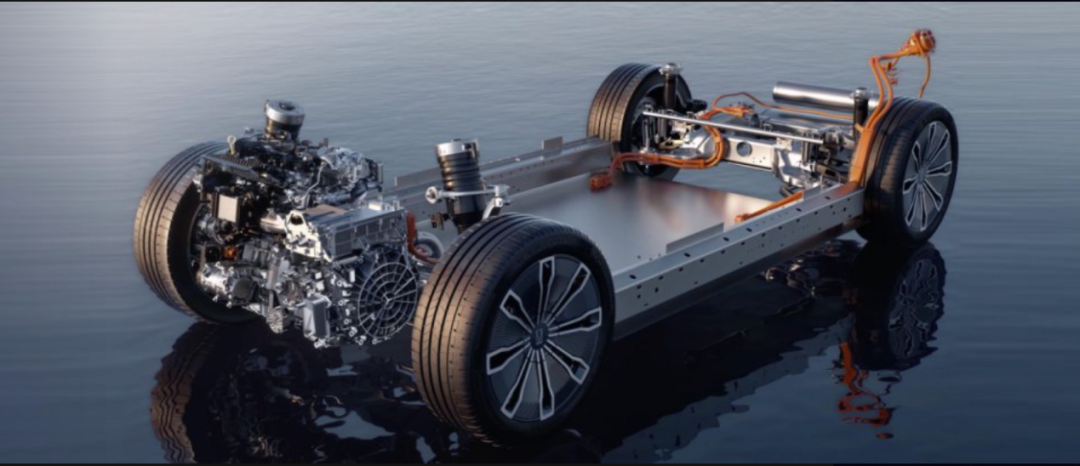

As a quintessential example of innovative cooperation in the new energy automotive industry, AITO's shareholding structure reveals Changan Automobile as the largest shareholder with 40.99% stakes, while CATL holds 14.1% as the second-largest shareholder. In terms of technical cooperation, Huawei primarily provides key technical support such as intelligent driving algorithms and intelligent cockpit solutions. In terms of product layout, the brand has launched four models within three years, encompassing both pure electric and extended-range technology routes. Its product configurations highlight the following: all series come standard with CATL battery technology; dual zero-gravity seats in the front row are standard equipment; and innovative technologies like nano-water ion air conditioning and electronic exterior rearview mirrors are applied. From a market performance perspective, AITO has established its position in China's high-end new energy vehicle market through a differentiated product strategy, and its technological applications have a demonstrative effect on industry development.

Since delivering its first model at the end of 2022, AITO has successively launched four products, forming a complete product matrix. The brand's first model, AITO 11, established a unique design language and incorporated multiple innovative technologies. Subsequently, AITO 12 eliminated the traditional rear quarter window, equipped with a 35.4-inch integrated remote display, and electronic exterior rearview mirrors. AITO 07, on the other hand, is the first to carry the self-developed Kunlun Intelligent Range Extension System and Taihang Intelligent Control Chassis. The latest AITO 06 continues the brand's design philosophy, particularly emphasizing sports performance.

Public sales data indicates that AITO has surpassed 150,000 units in cumulative sales within four years, completing the research and development and launch of four new models. This rapid product launch pace demonstrates strong R&D and mass production capabilities. AITO continues to enhance its software and hardware service system. On the software front, 36 OTA upgrades have been completed, with the upcoming major update including three key features: the popularization of the "Smart Scene" function across the entire lineup, the addition of parking space-to-parking space intelligent driving (supporting ETC automatic passage), and the pre-unlock function 0.5 seconds before a collision.

In terms of channel construction, by the end of May, over 700 offline outlets had been established, covering 212 cities (with a prefecture-level city coverage rate of 82% and a core business district coverage rate of 76%). International market expansion is also being simultaneously promoted, with plans to enter more than 50 countries and establish over 160 overseas outlets in 2024. The service system is being upgraded simultaneously, with the new "Yuexin 5A Service Commitment" comprehensively enhancing the user service experience. Behind AITO's 150,000 users lies deep interaction between the brand and its users.

The Golden Signboard's Empowerment for AITO

According to AITO's plans, it will launch 17 new products by 2030, including a groundbreaking large six-seater flagship product priced at the million-yuan level, forming a full-spectrum product matrix encompassing sedans, SUVs, sports cars, and MPVs. With Changan Automobile's upgrade to an "independent central enterprise," AITO, as its high-end smart electric vehicle brand, will gain more advantages in resource integration. This strategic adjustment will bring substantial improvements to AITO at three levels:

First, at the technology research and development level, the background of a central enterprise implies more stable support from national strategic resources. Relying on Changan Automobile's central enterprise platform, AITO can accelerate breakthrough research and development in core technologies such as high-voltage fast charging and intelligent driving. Especially in key areas like the 800V high-voltage fast charging platform and L3+ autonomous driving technology, it is expected to receive more policy support and R&D resource inclination.

Second, in terms of industrial chain collaboration, AITO will deeply integrate into the central enterprise supply chain system. This will not only help ensure stable supply of key components like power batteries and chips but also reduce procurement costs through economies of scale, enhancing product competitiveness.

Third, in terms of financial support, the central enterprise background will provide AITO with more stable financing channels and financial support. This is crucial for new energy vehicle brands that require continuous investment in technology research and development, especially in the current market environment marked by intensified competition.

It's worth noting that this resource integration advantage goes beyond mere capital injection, encompassing systemic support across multiple dimensions such as research and development, supply chain, and finance. This will significantly enhance AITO's long-term competitiveness in the high-end smart electric vehicle market, providing solid support for its vision of becoming "the leader of high-end smart electric vehicles in China."

More importantly, with the empowerment of an "independent central enterprise," AITO's brand premium and trust endorsement will be significantly boosted. As a high-end smart electric vehicle brand controlled by a central enterprise, this identity transformation will strengthen its market competitiveness in multiple dimensions, aiding in expanding cooperation with enterprise-level key accounts. The "national team" identity will not only elevate the credibility of the AITO brand but also significantly increase technical trust, enhancing consumer safety trust in intelligent driving systems. This makes the brand more persuasive in promoting L3+ autonomous driving technology and gives it a competitive edge in government procurement and the high-end business vehicle market, while also facilitating expanded cooperation with enterprise-level key accounts.

However, while the prestigious status can bring AITO resources and brand endorsement advantages, it also presents considerable challenges. Compared to private or mixed-ownership enterprises, central enterprises may be more cautious about trial-and-error innovation and rapid strategic adjustments, which might affect AITO's agility in the smart electric vehicle market. Furthermore, if it relies excessively on policy resources, it may weaken its ability to quickly capture consumer needs, resulting in a disconnect between product definition and the market. Moreover, the "national team" label is a double-edged sword. While it enhances credibility, it may also lead some young or high-end users to perceive the brand as "relatively traditional," potentially diluting AITO's original technology pioneer image.

Commentary

It is foreseeable that Changan Automobile's status as an "independent central enterprise" will provide AITO with unique advantages in brand building in the high-end market, particularly in the commercialization of intelligent driving technology, where such official endorsement is crucial. This change may propel AITO's evolution from a "high-end smart electric vehicle brand" to a "national intelligent mobility technology platform." However, enhancing brand value is not an overnight process and requires continuous improvements in product strength and service system construction. In the short term, AITO will benefit from the tilt of central enterprise resources; in the medium to long term, it remains to be seen whether it can maintain the agile innovation genes of a "technology company." AITO must adeptly balance the integration of "central enterprise resources" with its "market genes" while leveraging central enterprise resources, maintaining its decision-making autonomy, the continuity of market-oriented innovation, and adherence to brand differentiation. Achieving such a balance will test the wisdom of the AITO team.

(This article is originally created by Heyan Yueche and may not be reproduced without authorization)