Who is Saving the Supply Chain?

![]() 06/11 2025

06/11 2025

![]() 708

708

Each entity faces its unique challenges.

On June 6, Japan's Suzuki Motor Corporation announced the temporary suspension of some of its automotive production lines in Japan due to delays in the arrival of parts containing rare earth materials from China.

Furthermore, Suzuki's statement highlighted that the shortage of these parts, primarily used in automotive electronic systems and engine components, had a direct impact on production plans. Not long before, in May, the Society of Indian Automobile Manufacturers (SIAM) complained at an emergency meeting, stating, "Inventories won't last until the end of the month!"

In the same week Suzuki announced its production halt, Ford Motor Company also suspended production of the Ford Explorer model at its Chicago plant due to a shortage of rare earth supplies. The crisis caused by disruptions in the supply chain has far-reaching impacts.

Currently, multiple multinational automakers, including Toyota, Volkswagen, and BMW, are urgently reviewing supply chain risks and assessing how close they are to halting production. The industry believes that the current rare earth shortage is as severe as the chip crisis in 2020.

If the rare earth shortage represents one corner of the global auto supply chain crisis, then the supply chain crisis in China's auto market does not stem from a lack of rare earths but from "excessive competition." This excessive competition is akin to a sharp knife mercilessly cutting into the healthy development of China's auto supply chain.

Each entity faces its unique challenges.

The "Rare Earth Crisis" in European and American Markets

Rare earths, a collective term for 17 metals including lanthanides, scandium, and yttrium, form an irreplaceable technological foundation in the automotive sector. They are core materials for electric vehicle motors, conventional car power windows, and speakers.

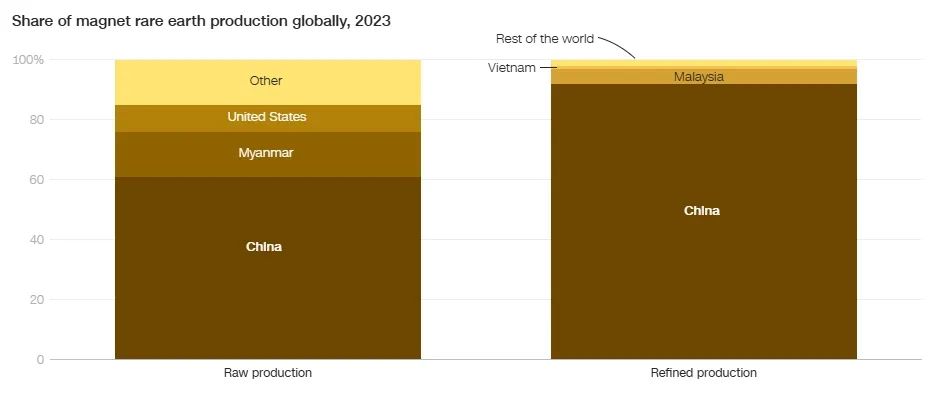

Over 70% of global rare earth production comes from China, and China also holds 92% of the global share in rare earth refining and processing. Other countries either lack mines or their technology lags behind. For example, the Mountain Pass mine in California, USA, is one of the world's largest rare earth mines, but processing still relies on China, making it costly.

More directly put, "Without this raw material, global automakers would have to halt production, and the decision-making power rests in China's hands."

Recently, due to Trump's tariff war, China strengthened controls on the export of rare earth magnets as a countermeasure, leading to disruptions in the supply of rare earth magnets essential for automotive brakes, steering systems, fuel injection devices, electric seats, and more.

This gave the accustomed domineering European and American powers a taste of being "choked off." After all, previous tariffs imposed by Europe and the US on chips and batteries were all attempts to stifle China's auto industry.

It's indeed tough, with complaints drifting across the ocean.

Frank Eckardt, CEO of German magnet manufacturer Magnosphere, complained that he receives numerous phone calls every day. Due to China's export restrictions, there is a shortage of magnet supplies, and irate automakers and parts suppliers urgently need to find alternative sources of magnets.

"The entire automotive industry is in a panic," expressed Hildegard Müller, president of the German Association of the Automotive Industry. "If this situation does not improve soon, production delays or even interruptions will be inevitable."

In May this year, Ford Motor Company's Chicago plant experienced a production crisis. The main model, the Explorer SUV, faced a shortage of rare earth permanent magnets, leading to disruptions in the motor supply chain and a one-week suspension of production lines.

The Automotive Innovation Alliance, a consortium of automakers including General Motors and Toyota, jointly issued an industry warning with the Motor & Equipment Manufacturers Association (MEMA): If the supply of rare earth elements and permanent magnet materials remains unstable, the manufacturing of core components such as automatic transmissions, sensors, and power steering systems will face a comprehensive impact, potentially endangering the overall production capacity security of the US auto industry.

The American Automotive Policy Council estimates that if the supply of rare earths is cut off for more than 30 days, the daily loss for the entire US auto industry will reach $230 million. The US media mentioned that Trump was "extremely anxious," possibly realizing the impact of the vulnerability of the rare earth supply chain on national economic and technological competitiveness.

India, which maintains a superficial friendship with the US, is also complaining. Indian automakers rely on China for over 90% of their rare earth magnet imports annually. This year, they originally planned to import 700 tons, but after China tightened exports in April, permanent magnet exports were halved.

With the announcement of Suzuki's supply chain disruption, it quietly kicked off a new round of supply disruption crises in the global auto industry. The industry fears that the rare earth situation could trigger another large-scale supply chain shock, similar to the multi-year chip crisis that led to reduced production of millions of vehicles globally.

Everstream Analytics, a supply chain risk management firm, pointed out that China's unilateral rare earth export controls are severely impacting global supply chains amid the aftermath of Sino-US trade frictions.

However, China should not be blamed for this.

First, rare earths are indeed scarce resources, and the global auto industry chain is deeply dependent on them. Second, Trump's indiscriminate tariff policies have disrupted the economic order of the global market. Trump should take the blame for this.

Nevertheless, it is certain that under the chip crisis and rare earth crisis, the global industrial chain is undergoing profound changes.

According to reports, diplomats and automotive and core industry executives from India, Japan, and Europe are urgently requesting the Chinese government to approve rare earth magnet export licenses as soon as possible and to apply for an emergency meeting. A Japanese business delegation announced in early June that they would consult with China's Ministry of Commerce in Beijing, and India plans to arrange a visit by automotive industry executives within 2-3 weeks.

Meanwhile, multinational automakers and suppliers are also looking for alternatives or developing parts with lower rare earth content. The European Union has initiated multiple initiatives, including the Critical Raw Materials Act, to promote the development of European rare earth resources.

However, this is difficult to achieve in the short term. Noah Barkin, senior advisor at the US think tank RDI, said that the EU's actions are not fast enough, and even companies that have developed marketable products struggle to compete with Chinese producers in terms of price.

The top priority is to approach China to seek relaxation of the rare earth export strategy. "The global automotive industry has seen the power of China's countermeasures against the US and is in extreme panic," Reuters reported.

On June 6, Reuters reported that China had approved the issuance of temporary export licenses for rare earths to suppliers of the three major US automakers, General Motors, Ford, and Stellantis, with a validity period of up to six months. However, export volumes and categories remained strictly limited.

This "precise control" strategy avoids escalating the trade war while ensuring China's discourse power in the global rare earth market. It is reported that the first meeting of the China-US Economic and Trade Consultation Mechanism will continue on June 10, with rare earths being a key discussion point.

From the perspectives of the chip and rare earth supply chain crises, fluctuations in the supply of strategic resources affect the production rhythm of global automakers and the global industrial layout. Obviously, compared to the US approach to the chip solution, China's strategy to address the rare earth supply disruption crisis takes a more holistic approach.

You Lack, I Compete

Unlike the rare earth "shortage" crisis encountered in European and American markets recently, the supply chain crisis faced by China's auto industry can be summed up in one word: "competition."

How intense is the competition?

Even the China Iron and Steel Association has complained that automakers are "competing" on price, putting immense pressure on upstream raw material suppliers and severely impacting the stable operation of steel enterprises.

According to steel mills, automakers have been engaged in extreme cost reduction in recent years, constantly demanding that steel mills reduce the prices of automotive steel plates. Last year, some OEMs required steel mills to reduce the prices of automotive steel plate supplies by more than 10%, far exceeding the acceptable capacity of steel mills.

The root cause lies in excessive competition and the intense price war. It is understood that due to the "price war," the overall retail loss of the new car market in the automotive industry approached RMB 200 billion in 2024. According to National Bureau of Statistics data, the profit rate of the automotive industry was 7.3% in 2018, falling to 4.3% by 2024 and further to 3.9% in the first quarter of this year.

Alarming figures.

The cost pressure and profit decline under the price war inevitably spill over to the supply chain. Steel enterprises have complained that some automakers, relying on their own supply chain finance platforms, delay payment to steel and other upstream enterprises after they supply goods. Some automakers even implement a "0-day payment term + 180-day supply chain finance" model.

Payment is further delayed for several months through corporate bills, essentially amounting to issuing IOUs first. Suppliers need to go to the bank to settle the bills after receiving the acceptance bills, taking at least six months for suppliers to receive the bills and at least another six months to cash them out.

As payment terms are continuously extended, it takes a year from the initial settlement to when suppliers finally receive payment. Statistics show that the average payable turnover days for Chinese automakers have reached 182 days and continue to grow.

However, during the waiting period for payment, some brands that fail to establish a firm footing collapse, and IOUs turn into bad debts. Previously, a supplier sued Nezha Automobile for defaulting on payments, applied to the court for asset preservation, and recorded the debt as a bad debt.

"You never know when automakers will settle payments with you," similar sentiments are echoed by countless supplier enterprises. Moreover, in this year, suppliers need to advance mold fees, R&D expenses, production expenses, and more.

"From the time parts are installed on vehicles to when suppliers actually receive payment, it may take a year." If China's auto supply chain is already on the brink of collapse, then the final straw that breaks the camel's back will undoubtedly be payment terms.

Li Yunfei, general manager of BYD Group's Brand and Public Relations Department, pointed out on social media on May 30 that the average turnover days for accounts payable and notes payable in the financial reports of domestic automakers were 127 days for BYD, 127 days for Geely, 163 days for Great Wall, and 164 days for SAIC.

In other words, enterprises in the supply chain face the dual squeeze of price and payment terms. Tongbao Optoelectronics, a supplier of automotive lighting systems and electronic control systems, disclosed in its 2024 annual report that the company's net profit last year was RMB 83.09 million, but it still had to carry accounts receivable of RMB 182 million.

"It's helpless. We can't even get paid, but we still have to cooperate with automakers in the price war. Reducing prices means no profit, while not reducing prices may mean being replaced."

A supplier said that not doing business can lead to starvation, but doing business may lead to being dragged down. At present, large and small suppliers in the automotive supply chain are facing a "crisis of struggling to survive," and even giants like Bosch have been forced to extend their payment terms from 60 days to 120 days.

"Caught between a rock and a hard place, but in the end, we'll choose to do it." Under compulsion, only one level presses down on another. Automakers delay payments, and the next level of suppliers, to ensure their own operations, will pass on the risk to the next level of suppliers.

"It will eventually fall apart." Some suppliers said that automakers engage in price wars, while suppliers who are "required to make significant price reductions every year" are struggling under heavy burdens. "Our products are required to meet automotive-grade standards, but the prices must reach consumer-grade levels. Behind this is automakers pretending to be ignorant."

A pressing fact is that the more intense the price war, the bigger the snowball of accounts payable will roll, and supply chain enterprises will be overwhelmed. At that time, the emergence of an "automotive industry Evergrande" will not be an alarmist statement.

Evergrande's collapse was due to its aggressive use of high leverage and high debt in the real estate industry, leading to high debt ratios and funding costs. As a key industry in manufacturing, the automotive industry is asset-heavy and has a long cycle, so high debt ratios are common.

Judging from the 2024 financial reports, high debt ratios are a common phenomenon among automakers. From global giants like General Motors, Volkswagen, Mercedes-Benz, and Toyota to domestic leading automakers like BYD, Geely, SAIC, and Changan, most have asset-liability ratios above 60%.

Statistics indicate that 80% of automakers maintain a debt ratio exceeding 60%. "The high debt ratios among automakers are not attributed to a lack of funds, but rather to their large scale, heavy models, and lengthy production cycles." The issue is not the high debt ratio itself, but rather "whether it can be managed effectively."

Currently, the profit margin of the automotive industrial chain has dipped to a perilous 3%, serving as a dire warning. China's auto supply chain is akin to "a taut string on the brink of snapping." When will it break? And where will the final snowflake fall that triggers an avalanche?

While definitive answers elude us, efforts are underway to postpone this inevitable day.

Written at the end:

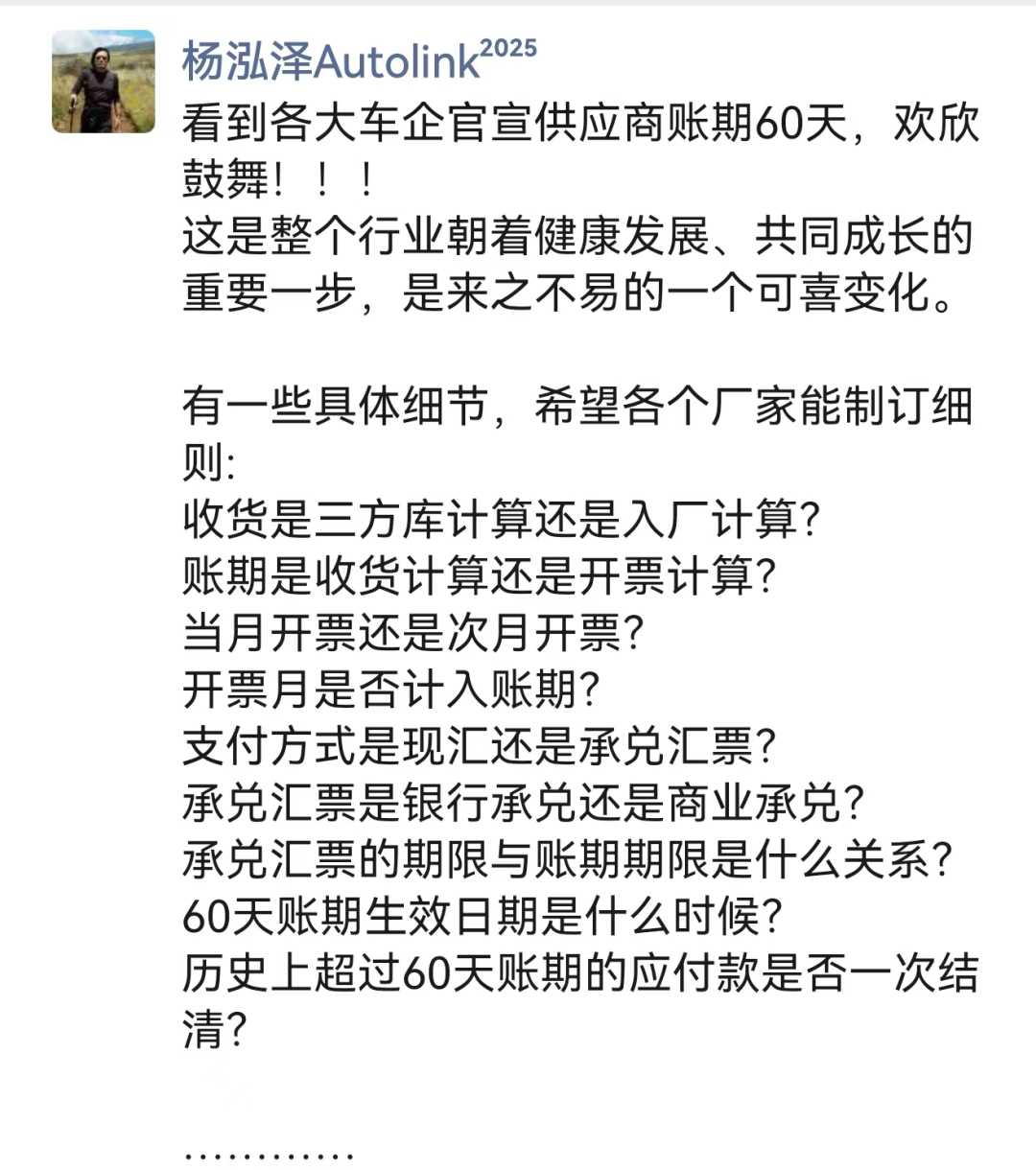

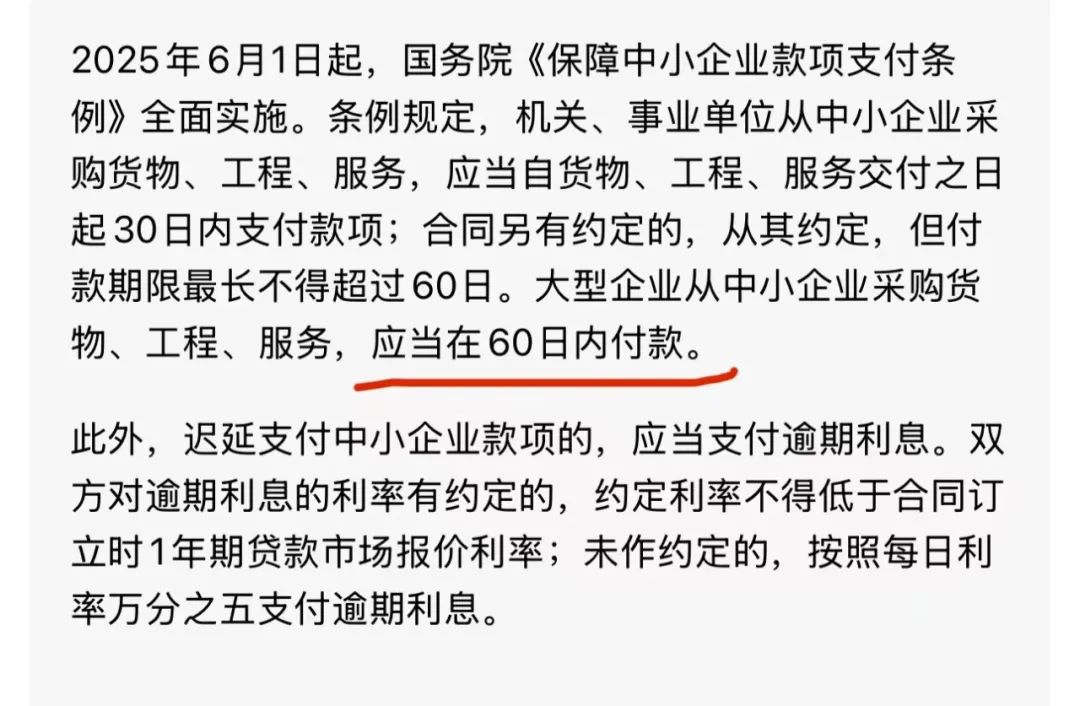

On June 10, several automakers, including Dongfeng Motor Corporation, China FAW Group, Changan Automobile, SAIC Motor, and Thalys, pledged to "maintain payment terms of no more than 60 days" and vowed to prohibit the forced acceptance of non-cash payment methods like commercial bills. Additionally, they committed to continuously refining internal procurement and financial settlement processes.

These automakers stated that this initiative aims to fulfill the deployment requirements set by the state and relevant ministries and commissions, ensuring the stability of the industrial and supply chains, fostering high-quality development in the automotive industry, and supporting the healthy growth of SMEs. However, further implementation details are still forthcoming.

Meanwhile, to reinforce the commitment to the "60-day payment term," Dong Yang, former Executive Vice President and Secretary-General of the China Association of Automobile Manufacturers and Chairman of the China Power Battery Industry Alliance, emphasized, "Countering internal competition cannot solely rely on self-discipline" and hinted that the government might enhance penalties for illegal and non-compliant corporate practices.

In this regard, multinational automakers already possess well-established processes.

According to the financial reports of various international automakers, payment terms are generally within 60 days. Honda boasts the shortest term at 32 days, while Mitsubishi has the longest at 105 days. German automakers like Volkswagen, Mercedes-Benz, and BMW have payment terms of approximately 40 days and are subject to regulatory constraints.

Taking Germany, the birthplace of the automobile, as an example, the country has specific legislation addressing delayed payments in commercial transactions. Once the standard payment period is exceeded, creditors are entitled to default interest at a rate 9 percentage points higher than the base rate.

Currently, car companies and supply chains are undergoing a crucial period of resource reorganization. Transforming the mindset in supply chain management, enhancing the relationship between the whole and its parts, fostering healthy upstream and downstream development, and achieving "profitability across the entire industry" are crucial for the future of China's automotive industry.

"Cost control equals technological innovation plus efficient management minus all unnecessary expenses. Protecting suppliers' interests does not necessitate raising product prices," remarked an insider.

With the intervention of national policies, the rescue plan to avert an avalanche has commenced. Fortunately, it is not too late.

Note: Some images are sourced from the internet. In case of any infringement, please contact us for removal.