"60-Day Payment Terms" Trending on Social Media as Automakers Prepare for the New Year

![]() 06/12 2025

06/12 2025

![]() 667

667

Who hasn't followed suit yet?

Author|Wang Lei

Editor|Qin Zhangyong

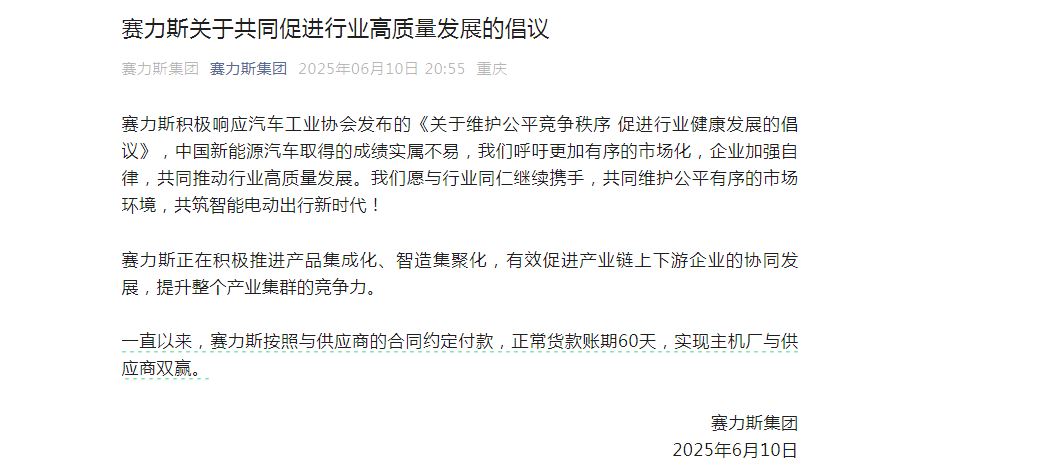

Since last night, the automotive industry has been abuzz with automakers proactively reducing their payment terms to 60 days.

Around 8 PM last night, GAC Group led the way, issuing an announcement that it would adhere to supplier payment terms of no more than 60 days to ensure efficient capital turnover in the supply chain.

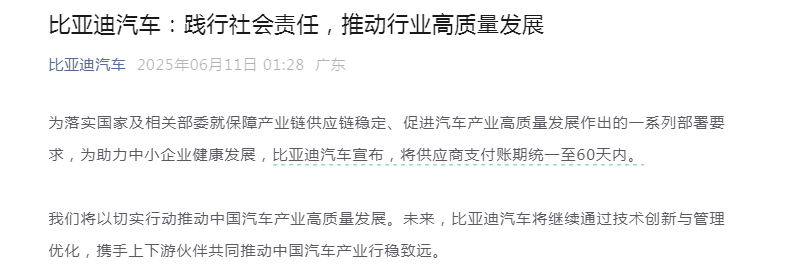

Subsequently, China FAW Group, Dongfeng Motor Corporation, and Thalys Group followed suit, announcing that supplier payment terms would be uniformly shortened to within 60 days. By 1:30 AM, BYD also issued an announcement unifying supplier payment terms to 60 days.

As of press time, as many as 15 automakers, including several new force automakers, have issued successive announcements. Indeed, those who do not follow suit may feel left out under this collective response.

On the surface, it appears that the days of lengthy payment terms for automotive suppliers may be numbered.

However, judging from the attitudes of many netizens, things are not as straightforward...

01

Is spring coming for dealers?

Not long ago, a viral public letter titled "I Have a Dream" by Guo Chuan, chairman of Konghui Technology, a leading enterprise in the automotive air suspension supply chain, highlighted various irregularities in how automakers treat suppliers.

From the perspective of the supply chain, OEMs (Original Equipment Manufacturers) often occupy a strong position, while suppliers, especially small and medium-sized ones, are relatively weak. They typically lack bargaining power and are highly dependent on OEM orders for survival.

Since the price war began, the operational pressure from sales slowdowns and price reductions has been passed on to suppliers. Common demands include price reductions and extended payment terms.

For instance, some automakers adopt an "annual reduction" strategy, with reduction rates reaching 10% or more. Additionally, according to Wind statistics, the average payment term for domestic automakers to suppliers currently exceeds 170 days, with some even exceeding 240 days.

Simply put, work done this year may not see payment until next year.

This is why some suppliers complain, "It's normal for OEMs to delay payments for six months, or even a year. We are their 'interest-free banks.'"

According to Wind data, the accounts receivable balance of auto parts A-share listed companies tracked by CITIC Securities increased from 140.88 billion yuan in 2020 to 244.669 billion yuan in the third quarter of 2024, a four-year increase of 64.57%, undoubtedly indicating that auto parts enterprises have been forced to become the capital pool for automakers.

Some OEMs have even emulated the real estate industry's "commercial bill model" by introducing their own "supply chain financial tools," using "long payment terms + acceptance bills" to transfer their financial pressure.

Not only are payment terms extended, but commercial bills, drafts, or various chains issued independently by enterprises are used for payment, such as a combined payment term design of "90 or 120 days + 180 days bank acceptance." However, these commercial acceptance bills can only circulate within the internal ecosystem.

This means that once the enterprise's capital chain breaks, the bills in the hands of suppliers become worthless pieces of paper with only an amount.

In addition to extending payment terms, the "consignment system" implemented by some OEMs has also exacerbated the financial pressure on suppliers. Simply put, OEMs require suppliers to build warehouses near the factory area, and transactions only occur after goods are brought onto the production line, causing suppliers to advance raw material and production costs by 1-2 months.

Recently, Wei Jianjun of Great Wall Motors also mentioned this phenomenon in an interview. Some enterprises do not abide by business rules, indefinitely force suppliers to reduce prices, and delay payments for nearly a year, making it impossible for suppliers to survive. This practice is akin to killing the goose that lays the golden eggs; it may save money in the short term but will ultimately lead to an unstable supply chain and compromised product quality in the long run.

According to data released by the National Bureau of Statistics, the profit margin of China's automobile manufacturing industry has declined from a relatively healthy 7.8% in 2017 to 4.4% in 2024, and further dropped to 3.9% in the first quarter of 2025, approaching the red line for many enterprises to survive.

By extending payment terms, OEMs can reduce short-term financial pressure and even transfer risks to upstream suppliers, but this kind of "internal competition" will ultimately harm the entire industrial chain.

02

Can dreams come true?

Why have major automakers seemingly agreed to issue announcements one after another?

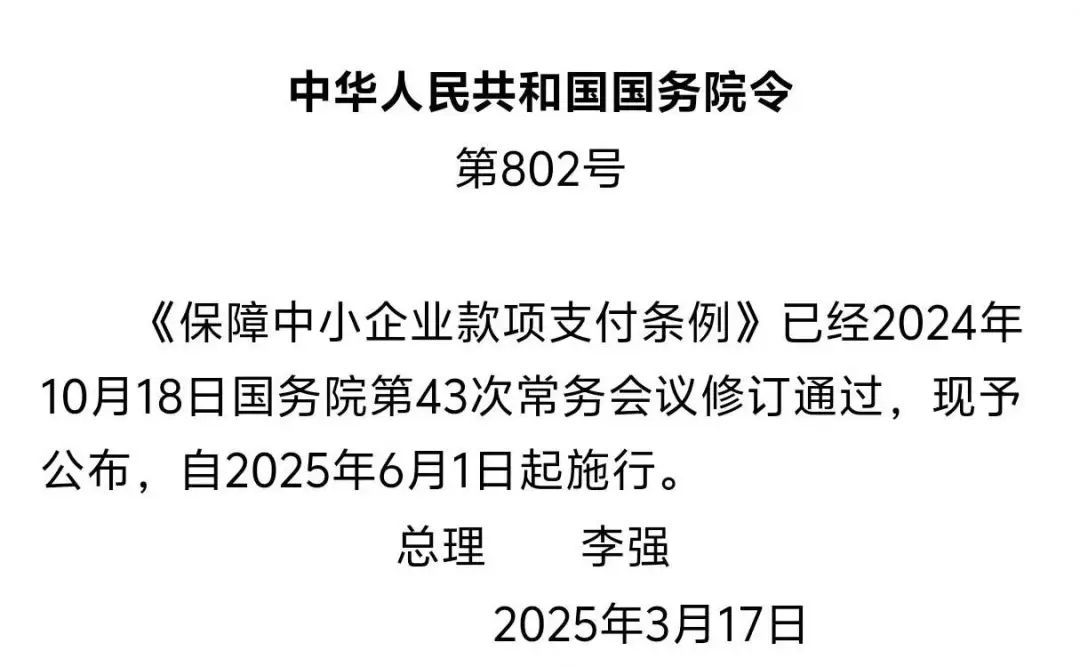

The following image can tell you the answer.

The newly revised "Regulations on Guaranteeing Payment for Small and Medium-sized Enterprises" came into effect on June 1st.

The regulations clearly stipulate that large enterprises procuring goods, engineering, or services from small and medium-sized enterprises shall pay within 60 days from the date of delivery of the goods, engineering, or services.

If otherwise agreed in the contract, the agreed terms shall prevail, but the payment term shall be reasonably agreed upon in accordance with industry norms and transaction habits, and payments shall be made promptly. It is not allowed to stipulate that receipt of payment from a third party is a condition for paying small and medium-sized enterprises or that payment to small and medium-sized enterprises is made based on the progress of third-party payments.

This explains why major OEMs are shortening supplier payment terms to within 60 days, not just out of a "conscience awakening" but also in compliance with the newly revised "Regulations on Guaranteeing Payment for Small and Medium-sized Enterprises" that have officially come into effect.

Additionally, the newly implemented regulations contain statements that are not revealed in most OEM announcements:

It is not allowed to force small and medium-sized enterprises to accept non-cash payment methods such as commercial bills or electronic vouchers for accounts receivable, or to use such non-cash payment methods to indirectly extend payment terms.

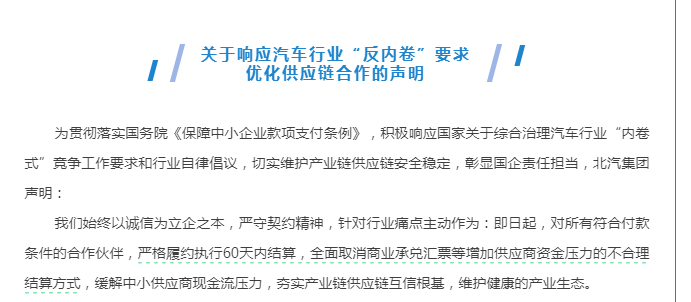

Currently, only a small number of automakers, such as SAIC Motor and BAIC Group, have clarified that they will not use settlement methods such as commercial acceptance bills that increase financial pressure on suppliers while shortening payment terms.

While the implementation of the new regulations is not solely targeted at the automotive industry, it undoubtedly provides a key to solving the persistent problem of payment terms in the automotive supply chain and sends a positive signal for the automotive industry to oppose ineffective internal competition.

For OEMs, short payment terms may place higher demands on the company's cash flow management, but from an overall industry perspective, shortening payment terms can improve the operational efficiency of the entire industry's supply chain and enable a quicker response to changes in market demand.

For parts suppliers, shortened payment terms allow suppliers to receive payments faster. Firstly, the speed of capital return accelerates, allowing more funds to be used for purchasing raw materials, updating equipment, expanding production scale, etc. Additionally, it can enhance production stability and continuity, reducing the risk of production stagnation due to capital shortages.

After major automakers issued successive announcements, the reactions of netizens were not as universally joyful as expected. Instead, many raised points of contention:

"Without inspection and invoicing, changing to 30 days is meaningless."

"It's too general. I hope each manufacturer formulates detailed rules. How is receipt calculated? Is the payment term calculated based on receipt or invoicing? Is invoicing done in the current month or the next month? Is the invoicing month included in the payment term?"

"First, respond to the policy. Can suppliers really afford to take legal action against automakers if they haven't received payment in 60 days?"

"What if the project inspection process is extended by two months? There's always a way around the policy."

It's not hard to see that people's reactions are not as excited as imagined, as the actual implementation effects are difficult to predict. After all, besides the overt rules, there are still many unspoken rules.

Of course, it's good that there is this statement. Can the suppliers' dreams really come true this time?