Battery Swapping: Navigating the High-Stakes Game Between Heavy Assets and Scale

![]() 06/12 2025

06/12 2025

![]() 480

480

【Tide Business Review/Original】

Zora, contemplating the purchase of a new car, has been frantically seeking advice online. "You should just get a charging one. Battery swapping is too expensive and not cost-effective." "Battery swapping is fast, done in minutes. Charging sometimes feels like a waste of time." Her friends are divided, leaving Zora pondering whether to choose battery swapping or charging.

Such discussions are commonplace. Scanning the views of many netizens, whether battery swapping or charging is better has always been a hot topic among car owners. Despite constant doubts, the battery swapping sector remains vibrant.

In March this year, news of NIO and CATL reaching a strategic cooperation agreement on the "Battery Swapping Plan" exploded on social media. Under the plan, CATL will invest up to 2.5 billion yuan in NIO, and the two parties also plan to build the world's largest and most technologically advanced battery swapping service network for passenger vehicles.

This cooperation, like a hammer, once again brought the controversy over the development route of new energy vehicles back into the public eye. Additionally, after the release of the first-quarter financial report, Li Bin even revealed plans to replace stores with battery swapping stations in some third- and fourth-tier cities. These actions have led people to ponder: Does battery swapping have a future?

This question is not only a concern for car owners but also relates to the direction of the entire new energy vehicle industry.

01 Is Battery Swapping a Viable Path?

In the realm of new energy vehicles, battery swapping refers to energy replenishment through direct battery replacement. As early as 2000, Shanghai Dianba began experimenting with bus battery swapping. In 2011, the State Grid's work conference established the basic operating model for new energy vehicles as "battery swapping as the primary method, plug-in charging as the auxiliary method, centralized charging, and unified distribution," and established China's first battery swapping station in 2015.

However, it was NIO, founded in 2014, that truly introduced the battery swapping model into the consumer sector for private car owners in China.

In 2018, Li Bin, who entered the new energy vehicle sector, officially determined this model as the company's commercialization strategy and declared that NIO would become the world's only passenger vehicle company with a large-scale layout for battery swapping.

Li Bin's early considerations were straightforward. Car owners would drive to a designated area and, when the battery was depleted, replace it with a new one in just a few minutes, achieving a separation of the car and battery for energy replenishment and regaining hundreds of kilometers of range.

At that time, the energy replenishment model for the new energy vehicle industry was still in the exploratory stage. Tesla and BYD's technology of adding 200 kilometers of range in 5 minutes had not yet been released, and the range-extender and chaotic 4C technology (referring to charging efficiency technology) had not yet been popularized.

Driven by new forces in the automotive industry, the battery swapping path gradually became a mainstream energy replenishment method that coexisted with the charging model in the development of new energy vehicles.

During this process, battery swapping was gradually incorporated into subsidy considerations. In January 2022, ten ministries and commissions issued the "Implementation Opinions on Further Enhancing the Service Guarantee Capabilities of Electric Vehicle Charging Infrastructure," which objectively promoted the development of this model.

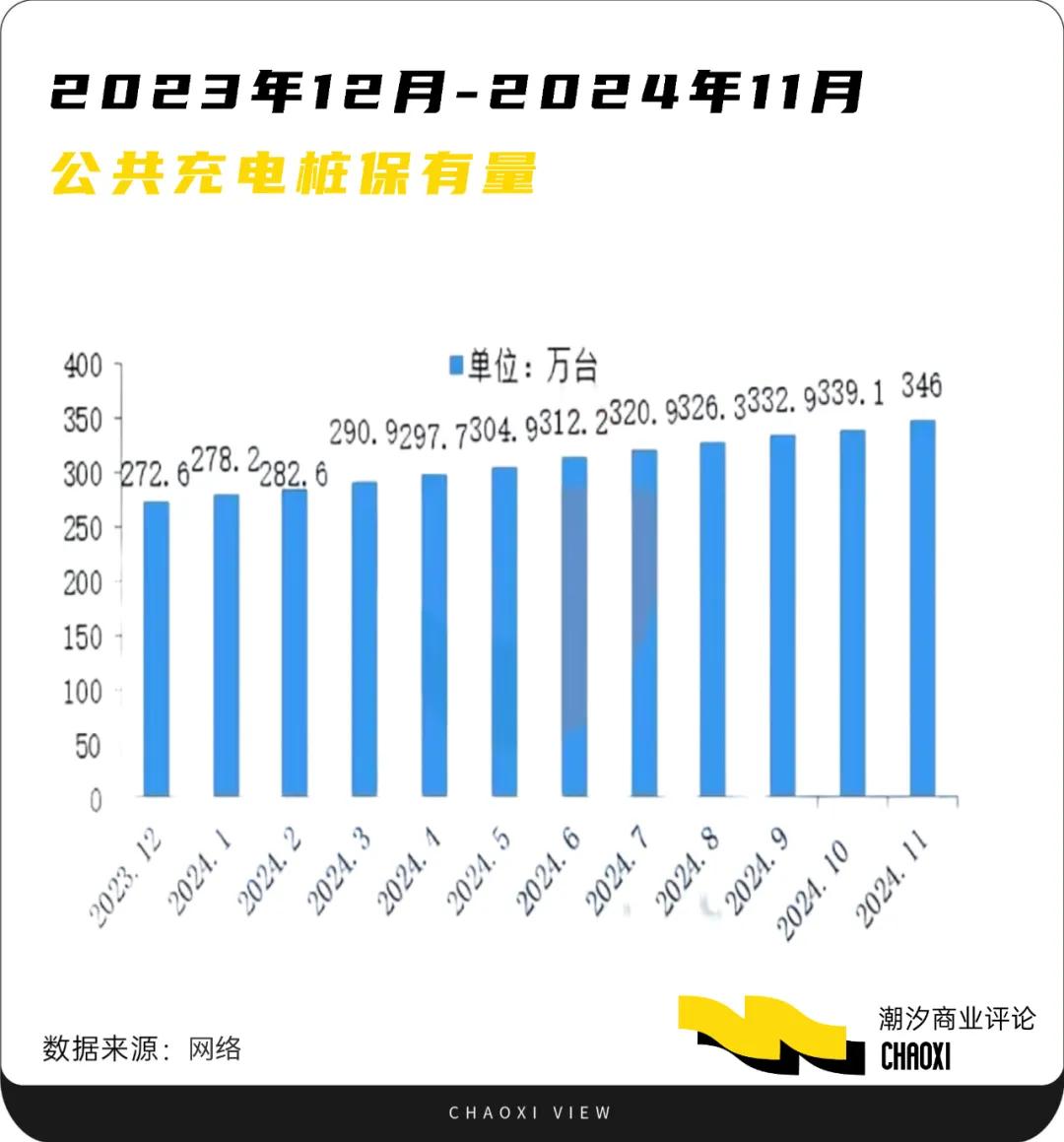

According to the Ministry of Industry and Information Technology, by the end of 2024, 4,443 battery swapping stations had been built nationwide, forming the world's largest battery swapping network. As of November 2024, member units within China's Charging Alliance had reported a total of 3.46 million public charging piles and 8.892 million private charging piles. By February 2025, the number of public charging piles reached 3.83 million.

As of May 31, NIO had cumulatively deployed 3,343 battery swapping stations nationwide, forming a high-speed battery swapping network spanning 9 vertical and 9 horizontal routes and 14 major city clusters, with nearly 1,000 highway battery swapping stations connecting over 700 cities, realizing the construction of a high-speed battery swapping network among major cities nationwide. Additionally, by April this year, NIO's battery swapping count surpassed 70 million times. Since March, an average of approximately 88,000 battery swaps have been conducted daily, with a car "departing fully charged" from a battery swapping station every second on average.

In terms of quantity and scale, the achievements are undeniably outstanding. But what about when we turn our gaze to the financial data?

In February this year, Li Bin posted on social media that NIO's Shanghai battery swapping stations served about 9,000 orders per day. If this figure was maintained daily, it would be close to the breakeven point, and that was just in Shanghai. Elsewhere in the country or on highways, maintaining 10,000 orders per day would be a significant challenge.

Consumers have the final say in whether battery swapping is viable. The latest data from the China Association of Automobile Manufacturers shows that in the first two months of 2025, the production and sales of new energy vehicles increased by more than 50% year-on-year. This means that consumers who are quickly replacing fuel vehicles have more insights into this matter.

"Generally, the battery swapping time is about 2.5 minutes, including parking and self-inspection, and the entire process takes less than 5 minutes to depart fully charged, which is much faster than charging, and that's a benefit," said one driver.

"But I always feel that battery standards have not yet been unified. Automakers and battery manufacturers have different standards for the overall design of battery swapping models, the form, size, and interface of battery replacements," said a Didi driver.

There is no authoritative data to support the exact number of existing battery swapping users. Considering that NIO is a major player in this sector, based on NIO's current cumulative vehicle deliveries of around 700,000, and the annual sales scale of new energy vehicles in China being tens of millions, the proportion of NIO's battery swapping model users can be imagined.

Coincidentally, in a survey conducted in 2023, over 80% of Chinese new energy vehicle owners indicated that charging was their preferred option. Unless purchasing a specific type of model, most were still accustomed to refueling and charging.

A new NIO user said, "Battery swapping is not unacceptable, but my wife worries that the replaced battery will have some loss, which will affect the vehicle's range and safety performance. It's not as good as a new car's battery, so we have been charging ourselves." Compared to battery swapping, charging technology gives car owners more flexibility and autonomy.

This consumer habit makes it more difficult to promote the battery swapping model in the Chinese market. Moreover, it is challenging for vehicles of different brands to swap batteries at the same station, limiting the promotion of the battery swapping model. Of course, as a new exploratory model, battery swapping has also become a typical niche business route and model for the development of China's new energy vehicle industry.

02 Can the Heavy Asset Game Continue?

The essence of the battery swapping model is a commercial game of heavy assets, where players must fully navigate through the challenges to see the end.

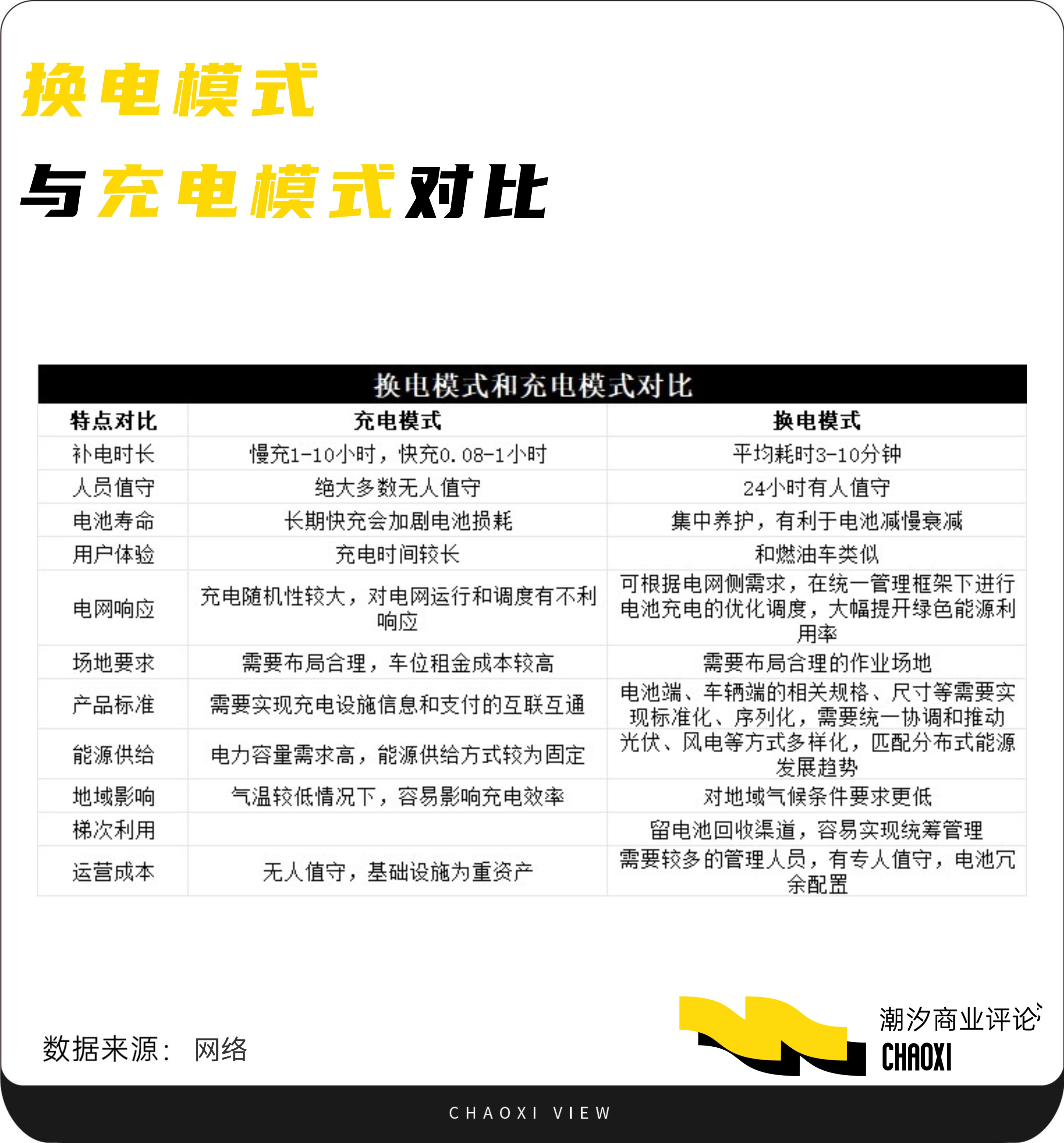

Due to many differences in the industrial chain, technical direction, range extension methods, and service scenarios, it can also be briefly compared with the charging model. The differences between the two are obvious:

It is not difficult to find that charging and battery swapping each have their unique characteristics. For drivers, two keywords are the primary preconditions: efficiency and cost.

Efficiency mainly considers the scenarios faced by car owners. Currently, battery swapping is not without advantages. Battery swapping generally takes a minimum of 3 minutes (some fourth-generation battery swapping models can be reduced to 2 minutes and 24 seconds), while charging takes about 5 minutes (even if it claims to add over 200 kilometers of range).

Trading efficiency for cost and gradually obtaining profits through scale from cost is the main business model for players in the battery swapping sector.

In layman's terms, battery swapping stations replace the function of charging for range extension with a time efficiency of 3 to 10 minutes. By acquiring users for product sales, when the sales scale reaches a certain level and obtains a stable order scale, enterprises entering this field can achieve a break-even point.

Achieving such a goal is not easy. Since cost issues are considered, another characteristic of the business model of battery swapping stations becomes prominent – heavy asset investment.

For example, to build a good battery swapping station, enterprises need to invest a large amount of funds in constructing the station, purchasing batteries, and also need to bear operating costs, including personnel salaries, equipment maintenance, battery charging, and other expenses. From a cost perspective, the construction costs of battery swapping stations mainly include land leasing, equipment purchase, battery procurement, and other aspects.

For example, in terms of land leasing, land resources are scarce and rents are high in urban central areas and on highways, which undoubtedly increases the construction cost of battery swapping stations. In terms of equipment purchase, advanced battery swapping equipment is not cheap, and with the development of technology, equipment needs to be continuously updated and replaced to improve battery swapping efficiency and service quality. Battery procurement is also a huge expense. Batteries are the core component of new energy vehicles and are expensive, with some even accounting for one-third of the total vehicle cost. However, even so, enterprises still need to stockpile a large number of batteries to meet users' battery swapping needs.

Without going into the cost details of each of the above links, we can still draw an economic account from the sales end. According to previous research by Zhongyou Securities, a battery swapping station needs to conduct an average of 60 battery swaps per day to achieve a break-even point for a single station, and only 20% of the industry can meet this standard. In layman's terms, 80% of battery swapping stations are operating at a "loss." So, how much are they losing?

Based on NIO's data of losing more than 6 billion yuan in the first quarter of this year and around 100 billion yuan over the past decade, the company's overall operations continue to be under pressure. However, the battery swapping model is also an extremely costly commercialization method. Li Bin mentioned in an interview last August that only 20% of NIO's battery swapping stations met the profitability standard, meaning that the inflection point for profitability in the battery swapping business has not yet fully arrived.

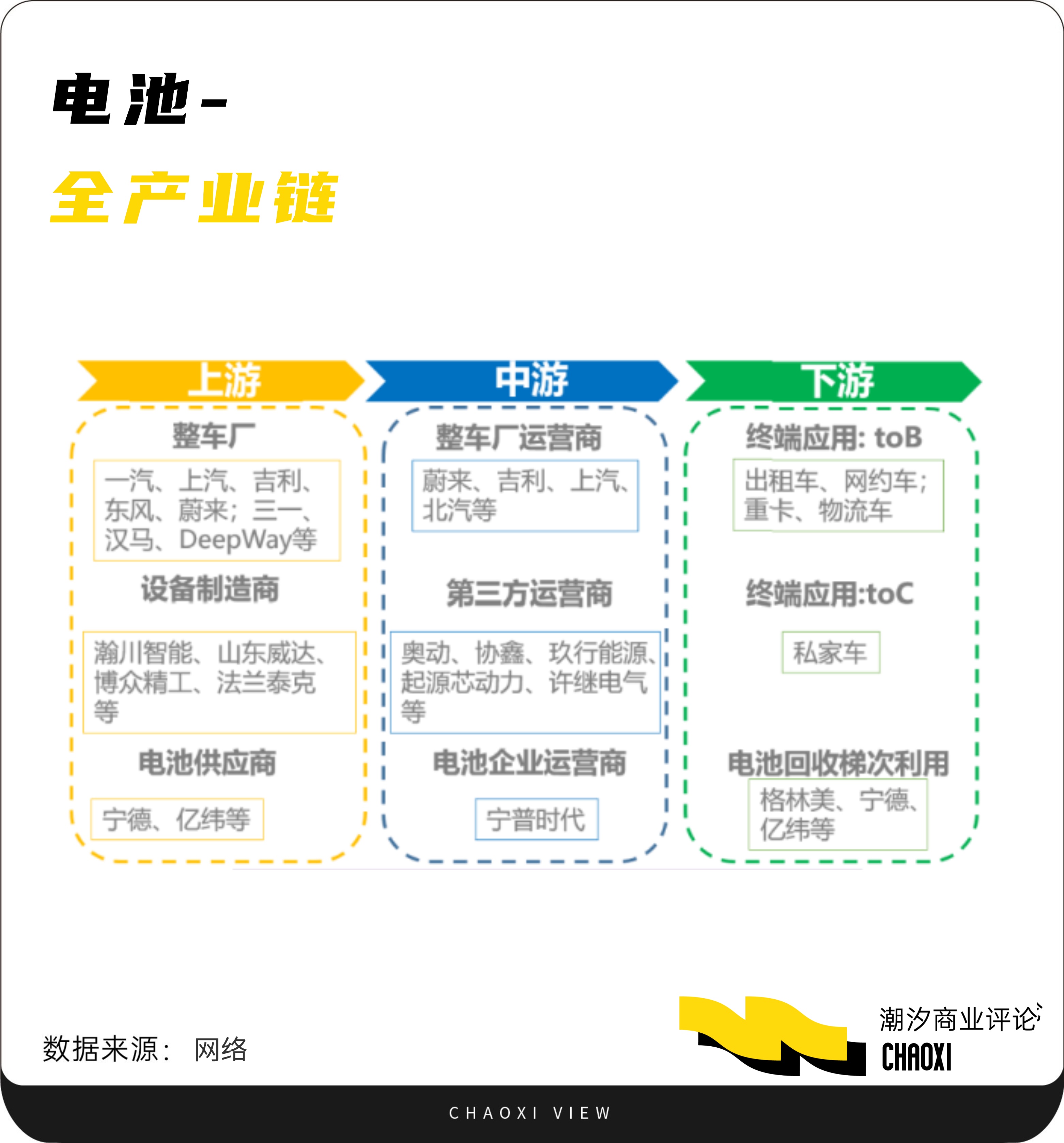

On the industrial side, this model needs to connect the upstream (vehicle manufacturing, etc.), midstream (operators), and downstream (basic equipment, etc.) to achieve a complete business closed loop. This explains why CATL chose to cooperate with NIO. Looking at the industry, there are almost only these two companies with late-mover advantages in technology and early-stage experience in application.

Considering the commercial capital nature of this industry, CATL is committed to connecting the entire industrial chain to build a higher-quality and lower-cost link. Specifically, as early as December 2024, CATL released the third-generation chocolate battery swapping station and announced plans to build 1,000 battery swapping stations in 2025, with a long-term plan for 30,000 battery swapping stations.

Thirty thousand battery swapping stations are not a small number.

Currently, there are two charging models for battery swapping stations. Most battery swapping stations for C-end car owners adopt a monthly package model, which includes battery leasing fees and a limited number of battery swapping fees in the package price. Since the battery swapping package is generally signed at the vehicle purchase stage, the profitability of battery swapping stations is mainly affected by the sales volume of battery swapping models; B-end battery swapping stations are based on different agreements signed with city-based operating vehicle companies.

CATL is not blind to NIO's "fatigue" in betting on this path. Therefore, under the background of the heavy asset business model, CATL wants to obtain NIO's years of operational experience and scenario-based technology, and also intends to use more than 2 billion yuan for deep interest binding to form a full-cycle closed loop and promote cross-brand and cross-model battery compatibility. In this way, both parties can only move towards profitability.

03 Where Lies the Future of Battery Swapping?

Based on the above business logic, scale can weaken the burden of heavy assets, and car owners decide whether this path can make money.

Industry players are not unaware of this principle. When the number of battery swapping stations reaches a certain scale and the number of users continues to increase, the unit cost will decrease, thereby achieving profitability.

Such stories have been told all along.

For instance, in November 2023, NIO officially unveiled its battery swapping service and inked cooperation agreements with seven automakers, encompassing Changan Automobile, Geely Holding Group, JAC Group, Chery Automobile, Lotus Cars, GAC Group, and FAW Group, thereby establishing the "Battery Swapping Alliance." By partnering with these automakers, NIO aims to jointly shoulder the construction and operational costs of battery swapping stations, enhance their utilization rates, and further propel the advancement of the battery swapping model.

Even if other automakers prioritize charging as their primary method, they haven't overlooked the potential of alternative business models and their ecological implications. Consequently, NIO embarked on forming alliances with these automakers, ultimately leading to its current collaboration with CATL.

However, the bottlenecks hindering its subsequent growth revolve around three pivotal points: the genuine need for such services among car owners, the internal competition spurred by technological advancements, and the sufficient financial resources available to players in the industry.

According to a report published by the China Electric Vehicle Hundred People Forum, the average driving range of new energy vehicles has surpassed 400 kilometers, adequately catering to the daily commuting needs of most individuals.

Furthermore, the opinions and sentiments of car owners hold significant weight in the development of the battery swapping model. Approximately 60% of the energy replenishment for NIO users stems from battery swapping services.

Some car owners have expressed, "Battery swapping is incredibly convenient. When I used to drive a fuel vehicle, I had to queue up every time I refueled. Now, battery swapping rarely requires waiting and can be completed in a matter of minutes. Moreover, it allows me to inspect the vehicle's chassis and battery, providing me with peace of mind."

Nevertheless, the undeniable fact is that the advantages of batteries are diminishing rapidly, primarily due to breakthroughs in battery technology achieved by some leading new energy giants. For instance, 4C fast charging takes just over 11 minutes to charge from 10% to 80%, while 6C fast charging accomplishes this in just 7 minutes.

Currently, BYD has introduced megawatt flash charging piles that can add 400 kilometers of range in just 5 minutes. With a maximum voltage of 1000V and a maximum power of 1000kW, this flash charging technology is undeniably appealing to users.

As technological advancements enhance car owners' experiences, the operational pressure faced by the battery swapping model may intensify.

XPeng and Li Auto primarily adopt the charging model. Although their charging speeds are relatively slower, in terms of cost, they avoid the need to invest heavily in constructing battery swapping stations and stockpiling batteries, as is the case with NIO. XPeng collaborates with third-party charging operators to leverage existing charging pile resources and provide charging services to users, thereby reducing its own cost pressure. Li Auto, on the other hand, focuses on extended-range electric vehicles, utilizing an engine to generate electricity to charge the battery, further alleviating users' range anxiety. In terms of energy replenishment, this approach is relatively flexible and doesn't rely solely on external charging facilities.

Recently, Li Auto's financial report revealed a net profit of RMB 8 billion and a cash flow of RMB 112.8 billion for the full year of 2024 (as of the end of 2024). XPeng's gross profit margin also turned positive, rising from -1.6% to 8.3%. While its net loss still stood at RMB 5.79 billion, it narrowed by 44% year-on-year, with accumulated assets reaching RMB 41.96 billion (as of the end of 2024).

In contrast, NIO's situation isn't as favorable. If it continues to heavily invest in the battery swapping sector, its demand for funds will remain high. However, as of the first quarter, the company's cash and equivalents reserves stood at RMB 26 billion, suggesting that it may continue to face financial pressures in the future.

Additionally, sales volume poses another challenge. Currently, brands such as Leapmotor, XPeng, Li Auto, Xiaomi, and AITO have consistently exceeded an average of 20,000 vehicles per month in the first five months of this year. In comparison, NIO has yet to reach this milestone. Objectively speaking, scaling up sales volume is NIO's top priority.

The collaboration between CATL and NIO may have infused new vitality into the development of the battery swapping model, offering car owners enhanced travel service experiences. However, in such a fiercely competitive new energy vehicle market, time is of the essence, and so is capital. Car owners, confronted with increasingly innovative charging technologies, are also in a race against time.

This is the unforgiving nature of business.