African Auto Market | South Africa May 2025: Robust Recovery and Chinese Brands Shine

![]() 06/12 2025

06/12 2025

![]() 633

633

In May 2025, the South African automotive market experienced a remarkable resurgence, with total sales soaring 22% year-on-year to 45,308 units, and cumulative sales growth for the year reaching 12.6%.

Chinese automotive brands emerged as standout performers, particularly newcomers like Great Wall Motors, Chery, and the combined force of Omoda and Jetour, who have firmly established their presence in the African market. We delve into the overall market performance in South Africa and the burgeoning development of Chinese brands locally.

01

Comprehensive Recovery of the South African Automotive Market

Subtle Shifts in Market Structure

In May 2025, new car sales in South Africa hit 45,308 units, marking a substantial 22% increase compared to the same period last year. Cumulative sales for the year stood at 231,719 units, up 12.6%. Following a prolonged downturn in 2024, this recovery signifies the South African market's emergence from stagnation and return to growth.

However, unlike the domestic market, auto exports fared relatively poorly, with a 14.6% year-on-year decline in May and a modest 1.4% increase year-to-date, reflecting uncertainties in overseas demand.

Brand Landscape

◎ Toyota, the traditional market leader, maintained its top spot with sales exceeding 10,000 units in May and a market share of 22.8%. However, its growth rate lagged slightly behind the overall market, indicating a defensive posture.

◎ In contrast, Suzuki registered robust growth, with a 35% year-on-year increase and a market share of 12.2%, solidifying its second position and further widening the gap with the Volkswagen Group.

◎ Volkswagen, despite retaining third place, experienced a 7.2% year-on-year decline, with its market share dipping to 10.1%, hinting at a gradual erosion of competitiveness in the South African market.

◎ Hyundai and Ford ranked fourth and fifth, respectively. Hyundai impressed with a 48.8% year-on-year surge and a market share of 7.2%. Ford, on the other hand, showed mediocre performance with a marginal 2.5% increase.

◎ Great Wall Motors (inclusive of Haval), the sixth-ranked Chinese brand, delivered exceptional performance, recording a 71.7% year-on-year increase, monthly sales exceeding 2,000 units, and a market share rise to 4.6%, notably higher than the year's initial average of 4.1%.

◎ Other notable mentions include the Indian brand Mahindra, with a 62% year-on-year increase and a market share climbing to 3.4%; Kia, growing by 40.2% and firmly holding the tenth position; and the combined force of Omoda and Jetour, ranking thirteenth with sales surpassing 900 units for the first time, further underscoring the swift rise of emerging Chinese brands.

Specific Models

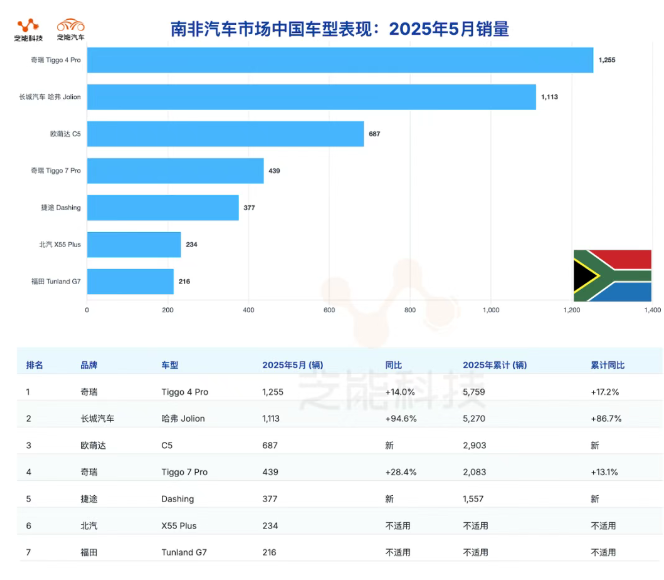

◎ Toyota Hilux remained the top-selling model in South Africa, with sales of 2,548 units in May, a 7.6% year-on-year increase, and a market share of 5.6%.

◎ Closely trailing were Ford Ranger and Suzuki Swift, with the latter experiencing a nearly 49% year-on-year surge and ranking second in cumulative annual sales.

◎ Other notable performers included Toyota Corolla Cross, Volkswagen Polo Vivo, Suzuki Fronx (+157.2%), Haval First Love (+94.6%), and Hyundai Grand i10, all ranking among the top ten in monthly sales.

From a powertrain perspective, the South African market remains dominated by fuel vehicles, with low penetration of new energy models, and no significant trends have yet to emerge.

Overall, the South African market is evolving into a diversified competitive landscape, with Japanese and Korean brands forming the foundation, while Indian and Chinese brands accelerate their breakthroughs. European brands, excluding BMW, generally perform weakly, with the market share of German and French models continuing to shrink.

02

Rapid Ascent of Chinese Brands

South Africa Emerges as a Strategic Battleground

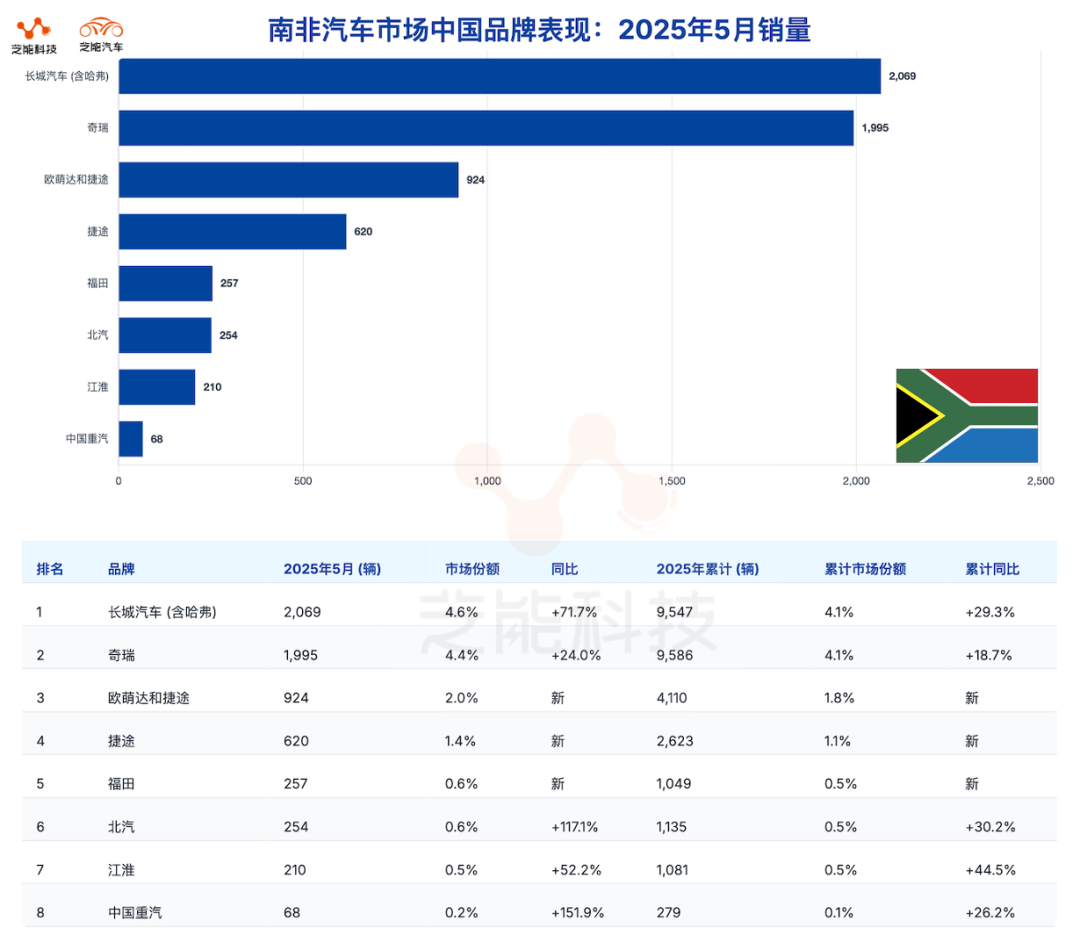

Among the top 20 auto brands in sales this month, six hailed from China, with most showcasing rapid growth.

This not only underscores the intensified investment by Chinese brands in the African market but also validates the initial success of their globalization strategies.

◎ Great Wall Motors (inclusive of Haval) currently stands as the most representative Chinese brand in South Africa. Its sales in May reached 2,069 units, a remarkable 71.7% year-on-year increase, and its market share climbed to 4.6%. Haval First Love's performance was particularly noteworthy, with monthly sales surging nearly 95%, consistently ranking among the mainstream compact SUVs in the South African market.

This achievement is attributed to its cost-effective product strategy and Haval's relentless efforts in channel expansion in Africa in recent years.

◎ Chery Automobile maintained its steady growth trajectory, with sales of 1,995 units in May, a 24% year-on-year increase, forming a duopoly with Great Wall Motors.

Chery's localized assembly operations in South Africa have progressively advanced, offering flexibility in pricing and supply. Additionally, Chery's significant investments in design and intelligence over the past few years have significantly bolstered its brand image, further enhancing its appeal to middle-class consumers.

◎ The combined entity of Omoda and Jetour, as emerging players, entered the top 15 for the first time with sales of 924 units and a market share of 2%, doubling from the beginning of the year.

This growth stems from breakthroughs in exterior design, rich configurations, and independent brand operation strategies, precisely catering to young South African consumers' demands for "high aesthetics, high configuration, and reasonable price".

◎ Jetour sold 620 units in May, delivering impressive performance, further confirming the adaptability of "New Chinese-style SUVs" in overseas markets. This model type, characterized by a leisure travel style and advanced technological configurations, holds strong appeal in South Africa's urban-rural fringe areas and among young car buyers.

◎ JAC Motors and BAIC are also steadily advancing their local market expansion. JAC recorded a 52.2% year-on-year increase with sales of 210 units in May, while BAIC grew by 117.1% with sales of 254 units. Despite their relatively small market shares, their steep growth curves pave the way for subsequent scaling up.

◎ Commercial vehicle brands such as FAW Jiefang, Foton, and Dongfeng are also gaining increased prominence in South Africa. Amidst Africa's economic recovery and accelerated infrastructure development, Chinese commercial vehicles have garnered high recognition for their durability and cost-effectiveness, becoming the preferred choice for small and medium-sized enterprises and individual operators.

Some Chinese brands are also advancing their after-sales systems and local assembly plans to enhance consumer trust and secure policy support. For instance, Chery and Great Wall Motors have established regional warehousing centers in South Africa and introduced rapid parts supply systems. The implementation of these supporting measures is crucial for sustaining sales growth.

Summary

The rebound of the South African automotive market in May 2025 mirrors the global automotive market's recovery, and the phased triumph of Chinese brands signifies that their globalization strategy has entered a "deep cultivation phase".

In the South African market, where traditional powerhouses from Japan, Korea, and India still reign supreme, Chinese brands have swiftly broken through with differentiated products and localized operational strategies, poised to further gain market share in the future.