Rare Earths Turn "Scarce," Mirroring the Chip Shortage's Grip on the Global Auto Industry

![]() 06/12 2025

06/12 2025

![]() 473

473

Introduction | Lead

Reuters reports that China has issued temporary export licenses to rare earth suppliers for the three leading North American automakers—General Motors, Ford, and Stellantis—with some licenses valid for six months. This move is expected to temporarily ease the "rare earth shortage" that has beleaguered global automakers. This supply chain crisis, fueled by rare earth constraints, echoes the previous chip shortage and may catalyze fresh transformations in the global automotive landscape.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Total Words: 2193

Reading Time: 4 minutes

From the "chip shortage" of recent years to the current "rare earth shortage," these events underscore the interdependence and interconnectedness of countries under the trend of global automotive industry integration.

Since April 2025, when China officially implemented the "export licensing system" for seven key rare earth materials, establishing a tracking mechanism and approval process to regulate rare earth flows and mitigate technology leakage risks, the global rare earth supply has been on high alert. The alleviation of this rare earth crisis is merely temporary, prompting automakers and component suppliers to consider the long-term layout of their manufacturing bases to avert future production halts.

On June 7, the Ministry of Commerce spokesperson stated that implementing export controls on rare earths aligns with international practices, and China has approved a certain number of compliant applications in accordance with the law. China is committed to enhancing communication and dialogue on export controls with relevant countries to foster facilitated and compliant trade.

△China's tightened control over rare earth exports profoundly impacts the global automotive industry

Global Auto Manufacturing Sounds Alarm

According to the European Automobile Manufacturers' Association, since China began implementing rare earth export controls in April, only 25% of the hundreds of rare earth export license applications submitted by major European component manufacturers have been approved. Lengthy approval delays have left many component suppliers grappling with uncontrollable product deliveries, forcing related enterprises to cut production or even face short-term shutdowns. The cessation of some component companies will directly lead to the shutdown of some European automakers, thereby affecting the European economy's pillar industry—the automotive sector.

△Suzuki was forced to suspend production of its flagship model, the "Swift," from May 26 to June 6

The Nikkei reported on June 5 that due to the shortage of key components caused by rare earth export controls, Suzuki was compelled to halt production of its main model, the "Swift," from May 26 to June 6. Similarly, the Society of Indian Automobile Manufacturers issued an emergency notice stating that the rare earth magnet inventories of India's three major automakers—Tata, Maruti Suzuki, and Mahindra—could sustain normal production for only three days. Without timely replenishment, a comprehensive shutdown of the Indian automotive industry would be inevitable. Across the ocean, Ford was also forced to suspend production of its primary SUV model, the Explorer, at the end of May for the same reason.

△Ford was forced to suspend production of its main SUV model, the Explorer, at the end of May due to the rare earth shortage

Rare Earths: Indispensable in the Automotive Industry

Rare earths have always played a pivotal role in automotive manufacturing.

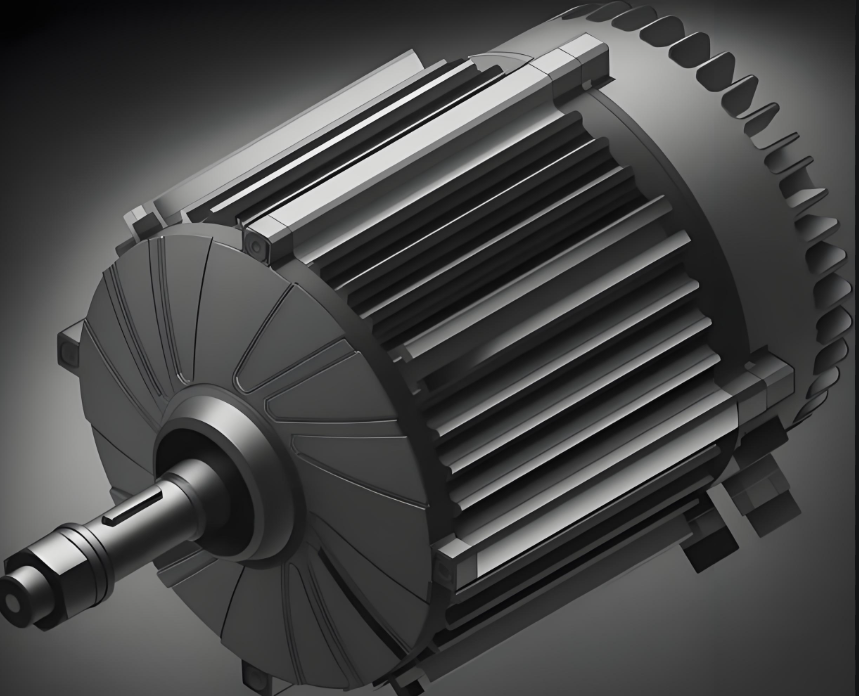

In the era of new energy vehicles, the significance of rare earths has grown even more pronounced. Rare earth permanent magnet materials and neodymium-iron-boron, for instance, enhance motor power density, significantly impacting electric vehicle performance indicators such as 0-100 km/h acceleration and range. Rare earth elements like lanthanum and cerium are crucial components of lithium-ion battery electrode materials, playing a vital role in improving battery capacity, stability, and lifespan. Furthermore, rare earth elements are found in key automotive components such as sensors, seat belts, and headlights. For a vehicle comprising as many as 20,000 to 30,000 components, the absence of any single component can halt production. China's stringent control over rare earth exports in response to Trump's global trade war underscores the critical role of China's rare earth raw materials in the global automotive industry.

△Rare earth materials play a crucial role in enhancing motor performance

After experiencing this rare earth supply chain crisis, multinational automakers must reconsider their rare earth-related component strategies. China's current measures primarily control the direct export of rare earths but not products made from them, such as magnets. In this context, major automakers and Tier 1 component suppliers need to consider establishing more factories in China to ensure uninterrupted production lines despite future controls.

Trump's implementation of so-called reciprocal tariffs essentially leveraged the US's position as the world's largest consumer market to coerce global enterprises to invest and establish factories in the US. However, amidst years of trade integration, Trump's counter-trend of erecting high trade barriers adversely affects the US and even the global automotive supply chain, disrupting global free trade.

In recent years, Chinese electric vehicles, known for their high product strength and cost-effectiveness, have repeatedly encountered tariff barriers in the US, Canada, and the European Union. This time, China's use of rare earth countermeasures is sufficient to prompt countries like the US, which have repeatedly wielded trade sticks, to reassess their foreign trade relations with China and pursue mutual benefit and reciprocity rather than going it alone in sectors like the automotive industry.

△Chinese automobiles have faced unfair treatment in multiple global markets in recent years

China's Dominance in Rare Earths

China has long been a significant player in the global rare earth industry, and its position in this field is difficult to shake in the short term.

Data shows that China maintained a 60% share of rare earth mining and 92% of refining capacity in 2023. This is underpinned by China's robust systemic capabilities in the rare earth field. In terms of talent reserves, many Chinese universities have established rare earth majors, cultivating tens of thousands of rare earth professionals annually. Such a vast rare earth talent pool enables China to continuously innovate in the rare earth industry and drive the development of the entire sector. In the past five years, 62% of global patent applications related to rare earths have originated from China.

△China cultivates numerous rare earth professionals each year

Neither the US nor other countries can currently unseat China's advantage in the rare earth field, as it requires not only the discovery of rare earth mineral resources but also the nurturing of a team capable of overcoming challenges and mastering refining technologies. Developing an industrial chain is not an overnight endeavor. For other countries to develop rare earths, they need to achieve technological breakthroughs and be competitive in terms of cost. Globally, only a handful of countries and industries can compete with China in terms of cost after China has made technological advancements. Many global automakers are temporarily unable to break free from their dependence on Chinese automakers. If the US were to experience a disruption in rare earth supply, not only would its aircraft struggle to take off, but its automobiles would also fail to roll off the production line, ultimately harming itself with the trade stick it first wielded. Therefore, dialogue and cooperation are the only viable options for China and the US.

△China's rare earth refining technology leads globally

Commentary

For global automakers that have endured the chip shortage crisis, this rare earth crisis presents another significant challenge to their supply chains. It is worth contemplating how countries can collaborate in the automotive supply chain to manufacture better cars for global consumers, rather than resorting to trade sticks like the US, which can trigger massive disruptions in the global automotive supply chain. China's automotive industry has continued to make new breakthroughs in both raw materials and technology, with its global position on the rise, making it far from being a "soft target" that the US can easily manipulate.

(This article is originally created by Heyan Yueche and may not be reproduced without authorization)