Collective Commitment to 60 Days: Has the Automotive Market Fired the First Shot Against Involution?

![]() 06/12 2025

06/12 2025

![]() 671

671

Guo Chuan, retaining an endearing innocence, is gradually turning his Children's Day wish into a tangible reality.

On June 1 this year, Guo Chuan, Chairman of Konghui Technology, an automotive parts company, penned "I Have a Dream." He aspires for harmonious coexistence among stakeholders in China's automotive industry, fostering true high-quality development.

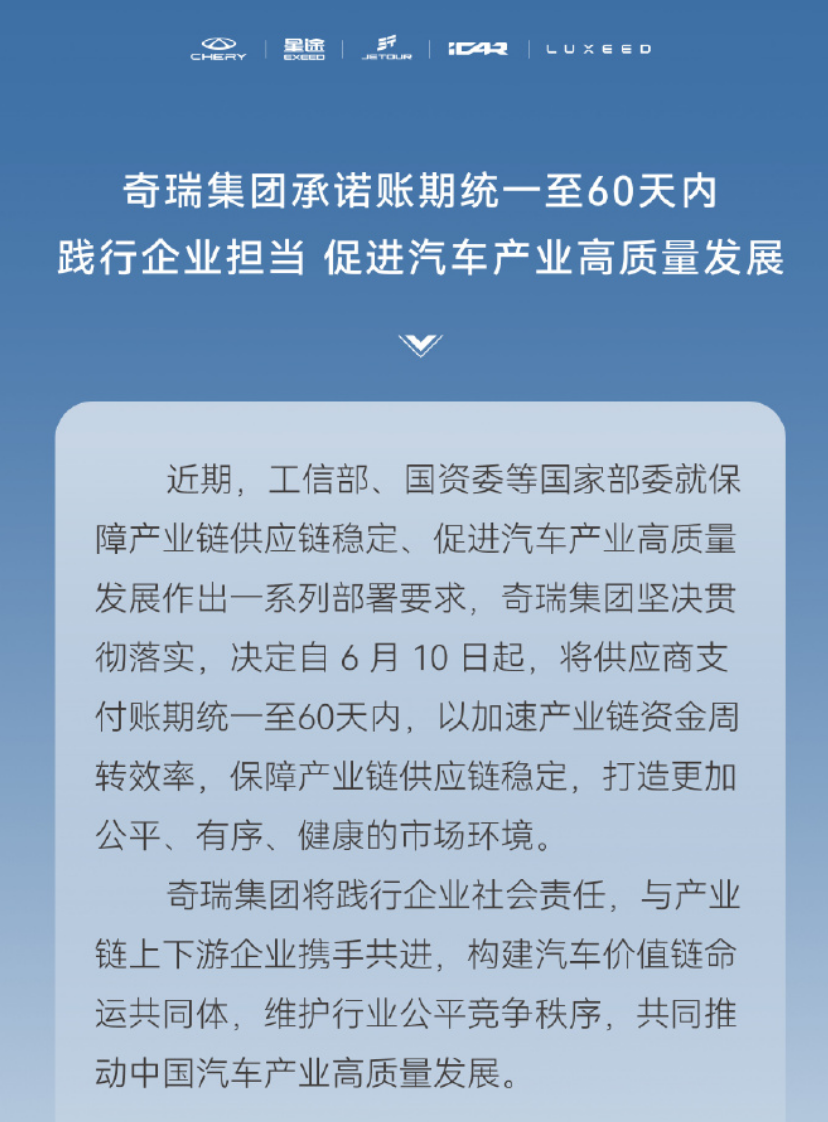

From the evening of June 10 to June 11, China's leading vehicle manufacturers have successively pledged to shorten their payment cycles to suppliers to within 60 days, ensuring the stability of the industrial supply chain.

The long-anticipated "anti-involution" movement in China's automotive industry has finally taken a significant and meaningful step forward.

Collective Commitment to 60 Days

From the evening of June 10 to June 11, domestic mainstream vehicle manufacturers have successively committed to reducing their payment cycles to suppliers to within 60 days. This initiative aims to enhance supply chain capital efficiency, safeguard supply chain stability, and propel the automotive industry towards high-quality development.

The backdrop of this unified commitment by vehicle manufacturers is the widespread abhorrence towards the price wars emblematic of industry involution.

At the recently concluded China Automotive Chongqing Forum, some executives from leading vehicle manufacturers even resorted to public accusations among peers.

At the end of May, the China Association of Automobile Manufacturers issued an "Initiative on Maintaining Fair Competition Order and Promoting Healthy Development of the Industry." It highlighted that while China's new energy vehicle industry has burgeoned, the "involutionary" competition, primarily manifested in disorderly "price wars," has eroded industry profits, disrupted normal enterprise operations, jeopardized industrial and supply chain security, and propelled the industry into a vicious cycle.

Since May 23, a significant price reduction campaign initiated by a certain vehicle manufacturer has triggered a cascade of follow-ups, sparking fresh panic over "price wars."

The China Association of Automobile Manufacturers clearly cautioned that disorderly "price wars" exacerbate vicious competition, further squeezing corporate profit margins, thereby impacting product quality and after-sales service guarantees. This not only hampers the healthy development of the industry but also infringes upon consumer rights and poses safety hazards.

Hence, the China Association of Automobile Manufacturers issued an initiative, urging all enterprises to strictly adhere to the principle of fair competition and conduct business activities in accordance with laws and regulations. Advantaged enterprises should refrain from monopolizing the market, squeezing the survival space of other entities, or infringing upon the legitimate rights and interests of other operators...

As one of the competent departments of the automotive industry, the Ministry of Industry and Information Technology endorsed and supported the association's initiative, stating that it will intensify efforts to rectify "involutionary" competition in the automotive industry.

Furthermore, the "Regulations on Ensuring Payment of Accounts Owed to Small and Medium-sized Enterprises," revised and approved at the national level, came into effect on June 1 this year. These regulations strengthen constraints on purchaser behavior and provide national-level safeguards for the accounts receivable of small and medium-sized enterprises.

Spurred by the vehicle manufacturers' commitment to significantly shorten payment terms, the performance of the A-share automotive parts sector was remarkable yesterday, with multiple companies' share prices hitting their daily limits.

The Pain of Excessively Long Payment Terms

In recent years, as the automotive industry has swiftly transitioned from traditional fuels to new energy, China's automotive industry has surged ahead through early strategic planning.

However, during the rapid development of new energy vehicles, various enterprises have engaged in vicious competition, such as price wars, to vie for market share.

For ordinary consumers, lower car prices can indeed lower the threshold for purchase, but the subsequent decline in product and service quality cannot be overlooked.

As Li Shufu, Chairman of Geely, mentioned in a speech, China's automotive industry ranks first globally in the degree of involution, with price wars intensifying. This trend has two facets. "If the market environment is mature, regulations are comprehensive and strictly enforced, and competition is transparent and fair, then this phenomenon of involution can instead propel industry progress. Conversely, it may have adverse effects."

He cautioned that excessive involution and sole reliance on price wars may lead to issues such as decreased product quality, counterfeiting, sale of fake products, and disorderly competition.

In response to frequent price wars at the terminal and to maintain their price advantage, various vehicle manufacturers have continuously squeezed the supply chain. On one hand, they demand parts suppliers to reduce prices, compressing upstream profit margins. On the other hand, they indefinitely extend payment terms to minimize their financial costs, effectively turning suppliers into the "interest-free capital pool" of vehicle manufacturers, further eroding their profitability.

Parts suppliers generally lack leverage in negotiations with vehicle manufacturers, especially leading ones. To secure orders, they often have to grudgingly accept unreasonable business terms.

In 2024, "Caijing" magazine drew a startling conclusion through an analysis of the financial reports of listed vehicle manufacturers in China: the average number of days for accounts payable and notes payable of Chinese vehicle manufacturers was as high as 182 days, with payment terms nearly twice the average cycle of international vehicle manufacturers.

An analysis of the financial reports of A-share listed automotive parts companies reveals that in recent years, the pressure on related companies to collect payments has generally increased.

Inovance, a leading enterprise in the new energy electric drive system, witnessed its accounts receivable turnover days rise from 74.13 days in 2021 to 94.80 days in 2024, accompanied by a significant drop in the accounts receivable turnover rate.

Desay SV Automotive, a pioneer in intelligent cockpits, has also seen a marked increase in its accounts receivable turnover days, reaching 109.3 days in 2024.

Even Contemporary Amperex Technology Co. Limited (CATL), which holds absolute discourse power in the new energy battery market, is not immune to this trend. The company's accounts receivable turnover days increased from 44.77 days in 2022 to 63.72 days in 2024.

This is the case even for leading enterprises in various submarkets of automotive parts. The precarious situation faced by other small and medium-sized industry participants is easy to imagine.

Involution Has No Winners

Driven by new energy vehicles, China's automotive industry has once again embarked on an upward trajectory. However, due to the relentless deepening of involution, industry profits have generally declined.

Statistics indicate that in 2024, profits in China's domestic automotive manufacturing industry fell by 8% year-on-year, with a profit rate of only 4.3%, lower than the 5.4% profit rate of the overall industrial enterprise sector. In the first quarter of this year, the profit rate of the automotive manufacturing industry further dipped to 3.9%.

Simultaneously, the price war in the automotive industry continues unabated.

According to statistics, in 2024, over 200 domestic car models reduced their prices, marking a significant increase from the previous year. This year, the trend of vehicle manufacturers reducing prices to boost sales initially waned but picked up rapidly again by May, with hundreds of models joining the price reduction ranks.

On various occasions, the vast majority of vehicle manufacturer executives have voiced strong opposition to price wars and involution.

Zhu Huarong, Chairman of Changan Automobile, stated that the current vicious competition is exerting immense pressure on dealers and employees, and the sustainable development of enterprises faces severe challenges.

Yang Xueliang, Senior Vice President of Geely Holding, suggested that simply engaging in price wars is not feasible. Instead, while maintaining a price advantage, enterprises should compete on value, technology, quality, service, brand, and corporate ethics.

Recently, Geely Automobile announced that it will no longer build or expand automotive production capacity but will leverage global excess capacity to participate in global competition with a cooperative and resource-reorganization approach.

At the recent China Automotive Chongqing Forum, Wang Xia, President of the China Council for the Promotion of International Trade Automotive Industry Committee, emphasized that endless price wars and blind technological frenzies will squeeze corporate profit margins, impair product and service quality, and ultimately harm both enterprises and consumers.

Will China's automotive industry opt for a zero-sum game of "trading price for volume" or value competition of "winning with quality"? The answer is unequivocal.