Heading South for Gold: Chinese Auto Firms Swarm into Hong Kong

![]() 06/13 2025

06/13 2025

![]() 555

555

Introduction

The 'Golden Springboard' for Chinese Auto Firms Going Global?

With an area of 1,114.57 square kilometers, Hong Kong is roughly one-sixth the size of Shanghai. By the end of 2024, its temporary total population reached 7.5342 million, slightly less than Fuzhou. Annual car sales hover around 40,000, comparable to Zhengzhou's monthly sales. Yet, this small territory has attracted 11 Chinese auto manufacturers and over 40 auto suppliers to mine for gold.

"Amid the new wave of the global technological revolution, the new energy vehicle industry is entering an unprecedented 'golden era.' To empower future life with endless possibilities, auto companies are focusing on industry hotspots such as power technology innovation, new energy development, AI integration, alternative fuel cells, and intelligent connectivity.

The 2025 Hong Kong International Auto Expo, themed 'New Cars, New Journey,' leverages Hong Kong's unique advantages as an international financial, trade, and logistics center. It aims to create an extensive interactive platform connecting the auto industry, supply chain, and financial services, highlighting new technological breakthroughs in the global auto industry, establishing an international financial service coordination support system, and promoting high-quality and sustainable development across the entire auto industry chain."

The 2025 International Auto & Supply Chain Expo (Hong Kong) will be held from June 12 to 15 at the AsiaWorld-Expo.

Notably, this expo boasts top brands: 11 major Chinese auto manufacturers, including BYD, Geely, Changan, SAIC, and Xpeng, along with over 40 supply chain leaders such as CATL and Horizon Robotics, will showcase breakthroughs in smart cabins, autonomous driving, and next-generation chips.

The participation of these industry leaders not only demonstrates the overall strength of China's auto industry but also underscores the expo's crucial role in gathering global high-quality resources and fostering technical exchanges and cooperation.

Indeed, this expo transcends traditional exhibitions; it serves as a global hub for suppliers, manufacturers, and financiers, leveraging Hong Kong's international advantages to promote cross-border trade, finance, and intelligent policy solutions. During the critical period of global auto industry transformation, it establishes an efficient platform for the deep integration and coordinated development of all links in the industry chain.

01 Small Sales, Big Potential

As part of China, Hong Kong's auto industry is relatively unique. This uniqueness stems from its dense urban environment, lack of local auto production capacity, and status as a globally significant logistics and entrepot hub. Unlike mainland China, which has local auto manufacturers, Hong Kong has no auto production enterprises, and all auto supplies are imported.

This highly import-dependent model imbues Hong Kong's auto market with a distinct international character, with auto brands from Japan, Germany, the UK, and China gradually dominating the market.

Auto demand in Hong Kong differs due to a combination of factors, including lifestyle, tax policies, infrastructure construction, and government environmental protection strategies. Despite Hong Kong's developed public transportation system and relatively low per capita car ownership, the markets for high-end cars, electric vehicles, and auto accessories are thriving.

In recent years, Hong Kong consumers' preferences have significantly shifted, gradually leaning towards electric vehicles and environmentally sustainable modes of transportation. Simultaneously, public awareness of car emissions, air quality, and long-term sustainability is on the rise. This change in consumer attitudes aligns with Hong Kong's reality of limited space and emphasis on clean air.

Consequently, Hong Kong has set ambitious goals for reducing motor vehicle emissions, notably planning to halt new registrations of internal combustion engine private cars by 2035 and aiming for zero motor vehicle emissions by 2050.

Driven by both policy initiatives and shifts in consumer demand, the popularity of electric vehicles in Hong Kong continues to soar. In just a few years, electric vehicles have swiftly evolved from a novelty to an essential component of new car registrations.

Tesla has long dominated the market with its advanced technology and brand influence. However, other auto manufacturers are actively entering the Hong Kong market, with Chinese brands offering more affordable electric vehicle options, injecting new vitality into the market.

As a right-hand drive market, Toyota (especially the iconic Comfort taxi) and other Japanese brands in Hong Kong have always held a strong market share. Nevertheless, in recent years, Tesla has performed exceptionally well, with its Model 3 and Model Y models occasionally topping the market charts.

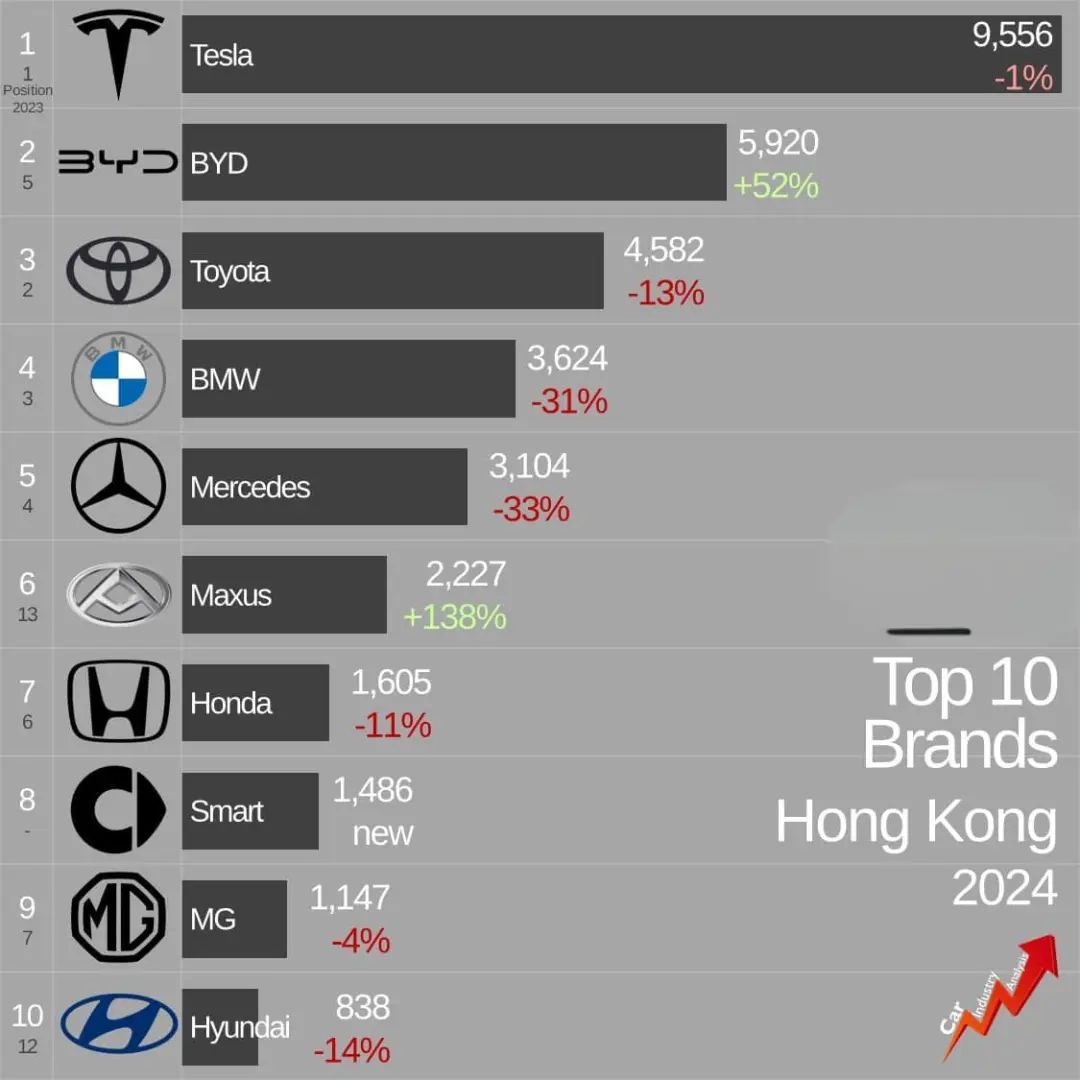

The fierce competition among these brands once posed significant challenges for Chinese auto manufacturers in the Hong Kong market. However, the situation is now changing. BYD's sales in Hong Kong have surged, making it the second best-selling auto brand in Hong Kong last year, trailing only Tesla. With the rapid expansion of the Hong Kong electric vehicle market, BYD is gradually becoming a favored brand among consumers.

To date, Hong Kong has approved nearly 400 electric vehicle models for market entry. As of the end of January 2025, the number of electric vehicles in Hong Kong exceeded 110,000, accounting for about 12.3% of the total number of cars in Hong Kong. Tesla accounts for nearly half of the total, while electric vehicles from Chinese manufacturers account for about 35% of all new car sales.

Last year, new passenger car sales in Hong Kong reached 44,200 units, a year-on-year increase of 2%. This growth trend has attracted more new players to the market. Some companies have announced plans to establish electric vehicle assembly or distribution operations in Hong Kong, aiming to leverage Hong Kong's status as a free port, favorable tax policies, and international convenience.

These initiatives are expected to make Hong Kong a small but influential player in the regional electric vehicle ecosystem, especially in the fields of high-tech, high-end, or export-focused electric vehicle solutions.

02 Many Opportunities, Great Significance

Hong Kong's Financial Secretary, Paul Chan, recently stated that in the fields of finance and technological innovation, Hong Kong can make unique contributions to China's electric vehicle industry. He emphasized that Hong Kong is fully capable of becoming a 'settlement, bridge, refueling station, and facilitator' for enterprises. He highlighted Hong Kong's unique support in two aspects:

First, Hong Kong can provide financial support for the globalization of the mainland auto industry. Thousands of enterprises in the industry chain need continuous investment to drive scientific research and innovation. He encouraged auto companies to establish international business headquarters, supply chain management centers, and asset management centers in Hong Kong.

Second, Chan said that Hong Kong is fully promoting the development of innovation and technology to become a new economic engine and collaborating with other cities in the Greater Bay Area to build an international innovation and technology hub. He also mentioned Hong Kong's other advantages: international-standard industry standards, a comprehensive intellectual property protection system, and the convergence of mainland and international data and talent, all of which will support the development of electric vehicles, intelligent transportation, and Internet of Vehicles technology.

Amid fierce domestic market competition, strong production and sales momentum, and overseas trade restrictions, Chinese electric vehicle manufacturers are accelerating their globalization process. Given the barriers to entering major overseas markets like the US and the EU, China and domestic auto companies view Hong Kong as a crucial starting point and testing ground for going global, leading to a series of strategic moves:

On the one hand, multiple auto companies are using Hong Kong for product testing and market expansion. Xpeng Motors has opened a flagship store in Hong Kong and launched right-hand drive models; Geely's Zeekr premiered the six-seat pure electric model 009 in Hong Kong; Changan Automobile plans to list its luxury brand Avita on the Hong Kong Stock Exchange in the first quarter of next year and will launch 6 to 8 electric vehicle models under this brand in the next five years.

On the other hand, Hong Kong is becoming a core hub for global financing for Chinese auto firms. More than a dozen mainland intelligent mobile travel companies have flocked to Hong Kong for financing, with IPO plans from automakers such as Chery and Thalys, as well as autonomous driving technology companies like Pony.ai, attracting significant attention. According to reports, Chery Automobile plans to raise at least $1.5 billion through its IPO, and its preliminary prospectus indicates that the funds will be used to produce more right-hand drive models and expand into high-standard markets such as Europe, Japan, and South Korea.

Bankers and analysts point out that such IPOs will not only enhance China's leading position in the global automotive technology sector but also further consolidate Hong Kong's status as a popular global IPO destination with their huge financing scales (exceeding $1 billion for a single company). In May this year, CATL topped global IPO transactions with a $5.23 billion deal, and at that time, over 150 companies were waiting to list in Hong Kong.

This 'Hong Kong Springboard' strategy forms a two-way drive: auto companies accumulate overseas operational experience through localized product testing while leveraging capital market funding to support their global layout. As industry observers note, a successful IPO "will be an international recognition of the strength of Chinese electric vehicle manufacturers and their supply chains," and Hong Kong's dual role as a 'testing ground + financing hub' is becoming a crucial fulcrum for the globalization of China's auto industry.

Editor-in-charge: Yang Jing | Editor: He Zengrong