The Era of Major Mergers: Simulating the Climax of Intense Competition in China's Auto Industry

![]() 06/13 2025

06/13 2025

![]() 487

487

This article, grounded in publicly available information, is solely intended for information exchange and does not constitute investment advice.

In mid-June, the Chinese auto industry seemed to find a temporary resolution in the proposal of a "60-day payment term" amidst heated public debate.

Yet, beneath the surface, the underlying issues persist: Shortening payment terms does not address the root cause of intense competition. The association's document fails to establish a pricing system for automobiles and disregards the objective laws of market development.

At the "2025 China Auto Chongqing Forum" held in Chongqing, Wang Xia, president of the China Association of Automobile Manufacturers (CAAM), proposed a more profound direction: mergers and acquisitions. He believes that mergers and acquisitions are an inevitable outcome and a crucial means of addressing intense competition.

Unlike marketing wars or blindly attributing the industry's primary contradictions to "intense competition," President Wang Xia's insights align with our research and judgment—

Whether considering the current fundamentals of auto companies or the laws and stages of industry development, a "wave of major mergers" is bound to arrive, albeit later than anticipated.

01

The "Diseconomies of Scale" Phenomenon in China's Auto Companies' Balance Sheets

In Scott Skinner-Thompson's book "Harvard's Minimalist Economics," an intriguing topic is explored:

If a business is unprofitable, should it cut losses immediately?

Skinner-Thompson uses a fried chicken shop as an example. Assuming market competition restricts pricing, a piece of fried chicken costing 3 yuan can only be sold for 2.5 yuan. Does selling fewer pieces mean losing less money?

The answer is no.

Costs include both variable and fixed costs. Fixed costs, such as rent, labor, and equipment depreciation, are predetermined and do not decrease with reduced sales.

Therefore, although each sale results in a loss of 0.5 yuan, the fried chicken shop owner needs the 2.5 yuan revenue to offset fixed costs—this explains why many businesses continue to operate at a loss due to intense competition.

Most mature companies and intelligent investors possess a sense of management accounting, enabling them to distinguish between fixed and variable costs and make long-term oriented decisions.

However, real-world developments are not constrained by accounting terminology.

The term "fixed cost" may suggest immutability, but a company's fixed cost expenditures can change, especially under changing external environments. The increase in implicit fixed costs is challenging for companies and investors to detect but significantly impacts business development.

Using the fried chicken shop as an example again, the raw materials for the chicken pieces remain unchanged, but lower prices and increased sales halve the frying machine's lifespan. Simultaneously, the landlord doubles the rent upon seeing good business. The fixed costs of the fried chicken shop surge, and with the same selling price of 2.5 yuan, gross profit becomes insufficient to cover unit fixed costs, rendering increased sales meaningless.

Currently, China's auto companies are facing this very issue of "diseconomies of scale."

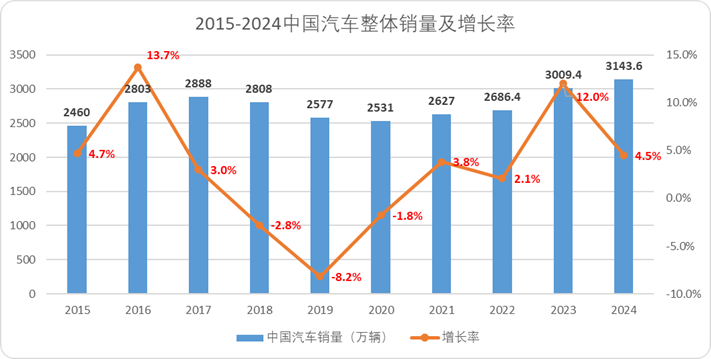

Contrary to widespread grievances from auto company owners, domestic car sales have surpassed the 30 million mark in the past two years, with growth rates approaching a 10-year high. Moreover, in 2024, despite a high base, sales still recorded a 4.5% increase, breaking historical records.

Figure: Overall sales and growth rate of China's automobiles from 2015-2024, Source: China Association of Automobile Manufacturers

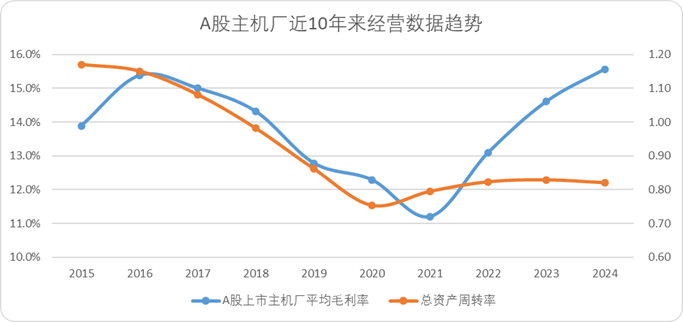

Meanwhile, despite the narrative of intense competition and unprofitability in car manufacturing, A-share listed automakers recorded an average gross profit margin of 15.6% in 2024, the highest in nearly a decade.

If only considering sales and profits, the collective grievances of auto company owners seem exaggerated.

Figure: Operating data trends of A-share automakers over the past decade, Source: Choice Financial Client

However, examining it from another angle, the total asset turnover ratio of automakers has not rebounded alongside profit and sales growth over the past five years. Analyzing various turnover indicators of automakers:

· The average fixed asset turnover ratio fell below 5, recording 4.83, the lowest in a decade.

· The inventory turnover ratio was 6.67, second only to 2023 and also the lowest point in a decade.

· The payment terms for accounts receivable and accounts payable diverged, with the accounts receivable turnover ratio nearing a decade-high, and the accounts payable turnover ratio at a decade-low. Automakers' bargaining power is at its decade-high point, explaining the recent outcry from upstream industry associations regarding automakers' payment terms.

Figure: Automaker turnover data trends, Source: Choice Financial Client

In other words, although automakers have experienced a sales bonanza due to the wave of electrification reform in recent years, significantly reducing the manufacturing cost per vehicle through scale expansion, if we extend the production cycle and compare it to overall capital investment, the marginal profits from economies of scale become insufficient.

In summary, from an industry perspective, automakers have increased capital expenditures during periods of relatively stagnant technology. However, perhaps due to overinvestment, unmet demand expectations, or intense competition lowering asset values, the asset values from the previous cycle have not been effectively utilized, resulting in "diseconomies of scale."

The "diseconomies of scale" we mention pertain only to the fixed cost side of the balance sheet and do not conflict with the "economies of scale" proposed by traditional manufacturing industries for the income statement. After all, within the overall upward sales trend, the gross profit margin of automakers' income statements has still improved significantly.

This is akin to a coffee shop with take-out windows next to a subway station. As foot traffic increases, the cost per cup of coffee decreases, exemplifying economies of scale. However, if a coffee shop with many seats is opened where the working crowd does not require dine-in service, although increased foot traffic will also drive down the cost per cup of coffee, the storefront still requires higher rent, reflecting "diseconomies of scale."

The "diseconomies of scale" in automakers' balance sheets will ultimately lead to a clear problem—asset depreciation.

02

The "Era of Major Mergers" in China's Auto Industry is Approaching

Upon opening a textbook on financial statement analysis, besides the six basic elements, the opening chapter elaborates on the core of statement analysis: there are check-and-balance relationships among all statement items.

The "diseconomies of scale" in automakers' balance sheets are undoubtedly a phased issue. Either the income statement converges with the balance sheet to change the "diseconomies" dilemma, or the balance sheet converges with the income statement to correct a reasonable asset size.

Most phased "diseconomies" are exogenous, meaning that after a significant technological stagnation, severe product homogenization can easily lead to widespread intense competition, which will not change through endogenous corporate transformations.

Therefore, it is more likely that the balance sheet will compromise with the income statement, i.e., the asset size will be actively corrected.

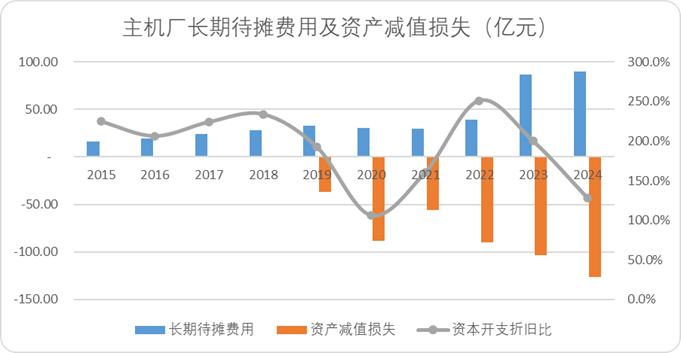

This is also reflected in the current financial statements of A-share listed automakers: Over the past decade, the long-term deferred expenses of A-share listed automakers have been within a relatively controllable range, but they have shown significant growth in the past two years. Meanwhile, since the implementation of the new accounting standards in 2019, asset impairment losses have continued to grow and reach new highs.

Since 2024, automakers have also become aware of issues on the fixed cost side. Last year, most manufacturers adopted a relatively conservative capital expenditure pace, and the overall capital expenditure depreciation ratio of automakers significantly declined.

Figure: Long-term deferred expenses and asset impairment losses of automakers, Source: Choice Financial Client

Even with the narrowing of capital expenditures, the excessive expansion of assets during the technological stagnation period has become an established fact that is difficult to change.

So, how to revitalize possibly depreciating redundant assets? The most straightforward answer is: mergers.

That is, the coffee shop owner leases out the dining area to a fast-food business to improve the value of the storefront.

Taking the automotive industry as an example, the establishment of the European automotive empire centered on Germany relied on rounds of industrial mergers and acquisitions after World War II. For instance, the Volkswagen Group acquired Skoda, Bentley, Bugatti, Porsche, and Scania around the turn of the millennium.

Japan has a similar experience, with Toyota's vertical industry chain mergers and acquisitions from Hino and Daihatsu to the formation of automotive alliances, all being excellent cases of redundant asset resets.

There are also negative examples: The American automotive industry experienced several industrial fluctuations after World War II. Unlike General Motors and Chrysler, a number of Detroit automakers in the 1950s, such as Packard (the inspiration for the Rolls-Royce Spirit of Ecstasy hood ornament), did not recognize the value of asset resets and missed the optimal period for asset liquidation and reorganization, ultimately disappearing into history.

So, how do we determine if the industry has entered a reasonable period of mergers and acquisitions?

We can use indicators to judge whether industrial assets need to be reset, namely: the economic depreciation rate.

Economic depreciation refers to the loss of asset value caused by sustained reductions, declines, or idleness in asset returns and asset utilization rates due to changes in external conditions, including economic depreciation caused by market competitive factors and policy factors.

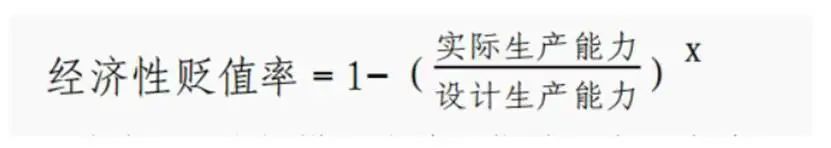

The formula is shown in the figure below, where the value of X is industry-related. Generally, the value for manufacturing is 0.7, which we will use for subsequent calculations. Meanwhile, there are two comparable nodes for the economic depreciation rate:

Figure: Economic depreciation rate formula, Source: Corporate Financial Reports, ZhiPingShiJie "How to Calculate Economic Depreciation of Assets"

· When the economic depreciation rate falls within a certain range, the industry possesses the basic conditions for mergers and acquisitions.

· If within the same industry, the economic depreciation rate of leading enterprises is significantly lower than the industry average, the greater the difference, the stronger the economic rationale for mergers and acquisitions.

Although there is a lack of comparable indicators for guiding cases in the automotive industry, some emerging industries in China have experienced complete reorganization cycles since the reform and opening up, such as the cement industry, which saw frequent mergers and acquisitions in 2012-2013:

In 2012-2013, China's cement industry had an overall capacity utilization rate of around 72%, with an average economic depreciation rate of approximately 0.205, marking the period with the most mergers and acquisitions in the cement industry.

In 2016, the economic depreciation rate of Conch Cement, a leading A-share cement company, dropped to 0.08, while the industry average economic depreciation rate reached 0.24, with a difference of nearly 0.16. Capital valuation increased by approximately 10% compared to 2012 (before entering the growth cycle in 2017).

Based on the experience of the cement industry, an economic depreciation rate greater than 0.2 will trigger a wave of supply-side reform mergers and acquisitions. For every 0.15 reduction in the difference between leading enterprises and the industry average, capital prices will depreciate by 10%.

So, what is the current situation in China's automotive industry?

According to calculations based on A-share listed automakers, the overall economic depreciation rate in 2024 reached 0.335, while the industry-wide calculation (capacity profit rate based on National Bureau of Statistics data) was approximately 0.204. If calculated using BYD's 100% capacity utilization rate (actually higher in the first quarter, taking the upper limit as the basis), the difference between the two exceeds 0.3.

In other words, based on the current overall asset utilization efficiency of the automotive industry, the basic conditions for an outbreak of mergers and acquisitions have been met. Moreover, the current economic depreciation rate of leading enterprises is extremely low, providing a window period for offering relatively higher consideration.

The automotive industry is undeniably at a pivotal point of structural transformation, plagued by "diseconomies of scale" in balance sheets, sluggish asset turnover, and escalating economic depreciation. To transcend meaningless marketing wars, public relations battles, and even price wars, the industry must seize the current window of opportunity and revalue assets through significant mergers.

The inevitable "Era of Major Mergers" in China's automotive industry is not only on the horizon; it is fast approaching.