Tesla Robotaxi Goes "Live"! Chinese Autonomous Driving Rival Momenta Prepares for the Race

![]() 06/13 2025

06/13 2025

![]() 708

708

Momenta disrupts the "impossible triangle" of Robotaxi with data-driven approaches and mass production reuse.

By Wu Enen

Edited by Chen Jiying

When Elon Musk transitioned from "Minister Musk" back to "President Musk," his primary focus was on Robotaxi.

On June 11, Musk announced the tentative launch of the public Robotaxi service on June 22.

He also revealed that on June 28, the first Tesla vehicle capable of full autonomous driving would be delivered directly from the factory to customers' homes.

Musk retweeted a video of a Tesla Model Y Robotaxi driving in Austin, praising its "simple and elegant design".

Tesla has signaled the shift from autonomous driving trials to full-scale deployment.

Perhaps sensing Musk's "aggressiveness," another US Robotaxi company, Waymo, swiftly released its latest update, stating that its weekly service volume had reached 250,000 orders, less than two months after the previous announcement of 200,000 orders.

Unlike Tesla, Waymo has long been the "leader" in Robotaxi. This June, the two companies will compete head-on for the first time.

To illustrate, the global "live-streaming" sales of Robotaxi are buzzing with excitement, with players accelerating their commercialization efforts amidst a festive atmosphere.

In China, companies like Luobo Kuaipao, Pony.ai, and WeRide, which are similar to Waymo, have accelerated their expansion after years of operational testing. Meanwhile, Momenta, which aligns more closely with Tesla, has announced that it will operate driverless Robotaxi models with mass production and pre-installed equipment by the end of this year.

In terms of Robotaxi deployment, Momenta is currently the Chinese autonomous driving player most akin to Tesla, both leveraging data-driven, mapless end-to-end technology and reusing mass-produced vehicles to achieve technological, safety, and commercial evolution.

However, the commercialization of Robotaxi has always faced the challenge of the "impossible triangle" of "safety, cost, and scale," which significantly restricts Chinese and American Robotaxi players from achieving a large-scale closed-loop business model.

Whoever can take the lead in breaking the "impossible triangle" of Robotaxi commercialization will occupy a central position in large-scale commercialization. Among them, Tesla is attempting to surpass from another route.

I. Towards L4: Same Direction, Different Paths

In the 1960s, John McCarthy of Dartmouth College first proposed the concept of "autonomous driving," envisioning the use of computers to control vehicles and achieve autonomous driving. Since then, autonomous driving has become one of the "crowns" of the automotive industry.

In 2016, Musk officially announced Tesla's Robotaxi plan in "Master Plan, Part Two," not only proposing to put autonomous driving into practice but also outlining the commercial vision of a "shared fleet of Tesla owners." The vision is beautiful, but it was leapfrogging companies like Waymo and Cruise that first launched Robotaxi test operations in North America.

This trend quickly spread to China, with many players quickly catching up. Today, leading Chinese and American companies are neck-and-neck in the global Robotaxi race.

In the global Robotaxi race, there are three types of players, all heading in the same direction but taking different paths.

The first is the "leapfrogging faction" that goes straight to L4, including Waymo, Luobo Kuaipao, Pony.ai, and WeRide.

The commonality among the leapfrogging faction is that they conduct small-scale tests in defined areas, equipped with hardware and software redundancy, primarily using high-precision maps, and steadily collecting driving data.

The advantage of this approach is that it can quickly achieve Robotaxi road operations, collect feedback data first, and even gain social attention, enhancing the company's brand. Luobo Kuaipao has provided over 11 million rides globally, with a 75% year-on-year increase in service volume in the first quarter of this year. The Chinese capital market is also optimistic about autonomous driving. This year, the fund managed by "Cathie Wood," known as the "female Warren Buffett," has increased its holdings in Baidu six consecutive times.

The second approach is the "gradualist faction" that gradually upgrades from L2 to L4, with Tesla as a typical representative.

Tesla began developing autonomous driving technology as early as 2014 and quickly entered L2 autonomous driving in 2016, gradually adding advanced features such as automatic parking, automatic lane changing, and automatic summoning.

Tesla's gradual approach also has its merits, with a longer accumulation period and a relatively mature "pure vision + AI neural network technology." Coupled with a vast amount of data feeding, once successful, it can be quickly replicated.

In addition to the first two approaches, there is actually a third "parallel" approach, most typically represented by China's Momenta, with L2 and L4 operating in parallel. Momenta has proposed a "one flywheel, two legs" strategy, with one leg being intelligent assisted driving, providing mass-produced intelligent assisted driving solutions for automakers, and the other leg being scalable Robotaxi, continuously investing in fully autonomous L4 driving solutions.

Interestingly, Momenta was founded in 2016, coinciding with the time when Tesla announced the launch of Robotaxi. After nine years, as Tesla announced that its Robotaxi will soon be operational, Momenta also reached a strategic cooperation with Xiangdao Mobility the previous month. The two parties will jointly build the world's first Robotaxi fleet based on mass production with pre-installed equipment and launch operations in Shanghai first.

At the same time, Momenta has also reached a strategic cooperation with Uber, planning to launch commercial operations in Europe in early 2026, providing a mapless autonomous driving solution based on the mass-produced vehicle platform, relying on Uber's global network.

From the current perspective, the "concurrent faction" and the "gradualist faction" converge on the same goal, solving the impossible triangle of "cost + safety + scale" and opening up large-scale commercialization.

II. Mass Production with Pre-installed Equipment to Lower Robotaxi Prices

What is the biggest factor affecting the commercialization of Robotaxi? Price, price, and price!

Recently, in the latest episode of "The Diary of a CEO," Cathie Wood emphasized her optimism for the future development of Robotaxi. She pointed out that AI is no longer a technological issue but a cost issue, "The key to the success or failure of Robotaxi is whether the cost model can work."

When the Robotaxi trend first emerged, there were no relevant mass-produced models in China, and almost all Robotaxi vehicles were retrofitted. To achieve better results, autonomous driving companies often spared no expense on retrofitting. For example, to ensure perceptual redundancy, some Robotaxi vehicles even need to carry several LiDARs.

Therefore, to reduce the cost of Robotaxi to the critical point where ROI can turn positive, the optimal solution is mass production with pre-installed equipment.

Mainstream domestic players are building solutions for mass-produced Robotaxi with pre-installed equipment and customizing relevant models to achieve cost reduction.

Tesla and Momenta, on the other hand, have taken a different approach, reusing mass-produced L2 assisted driving models for L4 Robotaxi.

It is understood that Tesla applies FSD to its existing Model Y and Model 3, achieving a significant breakthrough in the cost of Robotaxi.

In Momenta's domestic first Robotaxi solution based on mass production with pre-installed equipment, in collaboration with Xiangdao Mobility, the existing sensors and other hardware of SAIC's IM Motors LS6 are reused.

The benefits of mass production with pre-installed equipment on mature models are obvious. Since the hardware of mass-produced vehicles has undergone large-scale production and market testing, the cost is relatively low, and there is a stable supply chain, which can significantly reduce the cost per Robotaxi vehicle.

At the same time, mass production with pre-installed equipment means that the autonomous driving system is deeply adapted to the vehicle hardware during the vehicle design and production stages and also follows strict quality control standards. When designing and producing vehicles, automakers will consider the hardware requirements of the autonomous driving system to ensure compatibility and cooperative performance among hardware, improving system stability and reliability.

Moreover, mass-produced vehicles undergo extensive road testing and validation before being launched. Their hardware has been fully tested under various complex conditions. Using these validated hardware in Robotaxi can ensure better stability and durability in actual operations, reducing system failures and safety risks caused by hardware issues.

III. Feeding L4 with L2 Data to Create Learning Robotaxi

The greatest value of hardware reuse is that it allows the massive data obtained from L2 mass-produced models to be used to validate L4 in advance, collecting massive amounts of extreme case data to improve the overall level of autonomous driving model algorithms.

Why does the L4 model need L2 data to feed it?

It's actually quite understandable.

Safety is the bottom line and cornerstone for the Robotaxi model to succeed, which has become a consensus among Robotaxi players. After all, assisted driving still has a driver to fall back on, but Robotaxi has no room for retreat or shifting responsibility in terms of safe driving.

How to cross the safety line? If you want to achieve large-scale commercial Robotaxi, you need to deploy at least tens of thousands of Robotaxi in one city. To ensure the good operation of such a large-scale unmanned fleet, the autonomous driving system needs to achieve at least ten or even a hundred times the safety level of human drivers to ensure safe operation at scale. To meet such safety standards, the autonomous driving system must be able to solve millions of long-tail problems on the road.

Only by feeding the algorithm with enough massive data and iterating the algorithm in a data-driven manner can we solve these long-tail problems that Robotaxi is bound to encounter to the greatest extent.

How much data is needed?

The current industry consensus is that approximately 100 billion kilometers of data, equivalent to the data accumulated by 10 million passenger cars running for one year, are required.

A more important question is, where does the data come from?

Players like Tesla, which belong to the "gradualist faction," have millions of L2 vehicle sales, providing a continuous stream of data from around the world. After processing and learning through algorithms, these data can be fed back to L4.

According to Tesla, the Robotaxi service will use data to "feed back" technology, helping Tesla continue to develop and validate the FSD network, mobile applications, vehicle allocation, task control, and remote assistance operations, among others.

Momenta, which follows a similar path to Tesla, is the same. With L2 and L4 operating in parallel, Momenta's circle of automaker friends is growing wider and wider.

During this year's Shanghai Auto Show, Momenta successively signed strategic cooperation agreements with well-known brands such as Audi, Cadillac, Honda, Toyota, and Volkswagen, with over 130 models in mass production cooperation.

Currently, over 15 automakers worldwide have established cooperation with Momenta, covering Japanese giants like Toyota, Nissan, and Honda, German giants like Volkswagen, Audi, and Mercedes-Benz, American giant General Motors, as well as local automakers like BYD, FAW, SAIC, GAC, and Chery.

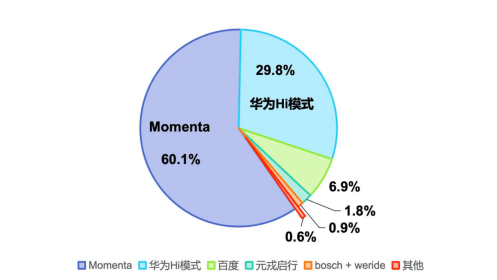

According to a report by Zooth Research, from January 2023 to October 2024, Momenta's market share in the third-party intelligent driving market for urban NOA reached 60.1%.

Momenta's vehicle deployment is growing at a leapfrogging pace, with the first 100,000 vehicles taking two years, the second 100,000 vehicles taking only half a year, and the third 100,000 vehicles taking less than three months.

Today, 300,000 mass-produced vehicles equipped with Momenta's L2 assisted driving system are on the road, capturing real "road fragments." Given that the complexity of Chinese roads far exceeds that of Europe, the United States, Japan, and South Korea, the value of the "data gold mine" accumulated by Momenta is helping it enter a new stage of scalable L4.

After being able to output a continuous stream of data from the L2 product side, Momenta relies on a data-driven automated closed loop, which then feeds back to the Robotaxi mass production technology stream, forming an efficient and interconnected mechanism based on a unified sensor platform.

At the same time, like Tesla, Momenta relies on mapless end-to-end technology, which can break the geographical constraints of high-precision maps. Through deep learning and real-time perception, it can quickly replicate learning results to different urban road environments and quickly adapt to them.

With safety as the foundation, breaking the "cost" barrier with mass production with pre-installed equipment and achieving rapid city expansion with mapless end-to-end technology, the "impossible triangle" of Robotaxi is being broken.

IV. Conclusion

Today, the unique value of various Robotaxi routes is becoming increasingly apparent. Both the gradualist approach championed by Tesla and the concurrent strategy employed by Momenta must continue to validate the viability of their respective routes. This endeavor aims to pioneer new models in the trillion-dollar future mobility market, laying the groundwork for exponential growth.

Looking ahead, these two entities will coexist as both collaborative teammates and competitive rivals within the same arena.

Tesla's approach resembles that of Apple, constructing a closed-loop ecosystem. As the world's leading electric vehicle manufacturer, Tesla aims to integrate Robotaxi technology across the millions of vehicles it produces annually. Conversely, Momenta operates akin to the Android system, leveraging its strength in openness. Its network of automotive partners is continually expanding, and with the combined strength of its ecological alliance, Momenta is poised to emerge as a formidable contender alongside Tesla in the Robotaxi sector.