Decoding the "New TSMC": Merger of Goertek Optical and Sunny Optical AR

![]() 08/25 2025

08/25 2025

![]() 765

765

01

Preface

Yesterday (August 22), two publicly traded firms, Goertek and Sunny Optical, jointly announced that Goertek's subsidiary, Goertek Optical, will acquire 100% equity in two Sunny Optical subsidiaries: Sunny Optical AR Micro-Nano Optics (Shanghai) Co., Ltd. and Sunny Optical AR Micro-Nano Optoelectronic Information Technology (Shanghai) Co., Ltd. (collectively referred to as "Shanghai AR"). Industry experts suggest that this union could herald the advent of a "New TSMC." So, what do Goertek Optical and Shanghai AR specialize in? What is their relationship? Is the term "New TSMC" mere speculation? How will this integration reshape the industry landscape? Today, 『AR Circle』 invites XR Research Institute to provide a detailed analysis.

02

Equity Relationships Before and After the "Merger"

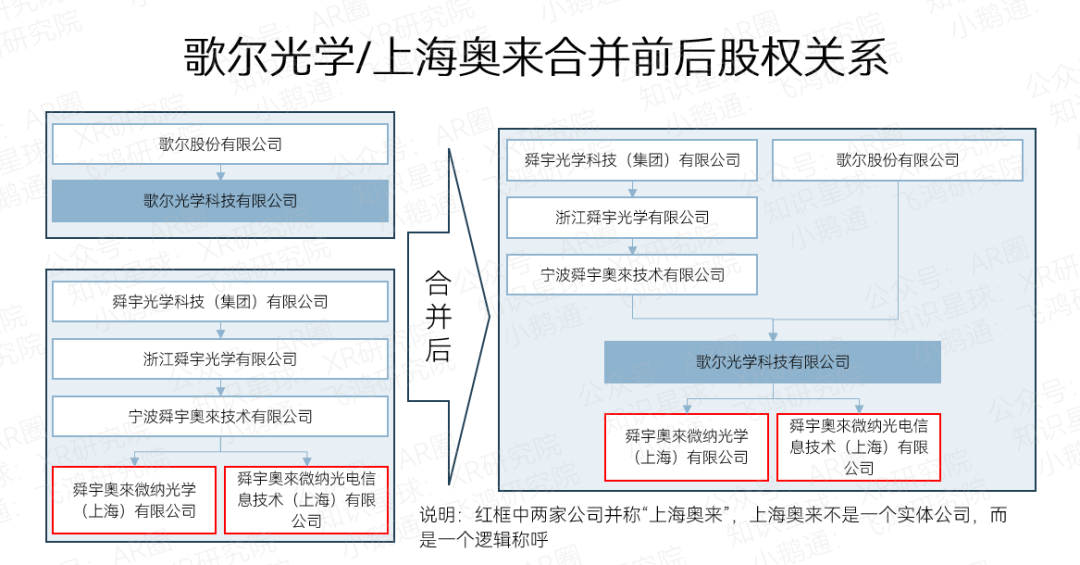

To better understand the equity relationships and their transformations, XR Research Institute has crafted equity relationship diagrams for both pre- and post-merger scenarios. Essentially, Sunny Optical had two companies focused on optical waveguides (enclosed in the red box in the diagram below, collectively known as "Shanghai AR"). Post-merger, Shanghai AR will become a wholly-owned subsidiary of Goertek Optical. Upon completion, the original shareholders of Shanghai AR will hold roughly one-third of Goertek Optical's equity, while Goertek Optical's original shareholders will retain approximately two-thirds. This can be seen as a cashless "merger." For instance, if Goertek Optical was valued at 20 billion yuan and Shanghai AR at 10 billion yuan, post-merger, they will form a new Goertek Optical with a combined valuation of 30 billion yuan.

Equity relationship diagram of Goertek Optical and Shanghai AR before and after the merger, source: AR Circle

03

8x Growth in the Smart Glasses Market

In a CCTV report in June, Zhao Shuo, head of JD.com's digital business department, stated, "The smart glasses market has recently witnessed explosive growth, with transaction volumes surging over eightfold year-on-year. Features like smart prompts and real-time translation are gaining popularity among professionals, foreign trade personnel, and students. AI shooting and image recognition functions in smart glasses have also attracted tech enthusiasts, outdoor adventurers, and photographers."

Zhao Shuo, head of JD.com's digital business department, said, "The smart glasses market has recently shown explosive growth, with transaction volumes increasing by more than 8 times year-on-year."

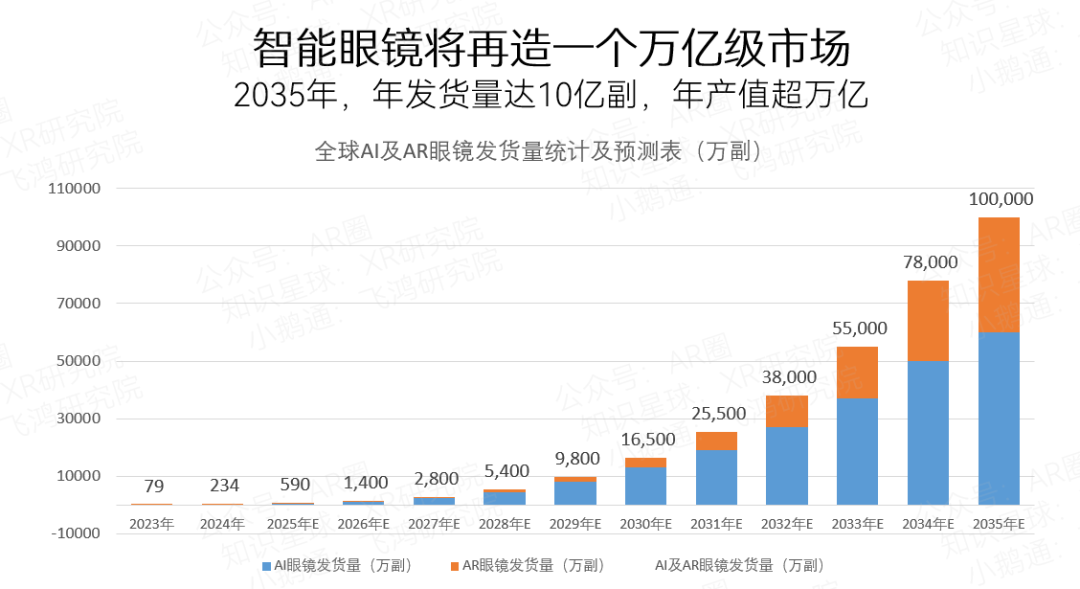

According to XR Research Institute, in the first half of 2025, smart glasses sales on e-commerce platforms soared tenfold year-on-year, with related keyword searches spiking more than 30 times. Smart glasses are primarily divided into AR glasses (with display functions) and AI glasses (without display functions). XR Research Institute predicts that by 2035, global annual shipments of smart glasses will reach 1 billion pairs, with 600 million being AI glasses and 400 million being AR glasses. Smart glasses represent not just a new market but a trillion-dollar industry, unlike smartphones.

By 2035, the annual shipments of smart glasses worldwide will reach 1 billion pairs, source: XR Research Institute

04

The Most Expensive Component in AR Glasses: Optical Waveguide

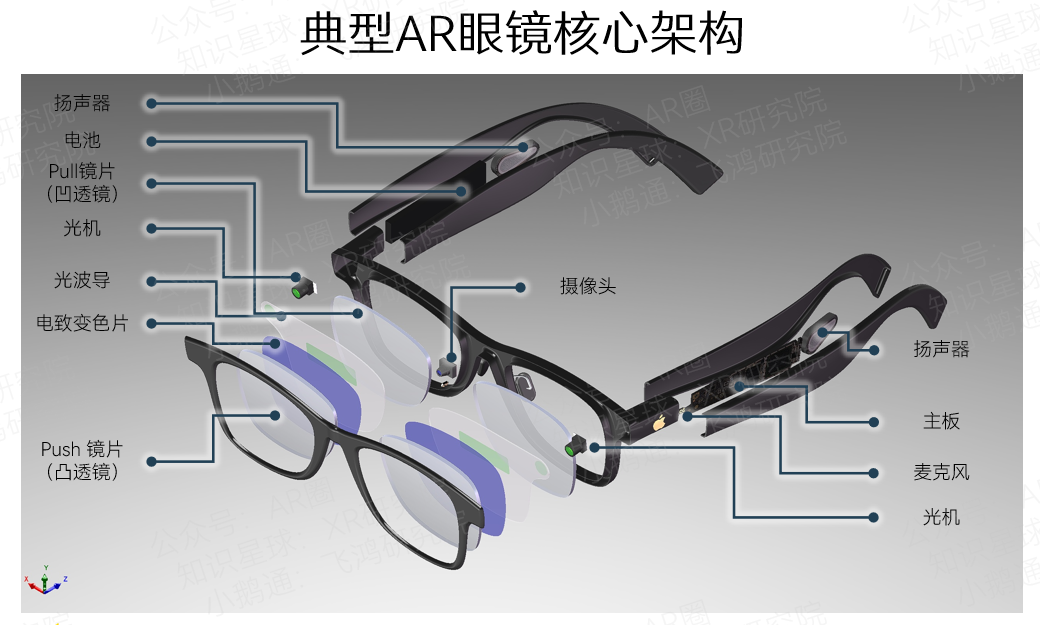

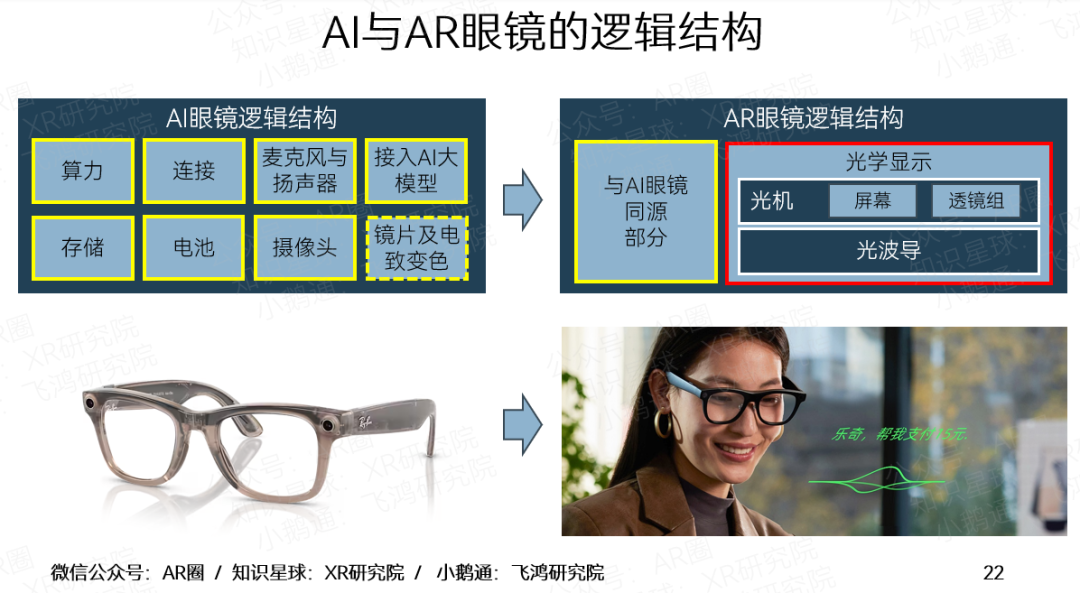

The logical structure of AR glasses resembles that of smartphones, encompassing basic components like computing power, storage, batteries, and connectivity. However, unlike smartphones, AR glasses incorporate two cutting-edge technologies: MicroLED and optical waveguides. Although these components might seem purely optical, their design and manufacturing processes align closely with chip manufacturing.

Diagram of a typical AR glass structure, source: AR Circle

Logical structure diagrams of AI and AR glasses, source: AR Circle

Taking the manufacture of silicon carbide optical waveguides as an example, the process begins with evenly coating photoresist on the substrate to ensure precise lithography and etching. Etching, crucial for defining the optical waveguide structure, includes plasma etching (ICP etching) and reactive ion beam etching (RIBE etching), both ensuring pattern precision. After etching, the unetched photoresist is removed, forming the desired pattern. Next, filling with low-refractive-index materials enhances transmission performance and reduces optical loss. Cutting and bonding ensure the optical waveguide's size and tight material bonding at different levels. Finally, blackening treatment minimizes optical interference and ensures stability. Optical waveguide manufacturing precision is at the nanometer level, falling under the academic domain of semiconductor optics or micro-nano optics.

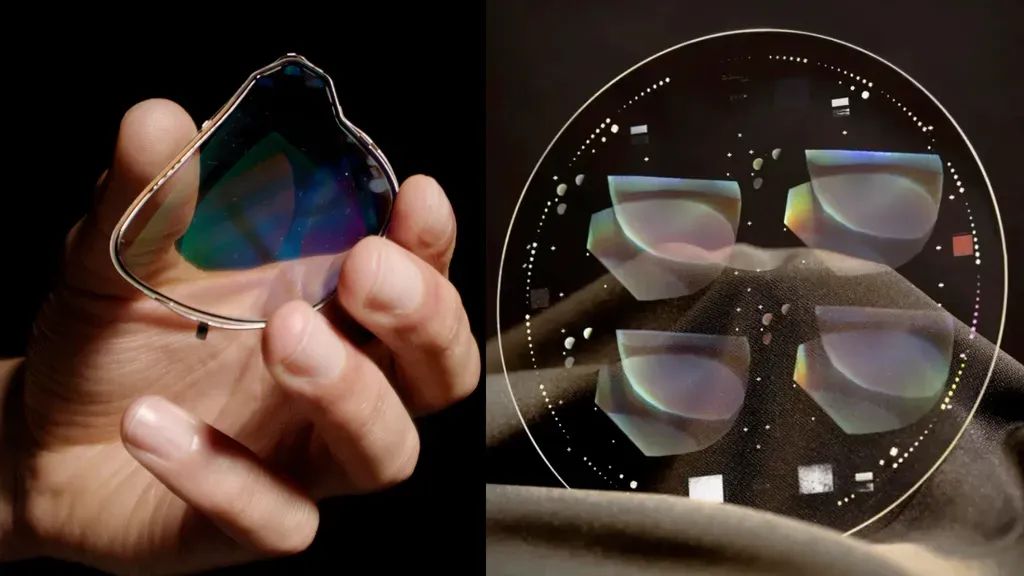

Left: Color optical waveguide with a silicon carbide substrate produced by Meta; Right: Four optical waveguides (for 2 pairs of glasses) can be produced on a single 6-inch silicon carbide wafer, source: Meta

(For an in-depth explanation of AR glasses technology, watch “Internal Lecture: AR Glasses and Their Optical Systems” on Bilibili)

In terms of value, consider a monochrome optical waveguide glasses model priced at approximately 2,500 yuan. Its optical waveguide costs around 1,250 yuan, half of the retail price. Previously, the industry widely believed that the most expensive chip was the SoC, like Qualcomm's AR1, priced at $65 (approximately 460 yuan). However, optical waveguides are significantly more valuable. Hence, they rightly deserve the title of "the most expensive chip in AR glasses."

05

Optical Waveguide Dual Titans: Goertek Optical & Sunny Optical AR

While many may be unfamiliar with Goertek Optical and Sunny Optical AR, these two companies are giants in semiconductor optics. They boast the world's foremost optical waveguide design teams and the largest production capacities, serving nearly all top international clients.

ASML lithography machine, source: ASML

To illustrate their strengths, consider this: Many industry players (even academic institutions) can produce optical waveguides, but achieving large-scale mass production with high consistency is another matter entirely. Sunny Optical AR, for instance, is the only company globally equipped with ASML DUV lithography machines. With the 2150i model, their annual production capacity can reach 1.8 million wafers. If each wafer produces optical waveguides for 10 pairs of glasses, their annual capacity equates to 18 million pairs of AR glasses. Even considering yield factors, their annual capacity still reaches tens of millions of pairs. In comparison, other optical waveguide companies' annual capacities barely exceed 100,000 pairs. Emphasizing production capacity is crucial because this year, the AR glasses industry shifted from "insufficient demand" to "insufficient production capacity." A Chinese AR brand missed the valuable 618 sales period due to supply chain constraints. According to XR Research Institute, demand for surface-relief diffraction optical waveguides from just six Chinese AR brands exceeds 1.6 million pairs next year. However, current domestic production capacity (excluding Goertek and Sunny Optical) is less than 400,000 pairs, leaving a gap of over 1.2 million pairs. Including demand from major international clients, the future optical waveguide capacity gap could exceed several million pairs. Goertek Optical not only rivals Sunny Optical AR in design capabilities and production capacity but also offers various optical products like AR glasses optical engine modules, VR glasses Pancake optical modules, iToF and dToF modules for depth perception, and automotive HUDs. Goertek was the first to mass-produce Pancake optical modules, and the top three global VR brands use Pancake modules supplied by Goertek Optical. Considering optical waveguides are the most valuable "chips" in the smart glasses industry, and these two companies excel in both design and manufacturing, jointly forming the world's largest optical waveguide company, while their scale might not match TSMC's, the industry's "New TSMC" moniker is not far-fetched.

06

Merger of Optical Waveguide Dual Titans Accelerates Industry Progress

The merger of these optical waveguide giants creates the world's largest and most powerful optical waveguide enterprise, integrating full-process capabilities from design to manufacturing. This union not only deepens technological and market synergies but also fosters product maturation and innovation. Beyond benefiting both parties' shareholders, it will propel various fields' common development. Firstly, the regional economies where Shanghai AR and Goertek Optical are located will thrive. Sunny Optical's optical waveguide factory in Shanghai Lingang has attracted enterprises like Tesla's superfactory, demonstrating robust industrial drive. With Goertek and Sunny Optical's cooperation, the Lingang factory is expected to further propel local related industries, forming a virtuous cycle that attracts more high-tech enterprises and enhances the region's overall economic vitality. Simultaneously, Goertek will positively influence Shandong provinces' Qingdao and Weifang. By transferring advanced manufacturing technology and management expertise, Goertek will upgrade the local industrial chain and drive high-tech industries' agglomeration and development. This regional economic synergy not only boosts various regions' industrial competitiveness but also lays a solid foundation for future technological innovation. Secondly, AR glasses downstream enterprises will also benefit. With the dual titans' merger, supply chain maturity and production capacity are expected to surge, creating better development conditions for downstream enterprises. Leveraging enhanced supply chain capabilities, these enterprises can utilize their product definition and ecosystem integration skills to launch superior AR glasses products. Beneficiary companies include overseas firms like Google, Meta, Apple, Microsoft, Snap, and Sony, as well as Chinese companies like Huawei, Xiaomi, OPPO, VIVO, Meizu, Rokid, XREAL, Leiniao, ByteDance, Alibaba, and Li Auto. Additionally, traditional eyewear brands like Luxottica, Hermes, LV, and Prada are poised to accelerate their AR glasses market entry. The third beneficiary group comprises numerous upstream enterprises. For instance, silicon carbide-related enterprises like Tianyue Advanced Materials, Zhejiang Jingrui, Tianke, and Shuoke will directly benefit from increased market demand post-merger. These companies excel in silicon carbide substrate research and production, crucial for AR glasses manufacturing. Moreover, smart glasses chip-related enterprises like Beken, Rockchip, Espressif, and Unisoc, with their chip design and manufacturing expertise, can better meet AR glasses' electronic chip demand, accelerating market product iterations. Simultaneously, structural component enterprises like Leadintech, Mia, Jingyan, and Dongmu will also benefit from this merger.

What are your thoughts on the smart glasses industry and the "merger of the dual titans"? Share your views in the comments section.