A 70% Monthly Active User Decline: Kimi's Perilous Tightrope Walk

![]() 12/18 2025

12/18 2025

![]() 447

447

Author: Guo Jiage

Editor: Zhang Xiao

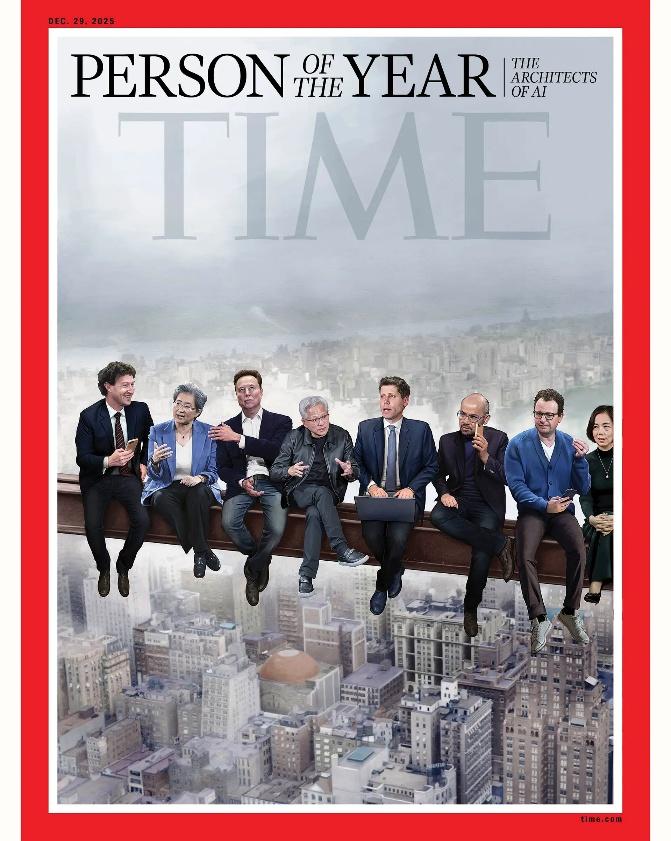

Recently, TIME magazine's newly unveiled Person of the Year cover paid homage to the iconic 1932 photograph, “Lunch Atop a Skyscraper,” captured during the Great Depression.

This time, however, the figures precariously perched on the high-rise steel beam are not construction workers but eight individuals acknowledged as the pivotal architects of “humanity's AI era.”

Photo Credit: TIME Magazine

This vantage point reflects the current state of the entire AI industry—navigating an incomplete system with rapidly evolving rules, where no one is truly in a safe zone. The reality of diminishing technological dividends looms large, unproven business models cast shadows, and the market demands concrete answers.

As the industry acknowledges that raw model capabilities alone no longer confer decisive advantages, debates intensify over “AI's next direction.” In his TIME interview, Li Yanhong reiterated the critical importance of the application layer. While not a new concept, this recurring emphasis signals a broader shift—from technological narratives to results-driven storytelling.

Who will spearhead commercialization? Who will deliver growth and cash flow? These questions have moved from the backstage to center stage. For AI companies lacking big-tech ecosystems and relying on single-product strategies, this pivot brings pressure rather than opportunity.

Amid such strain, Zhang Yutong assumed the role of “Kimi President,” formally taking on core external responsibilities. This understated personnel shift gains significance amid persistent questions about Kimi's financing pace, computational costs, and long-term cash flow models. The industry seeks clearer paths for commercialization and capital deployment.

Once celebrated for its technological scarcity, Kimi now faces demands for “implementation and returns,” compelled to answer critical questions.

01 From Behind the Scenes to Center Stage: Zhang Yutong's Defined New Role

Recently, Zhang Yutong made her debut as “Kimi President” at a ZhenFund event held at Tsinghua University. For Kimi, this public appearance occurred against a challenging backdrop—the product, once hailed as a benchmark for AI native applications, has seen its industry influence significantly wane over the past year.

Zhang will now oversee Kimi's holistic strategy and commercialization, including financing decisions, while directly participating in new product development. In today's context, a role spanning financing, commercialization, and product strategy reflects the company's concentrated expectations for next-stage results.

Before stepping into the spotlight, Zhang navigated a turbulent year. She faced arbitration disputes with her former employer, GSR Ventures, and Moonshot AI, with legal controversies remaining unresolved to date.

Concurrently, Kimi transitioned from an industry darling to a marginalized player as technological hype cooled, user attention shifted, and market dynamics evolved. The company is now reassessing its positioning.

Photo Credit: Xsignal

The AI community is well-acquainted with Zhang. As a Managing Partner at GSR Ventures, she specialized in early-stage tech investments and strategic judgments, leading investments in Xiaohongshu, Infusion AI, and other tech firms.

Zhang's “deep bind” (deep integration) with Moonshot AI became apparent in 2023 when she participated in multiple Kimi funding rounds, including securing over $1 billion from Alibaba in 2024.

Yang Zhilin repeatedly expressed trust in Zhang, acknowledging her critical contributions to Kimi's business, strategy, and financing. Regarding the arbitration disputes, GSR Partner Neil Shen questioned, “We don't understand why this company protects Zhang Yutong so fiercely.”

This statement inadvertently highlights Zhang's evolving role—she's no longer merely an external investor.

As president, Zhang embodies capabilities attuned to capital rhythms, commercial pathways, and resource allocation. However, viewing her appointment solely through “capability matching” overlooks its timing.

As technological competition cools, the market stops paying for “parameters” and “computational power,” with user attention shifting toward scenario-integrated products.

More broadly, the AI industry enters a commercial realization phase. Kimi's IPO window forms, with markets demanding clearer corporate governance, management stability, and commercialization paths. Comparable firms have similarly strengthened core commercial and operational roles.

Zhang faces clear challenges:

On the growth front, Kimi contends with DeepSeek's rise while losing user engagement battles against Yuanbao and Doubao. Monthly active users plummeted from 36 million late last year to 9.67 million by September (QuestMobile), with Doubao and DeepSeek surpassing 100 million.

Photo Credit: QuestMobile

Commercially, Kimi relies heavily on subscription revenue, with low overall payment rates and no diversified, scalable income structure. Competitively, user attention fragments toward emerging models and big-tech ecosystems, reducing average usage duration and ceding core scenarios to rivals.

Kimi confronts numerous challenges. As technological dividends diminish and markets demand results, someone must step forward to define the next phase.

Zhang's emergence occurs precisely in this context.

02 Behind the 70% MAU Plunge: Kimi's Strategic Retrenchment

Kimi's early breakthrough marked China's AI startups' first true mainstream success. With superior long-context capabilities and restrained product design, it briefly led China's AI native app rankings, seen as the most viable C-end model implementation.

Flush with capital, Kimi aggressively spent—over $16 million in 20 days last October—to stimulate user growth and industry visibility, sparking intense AI marketing competition.

However, industry dynamics shifted within a year: DeepSeek pioneered AI deep reasoning, big-tech models counterattacked through ecosystems, and independent AI apps lost ground. Kimi's influence faded, with “what's next” becoming increasingly urgent.

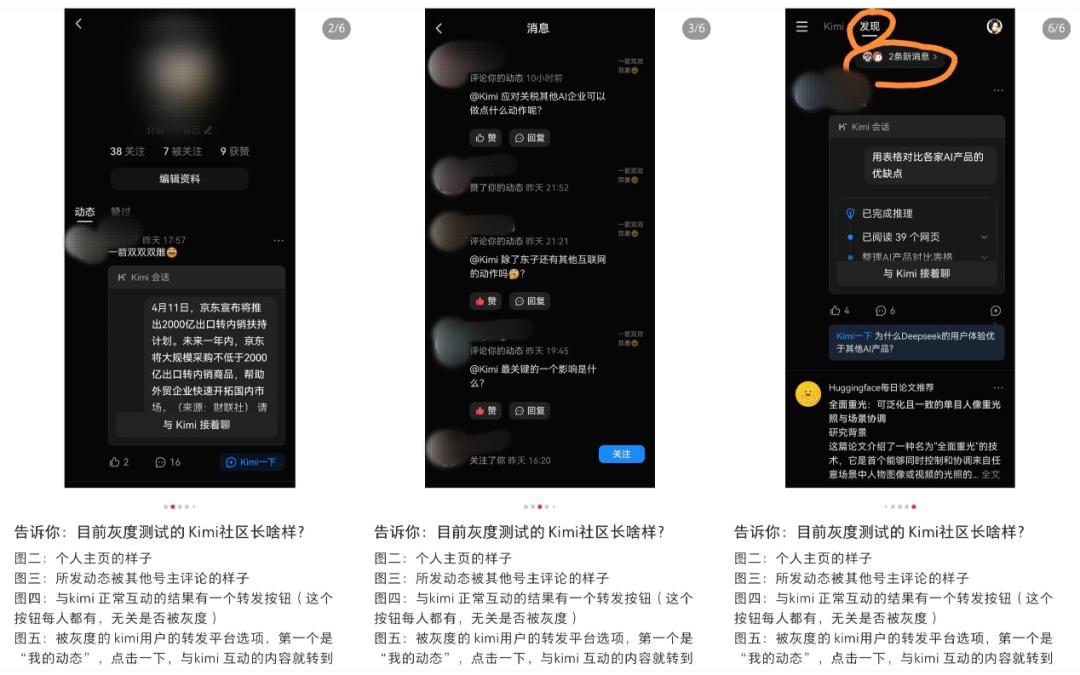

To retain users, Kimi experimented with external stimuli: a “21-Day Challenge” on Xiaohongshu, bargain-hunting campaigns, and “Community” product beta tests...

Photo Credit: Xiaohongshu

These efforts failed to alter Kimi's competitive standing. Meanwhile, Doubao taught users to create intelligent agents, and Manus introduced AI Agents to mainstream audiences.

Overinvestment in traffic and marketing delayed critical technological upgrades. While ByteDance built its “Doubao + Kouzi + Jimeng” ecosystem, Kimi neglected multimodal capabilities and video understanding.

Reliant on single-text interactions, Kimi's early technological moat eroded.

These attempts weren't mistakes but inevitable trial-and-error. With diminishing technological returns and fragmented user attention, startups must test boundaries externally. Yet Kimi's case reveals the limits of external stimuli: short-term user acquisition doesn't solve long-term growth or commercialization. Frequent experiments may even deplete resources, obscuring AI products' true competitive edge—foundational technology and complex task handling.

Against this backdrop, Zhang Yutong's presidential appointment clarified Kimi's next-stage strategy.

Speaking at Tsinghua, she emphasized that with less than 1% of the capital and 10% of the personnel compared to leading overseas models, Kimi could achieve “highest intelligent value per computational unit” through algorithmic-infrastructure synergy. Initiatives like Day-0 Co-Design, Muon second-order optimizers, and Agent-centric pretraining reflect a clear value proposition: integrating technology and product to deliver tangible user value, rather than relying on short-term traffic or gimmicks.

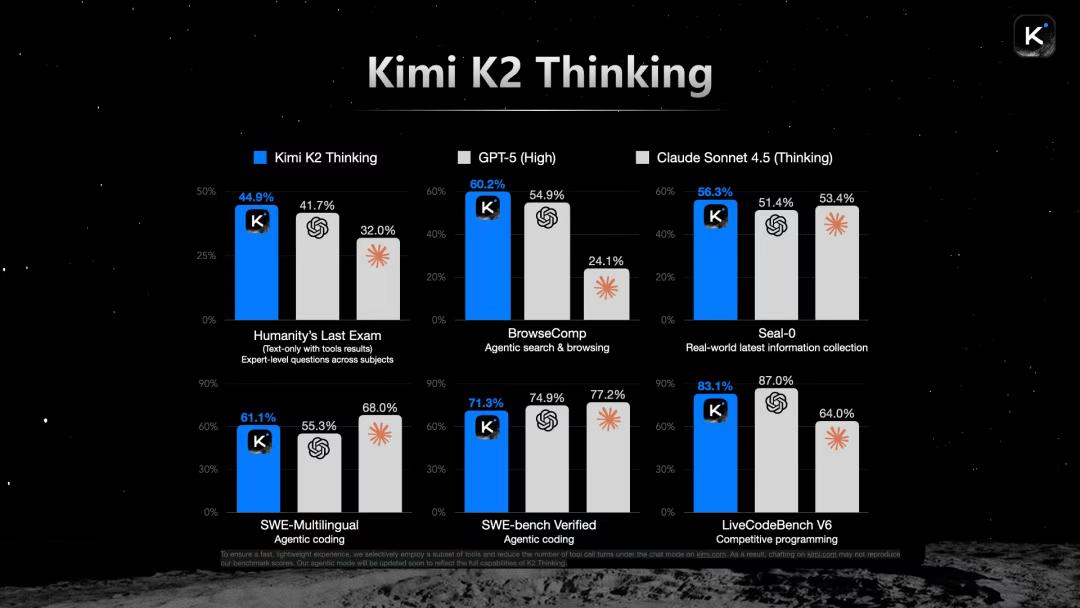

The Kimi K2 model iteration supports this strategy: outperforming GPT-5 and Sonnet 4.5 in benchmarks, enabling long-chain, multi-step tasks, and providing deep productivity capabilities.

Photo Credit: ZhenFund

Simultaneously, the Agent mode OK Computer supports over 20 tools, including image and audio generation, offering capabilities beyond coding to design, product definition, development, and deployment.

These developments suggest Kimi's next move focuses on differentiated choices within resource constraints.

Kimi's strategic retrenchment mirrors new domestic AI sector rules: technological dividends no longer automatically convert to users and revenue, and short-term traffic can't solve core issues. With Zhang's appointment, Kimi refocuses on model iteration and Agent implementation. Translating technological advantages into user value and commercial returns becomes the new imperative for Kimi and the broader AI industry.

03 Final Thoughts

Over the past two years, China's AI sector has undergone distinct phases. From 2023's explosive growth to 2025's “Hundred-Model War” conclusion, the number of active independent AI apps has declined.

On one hand, early-stage startups completed financing and product validation; on the other, user attention and traffic consolidated around big-tech ecosystems, with leading tech firms reclaiming dominance. Compared to two years ago, AI entrepreneurship faces significantly higher barriers and risks: capital, computational power, and ecological resources are no longer evenly distributed, favoring players with long-term execution and resource integration capabilities.

Competition criteria have also shifted. Early market discussions centered on model parameters, computational scale, and algorithmic innovation; today, investors and observers prioritize AI's ability to deeply integrate into businesses and deliver irreplaceable value.

Commercialization and investment flows have adjusted accordingly.

As early as late 2024, Sequoia Capital Partner Pat Grady noted that Sequoia's AI investments were shifting toward application development. He predicted that most future billion-dollar AI companies would emerge from the application layer rather than foundational model building.

Capital now favors projects that integrate technology into core businesses with quantifiable economic value. Meanwhile, applications relying solely on parameters, computational power, and traffic expansion face shrinking survival space. Vertical, business-process-integrated solutions—especially intelligent Agents and productivity tools handling multi-tool, multi-step tasks—attract more investment. This means startups must make more precise strategic choices with limited resources: either deeply integrate technology with business or face market elimination.

Against this industry backdrop, how much space remains for independent AI applications? As the stage returns to big-tech dominance and market focus shifts from technical parameters to implementation capabilities, who can convert technological advantages into user value and sustainable returns with limited resources? This is the central question facing the entire industry.