The Era of Large-Scale Robotaxi Commercialization Has Dawned: Are Infrastructure and Networking Experts Needed?

![]() 08/04 2025

08/04 2025

![]() 699

699

By Zhou Xiongfei

Robotaxi is undeniably a promising venture.

This burgeoning industry continues to attract new players. Late last month, Tesla announced the launch of Robotaxi pilot operations in Austin, Texas, USA, enabling locals to experience Robotaxi services for just $4.2 by integrating its Model Y into the operation.

Almost concurrently, Hello unveiled the establishment of ZaoFu Intelligent Technology Co., Ltd. in collaboration with Ant Group and Contemporary Amperex Technology Co. Limited (CATL). The venture focuses on L4 autonomous driving technology research and development, safety applications, and commercialization, aiming to build a Robotaxi operation platform. This marks Hello's official entry into the Robotaxi industry.

It's worth noting that, unlike Tesla, which operates the Robotaxi business independently through its FSD-equipped vehicles, the entire Robotaxi industry may have embarked on an era of cooperation and alliance.

Since May this year, Uber has successively announced the integration of Robotaxi vehicles from autonomous driving companies such as Waymo, Momenta, Pony.ai, WeRide, and AutoX onto its platform. Additionally, Uber has invested in autonomous driving company Nuro and automaker Lucid, further solidifying its Robotaxi business strategy.

Turning our gaze to China, Ruqi Mobility recently announced the launch of the "Robotaxi+" strategy, expanding cooperation with local regulatory agencies, autonomous driving technology companies, and other ecosystem enterprises. This enables Robotaxi vehicles from different companies, utilizing diverse technical routes and models, to access the Ruqi Mobility platform for operations.

Ruqi Mobility's "Robotaxi+" strategy aims to accelerate the large-scale commercialization of Robotaxi. Source: Ruqi Mobility official account

Coupled with the "Spark" and "Galaxy" plans, Ruqi Mobility aims to enter 100 core cities over the next five years, collaborating with partners to build a Robotaxi fleet exceeding 10,000 vehicles. Simultaneously, it will establish a three-tier operation and maintenance network tailored for this large Robotaxi fleet, marking the industry's first operational infrastructure network focused on large-scale Robotaxi commercialization.

Based on these strategic layouts, Ruqi Mobility is poised to enable more global users to experience well-maintained, safe, and intelligent Robotaxi services. Consequently, in the industry's perspective, Ruqi Mobility has begun to resemble the "Chinese version of Uber" in the Robotaxi sector.

So, why do autonomous driving companies like Pony.ai and WeRide choose to cooperate and form alliances with mobility platforms like Ruqi Mobility and Uber?

The Robotaxi industry has shifted focus from the first half, which centered on technical validation and pilot operations, to the second half, which emphasizes large-scale commercialization.

To achieve this, the ability to operate on a large scale becomes pivotal. This capability enhances operational efficiency and service experience for large-scale fleets while reducing operational and service costs, thereby making large-scale Robotaxi commercialization feasible.

Moreover, the industry views vehicle hardware manufacturing, autonomous driving technology iteration, and user reach as essential components supporting large-scale Robotaxi commercialization. Considering these factors, mobility platforms like Ruqi Mobility and Uber are likely to emerge as core players capable of integrating these four capabilities.

Therefore, in the latter stages of the Robotaxi industry's evolution, players like Ruqi Mobility and Uber are poised to become incredibly significant.

A series of "friend circles" are emerging within the Robotaxi industry.

Since last year, autonomous driving companies have successively partnered with Uber. In September 2022, WeRide announced a strategic partnership with Uber to promote the launch of its Robotaxi vehicles on the Uber platform. This year, AutoX revealed plans to connect thousands of Robotaxi vehicles to the Uber platform.

Also this year, autonomous driving companies such as Pony.ai and Momenta announced strategic partnerships with Uber, all aiming to integrate their Robotaxi vehicles and services onto the Uber platform. Simultaneously, Uber is investing in the Robotaxi sector.

Source: Uber official website

On the 17th of this month, Uber announced a strategic partnership with Nuro and Lucid, investing hundreds of millions of dollars in these two partners to equip Lucid vehicles with Nuro's autonomous driving technology. The goal is to form a Robotaxi operation fleet within six years.

While Uber is constructing its Robotaxi "friend circle," Ruqi Mobility is also taking action.

Recently, Ruqi Mobility held a press conference to announce the official launch of the "Robotaxi+" strategy. In essence, they will leverage their platform operation capabilities to expand cooperation with local regulatory agencies, autonomous driving technology companies, and other ecosystem partners. This will enable Robotaxi vehicles with different technical routes, algorithms, and models to access the platform for operations.

At the press conference, Ruqi Mobility signed cooperation agreements with GAC Trading, GAC Energy, and strategic partners of Robotaxi assets from Guangzhou and Hangzhou. Additionally, Ruqi Mobility introduced the "Spark Plan," aiming to expand Robotaxi operations into 100 core cities over the next five years and build a Robotaxi fleet exceeding 10,000 vehicles in collaboration with partners.

This signifies that in the future, global users will be able to hail not only Ruqi Robotaxi but also Robotaxi vehicles from other autonomous driving companies and different models on the Ruqi Mobility platform. This larger-scale Robotaxi fleet will enable more global users to experience Robotaxi services.

Thus, in the industry's perspective, with more autonomous driving companies cooperating with Ruqi Mobility to bring more Robotaxi vehicles to the world, Ruqi Mobility has begun to resemble the "Chinese version of Uber" in the Robotaxi industry.

Numerous such "friend circles" exist within the Robotaxi industry.

For instance, Momenta has partnered with Enjoy Travel to plan the establishment of an L4 Robotaxi fleet in Shanghai. Geely's Intelligent Driving Center also intends to operate Robotaxi services on the CaoCao Mobility platform, aiming to launch customized Robotaxi services by 2026.

Apart from expanding the Robotaxi operation scale through cooperation within "friend circles," many players are actively constructing operational infrastructure for the Robotaxi industry.

Taking Ruqi Mobility as an example, they have launched the "Galaxy Plan," aiming to promote a billion-level investment plan over the next five years. This plan integrates resources from the upstream and downstream automotive supply chains, innovatively creating a three-tier operation and maintenance network for Robotaxi in 100 core cities. This includes Ruqi Robotaxi Quick Response Fields, Ruqi Robotaxi Maintenance Stations, and Ruqi Robotaxi Hub Centers, with an estimated total of 1,000 locations.

Based on this operational infrastructure, it can cover the entire chain of operational services for Robotaxi vehicles, from emergency parking, cleaning, and maintenance to intelligent vehicle diagnosis and treatment. This can be considered the industry's first operational infrastructure network focused on large-scale Robotaxi commercialization.

Source: Ruqi Mobility official account

Apart from Ruqi Mobility, players like Uber have also announced plans to establish operational service networks for charging, swapping, cleaning, maintenance, parking, and repair points.

From the above, it is evident that autonomous driving companies like Pony.ai and WeRide are collaborating with mobility platforms like Ruqi Mobility and Uber to form "friend circles." Simultaneously, these mobility platforms are rapidly deploying Robotaxi operational infrastructure networks.

The reason for these actions is that the Robotaxi industry has entered the latter stages of its evolution.

In recent years, the Robotaxi industry has entered a "boom period."

Currently, we can observe that Robotaxi vehicles from autonomous driving companies like AutoX, Pony.ai, and WeRide have achieved fully driverless commercial operations in cities such as Beijing, Shanghai, Guangzhou, Shenzhen, and Chongqing in China. Furthermore, these players' Robotaxi vehicles have been exported to overseas cities like the United Arab Emirates, Saudi Arabia, Singapore, and Switzerland for pilot operations.

From this perspective, these autonomous driving companies have navigated the first half of the industry, focusing on technical validation and commercial pilot operations.

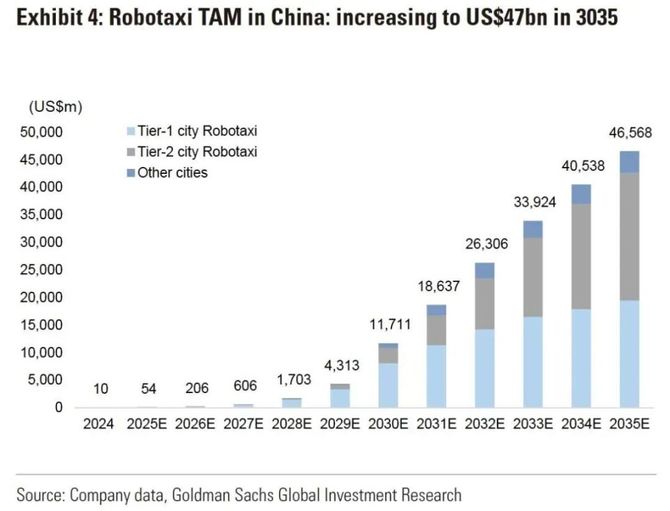

The second half of the industry will test players' ability to achieve large-scale commercialization, as the entire industry is progressing rapidly. According to Goldman Sachs' research report, the Chinese Robotaxi market is expected to grow from $54 million in 2025 to $47 billion in 2035, representing a 757-fold increase over ten years.

Forecast of the scale of China's Robotaxi industry. Source: Goldman Sachs

In response, autonomous driving companies have successively outlined their commercialization goals. For example, Peng Jun, co-founder and CEO of Pony.ai, predicts that the vehicle fleet size will enable the group to achieve break-even around 2028.

To meet their profit objectives, these players consider large-scale operational capabilities as a crucial factor in the industry.

Firstly, a large-scale fleet is necessary. In Peng Jun's view, the fleet size required to reach break-even is approximately 50,000 vehicles. Only when the Robotaxi fleet reaches a substantial scale can it satisfy the demand for more global users to experience Robotaxi services, thereby driving commercialization.

With the development of autonomous driving companies and the aggregation of Robotaxi vehicles from various autonomous driving companies by mobility platforms like Ruqi Mobility and Uber, the overall Robotaxi fleet size can be rapidly expanded to meet global demand for Robotaxi services.

After achieving large-scale Robotaxi fleet services, daily operational challenges for these vehicles emerge.

For instance, how to ensure that every vehicle in the fleet is in good condition with sufficient battery life, cleanliness, and safety? How to dispatch corresponding large-scale user service demands? How to handle user complaints and offline maintenance due to Robotaxi decision-making errors?

Source: Ruqi Mobility official account

To handle these operations effectively, significant costs will be incurred. According to Frost & Sullivan's "2024 China Robotaxi Industry In-Depth Research Report," the single-vehicle product investment for Robotaxi is around RMB 300,000, with annual maintenance costs of approximately RMB 50,000 and operating costs of approximately RMB 30,000. The safety redundancy cost for a single vehicle ranges from RMB 30,000 to RMB 100,000.

Additionally, the Robotaxi industry is heavily regulated. Robotaxi vehicles operating on the road must not only meet safety and compliance requirements under policy conditions but also satisfy the normal regulatory requirements of local governments for daily operations.

These operational issues will become more challenging as the Robotaxi fleet size expands. For this reason, in the view of former General Motors executive Mark Reuss, the development bottleneck of autonomous driving (Robotaxi) is not technology but operational capability.

"The core of Robotaxi mobility services lies in service density. If the service density is insufficient, the user experience will naturally be poor. Scalable operational capability is the key to realizing large-scale Robotaxi commercialization," Peng Jun once said.

Faced with these large-scale operational challenges, mobility platforms with extensive online car-hailing and Robotaxi operations have come up with solutions.

Taking Ruqi Mobility's aforementioned "Galaxy Plan" as an example, based on the three-tier operation and maintenance network for Robotaxi they have established, it can cater to the entire process of services for Robotaxi vehicles, from emergency parking, energy replenishment, and cleaning to intelligent diagnosis and treatment, operation scheduling, data storage, and maintenance. This is expected to form a comprehensive capability to support the offline operation and maintenance of 100,000 Robotaxi vehicles annually.

Han Feng, COO of Ruqi Mobility, stated that Ruqi Mobility will provide a comprehensive solution for scalable operations to all participants in Robotaxi commercialization. Source: Ruqi Mobility official account

Simultaneously, the Robotaxi Hub Center built by Ruqi Mobility, serving as a city's autonomous driving operation data platform, can also provide macro-indicator analysis such as vehicle coverage and safety accident rates. This provides data support for local regulatory agencies to formulate policies and enables Robotaxi to meet compliance requirements.

With the support of Ruqi Mobility's platform operation and operational infrastructure, it should be able to provide more global users with safe, comfortable, and intelligent Robotaxi services in the future, effectively reducing the overall operational costs of Robotaxi and improving operational efficiency.

Therefore, in the industry's perspective, Ruqi Mobility is at the forefront in terms of open cooperation on the Robotaxi platform and the construction of the Robotaxi operational service network.

Considering the intensifying competition in the Robotaxi industry, the latter half of the battle is poised to rigorously test players' systemic combat capabilities. Thus, large-scale operational prowess stands as just one crucial facet.

Firstly, for Robotaxi implementation, robust software and hardware technologies are indispensable. In terms of hardware, this encompasses perception suites, computing platforms, domain controllers, and more. Iterations in lightweight and integrated technologies centered around these components can substantially decrease the overall cost of Robotaxi vehicles.

For example, AutoX's sixth-generation model costs merely $29,000 (approximately RMB 200,000), marking a 60% reduction from the fifth generation. Pony.ai's seventh-generation Robotaxi boasts a 70% lower BoM cost compared to its predecessor, and WeRide's new GXR model also witnesses a cost reduction.

While hardware technology is vital, algorithm technology serves as the "cornerstone" for autonomous driving companies. Taking the aforementioned hardware iterations as an example, their foundation lies in the evolution of algorithms. The introduction of end-to-end and world models enhances algorithm intelligence and efficiency, enabling the use of fewer and smaller perception hardware to perceive the environment effectively.

Compared to L2 intelligent assisted driving, L4 autonomous driving sets a higher bar for safety. Hence, amidst industry cost reduction efforts, autonomous driving companies face stringent demands on their algorithmic capabilities.

Moreover, Tesla's entry into the Robotaxi industry is anticipated to ignite a fresh wave of algorithmic "arms race." Tesla deploys Robotaxi based on its FSD system leveraging pure vision technology, which the industry views as potentially more conducive to large-scale commercialization.

Tesla Robotaxi is now operational in Austin, USA. Image source: BBC

To develop autonomous driving technology-based products like Robotaxi, vehicles serve as the primary carrier. Like current mainstream Robotaxi offerings, they primarily result from collaborations between autonomous driving companies and OEMs, such as Luobo Kuaipao + FAW Hongqi, Pony.ai + Toyota, and WeRide + GAC Group.

However, the Robotaxi development model is transitioning from aftermarket modifications to factory-installed mass production. This approach significantly reduces manufacturing costs. According to CICC data, Luobo Kuaipao's RT6 costs 57% less than aftermarket models.

Beyond technology and manufacturing capabilities, once Robotaxi vehicles commence operations, operational and user capabilities become equally paramount. The importance of operational capabilities has been previously discussed and will not be reiterated here. A substantial user base has also emerged as a crucial factor.

To achieve large-scale Robotaxi commercialization, it's imperative to allow more ordinary users to experience Robotaxi services, fostering a stable user mindset and making Robotaxi travel a habit. This, in turn, reduces customer acquisition and overall costs through economies of scale.

Image source: Ruqi Travel official account

In this regard, Feishuozhixing believes that to attain large-scale Robotaxi commercialization, it's essential to forge a "hexagonal" warrior equipped with technology, manufacturing, operations, and user capabilities during the latter half of the industry battle.

From the broader Robotaxi industry perspective, autonomous driving companies or OEMs venturing into Robotaxi business may not possess all four capabilities. As Xiaopeng Motors CEO He Xiaopeng once noted, "In the future, we won't operate the Robotaxi business ourselves but will entrust it to travel companies for professional execution."

As previously mentioned, Ruqi Travel, with extensive Robotaxi operation experience and a vast user base, is currently aggregating more autonomous driving companies and industry chain ecosystem enterprises as platform partners. This strategy further bolsters its capabilities in autonomous driving technology and manufacturing.

Given Ruqi Travel's systematic investment and layout in the Robotaxi industry, Feishuozhixing predicts that they are likely to emerge as a key player in the latter half of the Robotaxi battle, accelerating the industry's journey towards large-scale commercialization. By then, China should gain a significant edge in the global autonomous driving competition.