Amazon’s Five-Year Gamble on the ‘Mobile Toaster’ Hits Vegas Roads, Introducing a New Contender to Take on Waymo

![]() 09/11 2025

09/11 2025

![]() 586

586

As a white, steering wheel-less box—resembling a “mobile toaster”—effortlessly weaves through the neon glow and bustling casinos of the Las Vegas Strip, the long-standing “duopoly” narrative in the U.S. self-driving taxi market is finally being rewritten.

On September 10, Amazon’s Zoox officially launched its robotaxi service in Las Vegas, marking the company’s first public debut since Amazon acquired it for $1.3 billion five years ago. This move signals Amazon’s direct challenge to Alphabet-owned Waymo, the current market leader.

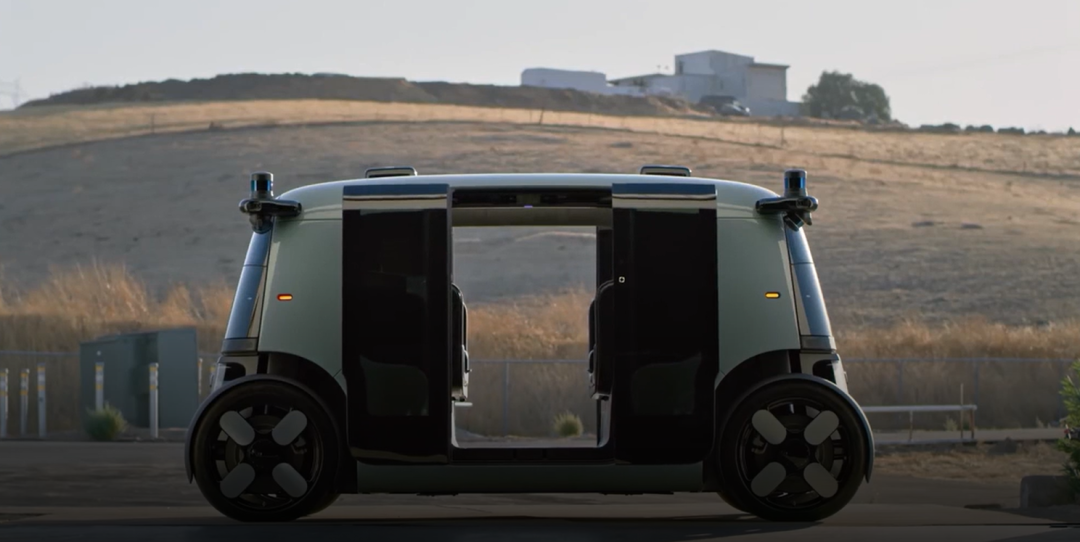

The ‘Unconventional’ Zoox: Built from Scratch, Not Retrofitted

From the start, Zoox has stood out as an outlier in the self-driving space.

While Waymo partnered with Chrysler and Jaguar to retrofit existing models with sensors and algorithms, and Tesla focused on refining its “Full Self-Driving” capabilities on its own EVs, Zoox’s co-founders—marketing veteran Tim Kentley-Klay and Stanford technologist Jesse Levinson—envisioned something entirely different in 2014: a “native” self-driving vehicle, not a traditional car retrofitted with an “autonomous brain.”

The result? The Zoox robotaxi now gliding through Las Vegas: steering wheel-free, accelerator pedal-free, with a rectangular frame, floor-to-ceiling windows, and two rows of face-to-face seating. More than a car, it resembles a “mobile living room.” Passengers need not worry about “front or back” seats—its symmetrical design and bidirectional wheels allow it to pivot sharply like a cat in Vegas’s crowded streets.

“You can cram self-driving tech into a traditional car, but it’s like putting a rocket engine on a bicycle—never optimal,” Levinson said in an interview. This philosophy underpins Zoox’s confidence. To achieve this “optimal solution,” Zoox even 3D-printed custom parts in its early days, rejecting any “compromise” retrofits—even if it meant commercializing five years later than Waymo.

Vegas Debut: Free Rides with a ‘Two-Pronged Strategy’

Zoox’s Las Vegas launch adopts a “steady” approach.

Currently offering free shuttles between five popular spots—Top Golf, Area15, and Resorts World Las Vegas—with plans to expand in the coming months. Vegas was chosen for its dense tourist traffic, steady demand, and lack of highway requirements for airport routes—avoiding complex road scenarios to highlight technical stability.

Russell James, a 68-year-old San Francisco resident and seasoned Waymo user, was among Zoox’s early testers. His first impression: “Spacious beyond belief.” “At 6’1”, I had to hunch in Waymo, but not in Zoox,” he said. He described the short resort loop as “boringly perfect”—no sudden brakes or sharp turns, like “a smarter airport shuttle.”

Behind the free rides lies Zoox’s dual strategy: building user trust and collecting real-world data while awaiting regulatory approval to charge fares. With Waymo already logging 10 million rides through paid services, Zoox’s “free-first, monetize-later” approach is the safest path to catch up.

Amazon’s Patience vs. Waymo’s Pressure

Zoox’s entry marks Amazon’s bold bet on “future mobility.”

Since acquiring Zoox in 2020, Amazon has granted it near-autonomy: keeping the core team intact, avoiding strategic interference, and investing billions in factories and fleets. In July, Amazon CEO Andy Jassy visited Zoox’s headquarters to offer support—a level of patience rarely seen in Amazon’s acquisitions like Whole Foods or One Medical.

Now, Zoox’s “payoff phase” is beginning: early passenger programs in San Francisco will launch by year-end, with tests in Austin and Miami underway. Its Hayward factory, currently producing one vehicle per day, will scale to three hourly (10,000 annually) at full capacity.

For Waymo, this spells “sweet trouble.” As the market leader, Waymo operates in five cities with plans for five more next year, boasting a 2,000-vehicle fleet—far exceeding Zoox. Yet Zoox’s “native design” could be a game-changer: its steering wheel-free “mobile box” offers a stronger “futuristic” appeal and better fits urban mobility needs than retrofits.

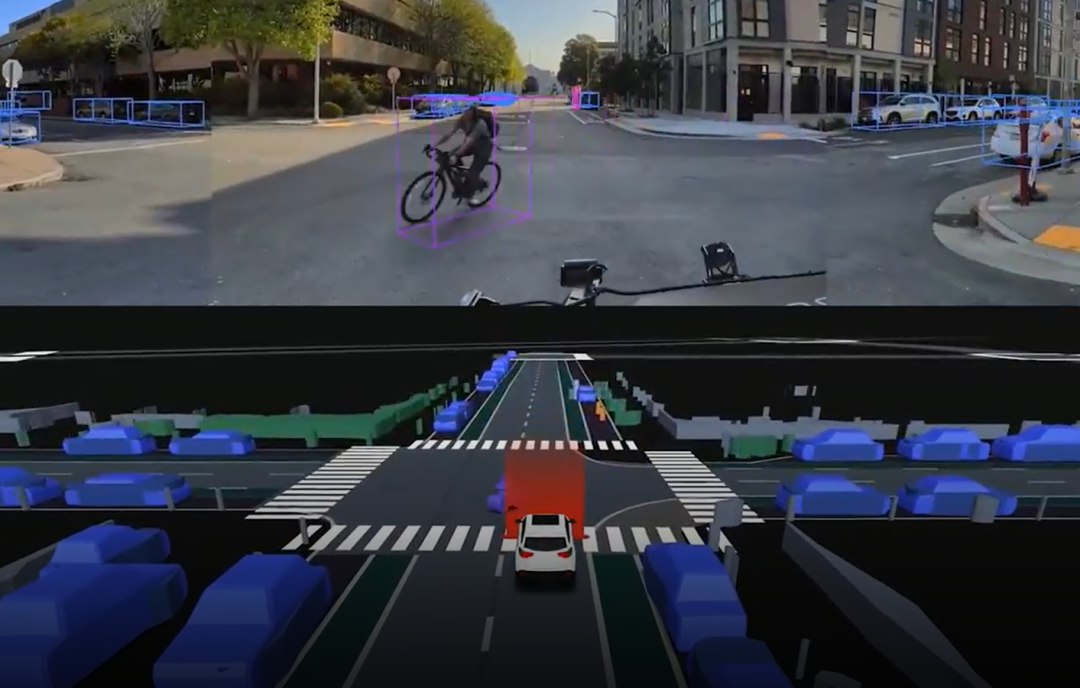

Challenges remain. In April, a Zoox self-driving vehicle collided with a private car in Las Vegas; in May, 270 vehicles were recalled due to software’s inability to predict other vehicles’ trajectories accurately. These incidents underscore a truth: safety is the “lifeline” of self-driving tech. Levinson is blunt: “We don’t need perfection, but we must be 10 times safer than human driving.”

The Race Tightens, but the Finish Line is Far

Zoox’s entry has turned the U.S. self-driving taxi market into a full-blown contest: Waymo leads the pack, Zoox charges in with Amazon’s backing, Tesla’s “semi-autonomous” tests continue in Austin, and traditional automakers lurk in the shadows.

Yet beneath the hype lies industry-wide “profit anxiety.” Telemetry analyst Sam Abuelsamid notes: “Building fleets, R&D, and licensing—every step burns cash. Profitability won’t arrive until 2030 at least.”

For Zoox, Las Vegas is just the “appetizer.” Next, it must overcome Waymo’s first-mover advantage, regulatory uncertainties, and user trust barriers toward “steering wheel-less cars.” But Amazon’s patience and Zoox’s “native design” focus may help it find its rhythm in this marathon.

Like Las Vegas always welcoming new casinos, the self-driving race never lacks fresh contenders. The survivors will be those who patiently refine their tech and wait for market maturity. Zoox and its “mobile toaster” are clearly in it for the long haul.