Shenzhen's "20+8" Industrial Clusters and the Landscape of Foreign-Invested Enterprises

![]() 05/14 2025

05/14 2025

![]() 1132

1132

Shenzhen, a pioneer in China's reform and opening-up process, has long been a magnet for foreign investment, now aiming to solidify its position as the "premier destination for global investors".

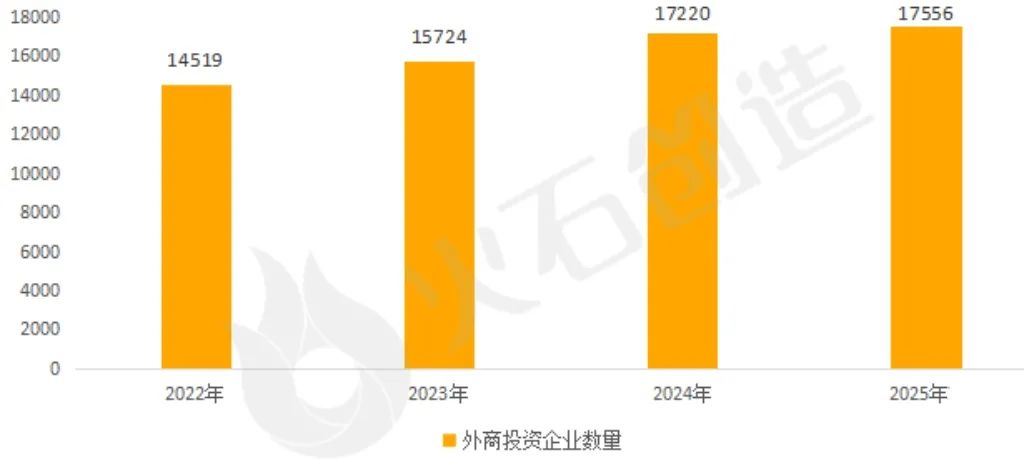

According to the Firestone Industrial Data Center, the number of foreign-invested enterprises in Shenzhen has been steadily increasing. As of March 31, 2025, Shenzhen was home to over 17,500 foreign-invested enterprises (solely those registered as such in industrial and commercial records). Among them, 77 are listed companies, 9 are among China's Top 500 enterprises, 9 are unicorn companies, 80 are specialized and innovative small giants, and 646 are high-tech enterprises.

Figure: Number of Foreign-Invested Enterprises in Shenzhen Over the Past Three Years

Source: Firestone Industrial Data Center

[Note]: The scope of foreign-invested enterprises mentioned in this article encompasses those registered as "foreign-invested" in industrial and commercial records.

01

Profile of Foreign-Invested Enterprises

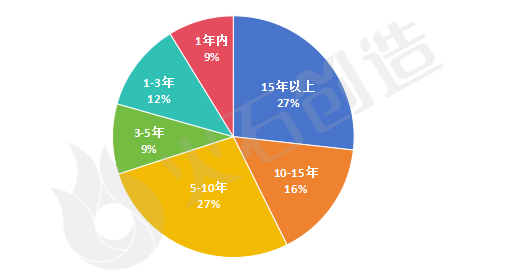

1. Establishment Years Distribution: Foreign-invested enterprises in Shenzhen show a concentration among those established between 5-10 years ago, totaling nearly 4,800. Closely following are enterprises with over 15 years of establishment, approaching 4,700. Comparatively, there are fewer foreign-invested enterprises that have been established within the past year.

Figure: Distribution of Years of Establishment for Foreign-Invested Enterprises in Shenzhen

Source: Firestone Industrial Data Center

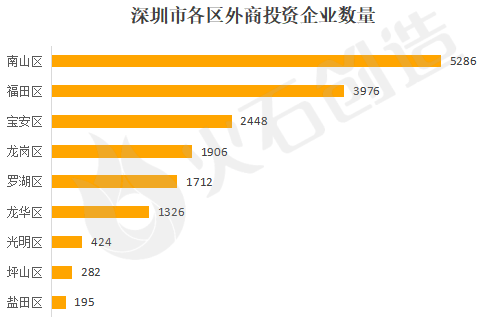

2. Regional Distribution: Foreign-invested enterprises in Shenzhen exhibit pronounced regional clustering. Nanshan District leads with over 5,000 enterprises, accounting for 30.1% of the city's total. Futian District follows closely with 3,976 enterprises (22.6%), leveraging its status as a financial hub and mature business environment to attract numerous multinational corporate headquarters and service agencies. Bao'an (2,448 enterprises), Longgang (1,906 enterprises), and Luohu (1,712 enterprises) constitute the second tier, benefiting from advanced manufacturing industry chains, electronic information clusters, and traditional trade advantages (Luohu Port economy), respectively.

Figure: Number of Foreign-Invested Enterprises in Various Administrative Regions of Shenzhen

Source: Firestone Industrial Data Center

02

Distribution of Foreign-Invested Enterprises Across Key Industries

In 2022, the Shenzhen Municipal Government issued the "Opinions on Developing and Strengthening Strategic Emerging Industrial Clusters and Cultivating and Developing Future Industries," emphasizing the cultivation of 20 strategic emerging industrial clusters and 8 future industries.

Figure: Shenzhen's "20+8" Industrial Clusters

Source: Firestone Creation based on public information

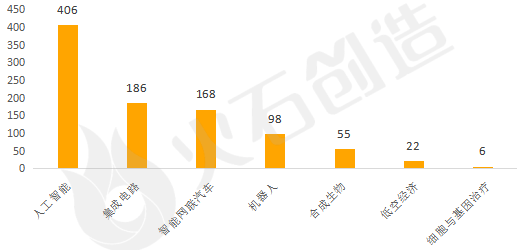

Broadly speaking, sectors attracting significant foreign investment include the digital economy (over 2,300 enterprises), new materials (over 800 enterprises), biopharmaceuticals (nearly 800 enterprises), and new energy (nearly 700 enterprises). Additionally, nearly 300 foreign-invested enterprises are concentrated in the high-end manufacturing sector. From a segmented perspective, fields like artificial intelligence, integrated circuits, and intelligent connected vehicles boast a higher number of foreign-invested enterprises, while cutting-edge areas such as cell and gene therapy, the low-altitude economy, and synthetic biology have fewer foreign investors.

Figure: Distribution of Foreign-Invested Enterprises in Selected Key Industries in Shenzhen

Source: Firestone Creation based on public information

—END—

Author | Firestone Creation, Weng Jianping, Wang Juan

Review | Firestone Creation, Yin Li