7-Fold Surge in Robotics Stock: Executives and Shareholders Cash Out Amid Institutional Frenzy—Whom Should Investors Trust?

![]() 09/30 2025

09/30 2025

![]() 553

553

A Dark Horse Emerges in China's A-Share Humanoid Robot Sector

Since hitting a low in September 2024, Zhejiang Rongtai's stock price has skyrocketed by over 700%, making it the second-most volatile stock in the sector, trailing only SWANCOR. The question remains: How long can this capital-driven frenzy endure?

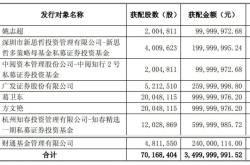

【Institutional Clustering vs. Shareholder Reduction】

Prior to the surge, Zhejiang Rongtai's stock had nearly halved, with valuations plummeting to 13 times earnings. Unexpectedly, within a year, it transformed into the sector's second-most volatile stock.

This meteoric rise is attributed to a confluence of factors.

Starting in late September 2024, China's A-shares staged a strong rebound, with technology stocks leading the charge. Humanoid robots, on the cusp of commercialization, were heavily hyped—sector indices surged over 160%, reaching all-time highs.

Leveraging this trend, Zhejiang Rongtai reversed its downward trajectory.

Crucially, institutional investors, spearheaded by public funds, aggressively flocked to the stock. By the first quarter of 2025, public funds held a 16.9% stake in Zhejiang Rongtai, up 14.7 percentage points quarter-on-quarter, making it the top robotics stock for fund inflows.

By the end of the second quarter, nearly 200 funds held approximately 55 million shares, with their positions surging over 60% sequentially.

As the stock soared and valuations climbed, major shareholders seized the opportunity to cash out at peak levels.

In June, Yibin Chendao New Energy, backed by CATL, reduced its stake by nearly 1%, dropping from the third-largest to the fifth-largest shareholder.

In early September, director and CEO Zheng Minmin cashed out over RMB 92 million. Additionally, former eighth-largest individual shareholder Dai Dongya recently offloaded nearly RMB 100 million worth of shares.

With institutions aggressively clustering and shareholders reducing their stakes, whom should investors trust?

【Entering Tesla's Supply Chain】

Tesla CEO Elon Musk predicted that by 2040, humanoid robots would outnumber humans at 10 billion, potentially reaching 30-50 billion. He also claimed that the long-term value of Optimus could dwarf Tesla's automotive business, supporting a market capitalization of $25 trillion.

This grand narrative fuels market imagination, justifying the sky-high valuations for robotics stocks like Zhejiang Rongtai.

However, Zhejiang Rongtai entered the humanoid robot sector relatively late.

In April 2025, it acquired a 51% stake in Shanghai Diz Precision Machinery for RMB 400 million, marking its foray into the sector.

Under the agreement, Diz Precision's founding shareholders committed to achieving cumulative net profits of RMB 70 million (2025-2027), with annual targets of RMB 8 million, RMB 27 million, and RMB 35 million. Meeting these targets would significantly boost Zhejiang Rongtai's earnings.

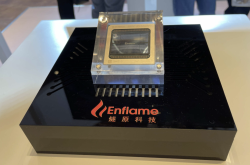

However, the market's focus lies on Diz Precision's technological prowess. Before mass production, technical capabilities are paramount, overshadowing branding and commercialization efforts.

Diz Precision has achieved C1-grade precision in miniature screw manufacturing (≤3mm diameter). In contrast, earlier entrants like Shuanglin Group have mastered C2-grade technology, while Zhenyi Technology achieves C3 and C5 grades. Screw precision directly impacts robotic transmission accuracy and stability—lower numbers indicate higher precision.

Screws are among the most technically demanding and valuable components in humanoid robots. Eastmoney Securities estimates that screws account for 16% of Optimus's total cost, with gross margins exceeding 60%, far higher than motors, reducers, or sensors. The low domestic production rates further fuel capital enthusiasm.

Beyond its leading technology, Diz Precision leveraged Zhejiang Rongtai's Tesla partnership in new energy vehicles to secure a spot in Optimus's supply chain.

Diz Precision's planetary roller screws are undergoing testing for Optimus Gen3, with small-batch deliveries expected in the fourth quarter of 2025. Its miniature ball screws will also feature in Optimus Gen3's dexterous hands, with Tesla's third-gen robot increasing miniature screw usage per hand by 5-10 units, boosting unit value.

Securing a spot in Tesla's supply chain is critical for competing in the robotics market.

China's humanoid robot sector is still in its infancy, with leaders like Unitree, Huawei, Zhiyuan, and Tiangong concentrated in Zhejiang, Guangdong, Shanghai, and Beijing. Overseas, Tesla Optimus and Figure dominate.

Optimus is seen as a formidable rival to Chinese leaders. Partnering with it offers compelling capital stories and valuation multipliers.

Notably, Musk has refocused on Tesla's AI and robotics divisions in recent months, accelerating Optimus's production. Rumors suggest a 2026 production target of 50,000-500,000 units.

Despite Tesla's automotive struggles, its stock has rallied to near all-time highs. This backdrop fueled a September surge in A-share robotics stocks like Zhejiang Rongtai.

【Chasing Trends】

Most A-share robotics stocks originated in the new energy vehicle sector. Only those with strong main businesses sustaining robotics investments command higher valuations.

Zhejiang Rongtai is no exception.

Founders Ge Tairong and his wife have a history of "chasing trends."

Before 2003, they ran a successful woolen sweater business. Later, they established a village collective enterprise, "Jiaxing Rongtai Electrical Materials Factory," in Fengqiao Town, Zhejiang—the precursor to Zhejiang Rongtai.

Initially a small-scale, low-tech mica products maker for home appliances, the company struggled as a rural workshop. As global appliance supply chains shifted to China and local brands rose, Zhejiang Rongtai secured clients like Midea, Panasonic, Samsung, and Whirlpool.

However, the home appliance mica market offered limited growth potential.

In 2013, the Ge couple pivoted to the new energy sector, developing fireproof insulation for electric vehicles. This marked a turning point.

Zhejiang Rongtai entered supply chains for Tesla, Volkswagen, BMW, and Volvo, becoming a key supplier of thermal runaway insulation.

With the global EV boom, its revenue and net profit compound annual growth rates (CAGRs) reached 32.8% and 67.8% (2020-2024), respectively, with net margins exceeding 20%.

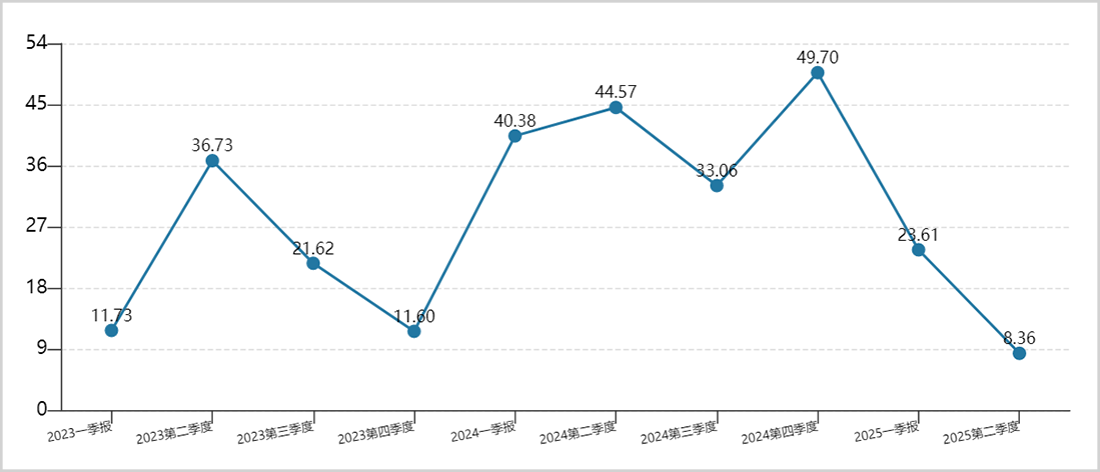

But growth slowed in 2025. Second-quarter revenue grew just 8.4%—the lowest since financial disclosures began—while net profit growth dropped to 18%.

▲ Quarterly Revenue Growth Hits Record Low. Source: Wind

At this critical juncture, the Ge couple entered the humanoid robot sector, securing Tesla's supply chain.

Without robotics, Zhejiang Rongtai's valuation as an auto parts supplier might hover at 20-30 times earnings. Its current 150-plus times price-to-earnings (P/E) ratio reflects market hopes for robotics.

However, its robotics market share and performance remain uncertain. Tesla screw orders face fierce competition from domestic firms like Beite Technology, Best, Jiangsu Leili, and Wuzhou New Spring.

Moreover, Zhejiang Rongtai benefits from the tech rally, but market rotations could expose its high valuations if capital shifts to low-valuation sectors like cyclicals or consumer goods.

Billionaire investor George Soros once said, "To make wealth, identify illusions, invest in them, and exit before the public catches on."

Today, valuations for Zhejiang Rongtai and other robotics leaders may far outpace industrial realities.

Perhaps pausing and reassessing is the wise choice.

Disclaimer

This article contains personal analysis and judgments based on publicly disclosed information (e.g., interim announcements, periodic reports, official interaction platforms) from listed companies. The information or opinions herein do not constitute investment or business advice. Market Cap Observer assumes no liability for actions taken based on this article.

——END——