Samsung Electronics: Advancing with Momentum

![]() 10/02 2025

10/02 2025

![]() 626

626

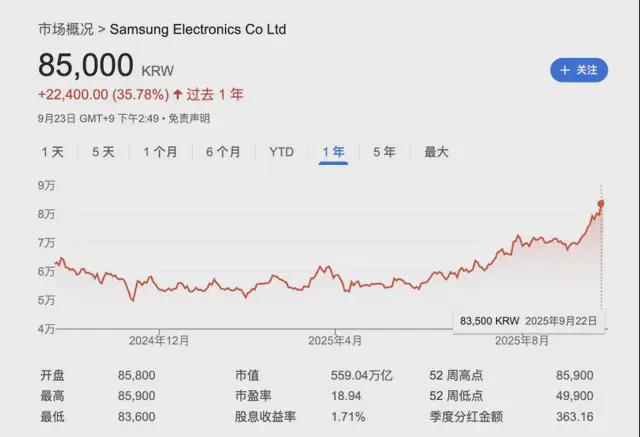

On September 22, Morgan Stanley issued a bullish forecast for the memory sector, highlighting the emergence of a global shortage in memory semiconductors. Based on this analysis, the firm designated Samsung Electronics as its top pick, raising its target price to 96,000 Korean won per share—a 12% increase from its previous target of 86,000 Korean won.

From a data standpoint, the memory market has shown a consistent upward trajectory since the latter half of 2025. By the end of September, constrained supply conditions prompted Samsung to significantly hike prices for its DRAM and NAND flash memory products, with certain items experiencing increases as high as 30%. Additionally, recent reports confirm that Samsung's fifth-generation high-bandwidth memory (HBM) product, the HBM3E 12-layer stack, has successfully cleared Nvidia's rigorous quality testing. Following this announcement, Samsung's stock price soared to a new annual peak.

In May 2025, Samsung Electronics activated a crisis contingency plan, securing a $7.27 billion credit line with South Korean commercial banks. Throughout the latter half of the year, the company has made strategic moves across the memory market, semiconductor processes, mobile processors, next-generation flagship phones, and foldable devices.

01

Memory Chips: A Glimmer of Hope on the Horizon

In the first quarter of 2025, SK Hynix overtook Samsung Electronics as the global leader in DRAM revenue, capturing a 36% market share. By the second quarter, SK Hynix's storage sales reached 21.8 trillion Korean won, surpassing Samsung's 21.2 trillion Korean won to claim the title of the world's largest storage manufacturer.

Leveraging its technological edge in HBM products, SK Hynix experienced rapid business growth. Conversely, Samsung Electronics faced a bottleneck when its products initially failed Nvidia's certification. However, Samsung's 12-layer HBM3E passing Nvidia's rigorous tests and preparing for shipment marks a significant milestone for its memory business.

Beyond securing a spot in Nvidia's supply chain, Samsung Electronics also announced the completion of internal HBM4 development, with plans to integrate it into Nvidia's "Rubin" AI accelerator slated for release in 2026. This move signals Samsung's full-fledged entry into the competitive AI chip memory market, where it aims to catch up with SK Hynix.

According to TrendForce data released on September 24, the average spot price for DRAM commodity products (DDR4 8GB) reached $5.87 in August, setting a new annual high, compared to just over $1 at the beginning of 2025. The rising memory chip prices have fueled industry optimism about Samsung's performance. Korean analysts predict that both Samsung Electronics and SK Hynix are poised for "surprising" third-quarter results. FnGuide forecasts Samsung's third-quarter operating profit at 9.6687 trillion Korean won, with SK Hynix expected to reach 10.7175 trillion Korean won.

This projection also suggests that SK Hynix is likely to maintain its profit lead in the third quarter. For Samsung to reclaim its top position, it must ensure a stable supply of HBM products.

02

Chip Manufacturing: A Future Full of Promise

In September, the Texas state government announced a $250 million allocation from its Semiconductor Innovation Fund to support Samsung Electronics' advanced-process logic wafer fab under construction in Taylor, Texas. This investment brings Samsung's total state government assistance to $520 million.

Samsung's Taylor wafer foundry, which began construction in 2021, is scheduled to start production in 2026. The facility will produce cutting-edge 2-nanometer semiconductors for next-generation technologies such as 5G, artificial intelligence, and high-performance computing.

In terms of foundry customers, Samsung has secured new orders for both its 2nm and 7nm processes.

For the 2nm foundry business, Samsung has inked a $16.5 billion foundry agreement with Tesla to manufacture its AI6 chips at the Taylor facility. Tesla founder Elon Musk shared on social media on September 7, stating, "Had a fantastic design review with the Tesla AI5 chip design team. This will be an epic chip, and the upcoming AI6 is expected to be the best AI chip ever." Tesla's AI5 chips are currently manufactured by TSMC. If Samsung can successfully deliver on the AI6 chip foundry task, it will mark a significant achievement in its long-standing competition with TSMC in advanced processes.

For the 7nm foundry business, Samsung recently secured an order for IBM's Power11 processor. The Power11 utilizes Samsung's enhanced 7-nanometer EUV lithography process (7LPP EUV) combined with 2.5D ISC advanced packaging technology, delivering a 23% performance boost and a 45% reduction in power consumption compared to the previous generation.

However, a Morgan Stanley report noted that Samsung Electronics' win of the Tesla order is expected to have only a 1% impact on TSMC's revenue, indicating that Samsung still has a long road ahead in the foundry market.

Beyond its advanced process endeavors, Samsung has recently unveiled its plans for silicon carbide chips.

Steven Hong, Business Head and Executive Vice President of Samsung's Composite Semiconductor Solutions Team, stated at a Busan conference that Samsung aims to commercialize silicon carbide chips "as soon as possible." Samsung established the CSS department in late 2023, focusing on developing 8-inch silicon carbide devices, surpassing the current industry standard of 6-inch wafers. However, Samsung Electronics has yet to provide a specific timeline for the commercialization of its silicon carbide products.

Regarding Samsung's silicon carbide strategy, analysts believe that Samsung Electronics still lags behind its competitors in technological readiness. They also pointed out that Samsung appears to be prioritizing its 8-inch gallium nitride foundry, which may not be ready for commercial use until after 2026. Consequently, Samsung's commercialization path for third- and fourth-generation semiconductors remains uncertain.

A critical question looms over Samsung Electronics' wafer manufacturing business: Will the strategy of simultaneously pursuing traditional silicon-based chips and third-generation semiconductors risk diluting its resources?

03

Electronics: Navigating Uncertainty

In 2024, Samsung Electronics reported total annual revenue of 300.9 trillion Korean won. Within the consumer electronics sector, mobile business sales reached 114.4 trillion Korean won, up 5% year-on-year, while visual display business sales declined 6% year-on-year to 29.2 trillion Korean won. From a revenue composition perspective, consumer electronics remain a vital income stream for Samsung, accounting for approximately 47.7% of its total revenue.

Ideally, Samsung Electronics could achieve a seamless closed loop by incorporating chips produced in its own factories into its products, granting Samsung's consumer devices significant cost advantages. So, how are Samsung's chips being utilized in its products?

The reality is that Samsung Electronics' self-developed mobile chips have been absent from the Chinese mainland market for a decade. It wasn't until 2025, when Samsung launched the Galaxy Z Flip 7 equipped with its self-developed 3nm chip, Exynos 2500, that this situation changed. Factors such as computing power, power consumption, and performance have hindered Samsung from breaking free from Qualcomm's Snapdragon ecosystem.

Samsung is anticipated to unveil a triple-fold smartphone at the end of September. According to reports, the device will feature a dual inward-folding design and utilize ultra-thin hinges to enhance durability. The display is expected to measure 10.2 inches when fully unfolded, 7.9 inches when folded on one side, and 6.4 inches when fully folded.

Korean media predict that production volumes for this model will be limited to between 50,000 and 100,000 units. The phone's price is expected to surpass that of the existing Galaxy Z Fold and Flip models, hovering around 3 million Korean won (approximately $2,150). However, reports suggest that this triple-fold phone will likely be powered by Qualcomm's Snapdragon 8 Gen 3 Elite processor.

Beyond the triple-fold phone, Samsung's Unpacked event at the end of the month is also expected to showcase an XR headset and AI glasses. Notably, industry predictions indicate that Samsung's XR device will utilize Qualcomm's Snapdragon XR2+ Gen 2 chipset and run on the Android XR platform, jointly developed by Samsung, Google, and Qualcomm, along with Google's proprietary Gemini AI model.

Overall, Samsung Electronics' core competitiveness in the consumer market does not appear to stem from groundbreaking innovation. Instead, its competitiveness is more rooted in its established brand strength and loyal user base in South Korea. Faced with Chinese manufacturers closing the gap in terms of quality, innovation, pricing, and cost efficiency, Samsung Electronics encounters substantial pressure in the consumer market.

04

The Dual Nature of "Adaptability"

For Samsung Electronics, its once-expansive business布局 (layout) now poses a current challenge.

In December 2021, Samsung Electronics merged its Consumer Electronics and IT & Mobile Communications divisions, appointing the Samsung Electronics CEO to oversee the chip business as well. This move marked Samsung's most significant organizational restructuring since 2017, followed by multiple senior management reorganizations.

In 2023, Samsung Electronics established an Artificial Intelligence Center to proactively respond to the transformative changes in the AI era.

In 2024, the DS (Device Solutions) division underwent extensive organizational restructuring in areas such as HBM memory and AVP advanced packaging, establishing an HBM capacity and quality improvement team dedicated to HBM4 development.

In November 2024, Samsung Electronics announced its 2025 organizational restructuring plan. The memory business was elevated to a CEO-direct department, and the head of the DS division's Foundry business unit was replaced.

From this adjustment trajectory, it is evident that Samsung Electronics continues to concentrate its business efforts on its core memory business. Meanwhile, from a historical perspective, Samsung Electronics' significant competitiveness lies in its ability to swiftly adapt its business strategies. This agility can largely compensate for its lag in technological innovation.

For instance, to expedite the iteration of memory products, Samsung Electronics signed a patent licensing agreement with a Chinese memory chip company to develop "hybrid bonding" technology essential for stacking over 400 layers of NAND Flash. This enables Samsung to commence manufacturing using this patented technology from its 10th-generation (V10) NAND Flash products (430 layers). Rather than "working in isolation," this Korean company prefers to swiftly enter production rhythms and exchange time for market share. Those familiar with Samsung Electronics' history in the memory market will recognize that this operational style is quintessentially "Samsung-like."

According to the latest memory semiconductor data released by Counterpoint Research on September 24, SK Hynix led the HBM market in the second quarter with a 62% market share. Micron Technology ranked second with a 21% share, while Samsung Electronics placed third with a 17% share.

However, Counterpoint also predicts that with Samsung Electronics' HBM products entering Nvidia's supply chain, its future market share in HBM is expected to surpass 30%.

Learning rapidly and replicating quickly, the "adaptable" Samsung Electronics remains acutely perceptive in the memory industry.