Reaching the IPO Threshold: China's Large Language Models Finally Take Stock

![]() 12/30 2025

12/30 2025

![]() 418

418

As the hype of the 'thousand-model war' fades, China's large language model industry is entering a pivotal transition from 'scale competition' to 'commercialization breakthroughs.'

By late 2025, Zhipu and MiniMax had submitted their prospectuses, officially kicking off the race to become the first large language model company to go public. Both companies' financial positions were fully disclosed for the first time. Zhipu has begun its share offering, expected to conclude on January 5, 2026, with plans to list on the Hong Kong Stock Exchange's main board under the stock code '2513' on January 8, 2026.

The financial reports of these two companies reveal two distinct business paths. Zhipu focuses on government and enterprise sectors, aiming to build technical service barriers amid the trend of domestic substitution. MiniMax, on the other hand, bets on the global consumer market, striving to balance user growth and computing power consumption.

Despite their different approaches, both companies face a common industry challenge: in the traditional internet era, scale meant cost dilution; but in the large language model era, every invocation incurs expensive computing fees. When the law of diminishing marginal costs fails, how can large language model companies achieve profitability?

By dissecting the two prospectuses, we aim to uncover the true realities behind Zhipu and MiniMax's high growth and high losses. Their successes and failures will provide crucial insights for the industry's next phase.

I. Diverging Paths Before Going Public

Reading the prospectuses of MiniMax and Zhipu, it's hard to classify them as the same type of company.

Zhipu AI is a typical B2B company, with revenue long concentrated in localized deployments, accounting for about 85% in recent years. Cloud-based business increased from 4.5% in 2022 to 15.2% in the first half of this year.

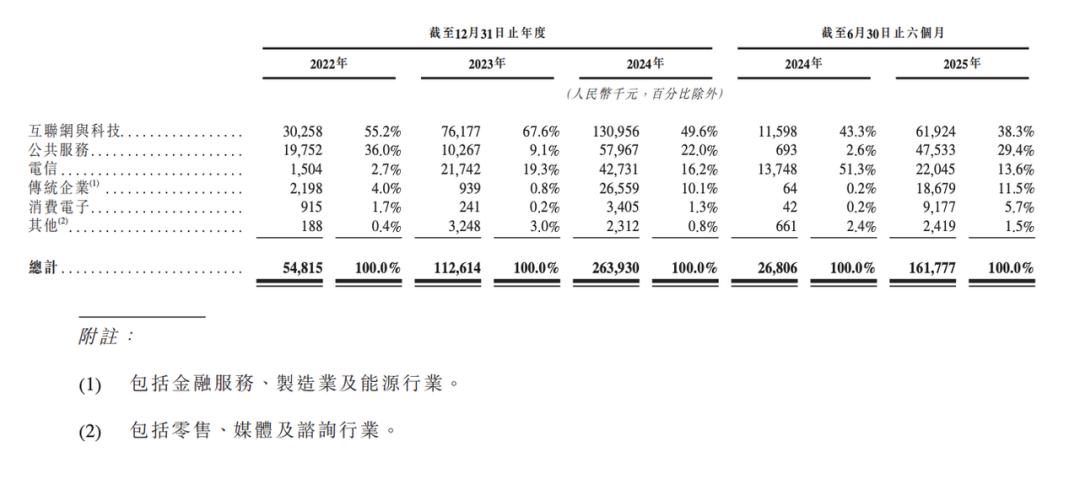

It heavily relies on large clients, including internet and tech companies, and public service departments. The number of institutional clients grew from 48 in 2022 to 3,156 in the six months ending June 30, 2025. The largest client accounts for over 10% of total revenue, while the top five clients consistently contribute over 40%.

From a client structure perspective, internet and tech companies are Zhipu's largest revenue source but face declining revenue share risks.

Their primary applications include office software (e.g., document generation), operational data analysis, and creative platforms—early and easily implementable commercial scenarios for large language models. However, these clients also have the strongest intent and most mature technical capabilities to develop their own models.

The revenue share from this client type rose from 55.2% in 2022 to 67.6% in 2023 before declining to 49.6% in 2024 and further to 38.3% in the first half of 2025.

The Economic Observer quoted a source close to Zhipu's management, stating that Zhipu's AI large language models were 'very easy to sell' in 2022, with models priced at tens of millions of yuan. Companies like Meituan and 360 purchased them. This drove Zhipu's revenue surge in 2022, but by 2023, amid the 'thousand-model war,' selling models at such prices became difficult.

In contrast, public service and telecom clients' share increased. In the first half of 2025, public service clients accounted for nearly 30% of revenue, while telecom remained at 13.6%.

MiniMax resembles an internet company, with primary revenue from AI-native products through user subscription services, rising from 21.9% in 2023 to 71.4% this year. Another revenue stream comes from open platforms and other AI-based enterprise services, which declined from 78.1% early on to 28.9% in the first nine months of 2025.

MiniMax's AI product user base grew rapidly, with monthly active users surging from 3.1 million in 2023 to 27.6 million today. Paid users increased from about 120,000 in 2023 to 1.77 million in September 2025.

Hailuo AI, launched in early 2023, saw rapid user growth after adding video generation features in September 2024. In 2024, the AI companion app Talkie contributed nearly 63.7% of revenue, while the video generation model Hailuo AI accounted for 7.7%. By the first three quarters of 2025, Hailuo AI's share rose to 32.6%, joining Talkie as dual revenue pillars, together contributing over 60% of revenue.

These differences were predetermined at their origins.

Zhipu originated from Tsinghua University's Knowledge Engineering Laboratory. Founded in 2019, its founders, Zhang Peng and Tang Jie, have strong computer science academic backgrounds, giving the company a scholarly and engineering-driven focus. In contrast, MiniMax, founded in 2021, is more industry-oriented. Its founder, Yan Junjie, a former SenseTime vice president, leads a team with mature commercialization and product launch experience, emphasizing market feedback and application efficiency from the start.

II. High Growth and High Losses

Despite differing business paths, Zhipu and MiniMax share similar financial profiles: both are experiencing high growth, high investment, and high losses.

Zhipu's revenue grew from 57.4 million yuan in recent years to 312 million yuan in 2024, further increasing to 191 million yuan in the first half of the year, a year-on-year increase exceeding 300%. However, adjusted net losses widened from 97.417 million yuan in 2022 to 1.752 billion yuan in the first half of 2025.

MiniMax also maintained rapid growth, with revenue rising from 3.5 million USD in 2023 to 30.5 million USD in 2024, reaching 53.4 million USD in the first three quarters of 2025. Meanwhile, adjusted net losses expanded from 12.2 million USD in 2022 to 186.3 million USD in the first three quarters of 2025.

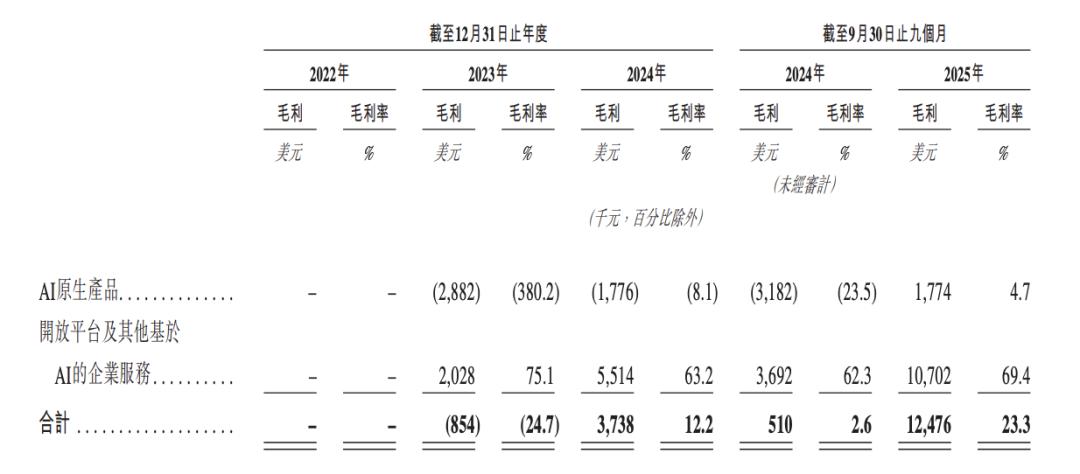

Gross margin performance reveals the profitability challenges of their business models.

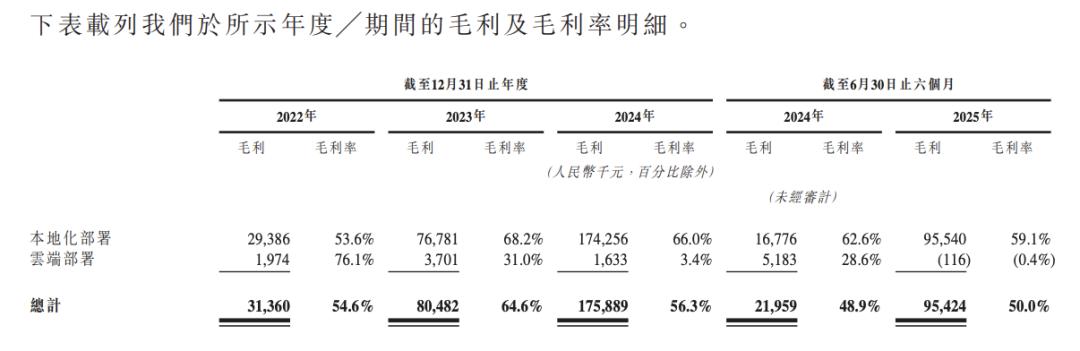

Zhipu's overall gross margin was 54.6% in 2022, 64.6% in 2023, and 56.3% in 2024. It dropped to 50.0% in the first half of 2025 due to cloud-based business drag. Localized deployments remain its profit moat, with gross margins consistently above 50%, reflecting the high premium of private deployments for government and enterprise sectors.

However, Zhipu's cloud deployment gross margin plummeted from 76.1% in 2022 to -0.4% in the first half of 2025, indicating operational losses in the public cloud standard product market.

MiniMax's gross margin showed a clear U-shaped reversal, turning from -24.7% in 2023 to 23.3% in the first nine months of 2025. Despite overall improvement, AI-native products (Hailuo AI, Talkie), contributing over 70% of revenue, had a gross margin of only 4.7%. This reflects that consumer product commercialization levels are far from covering computing and other costs. Combined with high overseas user acquisition costs, MiniMax remains far from profitability.

Both companies validate a commonality across different business models: growth requires heavy investment, especially in R&D. Over the past three and a half years, Zhipu and MiniMax accumulated R&D investments of 4.4 billion yuan and 500 million USD (about 3.5 billion yuan), respectively.

R&D spending primarily covers computing service fees and researcher salaries. In the first half of this year, Zhipu allocated 1.1 billion yuan to computing in R&D, while MiniMax spent 140 million USD (about 987 million yuan) in the first three quarters.

Unlike traditional internet industries, where user scale expansion leads to diminishing marginal costs, large language model businesses exhibit a different structure: more users and frequent invocations increase inference computing consumption, with costs rising alongside scale.

The shared challenge for both companies is reducing inference costs through technological iteration or finding high-premium applications to cover costs, given rigid computing expenses.

From a unit economics perspective, neither company has achieved a profitable closed loop (closed loop). MiniMax's low gross margins for AI-native products indicate that the ratio of customer lifetime value (LTV) to customer acquisition cost (CAC) remains unhealthy—faster user growth accelerates cash burn.

Zhipu can transfer some computing costs to clients through localized deployments, but its project-based delivery model limits exponential scale expansion, imposing an implicit 'growth ceiling.'

This dilemma explains why IPOs are critical for both companies. In the long-term race for artificial general intelligence, competitors like OpenAI possess strong technological reserves, capital, and talent advantages. Firms must secure resources in advance to ensure operational flexibility for the next technological breakthrough or market expansion. IPOs are essentially about stockpiling ammunition for future strategies.

III. From Burning Cash on R&D to Scrambling for Revenue

This year, the competitive focus of China's large language model industry is shifting.

Early on, firms built advantages through parameter upgrades and technological iteration, rapidly scaling model sizes. However, as financing scales expanded and losses mounted, technological leadership alone could no longer sustain high valuations. Commercialization efficiency has taken center stage.

Given high computing costs, the core question is whether growth can translate into real profits as the industry enters a new phase. Zhipu and MiniMax have chosen nearly opposite paths to address this.

For Zhipu, the focus is not on user scale but securing substantial cash flow through high-priced, localized deployment orders. It has demonstrated strong B2B competitiveness, with client numbers growing from 48 in 2022 to 123 in 2024, and annualized average contract value rising from 1.14 million yuan to 2.15 million yuan.

Its Tsinghua affiliation and full autonomy over the GLM large language model framework grant it inherent trust advantages in domestic substitution and government security sectors.

Localized deployments not only maintain gross margins above 50% but also allow partial transfer of computing costs to clients through project quotes. This explains its client structure shift toward public services and telecoms—sectors with stronger payment capabilities, longer project cycles, and lower sensitivity to model advancement.

However, this path has clear trade-offs. The government and enterprise market has inherent growth limits, and project-based delivery restricts exponential scale expansion. Zhipu's future challenge lies in transforming localized deployment experience into standardized, lighter vertical industry solutions.

MiniMax took the opposite approach, avoiding China's hyper-competitive general API price wars and focusing on overseas consumer subscriptions and differentiated multimodal APIs. Through products like Talkie and Hailuo AI, it rapidly expanded its overseas user base, using subscription revenue to cover rising inference costs.

Results show initial feasibility, but financial data reveals constraints: AI-native products contribute over 70% of revenue but only 4.7% gross margin, with computing and user acquisition costs consuming nearly all growth dividends.

MiniMax's business model hinges on two uncertain factors: reducing model inference costs through technological iteration and achieving higher premiums and payment rates in frequent-use scenarios like video generation. Until these conditions are met, faster user growth accelerates cash burn.

Additionally, consumer traffic is inherently volatile. Facing giants like ByteDance with community traffic, MiniMax must prove Hailuo AI is not just a fleeting tool but a high-engagement, subscription-worthy application.

This IPO race is not the end of the large language model war but the start of a new phase. The two companies have validated two distinct paths: government-enterprise digitalization and global consumer applications. Post-IPO, Zhipu must improve scalable delivery efficiency, while MiniMax needs to reduce computing costs and build traffic moats.

Both companies have demonstrated initial self-sufficiency, but the first to achieve a viable profit model will secure entry to the large language model industry's next phase.