Exit of Self-Built Charging Piles: Will Automakers Embrace a New Era of 'Seamless Energy Replenishment'?

![]() 12/30 2025

12/30 2025

![]() 551

551

From 'Range Competition' to 'Energy Replenishment Efficiency Competition'

Written by / Meng Huiyuan

Edited by / Chen Dengxin

Layout by / Annalee

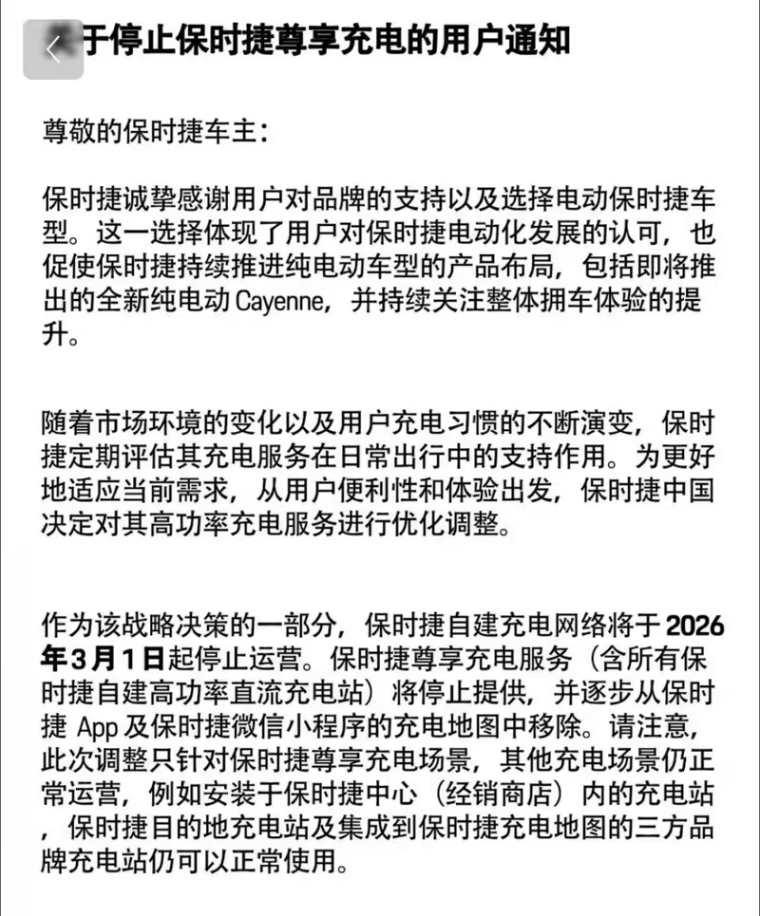

Recently, Porsche China officially announced that it would begin a phased dismantling of its premium charging service facilities starting March 1, 2026, and would subsequently shift to in-depth collaboration with leading charging operators in the industry, sparking widespread discussion.

In related media reports, Porsche's decision to shut down its operations is undoubtedly seen as wise and forward-looking. With a total of approximately 200 charging stations, each requiring a multi-million-dollar investment, yet consistently maintaining a proprietary pile utilization rate of below 20% (with some estimates around 15%), this not only reflects deficiencies in the operational efficiency of Porsche's self-built charging infrastructure but also highlights misalignments between its market layout (market layout) and user demand.

In fact, automakers are delivering different answers in the 'required course' of charging infrastructure. Some brands, like Xiaomi, Neta, and Leapmotor, choose not to large-scale (massively) build charging piles on a large scale, believing that energy replenishment is a function that vehicles should provide rather than an asset that brands must construct themselves. On the other hand, brands like NIO, Tesla, and Li Auto lean towards heavy investment, viewing self-built energy networks as an extension of product definition and a key strategy for constructing long-term competitive barriers and future energy ecosystem entry points...

Clearly, this divergence marks that China's new energy vehicle industry is transitioning from an early stage of hardware competition to an advanced stage of competition centered on the user's full lifecycle experience and deep collaboration across the industrial chain. While the two development routes may seem diametrically opposed, they actually point to the same endpoint: solving the electric vehicle's energy replenishment problem with the lowest total social cost and the highest user satisfaction.

Crossroads in the Energy Replenishment Battlefield

Regarding Porsche's decision to shut down its self-built high-power DC ultra-fast charging piles, i.e., the 'Porsche Premium Charging' service network, many users perceive this as a significant reduction in convenience when using the brand's electric vehicles.

After all, in today's increasingly competitive electric vehicle market, the completeness of charging facilities directly relates to the user's driving experience and brand loyalty. This is especially true for Porsche owners who previously enjoyed faster and more convenient charging services through 'Porsche Premium Charging,' as well as a certain sense of special prestige associated with it.

However, Porsche's decision to cut this benefit also stems from its own considerations:

On one hand, Porsche's development in the domestic electric vehicle market has encountered obstacles. According to its latest financial report for the first three quarters of 2025, sales revenue was €26.86 billion, a 6% decrease year-on-year. Facing significant profit pressure and a sharp decline in profits, its self-built charging piles, while of high quality, incur high maintenance costs and have limited coverage.

For automakers' self-operated ultra-fast charging networks, if utilization rates are insufficient, the service not only fails to generate expected revenue but also becomes a heavy burden for manufacturers, continuously draining corporate profits. Given the increasingly severe market environment, strategic contraction and optimization of resource allocation have become choices that Porsche has to make.

On the other hand, the concentration of the charging pile industry is rapidly increasing, and the market landscape is undergoing profound changes. Data from the first half of 2025 shows that the top 15 operators in the industry, including Teld, StarCharge, and CloudFastCharge, already account for over 80% of the national public charging pile market share, demonstrating a significant Matthew effect.

Source: Charge and Swap Headlines

This means that a competitive landscape dominated by a few giants has formed in the charging pile market. For automakers like Porsche, instead of investing substantial resources in building their own charging piles and competing head-on with these industry giants, it is more advisable to choose collaboration with them to jointly build a more complete charging network and provide users with more convenient and efficient charging services.

Compared to Porsche, which only began its strategic pivot after realizing it was on a 'bloody path' and paying a high price for it, a considerable number of new energy automakers abandoned the self-building route from the outset.

Lei Jun once stated in a livestream, 'Xiaomi has built a small number of charging stations, but currently has no plans for large-scale construction. Our primary task is to build great cars and make the SU7 the electric vehicle with the best compatibility with public charging piles.' Public information shows that Neta's energy replenishment services mainly involve providing home charging piles for its users, while relying on third-party collaborations for public energy replenishment. Zhu Jiangming, the founder of Leapmotor, has repeatedly emphasized focusing on 'cost pricing' and 'full-domain self-research' to achieve 'technological equality,' leading the company to naturally choose reliance on existing public charging networks rather than pursuing self-built, asset-heavy paths for energy replenishment...

For these brands, China already boasts the densest and most convenient third-party public charging network globally. Building their own charging piles would, to some extent, amount to asset reallocation and resource wastage.

However, many automakers still choose heavy asset investments, including NIO, Tesla, and Li Auto.

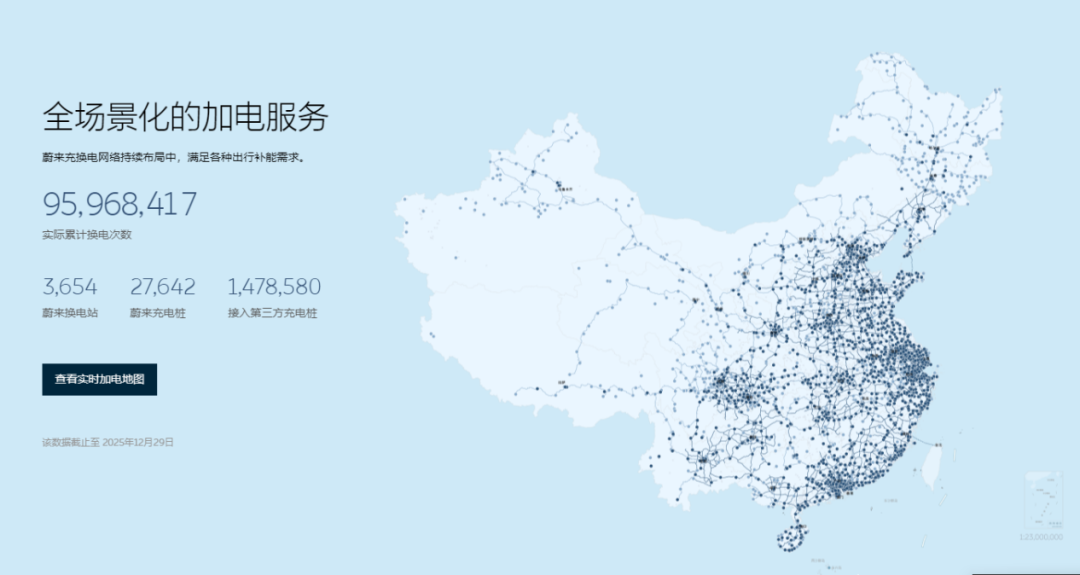

Since its inception, NIO has invested nearly ¥10 billion in battery swap stations, ultra-fast charging piles, and destination charging stations, boasting the densest battery swap station network globally. Tesla's capital expenditures exceeded $10 billion in 2024, with its ultra-fast charging network being a core investment item. As of July 2025, Li Auto has built 3,614 ultra-fast charging stations, averaging four new stations per day and approximately 28 new ultra-fast charging piles per week...

Source: NIO Official Website

Similarly, for these brands, building their own charging piles is not just about providing supporting services but also about further consolidating and enhancing their brand competitiveness and market position by constructing a complete energy replenishment system. They even continuously explore and experiment with new energy replenishment methods and technologies, such as battery swap technology and wireless charging technology.

It is evident that choosing to integrate into a mature ecosystem allows brands to leverage third-party charging networks and service systems, enabling them to operate with a lighter asset footprint. On the other hand, investing substantial funds and resources in building a superior ecosystem can create unique brand advantages and strengthen market competitiveness.

Neither path is inherently superior or inferior; they simply adapt to the practical needs of different brands, both aiming to solve the most fundamental issue for users: how to provide a more personalized and high-quality charging experience?

The Endpoint: Seamless Experience Integration

When shifting the perspective from a specific automaker's strategic choice to the charging industry itself, the primary contradiction has long since shifted from 'availability' to 'quality.'

From the user's perspective, the average power of public slow charging is 44.69 kW, requiring approximately 2-3 hours to charge to 80%. However, users expect to replenish 400 km of range in 5-8 minutes (equivalent to refueling speeds), with increased range anxiety in long-distance/peak scenarios, forcing demand for faster ultra-fast charging.

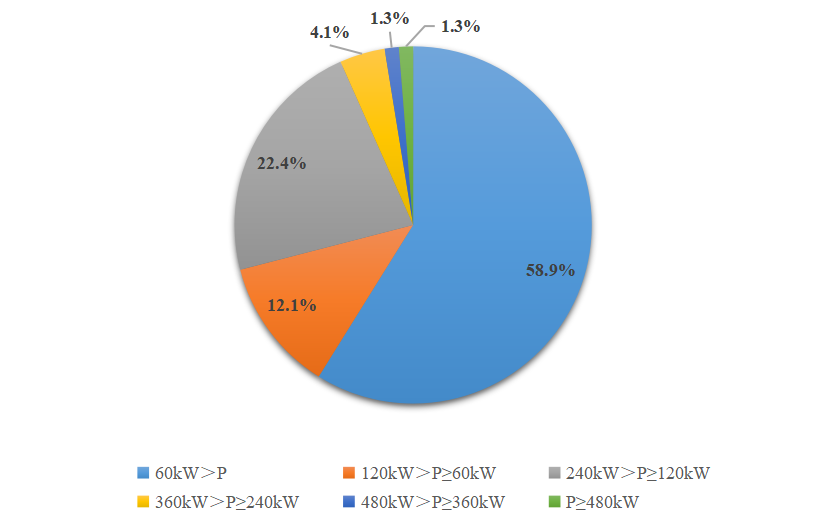

From the supply-side perspective, public charging piles exhibit a structural imbalance of 'many slow chargers, few fast chargers, and rare ultra-fast chargers.' Data shows that as of the end of 2025, ultra-fast charging piles account for less than 5%. Industry analyses generally point out that a significant number of existing charging piles are incompatible with 800V high-voltage platforms. While the coverage of charging piles in highway service areas has reached 98%, normalization (normalized) queuing during holidays is an undeniable fact.

Proportion of Public Piles by Power Segment Source: China Charging Alliance

Consequently, the focus of relevant enterprises has shifted from a 'range competition' to an 'energy replenishment efficiency competition,' with megawatt-level ultra-fast charging (≥1000kW) emerging as the breakthrough point to address 'slow charging and long queuing times.' Thus, the ultimate competition in the industry has become one of 'ecosystem integration capabilities,' where whoever can better connect vehicles, charging piles, power grids, and parking scenarios to achieve seamless, efficient, and intelligent energy replenishment will win the future.

At present, leading enterprises are adopting differentiated technological and scenario-based layouts. For example, Huawei's all-liquid-cooled megawatt ultra-fast charging technology offers four times the efficiency of traditional fast charging, enabling heavy trucks to recharge to 90% in 15 minutes. StarCharge's liquid-cooled ultra-fast charging 2.0 technology supports charging initiation within 3 seconds and features dynamic power allocation across multiple terminals. BYD also possesses megawatt flash charging technology, achieving an ultra-fast charging speed of 2 km per second and replenishing 407 km of range in 5 minutes, compatible with 1000V platforms... However, beyond technological visions, large-scale deployment still faces multiple constraints, especially in terms of industrial collaboration, where the complexity of ecosystem integration far exceeds expectations.

Specifically, at the automaker level, while leading companies like Tesla, NIO, and XPENG have deployed ultra-fast charging networks, the incompatibility of charging protocols across different brands is an industry consensus, limiting charging power for users when charging across brands. At the power grid level, differences in charging facility standards between State Grid and China Southern Power Grid, along with the phenomenon of 'multiple standards for a single pile' in some regions, increase operational and maintenance costs. At the venue level, the layout of charging piles in core scenarios such as highway service areas and commercial complexes is often constrained by land resources and power capacity, leading to delays in commissioning ultra-fast charging piles.

So, do players like Xiaomi, which have not entered the market, or Porsche, which has abandoned deep investment in self-built charging piles, still have opportunities in the energy replenishment battlefield? The answer is yes.

From a differentiated competition perspective, they can fully rely on their user bases and utilize software solutions (such as plug-and-charge, exclusive reservations, etc.) to achieve brand-specific services on top of third-party charging service providers, which is far more efficient than merely operating physical devices.

For example, by developing cross-brand charging aggregation platforms that integrate charging resources from different automakers and operators, using big data algorithms to recommend optimal energy replenishment solutions for users (considering dimensions such as battery level, time, cost, and queuing status), and enhancing user stickiness through membership systems and point redemption. While not directly involved in hardware construction, this model can become a crucial 'connector' in the energy replenishment network through ecosystem integration capabilities, even driving automakers and operators to open up protocol standards.

In the future, competition among automakers in the energy replenishment battlefield will no longer be a single-dimensional 'technological arms race' but a dual competition of 'ecosystem integration capabilities' and 'user value creation.' Whether new entrants or traditional players, only by focusing on user needs and breaking down industrial barriers through open collaboration can they gain an advantage in the energy replenishment efficiency competition and ultimately shape a future of 'charging as seamless as refueling.'