AI Computing Power Race (Part 2): Ecological Battle and the Future Value Reassessment of Domestic GPUs

![]() 02/12 2026

02/12 2026

![]() 447

447

Written by | Qianyanjun

Source | Bowang Finance

01

Ecological Barriers: The Deepest Moat and the Toughest Battle

As domestic GPU companies accelerate their hardware performance catch-up and frequently announce breakthroughs in the capital market, a deeper and more fundamental challenge is gradually emerging—ecological barriers. The author believes this may be the most complex and difficult gap for China's semiconductor industry to bridge beyond technological challenges.

The current global GPU market is highly concentrated, with NVIDIA and AMD forming a near-duopoly. Their true competitive moat has shifted from hardware parameters to software and ecosystem construction. NVIDIA's "computing empire," built on its CUDA (Compute Unified Device Architecture), encompasses a complete toolchain from drivers to frameworks, while also aggregating the usage habits, code assets, and technical trust of millions of developers worldwide. Once this ecosystem takes shape, it generates a powerful network effect: the more developers there are, the more prosperous the application ecosystem becomes; the more prosperous the ecosystem, the more it attracts new developers. This self-reinforcing positive cycle creates an ecological hegemony that is nearly impossible to replicate in the short term, forming an industry inertia that is difficult for challengers to overcome.

Faced with this landscape, domestic GPU manufacturers have generally adopted a pragmatic approach of "ecosystem compatibility." While this strategy helps products enter the market quickly and lowers user migration barriers, it also carries long-term concerns. Compatibility may keep domestic platforms in a position of "ecological dependency," struggling to cultivate their own unique competitiveness and developer appeal. More alarmingly, if international dominant ecosystems make strategic adjustments or impose new technical barriers in compatibility, the sustainability of this dependency-based development path will face severe tests.

Therefore, ecosystem construction is not a short-term endeavor but a "slow march" that tests patience, capital, and foresight. It requires not only solid technical foundations but also deep insights into developer needs, continuous refinement of toolchain experiences, long-term cultivation of community culture, and understanding and support from investors. This is both the "perilous leap" that all challengers must complete and the ultimate test of corporate strategic resilience and ecological operational capabilities.

02

Dual Pressures: Industrial Foundation Constraints and Capital Endurance War

While striving to build ecosystems, domestic GPU companies also face multiple constraints from their industrial foundations. From the manufacturing perspective, access to advanced process nodes remains limited; in core IP domains, the degree of self-sufficiency urgently needs improvement; in design tools, the ecological substitution of domestic EDA is still progressing; and in advanced packaging, challenges persist in capacity and yield rates for cutting-edge technologies like CoWoS. These weaknesses in foundational areas pose another practical obstacle beyond ecological breakthroughs.

Meanwhile, the high-investment nature of the GPU industry makes this catch-up a protracted "capital endurance war." Take Biren Technology as an example: its allocation of 85% of IPO proceeds to R&D underscores the industry's consensus on sustained high-intensity investment. The financial performance of domestic GPU companies, characterized by "impressive revenue growth but elusive profitability," reflects this industrial reality.

While going public may provide an "entry ticket" to continue the race, the fundamental question is how to translate capital into sustainable technological breakthroughs and ecological influence. The competition in ecosystems is never just about technology—it is also about time, patience, and systemic capabilities.

03

From "Usable" to "User-Friendly": The Ultimate Test of Market-Driven Survival

Currently, the adoption of domestic GPUs largely benefits from policy-driven self-sufficiency goals and substitution demands in specific sectors. However, achieving true commercial success and industrial independence requires passing the test of fully market-driven, intense competition. The real litmus test lies in: Can they support internet giants in training next-generation trillion-parameter large models? Can they smoothly run globally top-tier AAA gaming titles? Can they provide stable and reliable services in cutting-edge fields like high-precision industrial simulation and life sciences computing? Can they achieve comprehensive cost-effectiveness that makes customers choose them proactively rather than passively?

Figure: NVIDIA's commercial software services, sourced from NVIDIA's official website

Only by achieving comprehensive superiority in performance, power efficiency, stability, and cost-effectiveness in these "hard-hitting" scenarios can domestic GPUs truly secure their future. We must calm ly (calmly) recognize that while Illuvium can deliver over 52,000 units to more than 290 customers and Maxio Technology has secured 1.43 billion yuan in orders, these figures primarily reflect the initial dividends of domestic substitution. As substitution demand saturates, market competition will revert to product strength alone.

04

Investment Value Reassessment: Rational Scrutiny Beyond the Hype

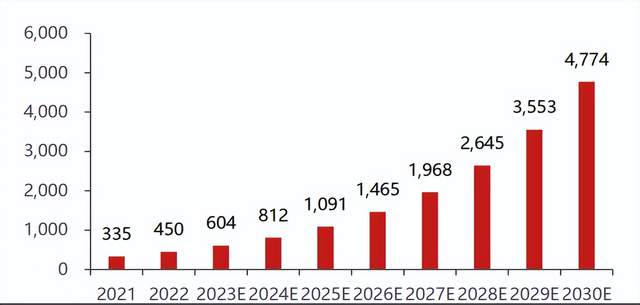

Figure: Global GPU market size (2021-2030, in USD billions), Source: Jingjiawei prospectus, Verified Market Research

For investors, the GPU sector offers strong growth certainty and allure, but calm observation (calm observation) remains essential. Behind the bustling IPO wave, a more rational evaluation framework is needed.

In the short term, focus on the actual penetration rate of domestic substitution and order visibility—examining the scale of backlog, breadth and depth of customer coverage; track technological iteration progress, including new product launch cadence, performance improvements, and generational gaps with mainstream products; and scrutinize revenue growth quality, particularly the proportion from genuine market-driven demand, customer repurchase rates, and gross margin trends.

In the medium term, the decisive factor lies in breakthrough innovations in core architectures rather than simple followership; software ecosystem robustness becomes critical, including developer community activity, toolchain completeness, and key application adaptation progress; profitability path clarity is also essential, requiring observation of loss reduction trends, scale effect emergence points, and positive cash flow timelines.

From a long-term perspective, the true determinant is whether companies can nurture globally influential development platforms and standards, establish irreplaceable positions in the global computing supply chain, and complete the transition from technology followers to rule setters.

Investors must look beyond superficial revenue growth hype, keenly assess the true magnitude of narrowing technological generational gaps with mainstream products; analyze penetration depth among key industry leaders—whether it involves pilot projects or genuine core system replacements; and monitor subtle shifts in developer community sentiment, from "barely usable" to "genuinely recommended."

The stir caused by domestic GPUs in the capital market is just the beginning of a long journey. As the financing frenzy subsides, details such as toolchain experience, developer recognition, and application ecosystem prosperity will become the litmus tests for corporate quality. There are no shortcuts—only by finding a dynamic yet resilient balance between compatibility and autonomy, catch-up and innovation, capital investment and ecological cultivation can success be achieved.

Conclusion: Computing Power as Power—A Journey Shaping the Future

The evolution of GPUs represents an epic shift in computing power. From humble beginnings as graphics coprocessors to becoming the computational foundation driving the AI revolution, they are now evolving into system platforms defining future computing paradigms. The essence of this global competition transcends mere technological rivalry—it is a strategic struggle for control over and standard-setting rights in the intelligent era's underlying infrastructure.

For China, building a self-sufficient GPU industrial system holds strategic significance far beyond economic calculations. It concerns the solidity of national technological competitiveness in the intelligent age, the true security of Digital China's lifeblood, and the structural upgrade of the entire industry from mid-to-low end to high end—achieving a historic leap from manufacturing power to intelligent manufacturing powerhouse.

The collective charge of domestic GPU companies represents a generational expedition bearing national expectations and industrial missions. Ahead lie triple "Kafkaesque canyons" of technology, ecology, and markets—each testing corporate wisdom and endurance. Behind them stand a vast domestic market, unwavering national will, and countless engineers working tirelessly day and night. The successive listing gongs on Shanghai's Exchange are merely the starting bugles for this expedition. As capital noise fades, the real competition begins: technological breakthroughs return to fundamental difficult explorations, ecosystem cultivation demands years of patient nurturing, and market recognition requires validation through product strength.

This journey offers no shortcuts. Every successful tape-out of a self-designed chip, every reliable deployment in benchmark scenarios, and every developer choosing a domestic platform lays an indispensable foundation for the nation's independent status and leading potential in the intelligent age. From the laboratory lights in Zhangjiang, Shanghai, to the racks of data centers nationwide; from eye-catching financial figures in prospectuses to the stable delivery of computational value in actual operations—the second half of domestic GPUs' journey promises to be an even more arduous yet thrilling odyssey.

The new era of "computing power as power" has begun. The global computing power landscape of the intelligent age is undergoing dramatic reconfiguration, and Chinese forces, through this arduous industrial expedition, are becoming indispensable shapers of this landscape. The road, though long and obstructed, leads forward if traveled. The ultimate answer will not be found simply in market capitalization figures at listing but etched in every technological breakthrough, embedded in every ecological partnership, and reflected in every order Win sincere recognition from the market (that wins genuine market recognition).