Microsoft vs AWS vs Google, who will win the AI cloud race?

![]() 10/28 2024

10/28 2024

![]() 587

587

IoT Analytics Original

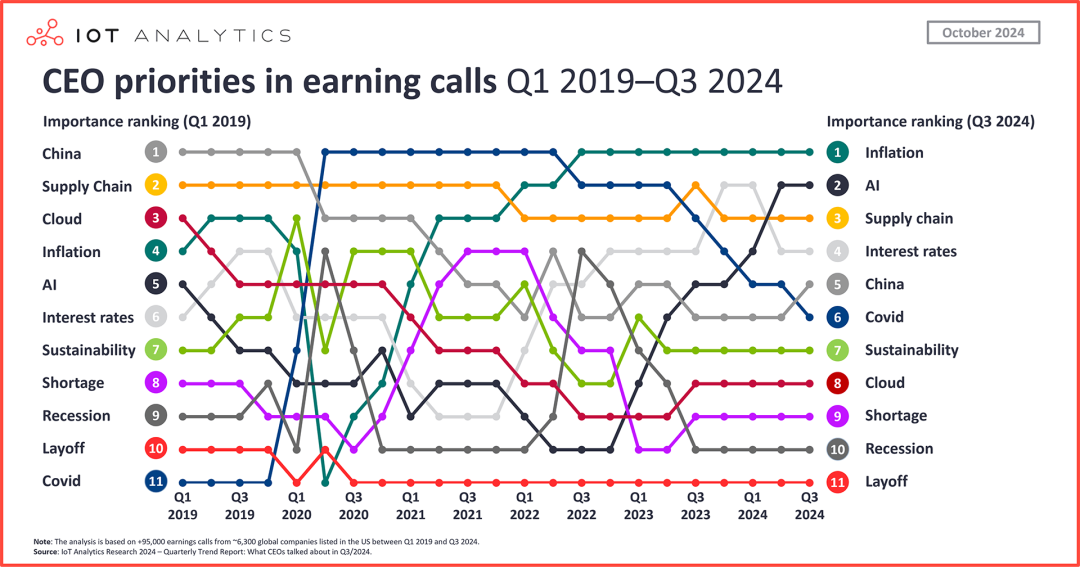

Today, the status of artificial intelligence in corporate technology priorities is rapidly rising. Data reports show that in the second quarter of 2024, CEOs discussed AI more than any other technology topic during earnings calls, reaching 34% - when CEOs talk about AI, their teams begin deploying cloud-based AI technologies.

The decline and rise of AI from Q1 2021 to Q3 2024 were common topics of discussion among CEOs

(Source: IoT Analytics)

According to AWS's definition, AI cloud adds AI-related functions and services to traditional cloud computing, enabling developers and enterprises to more easily build, deploy, and manage AI applications. With AI cloud services, enterprises and developers can quickly build and deploy AI applications without building their own extensive infrastructure and AI systems. AI clouds offer services such as machine learning, speech recognition and synthesis, natural language processing, computer vision, intelligent recommendation systems, predictive analytics, virtual assistants, automated decision-making, data analysis, and mining...

In October 2024, IoT Analytics, an IoT research organization, released a 188-page report titled "Global Cloud Projects Report and Database 2024," which included some core insights:

22% of recently announced cloud implementation projects included AI elements. Data shows that AI has become a driver of cloud demand, with generative AI (GenAI) playing an increasingly important role.

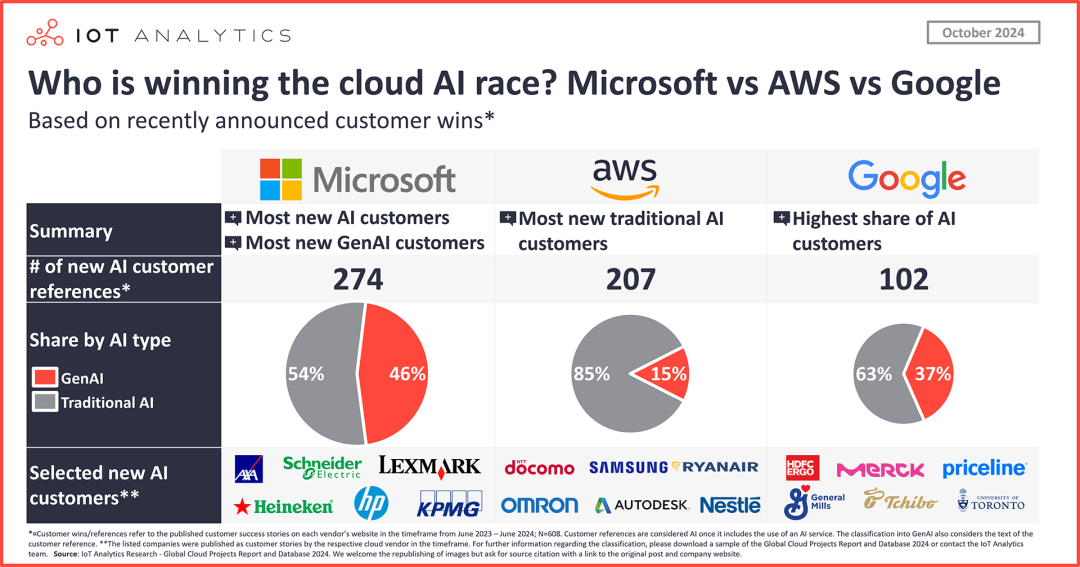

From an enterprise perspective, Microsoft leads in the overall AI and GenAI race, AWS leads in traditional AI, and Google has the highest share of AI customers.

Data Perspectives on the Current State of Cloud AI Projects in 2024

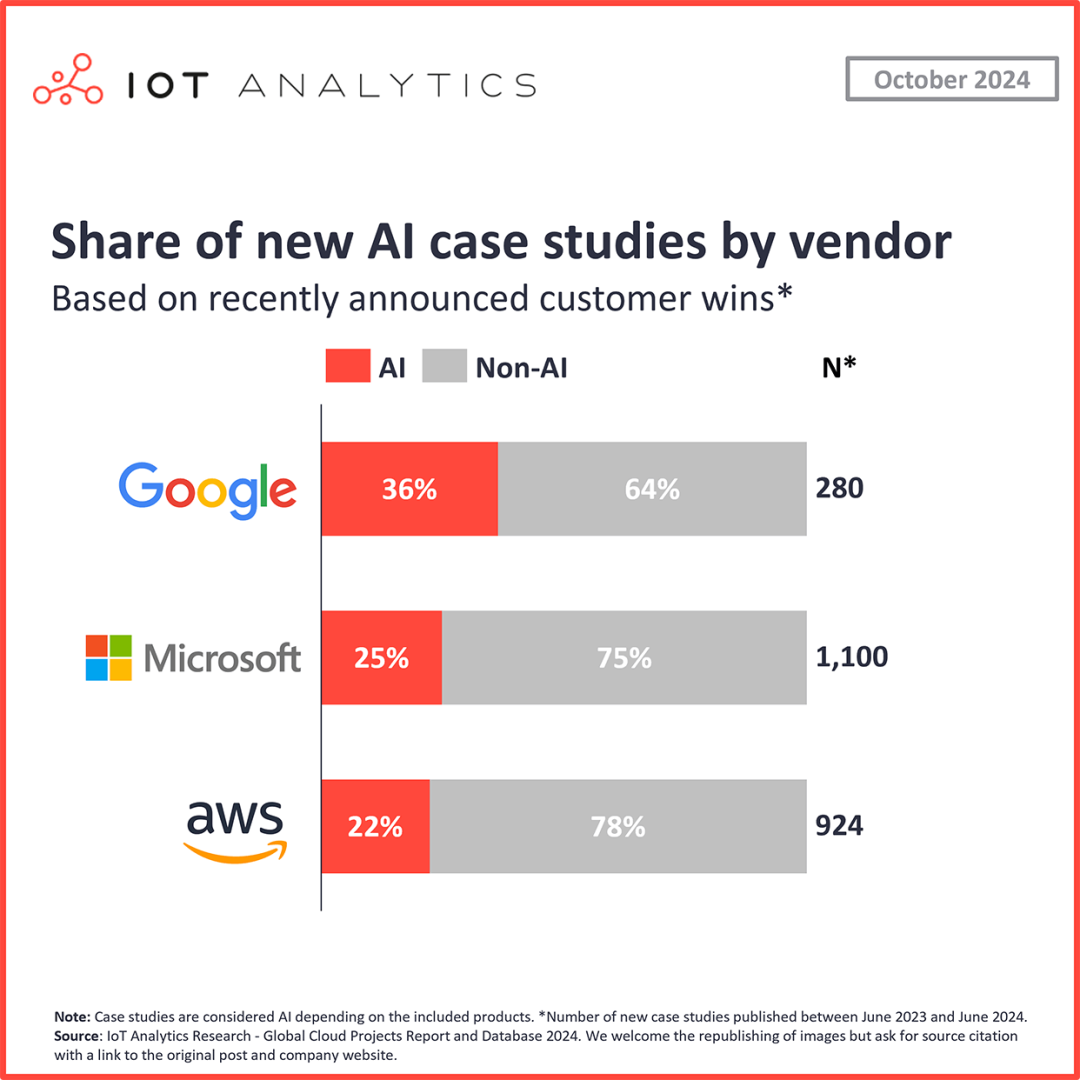

The "Global Cloud Projects Report and Database 2024" analyzed over 8,300 customer implementation projects from the largest cloud providers in recent years (including in-depth research on AI and IoT cloud projects). The results showed that from June 2023 to June 2024, the top five hyperscale enterprises globally released over 2,700 new customer case studies, of which 608 used cloud AI services (22%).

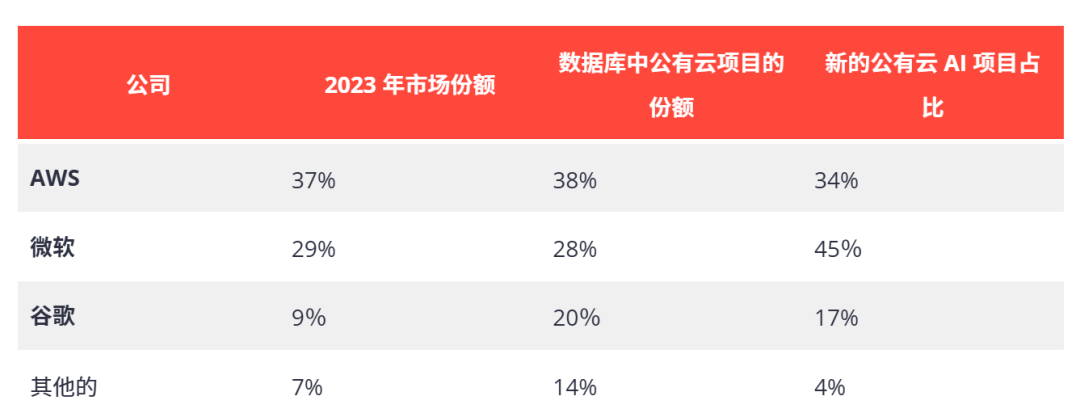

Based on IoT Analytics' own model, the following table summarizes the 2023 public cloud market share:

"Others" in the table include Oracle and Alibaba; however, given their smaller share in cloud AI projects, this article focuses on the top three hyperscale enterprises: AWS, Microsoft, and Google, comparing their latest cloud AI products and projects:

① Overall Cloud AI Projects

Total AI case studies: Microsoft added the most AI case studies, with 274 out of 608 new cloud AI case studies (45%), including new AI customers such as insurance giant AXA, professional services firm KPMG, industrial automation company Schneider Electric, and brewing company Heineken; AWS ranks second with 207 cases (34%), with new major AI customers such as electronics giant Samsung and food and beverage manufacturer Nestlé; Google ranks third with 102 cases (17%), with new customers including pharmaceutical company Merck and travel agency Priceline.com. AWS leads in traditional AI case studies (excluding GenAI) with 176 cases. Notably, Google's new AI case studies account for the highest proportion of all new cloud case studies, with 102 out of 280 (36%).

Relative market share of AI case studies: Microsoft has the largest gap between its share of new case studies and its market share; AWS's share of new cloud AI case studies (34%) is 3 percentage points lower than its 37% cloud market share in 2023; Google's case study share (17%) is 8 percentage points higher than its 9% cloud market share, while Microsoft's share (45%) is 16 percentage points higher than its 29% cloud market share. Thus, both Microsoft and Google outperform their cloud market shares.

② Cloud-based Generative AI Projects

The Global Cloud Projects Report and Database includes 206 new generative AI case studies, accounting for 34% of all AI case studies, with:

Microsoft leads in cloud-based generative AI case studies, with 127 out of 206 cases (62%); Google ranks second with 37 cases (18%); AWS has 33 (16%).

AWS's share of new cloud-based generative AI case studies (16%) is 21 percentage points lower than its 37% cloud market share in 2023; Google's case study share (18%) is 9 percentage points higher than its 9% cloud market share; Microsoft's 62% share of new generative AI case studies is 33 percentage points higher than its 29% cloud market share. This again indicates that Microsoft outperforms its peers in the cloud AI race.

Who will win the cloud AI race?

Based on survey data and analyst insights, we can draw some preliminary conclusions:

① Currently, Microsoft leads in the cloud AI and GenAI races

For now, when comparing new cloud AI case studies to overall cloud research, Microsoft is clearly ahead in the race and may maintain its lead in the short term.

Thanks to its close relationship with OpenAI, Microsoft has gained a significant lead in cloud-based GenAI. As early as 2019, Microsoft was a strong supporter of OpenAI and announced a "multi-year, multi-billion dollar" investment plan for OpenAI in January 2023, less than two months after ChatGPT's public release; in April 2023, Microsoft invested an additional $10 billion in OpenAI, increasing its stake to 49% and stipulating that Microsoft would receive a percentage of OpenAI's profits until its investment is recouped; Microsoft invested another $750 million in OpenAI's latest funding round of $6.6 billion. Overall, among the top three US cloud giants, Microsoft is the most decisive and comprehensive in its AI investments.

Many large enterprises have already launched their first GenAI projects on the Microsoft AI stack. However, as several LLMs are narrowing the performance gap with OpenAI models, it remains to be seen whether Microsoft's first-mover advantage will dissipate or persist.

Moreover, media reports have suggested tensions in the OpenAI-Microsoft partnership due to financial disagreements, resource competition, and strategic conflicts. According to a lengthy New York Times report, OpenAI CEO Sam Altman sought additional support from Microsoft's Satya Nadella, but Microsoft hesitated due to concerns about rising costs. OpenAI expects to lose $5 billion this year and projects losses of $44 billion by 2028, primarily due to the high costs involved in developing advanced AI systems. Facing financial pressure, OpenAI has been seeking new investors and partners to reduce its reliance on Microsoft.

② AWS leads in traditional AI

Shifting focus to cloud AI case studies without GenAI elements, we find that AWS leads in traditional cloud AI.

Meanwhile, AWS's Amazon SageMaker is the most widely used product in cloud AI case studies, accounting for 21%. Amazon SageMaker is a fully managed machine learning service that allows users to focus on model building and optimization rather than underlying complexities. With SageMaker, developers can quickly and easily build and train machine learning models, then directly deploy them to a production-ready hosted environment. SageMaker also provides an integrated Jupyter Notebook instance for easy access to data sources for exploration and analysis without server management.

As AWS further develops its cloud AI products, especially GenAI, it can start marketing these services to its existing and new customer base, seeing more cloud AI projects, and gaining a larger share of new projects.

③ Google has the highest share of AI customers

Google has traditionally been favored by smaller companies and has its own advantages in the cloud AI race. When examining each vendor's new case studies, Google's cloud AI case studies account for the largest proportion of its overall new case studies. 36% of Google's new public cloud case studies use cloud AI products, indicating that AI drives Google Cloud more than any other hyperscale enterprise.

Cloud Security Services are Critical

The report also mentions that cloud security services were among the fastest-growing products over the past year, excluding new cloud AI case studies. A typical product is Microsoft Sentinel, a cloud-native SIEM and SOAR service. SIEM stands for Security Information and Event Management, facilitating security teams to collect logs from hardware devices or applications, analyze suspicious logs, generate alerts, and create cases; SOAR focuses on security orchestration and automation, assisting security operations teams in daily work and improving efficiency.

As I've emphasized in previous articles, cloud security has become increasingly important in recent years as companies invest heavily in migrating data to cloud platforms. Companies like Facebook, Google, Microsoft, and Amazon collect vast amounts of data, from behavioral patterns and user preferences to proprietary algorithms and sensitive corporate data, making them lucrative targets for cybercriminals. Last year alone, companies like Norton, MailChimp, X, Verizon, Google, Activision, ChatGPT, T-Mobile, Microsoft, Walmart, Samsung, Fujitsu, and American Express suffered cyberattacks.

In July of this year, Google's parent company Alphabet was in advanced negotiations to acquire the cloud cybersecurity startup Wiz for approximately $23 billion. If the deal goes through, it could be Google's largest acquisition ever. As a leading global tech giant, Google's strategic moves often set the tone for the entire tech industry, and its significant investment in Wiz reflects the booming cloud security market.

Many research institutions predict that cloud security companies developing innovative solutions to address security challenges will be among the fastest-growing and highest-valued companies in the cybersecurity industry in 2024.

References:

"Who is winning the cloud AI race? Microsoft vs. AWS vs. Google," iot-analytics

"Amazon SageMaker: Making Machine Learning Simpler and More Powerful," Amazon Web Services Developer Blog

"OpenAI's Partnership with Microsoft Faces Risk of Collapse: Mysterious AGI Clause May Spark Conflict," Shui Ge

"$23 Billion! Google's Highest-Ever Acquisition Offer! The Cloud Security Market Explodes," IoT Analytics