Can Intel's New Chinese CEO End Its Decline?

![]() 03/19 2025

03/19 2025

![]() 459

459

Author|Ma Lin

Editor|Yi Fan

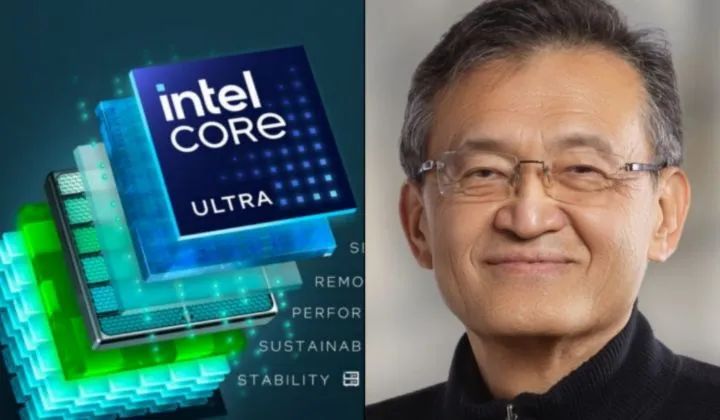

On March 18, 2025 (US time), Lip-Bu Tan officially assumed the role of Intel's CEO, succeeding interim co-CEOs David Zinsner and Michelle (MJ) Johnston Holthaus. Will he be the one to break the shackles of Intel's "technocratic" past?

According to Reuters on March 17, the new executive is poised to implement sweeping reforms in Intel's chip manufacturing and AI strategies, including reducing middle management and overhauling production methods. In a meeting with employees, Tan emphasized the need for "tough decisions," necessitated by Intel's failure to capitalize on the mobile and AI eras, and its gradual lag in keeping pace with Moore's Law.

In early March 2025, Intel appointed Chinese national Lip-Bu Tan as its new CEO.

The tech industry is replete with stories of turnaround leaders. In 2014, Satya Nadella took the helm at Microsoft, a company that had missed out on the mobile internet era's biggest opportunities in search and mobile phones. Despite being an underdog candidate, Nadella made pivotal decisions over the decade, including partnering with Apple, abandoning the mobile phone business, investing heavily in Azure cloud computing, acquiring LinkedIn, investing in OpenAI, and acquiring the then-unpopular open-source database Github. These moves not only restored Microsoft's market value but also positioned it as a competitive AI giant for the next decade.

Intel, too, had hoped for a "Nadella"-like figure. Its previous CEO, Pat Gelsinger, was once seen as Intel's savior. Appointed in 2021, he was entrusted with the task of reversing Intel's decline. However, in late 2024, the board of directors persuaded this long-time Intel employee to step down due to insufficient progress in reviving the company, leading to losses and a sharp decline in share price.

Intel's market value peaked in 2000. In November 2024, it was removed from the Dow Jones Industrial Average, replaced by NVIDIA. In 2024, Intel's share price plummeted by 60%, while NVIDIA's soared by 171%. Currently, Intel's market value stands at $103.7 billion, less than one-thirtieth of NVIDIA's.

In contrast to Microsoft, which has had only two CEOs in 25 years, Intel has had seven (including interim CEOs). Now, as a seasoned veteran of the chip industry, Lip-Bu Tan has been entrusted with the mission of restoring Intel's status as a global leader.

Domestic media have noted that among the five major American chip giants, all except Qualcomm are headed by Chinese nationals, suggesting that perhaps only Chinese nationals can shoulder the immense responsibility of the semiconductor industry's high technological threshold and pressure.

Can Lip-Bu Tan, a semiconductor veteran, lead Intel back to greatness?

Semiconductor Long-Termism vs. Intel's Short-Sightedness

In 1996, Intel's former CEO Andy Grove published "Only the Paranoid Survive," emphasizing the need for vigilance, self-reform, and pursuit of new technologies. However, Intel subsequently missed every major strategic turning point and future-changing technology. Former CEO Gelsinger's mixed reviews reflect the difficulty of transforming a large company, with different assessments pointing to the same problem: Intel's short-sighted genes, necessitating a more decisive and firm CEO.

"In the US, stock performance is the sole criterion for evaluating CEOs, which is very short-sighted," an Intel employee told the author. "Chinese CEOs tend to be more down-to-earth and diligent, and everyone is quite excited. However, most within the company believed that Pat (Gelsinger) was already Intel's best CEO, and giving him more time might have yielded results."

Semiconductor analyst Doug O'Laughlin also defended Gelsinger, stating in his article "The Death of Intel: When Boards Fail" that Intel's board of directors shirked responsibility for over a decade of failures, leading to the ultimate mistake: firing Pat Gelsinger. Semianalysis, a semiconductor blog, analyzed that the board lost its nerve before Gelsinger could turn the situation around, noting that semiconductors are among the most complex industries, requiring years to correct.

However, some opinions directly pointed to Gelsinger's inability to change Intel. Brian Cantrill, founder of Oxide Computer, a cloud computing technology company that worked with Intel post-Gelsinger, believes that appointing Gelsinger as CEO was a mistake. Intel lacks patience for innovation and often abandons early-stage products requiring iteration but with great potential. Instead of transforming this culture, Gelsinger exacerbated Intel's short-sightedness and arrogance as a large company, such as abandoning the Tofino switch chip. He also noted, "Intel's short-sightedness is an ingrained cultural problem that cannot be changed."

Gelsinger had been with Intel continuously since 1979, holding positions as an engineer, vice president, and CTO, and was a favorite disciple of Grove. Brought back by the Intel board in 2021 after an 11-year hiatus, he aimed to regain Intel's former chip dominance.

In 2021, Intel faced difficulties that could not be resolved overnight. The wrong decisions made by successive CEOs and the board of directors at critical junctures over the past 20 years had caused Intel to lose its former glory.

Starting from Paul Otellini's era, Intel continuously made mistakes and misjudgments.

In 2005, then-Intel CEO Paul Otellini proposed acquiring the then-unknown NVIDIA for $2 billion, but the plan failed due to opposition from the Intel board. Considering NVIDIA's current position in AI and high-performance chips, this remains Intel's enduring regret.

Paul Otellini, former CEO of Intel

In 2006, Apple founder Steve Jobs hoped Intel would produce a unique chip for the developing iPhone. Otellini rejected Jobs due to "unwillingness to pay an extra dollar," thus missing out on another great company and the burgeoning mobile chip market.

During the same period, the ARM chip architecture designed by UK-based ARM Holdings gained popularity in mobile phones. ARM's low-power chips were ideal for mobile devices, but Otellini insisted on using Intel's x86 architecture. Over the years, Intel failed to develop a competitive mobile chip.

In 2009, Intel abandoned the highly anticipated Larabee GPU project, repeatedly missing critical nodes, which left Intel out of the AI revolution.

In 2013, Brian Krzanich took office but failed to make the right judgments, leading to Intel not adopting extreme ultraviolet lithography (EUV) technology in a timely manner. Consequently, Intel was unable to deliver new chips on schedule. Analysts at the time noted that Intel could not even keep up with Moore's Law, and its market share shrank. By 2020, TSMC's manufacturing process had surpassed Intel's by two generations.

In 2018, then-Intel CEO Robert Swan made a wrong judgment, believing that generative AI models would not enter the market soon and that investments would not yield short-term returns. He thus rejected the opportunity to acquire a 15% stake in OpenAI for $100 million. Today, OpenAI's valuation has reached $80 billion.

These cumulative mistakes caused Intel to miss out repeatedly on mobile phones, mobile internet, process transitions, and artificial intelligence. Intel has always lagged behind in responding to future markets and been conservative in facing innovation opportunities, all pointing to the company's decaying culture.

In the article "The End of the Intel Dream," a former Intel employee directly pointed out one of Intel's problems: its bonus and promotion system often prioritizes short-term goals over long-term technological progress. This led to performative progress reports, with employees focusing more on appearances rather than solving problems.

Semianalysis analyzed that several CEOs before Gelsinger were failures, changing Intel's engineering culture, allowing business decisions to overshadow technology, making too many wrong decisions, and being "lazy, lacking technical vision, or even technically incompetent."

Gelsinger's Limitations and Intel's Culture

Against this backdrop, Gelsinger took office in 2021.

Currently, on the CEO anonymous rating platform Comparably, Gelsinger has a score of 74 out of 100, making him a B-grade boss. In contrast, NVIDIA's Jen-Hsun Huang scores 88, and AMD's Lisa Su scores 86, both being A+ bosses in the hearts of employees. Broadcom CEO Hock Tan only scores 66.

Gelsinger's reforms were bold and highly anticipated. He proposed the IDM2.0 strategy to revitalize Intel's leadership in the semiconductor industry. IDM refers to Integrated Device Manufacturer, where the company handles the entire process of chip design, manufacturing, and sales. Vertical integration has always been Intel's distinguishing feature compared to other semiconductor companies.

Patrick Gelsinger, former CEO of Intel

IDM2.0 is an upgraded version of design and manufacturing capabilities. Gelsinger aimed to change Intel's lagging process technology with a "five processes in four years" plan for investment in advanced process technology, gradually tackling the five process nodes of Intel 7, Intel 4, Intel 3, Intel 20A, and Intel 18A from 2021 to 2025.

Gelsinger also hoped to expand the independent foundry business, not only serving the US but also meeting global chip foundry demands, competing with TSMC and Samsung. However, multiple industry insiders have stated that the major customers for advanced chips are currently with TSMC and Samsung, making it difficult for Intel's foundry business to snatch orders from these two companies at this stage.

Against the backdrop of the return of American manufacturing, Intel's entry into the foundry business is clearly a political winner. Gelsinger promised to invest tens of billions of dollars in the US to build chip factories (as well as factories in Europe and Asia) to revitalize the American chip manufacturing industry. His plans also include accelerating deployment in AI, GPU, and high-performance computing.

Gelsinger's direction was correct, but in terms of execution, the speed and completion rate failed to satisfy the board of directors and Wall Street. Industry insiders analyzed that this is related to Intel's lack of a foundry gene. Foundries need to be tightly bound with customers, equipment manufacturers, and other partners, working together to refine products. A technician from an equipment manufacturer that has cooperated with TSMC and Intel told us that TSMC's factories have great initiative, adjusting machine settings based on actual conditions rather than purely executing R&D parameters. This is crucial for improving yield rates, an area where Intel is clearly unprepared or has not done well.

Regarding the "five processes in four years" plan, progress has been made in Intel 7, Intel 4, and Intel 3 processes, but they lag behind TSMC in transistor density and energy efficiency. The "highlight" 18A process technology has been delayed multiple times due to frequent technical issues, and the independent foundry division, Intel Foundry, is severely loss-making.

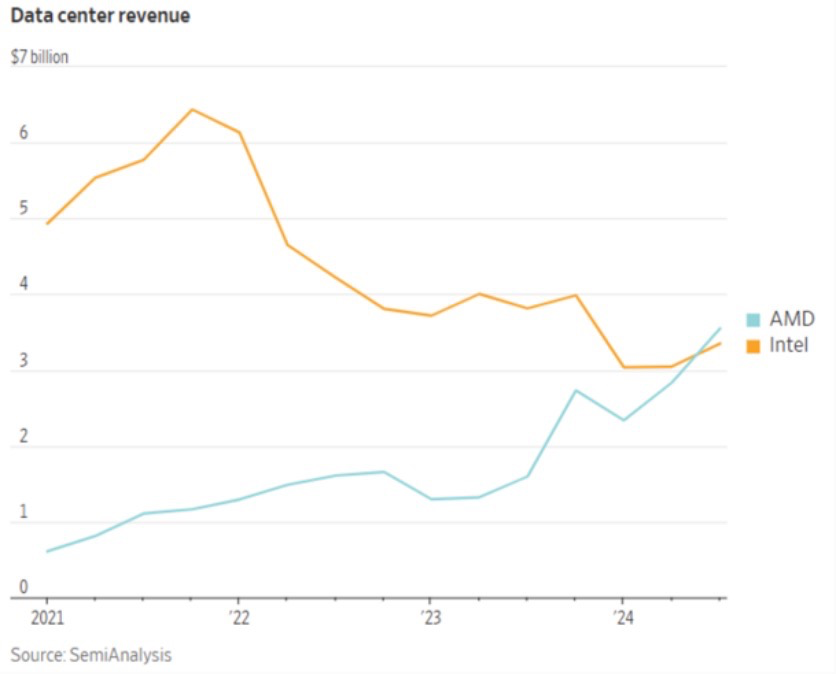

At the same time, Intel's core CPU business is still in retreat. AMD and other companies have quickly encroached on Intel's territory. Financial report data for the fourth quarter of 2024 shows that in terms of revenue from data center chips, AMD, Intel's long-time competitor, surpassed Intel for the first time. In 2022, Intel's data center revenue was still three times that of AMD. Meanwhile, more and more GPUs are replacing traditional CPU data center chips, but Intel has almost no market share in the high-end GPU market.

Investors and the board of directors expected immediate results, but Gelsinger was not a magician. By the fourth-quarter report in 2024, Intel reported a net loss of $153 million and a full-year cumulative loss of $18.8 billion, with the stock price looking increasingly bleak. The Intel board knew it was time for Gelsinger to go.

Recently, following Intel's announcement of Pat Gelsinger's appointment, the company's new Arizona fabrication facility commenced initial mass production of its 18A process. This advanced process is anticipated to reach full-scale production sooner than expected, with companies like NVIDIA and Broadcom already initiating testing. Additionally, in September 2024, Intel signed an agreement with Amazon to manufacture custom chips using 18A technology. Just before Gelsinger's arrival, the U.S. Department of Commerce granted Intel nearly $8 billion in funding for chip production, yet none of this could prevent the board from urging Kissinger to step down.

"Intel's sheer size makes it the most pressured for transformation. We anticipate great things from the new CEO, but Kissinger's capabilities were not far off," commented Intel employees on Kissinger's tenure. These same employees believe that Intel needs to further reduce its workforce due to overstaffing. Currently, employee benefits have been cut, pension ratios decreased, and annual and sabbatical leave periods shortened.

"The company is acutely aware of its current lag and that its traditional methods are no longer viable. We must catch up. The entire company hopes that the seamless mass production of 18A will halt the downward spiral of our stock price," shared an Intel employee with the author.

Can Pat Gelsinger rescue Intel?

Separating the foundry and design businesses appears to be a strategy to revitalize Intel. Post-spinoff, Intel's design arm could outsource production to foundries like TSMC and Samsung, while its foundry business could take on chip orders from other companies.

This will be Gelsinger's top priority upon assuming office. In his recent inaugural address to employees, the 65-year-old emphasized that under his leadership, Intel will become an engineering-centric company dedicated to developing superior products, attentively listening to customers, fulfilling promises, and building trust.

This statement, while seemingly straightforward, carries profound implications. Customer centricity is crucial for a foundry's success, a lesson TSMC has mastered to become the global leader. In recent years, some customers have lost faith in Intel's ability to prioritize and serve them well.

According to Intel's March 14 document, Gelsinger receives a base salary of $1 million, a 200% performance bonus, and $66 million in long-term equity awards, stock options, and new employee incentives. He has pledged to purchase $25 million worth of Intel stock within 30 days of taking office, demonstrating his confidence in the company and commitment to enhancing shareholder value.

Many media analysts consider Gelsinger the ideal choice for Intel's CEO. He understands Intel's current challenges and boasts extensive experience in semiconductor foundries. In 2022, Gelsinger joined Intel's board but left in August 2024 due to dissatisfaction with its bloated management structure, conservative culture, and lagging AI strategy. He emphasized Intel's lack of a clear AI strategy and excessive workforce, disagreeing with its conventional management style. His rich foundry experience also equips him to serve customers effectively. Industry insiders suggest that securing one or two major customers will be Intel's top priority post-spinoff.

Gelsinger holds multiple prominent positions. In 2009, he became CEO of Cadence Design Systems, one of the world's top three EDA companies, doubling the company's revenue and increasing its stock price by 3200%. He also served as a director at SMIC and is known as the "godfather of chip venture capital." In 1987, he founded Walden International, a venture capital firm that invested in Chinese semiconductor companies like SMIC, AMEC, GigaDevice, and VeriSilicon.

The current focus for Intel is whether to continue Kissinger's IDM 2.0 plan, if its vertical integration model is outdated, and whether to spin off products (chip design, data centers, Mobileye, Altera, etc.) from manufacturing (foundry).

Kissinger was firm on not spinning off Intel, leading to conflicts with the board. Intel's 2024 financial report revealed that while the foundry business generated $17.5 billion in revenue, it incurred losses of up to $13.4 billion, significantly dragging down overall performance.

Gelsinger now faces three options: continue Kissinger's IDM 2.0 plan (unsustainable due to high investments and losses), spin off Intel and sell the product business, or spin off Intel and sell the manufacturing business. Continuing the IDM 2.0 plan would require another $100 billion investment in four U.S. states, sustaining significant losses. Retaining manufacturing and selling products would transform Intel into a pure foundry, deviating from its chip design roots. Potential buyers included Broadcom, Qualcomm, and private equity firms like Francisco Partners, Silver Lake, Apollo Global Management, and Bain Capital.

Even if products and manufacturing are spun off, retaining the product business remains challenging, though AMD's journey provides a path. In 2008, AMD spun off its fabs, and in 2014, Lisa Su took over as CEO, selling the last two assembly and test factories, completing AMD's transition from IDM to a chip design company.

On the product front, Intel, based on the x86 architecture, has lost its competitive edge. ARM architecture dominates the mobile chip market, and Apple's Mac series almost exclusively uses ARM chips. Moreover, ARM-based Windows compatibility has improved (Windows-on-Arm, WoA), with Qualcomm-manufactured chips, and Microsoft is collaborating with multiple hardware manufacturers. TechInsights predicts that by 2029, ARM will account for over 40% of the laptop market, a significant blow to Intel.

Over the past two years, Amazon, the world's largest cloud computing service provider, has installed more than half of its custom ARM-based chips in its data center CPUs. Microsoft and Google have also developed custom ARM-based CPUs for their cloud services. NVIDIA, a leader in AI chips, is gradually reducing its reliance on Intel. While existing AI systems still use Intel CPUs, ARM-based chips are becoming the core of NVIDIA's cutting-edge hardware.

Regardless of leadership or structure, Intel's foundry business is likely to continue, with a spinoff appearing as the most probable direction. For the U.S., chip manufacturing is strategically vital in the technological rivalry with China. Jake Sullivan, the U.S. National Security Advisor, stated that in the coming years, no other technology will be more critical to national security than advanced AI systems. Intel's foundry is the best U.S. option to mitigate TSMC risks and ensure advanced chip supply.

For Gelsinger, the greater challenge lies in overhauling Intel's culture from top to bottom.

Intel's core issue is the malady of large corporations: arrogance, short-sightedness, mediocrity, and a lack of innovation. Some employees believe that even after the largest layoffs in Intel's history in late 2024, the company still harbors too many "parasites."

Whenever Intel changes CEOs, people recall Andy Grove, the former CEO. In the early 1980s, as Intel's memory business declined and inventory piled up, Grove discussed the company's plight with Chairman Gordon Moore. "If we stepped down and chose a new president, what would they do?" Grove asked. Moore replied, "Abandon the memory business." Grove concurred, "Then why don't we do it ourselves?"

Subsequently, Intel exited the memory business to focus on microprocessor development and production. Grove's strategic transformation was decisive and correct, guiding Intel through the "valley of death" and establishing it as the chip leader of the PC era for the next two decades. As Grove's motto goes, "Only the Paranoid Survive." People expect Gelsinger to exhibit Grove's paranoid courage and vision to rebuild Intel.