"King of African Phones" Faces Challenge as Xiaomi Soars and Transsion Stagnates

![]() 09/02 2025

09/02 2025

![]() 568

568

Introduction: Xiaomi's ecosystem expansion versus Transsion's low-cost strategy—will Xiaomi's surge erode Transsion's African dominance?

Long hailed as the "King of Africa" with half of the continent's mobile phone market share, Transsion is now confronting a "fierce onslaught" from Xiaomi.

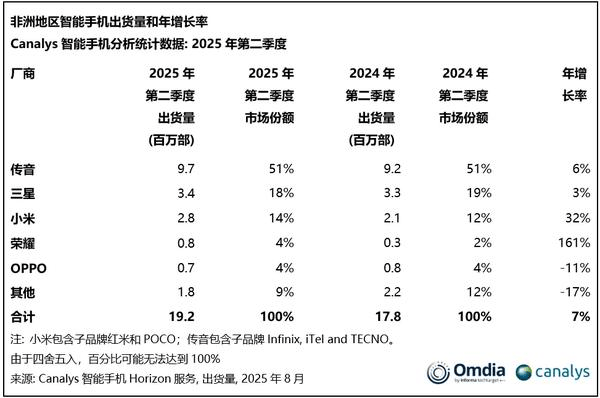

In the second quarter of 2025, Xiaomi Group (1810.HK) witnessed a 32% year-on-year increase in shipments in the African mobile phone market, while Transsion's growth rate stagnated at just 6%. Xiaomi's market share in Africa surged to 14.4%, securing the third position.

Xiaomi's relentless efforts in pricing strategies, channel expansion, and localization, coupled with the entry of Honor and other players, are reshaping the African mobile phone market landscape. The market is now testing Transsion's ability to maintain its half-market share stronghold.

01 The African Mobile Phone Landscape Shifts, with Xiaomi Gaining Momentum

In the first half of 2025, Xiaomi Group delivered impressive results: total revenue exceeded 227.249 billion yuan, a 38.2% year-on-year increase.

Specifically, Xiaomi's smartphone business revenue amounted to approximately 96.132 billion yuan, up 3.37% year-on-year from 92.996 billion yuan in the same period last year. Shipments reached 84.2 million units, a 1.69% year-on-year increase from 82.8 million units, maintaining Xiaomi's global third-place ranking in smartphone shipments with a market share of 14.7% for 20 consecutive quarters.

Notably, Xiaomi's expansion in Africa, an emerging market, has accelerated. Meanwhile, Transsion Holdings (688036.SH), the self-proclaimed "King of Africa," is witnessing its market share gradually eroded by competitors like Xiaomi.

According to the latest report from market analysis firm Canalys, Transsion shipped 9.7 million mobile phones in the African market in the second quarter of 2025, marking a 6% year-on-year increase.

While Transsion still holds a commanding 51% market share in Africa, Xiaomi's smartphone shipments soared by 32% year-on-year to 2.8 million units, lifting its market share to 14.4% and securing the third spot in Africa. Xiaomi is now within 4 percentage points of Samsung's 18% market share, with a shipment gap of less than 600,000 units.

The Canalys report highlights that Xiaomi's impressive growth is fueled by robust sales in Nigeria and Egypt, aggressive channel expansion, and significant local investments.

Meanwhile, a report by the Economic Observer, citing an employee from Transsion's African division, notes that Xiaomi's success is not ubiquitous across Africa but concentrated in West Africa, North Africa, and East Africa, with Nigeria, Kenya, and Morocco as key targets. In some of Transsion's strongholds, such as the Democratic Republic of the Congo, a strategic location in Central Africa, "Xiaomi has yet to make significant inroads."

Videos from Africa showcase Xiaomi billboards prominently displayed on the streets of Kenya, Nigeria, South Africa, and Morocco.

In addition to Xiaomi, Honor is also encroaching on the African market. Despite shipping only 800,000 units in the second quarter, its year-on-year growth rate soared to 166.67%, doubling its market share from 2% to 4%.

The financial impact of competitors like Xiaomi on Transsion is already evident.

In the first half of 2025, Transsion reported revenue of 29.077 billion yuan, a 15.86% year-on-year decrease, while net profit attributable to shareholders declined by 57.48% to 1.213 billion yuan. This is the first time since Transsion's listing in 2019 that both revenue and net profit have declined.

Transsion Holdings attributes this revenue decline to the product launch schedule and intensified market competition.

02 Xiaomi's Comprehensive Strategy and African Consumption Upgrades

Xiaomi's breakthrough in the African market is not a coincidence but the culmination of its "African strategy."

According to the Economic Observer, Xiaomi entered Africa in 2017, established a dedicated African business department in 2019, and explicitly identified Africa as a key growth region in its 2023 and 2024 annual financial reports.

In September 2024, Lei Jun, founder and chairman of Xiaomi Group, stated at the 8th China-Africa Entrepreneurs Conference that Xiaomi was already operating in 16 African countries, including Egypt, South Africa, Nigeria, Morocco, Algeria, and Kenya, and pledged to increase investments on the African continent.

Xiaomi chose the African market primarily due to the vast untapped demand for mobile phones, where strong competitors had yet to establish a significant presence.

In the second quarter of 2025, the African continent, with a population of 1.5 billion, saw smartphone shipments reach 19.2 million units, a 7% year-on-year increase, making it the fastest-growing region in the global smartphone market.

Xiaomi's "ace product" in its African market strategy is, of course, the Xiaomi smartphone, putting it in direct competition with Transsion.

In March 2025, Caijing Tianxia quoted insiders as saying that Xiaomi had internally formed a strategic group specifically to compete with Transsion. According to the Economic Observer, Xiaomi internally refers to this strategic group as the "Transsion Combat Office" or "T Combat Office."

Beyond competing for market share in African countries, Xiaomi smartphones are also locked in fierce competition with Transsion in terms of product and brand strategies.

Foremost among these strategies is the "price war."

Transsion's phones are primarily divided into three sub-brands: Infinix, Itel, and TECNO, catering to various price segments from ultra-low to mid-range.

The British Financial Times' "Tech Tonic" program mentioned that in 2023, Transsion's product pricing in Africa was approximately $110-120, emphasizing low prices and high cost-effectiveness.

According to public information from local e-commerce websites in Kenya and South Africa, Xiaomi not only launched the entry-level Redmi A3X (priced at approximately $60-80) in Africa but also covered the mid-to-high-end range of $200-450 through the Redmi Note series and Poco series, even introducing the Redmi Note 14 Pro 5G with 200MP imaging and IP68 protection, directly targeting the high-end market that Transsion finds challenging to penetrate.

To expand market share, Xiaomi has actively reduced prices for its smartphones. The performance announcement revealed that in the second quarter, despite increasing smartphone shipments, revenue decreased by 10.1% quarter-on-quarter to 45.5 billion yuan, primarily due to the decline in ASP (average selling price of smartphones).

In the first quarter of 2025, Xiaomi's smartphone ASP was approximately 1210.6 yuan, while in the second quarter, it fell by 11.3% to 1073.2 yuan. Xiaomi attributed this to the increased proportion of smartphone shipments in overseas markets with lower ASPs.

Furthermore, the African market is experiencing the dual trends of smartphone popularization and consumption upgrades. Previously, consumers favored basic features such as long battery life, camera optimization, and multiple SIM card slots, which are Transsion's strengths. However, with the proliferation of 5G, the rise of social media and video applications, users now prioritize processor performance, storage capacity, and brand image, areas where Xiaomi has natural advantages.

Unlike Transsion, which primarily expands in Africa with mobile phone products, Xiaomi boasts a more comprehensive ecosystem chain, capable of not only offering cost-effective hardware but also bundling IoT products with smartphones to enhance user loyalty. In contrast, Transsion's innovations are more focused on imaging algorithms and design, with a somewhat limited technical scope.

03 The African Mobile Phone Market Landscape Undergoes Transformation

Transsion's "dominant position" in Africa has a long history. With its three major brands—TECNO, Infinix, and itel—Transsion has long held over 50% of the African market share, earning it the title of "King of African Phones." However, with Xiaomi's accelerated penetration, the "moat" that Transsion prides itself on is being breached.

Transsion rose to prominence with low-cost models but has struggled to compete in the mid-to-high-end market. In contrast, Xiaomi has increased its average product price and profit margins through its premiumization strategy, creating a stark contrast.

Xiaomi's rapid rise signifies that the African market is no longer a "one-player game" for Transsion. With the entry of Samsung, Xiaomi, Honor, OPPO, and other vendors, competition in the African mobile phone market will intensify. In the coming years, Africa may witness a new landscape with multiple brands standing side by side.

Additionally, interesting data reveals that both Xiaomi and Transsion claim to rank among the top three in their respective global market shares, albeit with slightly different statistical methods.

Xiaomi stated in its financial report that, according to Canalys data, Xiaomi ranked third in global smartphone shipments in the second quarter of 2025 with a market share of 14.7%, maintaining a top-three position globally for 20 consecutive quarters.

On the other hand, Transsion Holdings stated that, according to IDC data, Transsion had a global mobile phone market share of 12.5% in the first half of 2025, ranking third among global mobile phone brands, with a smartphone market share of 7.9%, placing sixth globally.

It is evident that Transsion's market share in the smartphone market lags significantly behind Xiaomi's.

With the evolution of consumer demand and product iterations, the demand for smartphones in the African market is bound to increase. Whether Transsion can bolster its competitiveness in the African smartphone market may determine whether the title of "King of African Phones" will change hands.

In mid-August 2025, Xiaomi publicly announced significant personnel adjustments for its African region, including key positions such as the head of the East African theater, Kenya country manager, head of the African marketing department, and head of the African market after-sales service department, aiming to strengthen its refined operations in the African market.

It is foreseeable that in the coming years, the African mobile phone market will emerge as the most noteworthy "new battlefield" in the global smartphone landscape, with the rivalry between Xiaomi and Transsion potentially being one of the most captivating acts.