Cross-border Winds Sweep Through Mobile Phone Manufacturers: vivo Targets DJI Pocket, Will It Spark Another Ecological Revolution?

![]() 09/03 2025

09/03 2025

![]() 512

512

Do mobile phone manufacturers still need to create an 'ecological reaction'?

Apart from venturing into the automotive industry, what other avenues do mobile phone manufacturers explore for cross-border development?

Some manufacturers seem to have provided the answer. As reported by Jinxi Today, vivo, a smartphone giant, is actively deploying its presence in the handheld gimbal camera market, with the project initiated at the end of last year. The first product has completed the mold opening and is expected to be released next year.

Recently, rumors circulated that Honor might also join this cross-border battle, and some netizens even used AI to generate a series of potential Honor ecological products, including action cameras, handheld gimbal cameras, drones, and more.

(Image from Weibo)

As Lei Technology previously analyzed, manufacturers' cross-border development involves leveraging long-term technology research and development to create platform-level technology modules that can be extended to other industries. This is known as 'technology compound interest'.

Today, manufacturers capable of ranking among the top five have invested heavily and accumulated significant expertise in mobile phone imaging technology, which is sufficient to support their entry into other fields requiring imaging technology.

Signs of vivo's cross-border ambitions can be traced back to the vivo Vision conference and imaging ceremony held on August 21. During the event, vivo unveiled a newly upgraded imaging strategy, transitioning from single-point scenes to integrated scenes, from professional capability to popularization, and from individual abilities to empowering the masses. Additionally, the concept of integrated shooting between vivo mobile phones and vivo Vision was also mentioned, which will undoubtedly feature on the handheld gimbal camera.

Compared to making cars, developing a handheld gimbal camera is more practical. Moreover, with the growth of the mobile phone market having peaked, imaging technology is in demand beyond just mobile phones. This step may be worth considering for mobile phone manufacturers.

Aiming at DJI Pocket? vivo's First Handheld Gimbal Camera is Set

Continuing Jinxi Today's report, vivo's first handheld gimbal camera is positioned as a Vlog camera, targeting creative groups such as Vloggers and photography enthusiasts. It aims to provide a more stable and user-friendly handheld shooting solution, directly entering the market dominated by products from DJI and Insta360.

Not only vivo Vision but also vivo unveiled the portable professional slit lamp exploration version at the imaging ceremony. This is a strategic product based on the extension of imaging technology into the medical field. By combining mobile phone camera systems with medical optical design, it can help grassroots doctors improve diagnostic efficiency. Clearly, vivo has a significant commitment to the imaging technology path.

(Image from vivo)

Thus, the 'blueprint' for vivo's first Vlog camera is quite clear. It should be a handheld camera targeting the DJI Pocket series or the Insta360 Go series.

Gimbal and camera are precisely two of vivo's strengths. Among the vivo Apex concept phones that debuted in 2020, micro-professional gimbal stabilization technology was integrated into the main camera for the first time and applied to mass-produced models such as the X80 Pro, iQOO10 Pro, and X70 Pro+. Alongside Apex 2020, a black technology featuring a 5-7.5x continuous optical zoom lens was also released, setting a new trend for the next generation of imaging flagships.

Today, micro-gimbal technology has disappeared from vivo mobile phones, but the professional anti-shake capability has been retained.

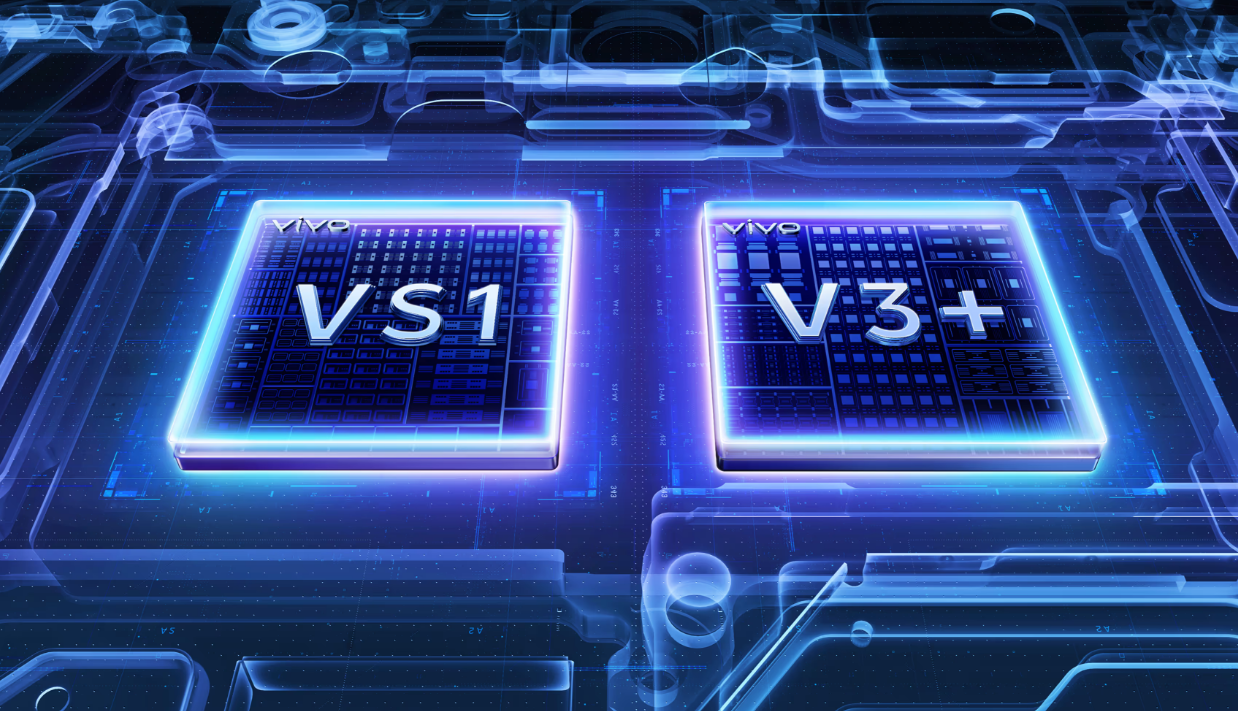

Mobile imaging is not just about anti-shake; it is also inseparable from the image processing system. More importantly, vivo's imaging is now supported by two self-developed chips: VS1 for front-end basic optimization and V3+ for back-end effect enhancement, forming a three-tier processing architecture alongside the mobile phone SoC.

(Image from vivo)

VS1 can achieve front-end optimizations such as dynamic range expansion, noise suppression, and distortion correction. It also uses AI algorithms to predict subsequent processing needs (e.g., when shooting moving objects) and transmit part of the data to V3+ for specialized optimization, reducing the load on the mobile phone SoC and enhancing the initial image quality.

V3+ is more familiar; it is a post-processing chip that more conveniently combines the rendering style desired by users with the native image. In short, it is a highly capable software and hardware solution.

Focusing on portable imaging products for mobile and computing, it does not pursue extreme optical devices like cameras. From a technical perspective, vivo's cross-border handheld gimbal camera is a perfect 'professional match' in the field, according to Lei Technology.

Cross-border into Handheld Gimbal Cameras: vivo Aims to Bolster Its Imaging Brand Power

Although vivo lacks the production experience of high-precision optical components comparable to camera manufacturers, mobile imaging and professional cameras follow different paths. The latter focuses more on the optical level, while the former emphasizes chip calculation and algorithm levels, which is a defining feature of cameras in the new era.

After all, handheld gimbal camera products represented by the DJI Pocket series and action camera products represented by the Insta360 Go series do not rely heavily on optical hardware. Moreover, the core sensor hardware of action cameras and handheld gimbal cameras is converging with mobile phones, eliminating the need for vivo to establish a separate supply chain system.

From a market perspective, vivo's cross-border entry into camera products may serve several purposes.

Firstly, the growth of the mobile phone market has peaked, and the market structure is relatively stable, entering an era of stock competition. According to data released by Counterpoint, vivo's annual market share from 2022 to 2024 was 19.2%, 16.9%, and 17.8%, respectively. In recent years, market share and competitors have continued to fluctuate. As a product that is almost 'one per person', it is challenging to develop new user groups.

Furthermore, smartphones are severely homogenized, and imaging hardware and technology routes are starting to converge, with increasingly obvious marginal effects. Often, manufacturers invest heavily in research and development, but the improvements are not as significant as anticipated. Apart from color adjustment styles, hard parameters like resolution and dynamic range make it difficult for competitors to differentiate themselves.

(Image from vivo)

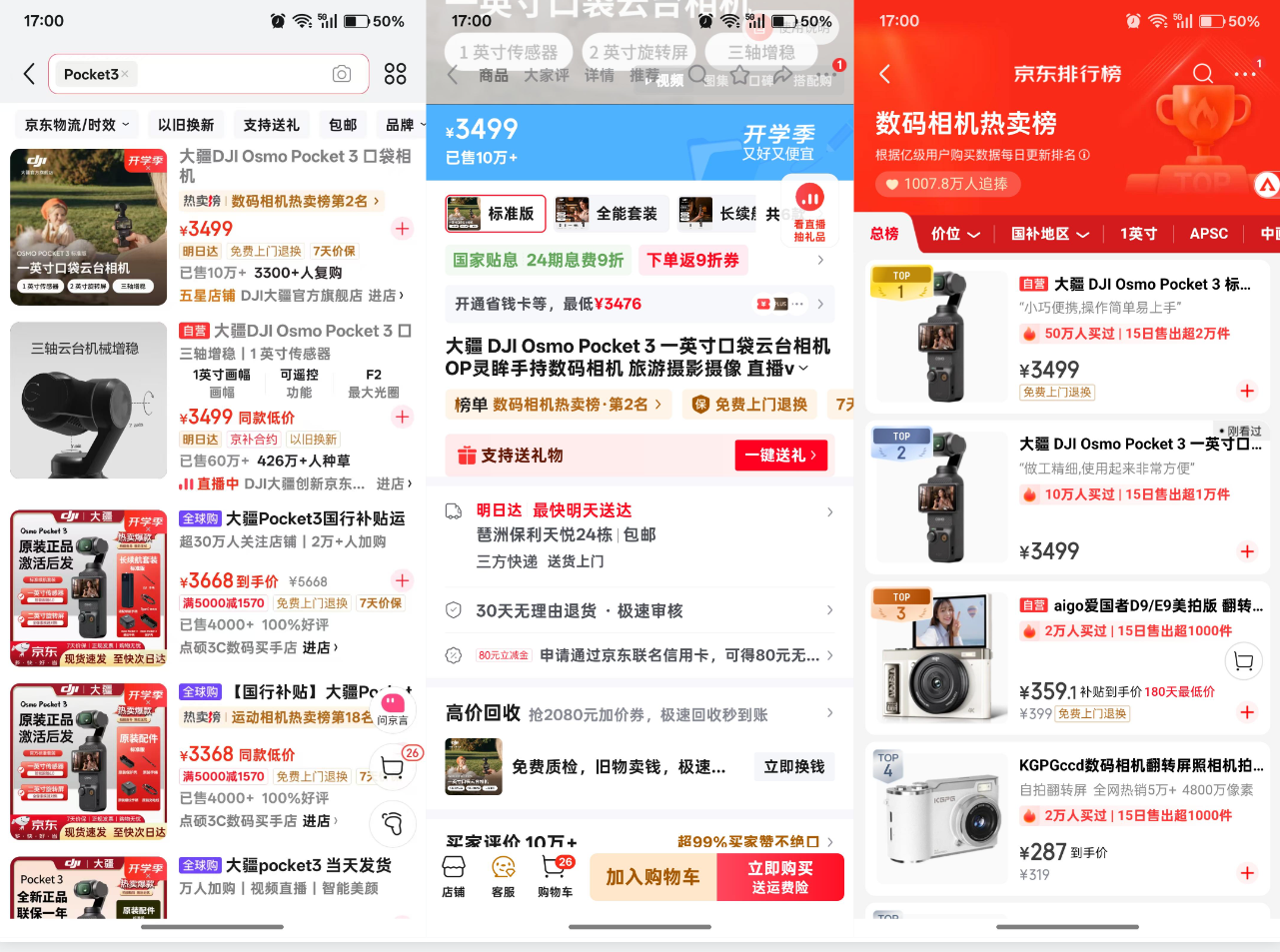

However, looking at a different category, handheld gimbal cameras or action cameras are still a blue ocean, especially handheld gimbal cameras. Currently, the market is almost exclusively dominated by the DJI Pocket series, leaving limited choices for consumers.

For users, concerts and events generally prohibit professional photography equipment, allowing only small shooting products like mobile phones or handheld gimbal cameras. In such scenarios, vivo's imaging set or handheld gimbal camera products become a rigid demand, aligning well with vivo's hard-earned reputation as a "concert artifact".

Lei Technology believes that vivo's entry into this market will have two impacts: one is to break DJI Pocket's dominance, and the other is that as the market sees vivo launch more professional camera products, it can deepen consumers' perception of vivo as a professional imaging brand, fostering a market perception of 'vivo=good imaging', which has positive implications for the mobile phone business.

(Image from Lei Technology Photography)

Handheld gimbal cameras are now as popular as cameras were in the past. Anyone with a slight recording or creative need cannot do without such a portable device. Because of this, DJI Pocket 3 was once hyped as "electronic Moutai", in short supply. Recently, DJI Pocket's new generation of products was unveiled, reportedly equipped with a dual-camera system and dual-screen design, further consolidating DJI's position in the handheld gimbal camera industry.

(Image from DJI Innovation)

So, why DJI Pocket?

To be precise, the DJI Pocket series achieved industry-wide acclaim with the third generation. But cultivating a popular product necessitates precise product definition, robust product strength, and the explosion of market demand—a confluence of the right time, place, and people.

The era of DJI Pocket 3 coincided with the surge in travel demand post-pandemic, driving the need for travel records. Combining portability, good image quality, and convenience for post-production, DJI Pocket 3 was and remains the "artifact for producing pictures" without a doubt. Moreover, DJI Pocket 3 boasts impressive product strength, featuring stable anti-shake performance, high image quality, excellent algorithms, and a plethora of templates and special effects for later stages. It can be used in various life scenarios such as friend gatherings and travel records, earning high praise even from professional media professionals.

Once in short supply, it perfectly bridges the gap between 'beginner' and 'professional' creators. Word-of-mouth spread on social platforms, infinitely amplifying DJI Pocket 3's internet celebrity status. It's no surprise that it was hyped as "electronic Moutai". Lei Technology has already provided targeted insights.

Currently, DJI Pocket 3 has gradually moved away from the shortage phase. The JD.com platform shows that DJI's self-operated channels have sold over 700,000 units, with 4.26 million recommendations and 3,300 repurchases. Overseas global purchase stores also have sales exceeding 4,000 units, ranking second on the digital camera bestseller list. So, who's at the top? It's still DJI Pocket 3.

(Image from Lei Technology)

The handheld gimbal industry is undergoing a paradigm shift from 'physical anti-shake' to 'intelligent imaging hub'. The '2025-2030 Comprehensive Research Report on In-depth Market Analysis and Development Planning Consultation of the Handheld Gimbal Industry' released by the China Research and Intelligence Institute points out that the global handheld gimbal market size has exceeded $10 billion. Clearly, despite the limited market options currently available, the handheld gimbal camera is a foreseeable new popular trend.

For mobile phone manufacturers, handheld gimbal cameras present a golden opportunity. With few options, great prospects, and easy entry, they can also help escape the fierce market competition in smartphones, achieve breakthroughs, and seek new growth. And DJI Pocket 3 is currently the only reference product in the handheld gimbal camera industry.

2025 is also the inaugural year of the explosion of creator hardware. Creator hardware manufacturers such as Insta360, DJI, and Mammut have risen rapidly, expanding the market. AI hardware based on imaging and audio technology will democratize creation, transitioning from professionalism to popularization. These manufacturers have benefited from the content entrepreneurship dividend.

As mobile phone manufacturers with existing imaging technology expertise, they obviously will not miss out on this market.

Is Making Cars Necessary? Do Mobile Phone Manufacturers Still Need to Create an 'Ecological Reaction'?

It seems that more and more mobile phone manufacturers are realizing that the future of smart devices is not about the 'single combat' of a single category but about 'cluster combat' centered around the theme of 'ecology'. When Jia Yueting proposed the 'ecological reaction' years ago, LeTV failed in 'chemical reactions' such as TVs, cars, and mobile phones. But today, the logic of the 'ecological reaction' is being validated by Huawei, Xiaomi, and others.

Lei Technology believes that today, it is challenging for a single mobile phone to form strong user loyalty. With severe homogenization, mobile phones are not irreplaceable products; it depends on who is more committed to innovation. However, once smart devices form an ecological closed loop, various seamlessly connected functions based on this ecology can significantly increase users' 'loyalty' to the brand. Xiaomi, Huawei, and Apple are prime examples.

It may be difficult for mobile phone brands like vivo and Honor to venture into making cars and home appliances, but leveraging their technological advantages to break through the existing circle may not be a bad idea.

Compared to making cars, handheld action cameras are easier to realize and can fully exploit the technological advantages that mobile phone manufacturers have accumulated in the field of mobile phone imaging. By stepping out of the smartphone circle, they may discover new growth points for their brands.

Taking vivo as an example, transforming the technological prowess in mobile imaging into a versatile technology module, which spans across diverse applications such as action cameras and medical imaging, and fosters an imaging device ecosystem, represents another form of 'cluster combat'. This integration with vivo's device ecosystem not only maximizes the advantages of its self-developed imaging chips but also introduces unique features like rapid data transfer and multi-camera synchronization between the camera and mobile phone, potentially differentiating it from competitors like DJI Pocket. With the launch of vivo Vision, the capability to capture spatial videos and photos is poised to become a distinctive selling point for this ecosystem-driven imaging product.

In the eyes of Lei Technology, crossing boundaries does not guarantee success. For vivo and other players venturing beyond the mobile phone realm to create professional camera products, there are both risks and opportunities. The opportunities lie in the limited market choices and significantly less intense competition compared to the mobile phone market. The challenge, however, rests in leveraging the market reputation and cutting-edge technology accumulated through mobile phone brands to compete against established products with strong brand potential, such as DJI Pocket.

There are precedents of mobile phone manufacturers faltering in cross-border endeavors. Samsung, despite having the capability to develop sensors and lenses independently, chose not to enter the professional camera market during the camera boom era.

Times have changed. Imaging has transcended mobile phone products, evolving into a product ecosystem that dominates fields like concert photography and live streaming. For vivo, establishing a cross-industry fusion ecosystem, with handheld gimbal cameras as the initial step, signals a broader ambition. Potentially, it is also gearing up for more competitive ventures in drones, action cameras, and beyond.

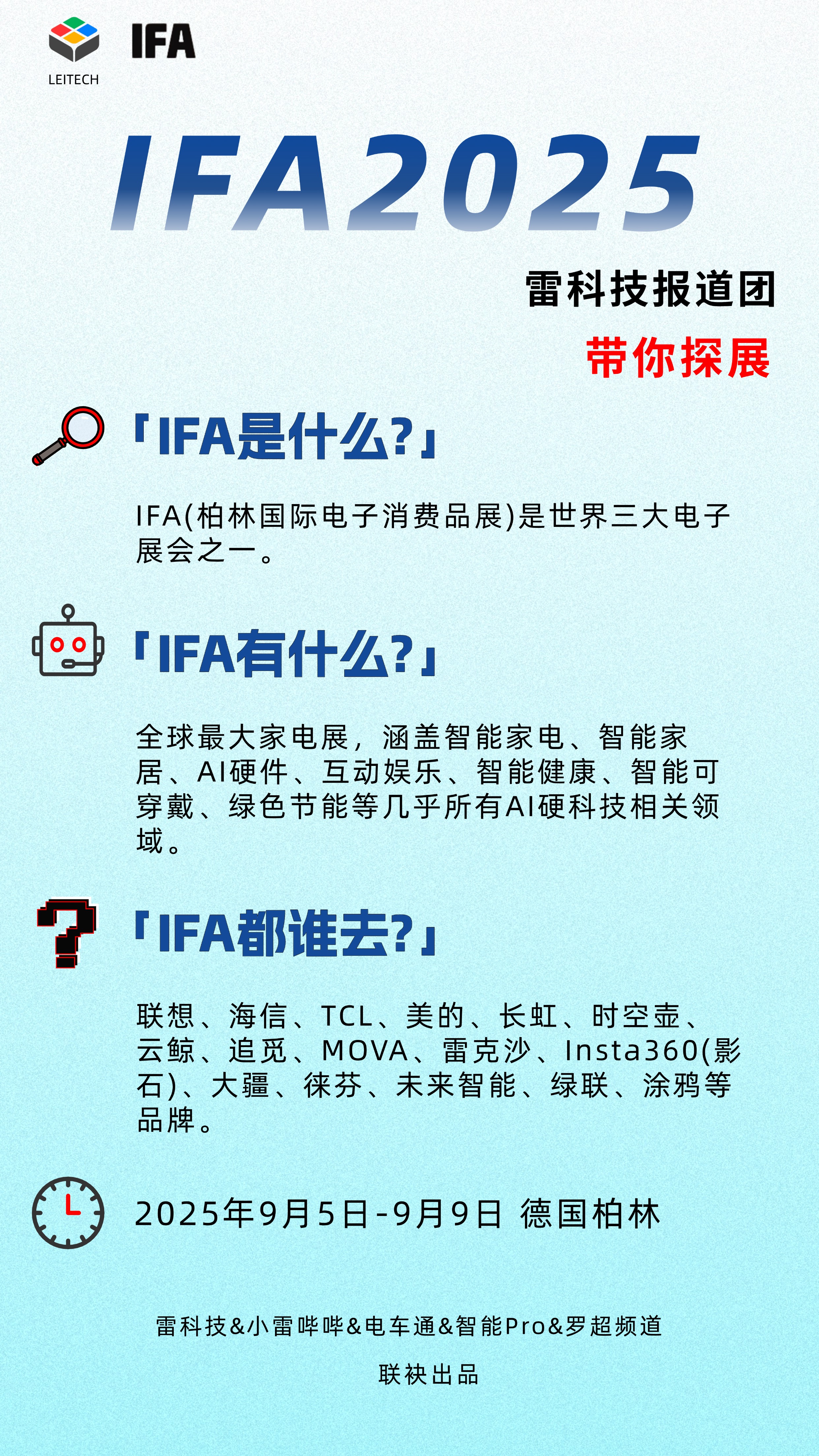

From September 5th to 9th, IFA 2025, the world's largest home appliance and consumer electronics exhibition, graced Berlin with its grand opening.

Chinese tech titans, including Lenovo, Hisense, TCL, Midea, Changhong, Haier, Timekettle, Future Intelligence, Anker, Ugreen, NARWAL, Dreame, MOVA, Tineco, Insta360, DJI, Vanward, Tuya, Lefant, INMO, Rokid, and many others, converged in Berlin to showcase China's dominance in AI hardware technology to the global stage.

The Lei Technology IFA 2025 reporting team is set to jet off to the venue shortly, exploring the exhibition and providing comprehensive coverage. Stay tuned!

Source: Lei Technology

Images in this article are sourced from: 123RF Authentic Stock Photo Library. Source: Lei Technology