Net Profit Soars 40%, Reaching Unprecedented Heights! Just Acquired a Third Listed Company—What Secrets Lie Behind This Success?

![]() 02/14 2026

02/14 2026

![]() 522

522

While everyone is focused on the price wars and the intensifying competition in the intelligent features of new energy vehicles, a low-key company based in Ningbo has just delivered an outstanding performance: a net profit of 1.35 billion yuan, marking a 40% year-on-year surge and hitting an all-time high. Just a few months ago, it also "acquired" its third listed company.

On January 27, 2026, just before the Lunar New Year, Joyson Electronic's announcement of a significant increase in expected earnings created quite a stir in the capital markets. With a net profit attributable to shareholders of 1.35 billion yuan, up 40.56% year-on-year, this figure not only set a new record for the company but also stood out prominently against the backdrop of widespread pressure in the entire automotive components industry.

Many still perceive Joyson Electronic as "that company obsessed with acquisitions." Indeed, since going public in 2011, the company has been on an acquisition spree, purchasing overseas firms such as Germany's Preh, America's KSS, and Japan's Takata assets, earning it the industry nickname "M&A Maniac."

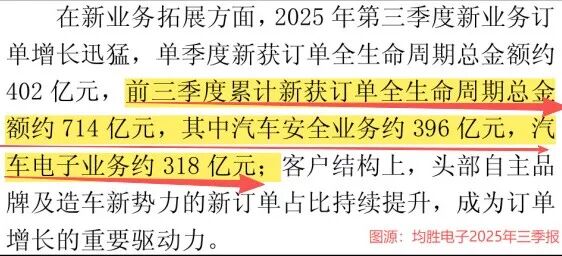

Yet, few have noticed the quiet transformation that has been taking place behind this aggressive M&A strategy. In the first three quarters of 2025, the company secured new orders with a total lifetime value of approximately 71.4 billion yuan, including 39.6 billion yuan for automotive safety and 31.8 billion yuan for automotive electronics.

More intriguingly, by late 2025, Joyson Electronic had successfully gained control of Sunshine shares through a series of sophisticated capital maneuvers, expanding founder Wang Jianfeng's empire of listed companies to three.

From "buying, buying, buying" to "acquiring A-share companies one after another"—what game is Joyson Electronic playing?

How will it manage the debt and goodwill pressures from these massive acquisitions?

From Automotive Safety to Electronics: A Two-Legged Approach Gains Stability

To understand Joyson Electronic's current position, we must first examine its business structure.

From the H1 2025 financial results, nearly all of the company's main business revenue came from automotive components (98.10%), with automotive safety systems and electronics forming the two pillars.

In H1 2025, automotive safety systems generated 18.98 billion yuan in revenue, accounting for 62.53% of total revenue. This segment includes both active safety (such as facial recognition and vehicle fire protection systems) and passive safety (such as seat belts, airbags, and steering wheels). As the world's second-largest automotive safety supplier, Joyson Electronic serves over 60 global clients across more than 300 vehicle models. Crucially, profitability in this segment is improving significantly, with a gross margin of 15.93% in H1 2025, up about 2 percentage points year-on-year.

Meanwhile, automotive electronics contributed 8.356 billion yuan in revenue (27.53% of total), spanning smart cockpits, intelligent driving, and new energy charging/power distribution. This segment boasted a much higher gross margin of 21.54%. From 2020 to 2024, automotive electronics revenue doubled from 7.599 billion yuan to 16.599 billion yuan. Although growth slowed somewhat in H1 2025, the segment maintained steady momentum.

In H1 2025, international markets contributed 22.54 billion yuan (74.28%) while domestic markets accounted for 7.657 billion yuan (25.23%). This global footprint offers both opportunities to tap into major automotive markets worldwide and challenges in cost control and integration for overseas operations.

The Price of Rapid Revenue Growth

Joyson Electronic's growth story is essentially an M&A story.

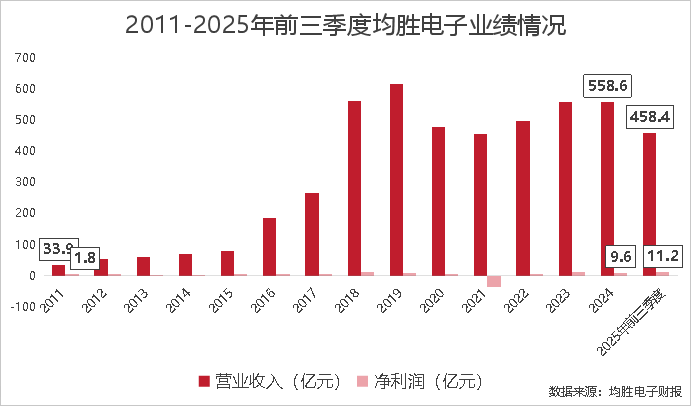

Since going public in 2011, the company has boosted revenue from 3.38 billion yuan to 55.86 billion yuan in 2024 through cross-border acquisitions—a nearly 16.5-fold increase. But this "acquisition-driven" scale has brought real financial pressures.

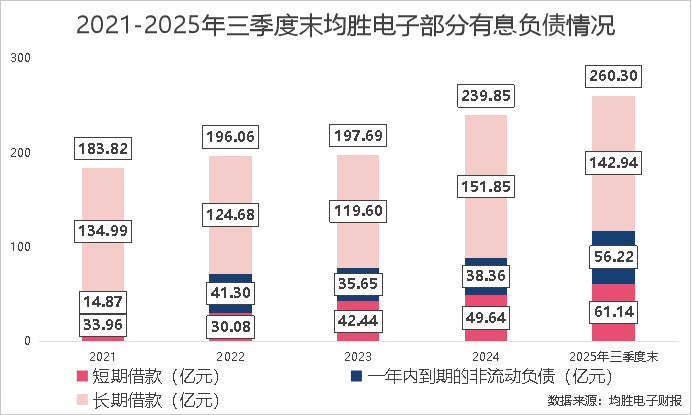

As of Q3 2025, the company reported short-term borrowings, current portion of non-current liabilities, and long-term borrowings totaling 26.03 billion yuan (6.114 billion + 5.622 billion + 14.294 billion), up 8.45% from end-2024.

This massive debt translates into hefty interest expenses. From 2021 to 2024, interest expenses rose from 932 million yuan to 1.13 billion yuan, driving financial expenses from 478 million yuan to 828 million yuan—nearly doubling. In the first three quarters of 2025, interest expenses already reached 894 million yuan, with a financial expense ratio of 1.82%, significantly higher than peers.

Frequent M&A have also sent goodwill soaring from 13.45 million yuan in 2011 to 7.25 billion yuan by Q3 2025—a nearly 520-fold increase. Goodwill now accounts for 32.7% of net assets, exceeding the 30% warning line.

Joyson Electronic has been burned by goodwill impairment before. In 2021, due to KSS's underperformance, the company took a 2.019 billion yuan goodwill write-down, resulting in a massive 3.753 billion yuan annual loss.

High management and financial expenses directly squeeze profit margins. In the first three quarters of 2025, the net profit margin was just 2.97%—an improvement year-on-year but still well below peers like Desay SV (8-13%) and Tuopu Group.

In the first three quarters of 2025, revenue reached 45.84 billion yuan (+11.45% YoY) with a net profit of 1.12 billion yuan (+18.98% YoY). More importantly, operating cash flow continued to improve, supporting future growth.

Sunshine Shares: A "Sell High, Buy Low" Strategy

If early acquisitions aimed to "buy technology and markets," the recent Sunshine shares acquisition demonstrates Joyson Electronic's more mature capital operation capabilities.

This case is a textbook example of "an A-share company acquiring another A-share company."

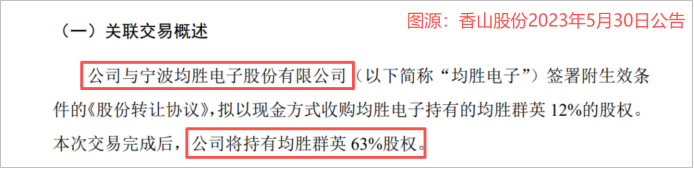

In November 2021, Joyson Electronic sold 51% of its subsidiary Joyson Automotive to Sunshine shares for 2.04 billion yuan, followed by another 12% stake sale in May 2023 for 510 million yuan. Through these moves, Joyson Electronic recovered 2.55 billion yuan in cash while divesting automotive functional components and premium interior businesses that didn't align with its core strategy.

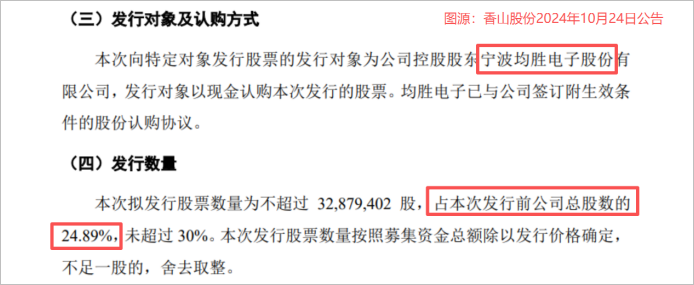

Starting July 2023, Joyson Electronic gradually acquired a 24.07% stake in Sunshine shares through agreement transfers (negotiated transfers) and share purchases, spending about 980 million yuan.

In October 2025, with Sunshine shares issuing new shares to Joyson Electronic, this nearly five-year capital operation concluded, leaving Joyson with a 44% stake and control.

This "sell high, buy low" strategy brought multiple benefits: net cash recovery exceeding 1.5 billion yuan eased funding pressure. Sunshine shares specializes in smart cockpits, air management, interiors, and new energy charging systems—highly complementary to Joyson's automotive electronics. With strong cash flow (current ratio near 2.0, debt-to-asset ratio about 20%), Sunshine can provide financial support to Joyson.

As Joyson stated: "Sunshine's automotive components business focuses on smart cockpits and new energy charging products, creating synergies with our smart cockpit and new energy businesses for a 1+1>2 effect."

Robots: The Next Growth Frontier?

While solidifying its automotive core, Joyson Electronic has begun deploying in the next battlefield: humanoid robots.

In April 2025, the company established a wholly-owned subsidiary, Ningbo Joyson Embodied AI Robotics Co., Ltd., and rapidly built its talent team. The logic is clear: the automotive and robotics industries are converging, and Joyson's R&D and advanced manufacturing capabilities in automotive components can extend upstream and downstream in the robotics supply chain.

Current achievements include developing gas sensors with 20-second response times and >99% accuracy for eight single gases. At CES 2025, it showcased a general-purpose humanoid robot dexterous hand and began customer sampling.

The company plans to position itself as a "Tier 1 Automotive + Robot" supplier, providing integrated hardware-software solutions for robot key components to global automakers and robotics firms.

Founder Wang Jianfeng: A Legendary Figure

This Zhejiang businessman with an art background started by taking over his father's small fastener factory and built Joyson Electronic into the world's second-largest automotive safety supplier through precise cross-border M&A. The Hurun Rich List shows the Wang Jianfeng family's wealth reached 11 billion yuan in 2024.

Regarding strategic choices, Wang explained: "We focus on automotive components manufacturing supplemented by capital operations—a dual-wheel drive model where the capital platform supports manufacturing growth."

In November 2025, as control of Sunshine shares was secured, Wang signaled confidence through Joyson's announcement: "We'll establish industrial funds to identify opportunities in intelligent and new energy vehicle supply chains, primarily investing in high-tech areas like intelligent vehicles, new energy, hard tech, semiconductors, AI, and robotics."

Yan Xi observes that Joyson Electronic has invested in globally leading technologies, production capacities, next-gen automotive intelligence high grounds, and key supply chain integration points.

These assets, while burdensome during downturns, deliver massive upside during upcycles—as evidenced by the 2025 record net profit.

The Sunshine acquisition's significance is underestimated. This wasn't simple "A acquiring A" but sophisticated capital operations and strategic synergy. Through "sell first, buy later," Joyson recovered cash, optimized structure, and acquired a cash-rich, business-complementary asset—demonstrating mature capital operation capabilities.

Goodwill risks require objective assessment. While 7.25 billion yuan in goodwill (32.7% of net assets) exceeds warning levels, two points merit attention:

1. This goodwill comes from acquiring global leaders like KSS and Takata—high-quality assets. 2. Having learned from past impairments, Joyson will manage goodwill more prudently. More importantly, the "economic goodwill"—customer resources, tech accumulation, brand value—represents Joyson's most valuable, unquantifiable assets.

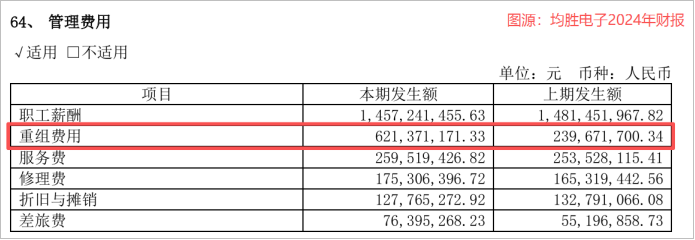

Of course, risks remain: 26 billion yuan in interest-bearing debt consumes nearly 1 billion yuan in annual profit; 2.97% net margin lags peers; overseas integration continues with high restructuring costs...

These warrant ongoing attention.

But as of February 2026, Joyson Electronic has responded to most market doubts with performance, orders, and strategic layout (deployments). From a small Ningbo automotive fastener maker to the world's second-largest automotive safety supplier controlling three listed companies, Joyson has come a long way in 20 years.

It never chose the easiest path—merger integration challenges, debt pressures, goodwill anxieties at every step. But precisely this "buy, buy, buy" strategic resolve and integration capability have positioned it advantageously in this automotive industry transformation.

In 2026, the intelligence wave continues surging, and the robotics race has just begun.

Note: (Disclaimer: Content and data are for reference only and do not constitute investment advice. Investors act at their own risk.)