Ten Days of Terror for Tech Giants: iPhones Avoid Price Hike as Apple Transitions from Crisis to Calm Overnight

![]() 04/14 2025

04/14 2025

![]() 650

650

Earlier, Reuters revealed that at the end of March, Apple took the unusual step of chartering multiple cargo flights to urgently transport over 600 tons of iPhones from India to the US.

The reason is straightforward: iPhone production heavily relies on the global supply chain, particularly the Asian supply chain. However, on April 2, the US announced that it would impose reciprocal tariffs of at least 10% on global trading partners, including China. Tariffs on China even soared to 34% and have continued to climb, reaching 145%.

Yet, the situation swiftly took a turn.

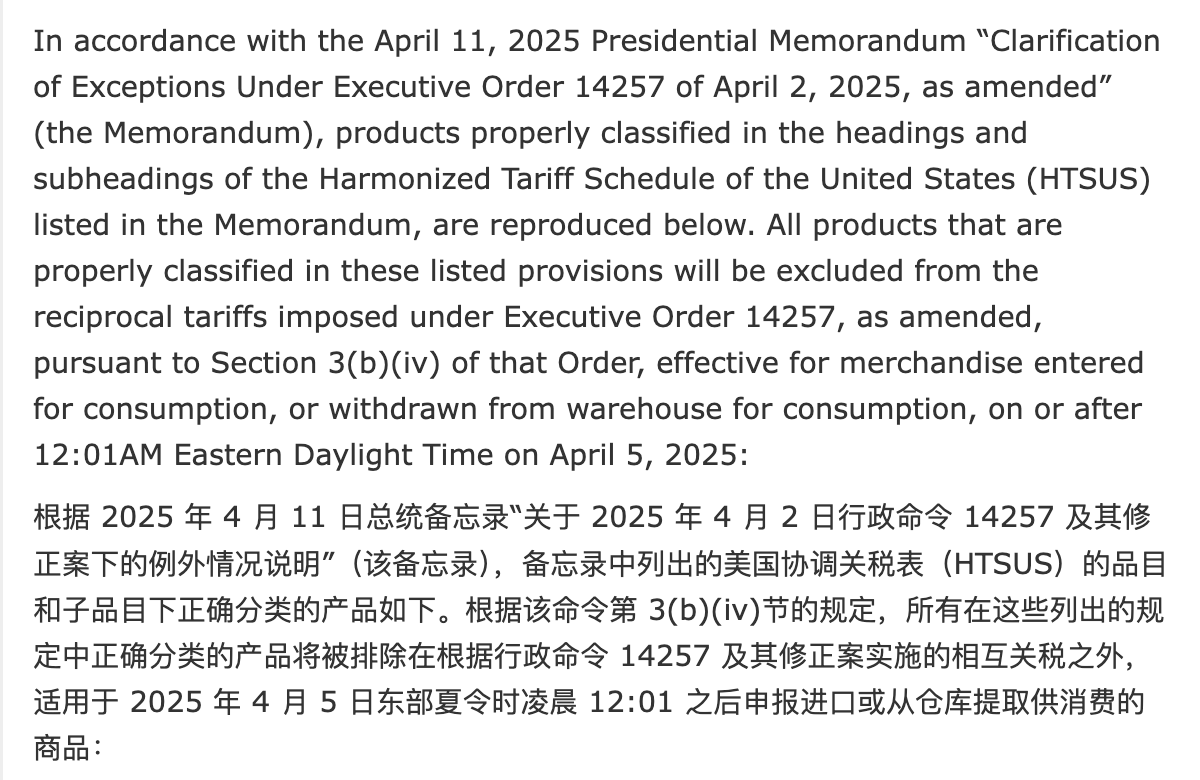

On the evening of April 11, local time, the US Customs and Border Protection (CBP) announced that it would exempt certain electronic products from "reciprocal tariffs," including smartphones, laptops, processors, memory, hard drives, display devices, and semiconductor equipment. Tariffs already paid could be refunded.

Image/US Customs and Border Protection

In simple terms, Apple importing iPhones made in China/India to the US market, or US tech giants like Microsoft and Nvidia importing chip products like processors, can now be exempted from the direct impact of "reciprocal tariffs." Similarly, Asian supply chain manufacturers and end manufacturers, including China, such as BOE's LCD/LED panels, Lenovo's laptops, and Samsung's smartphones sold in the US, can also avoid the direct impact of these tariffs.

From the introduction of the policy to its implementation and subsequent rollback, it spanned just ten days. This series of actions by the US government appears rather "hasty," causing the world to ride several roller coasters. After several nights of anxiety, tech manufacturers found it was all just a false alarm. The tacit approval of a series of electronic product "exemptions" reflects the practical difficulties faced by the US government:

US tech products cannot function without Asia, and specifically, without China.

Hence, the US has exempted these electronic products. US tech giants need a respite, and US consumers also require mobile phones, tablets, laptops, hard drives, and other electronic products without drastic price hikes. Of course, the new exemption policy is also destined to affect countless Chinese manufacturers.

No More iPhone Price Hikes, Apple Transitions from Crisis to Calm Overnight

"Now there's no reason for the iPhone to increase in price, right?"

This joke by netizens is the result of a realistic compromise by the US government. Among the key products exempted from this round of US reciprocal tariffs is the smartphone.

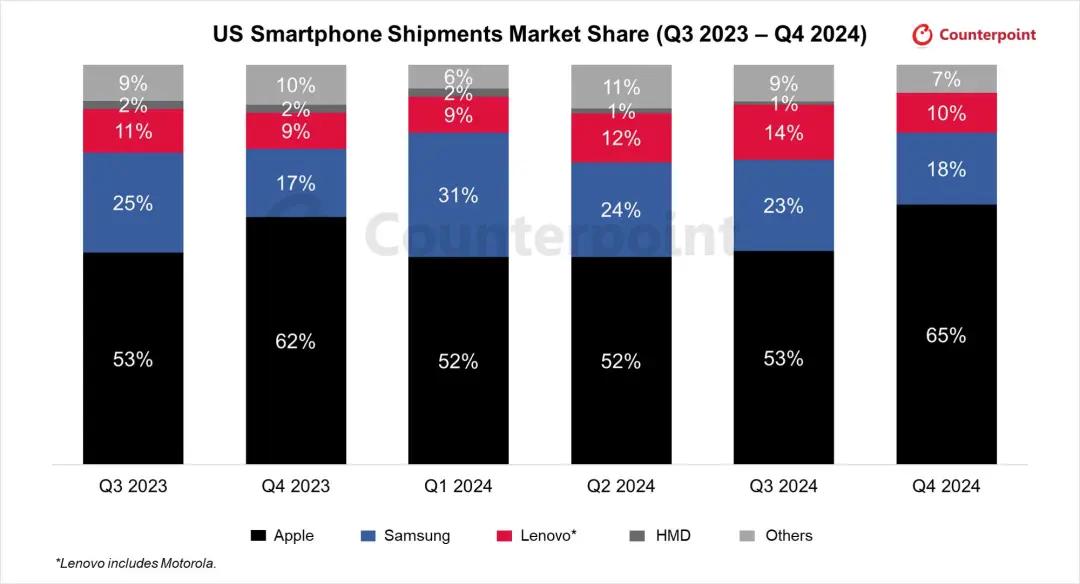

It should be noted that the iPhone is virtually the "national hard currency" of the entire US consumer electronics market. According to reports from market research firm Counterpoint Research, Apple's share of the US smartphone market remained above 50% for four quarters in 2024, reaching 65% in the fourth quarter alone.

Image/Counterpoint Research

According to previous calculations by Bloomberg, if the cost of reciprocal tariffs were fully passed on (in extreme cases), Apple would have to increase the price of a Pro Max from $1,599 to $2,300, a nearly 45% increase. In the current economic environment of high interest rates and inflation, this price hike would undoubtedly hit consumers' demand for new phones.

Even if a more practical strategy is adopted—distributing the tariff increase costs to Apple itself, upstream and downstream players, consumers, and other markets to varying degrees—it would inevitably affect the future sales performance of the iPhone.

However, with the introduction of the exemption policy, the pricing logic of the iPhone in the US market was temporarily maintained. Devices shipped from Apple's factories in Zhengzhou, China, and Chennai, India, will not be forced to raise prices due to a surge in tariffs. As a result, a large number of "Apple supply chain" manufacturers, such as Sunny Optical and Luxshare Precision, theoretically do not need to worry about significant reductions in Apple orders in the short to medium term.

As for iPhones in mainland China, in fact, according to Lei Technology's previous analysis, the impact before the introduction of the exemption policy was relatively small, and it will theoretically be even smaller after its introduction. More importantly, according to the latest regulations of the General Administration of Customs of China, Apple's entire line of chips (none of which are "taped out" in the US) are also not directly affected by China's punitive tariffs on the US, further reducing the medium-term factors influencing iPhone costs.

Image/Lei Technology

Moreover, it's not just Apple. Samsung and Lenovo (including Motorola) will also benefit from the new exemption policy, being able to import their smartphones to the US market without being directly affected by "reciprocal tariffs." As for Xiaomi, OPPO, vivo, and Huawei, since their market share in the US is very limited, the impact of whether or not they are exempted is minimal.

After the Earthquake in the PC Industry, It Will Recover Overnight Thanks to the "Exemption" Policy

Beyond mobile phones, the PC industry is arguably the core industry most affected by the US "reciprocal tariffs." After the announcement of "reciprocal tariffs," almost all mainstream PC brands, including HP, Dell, Acer, ASUS, and Lenovo, chose to suspend shipments to the US for two weeks pending policy clarification.

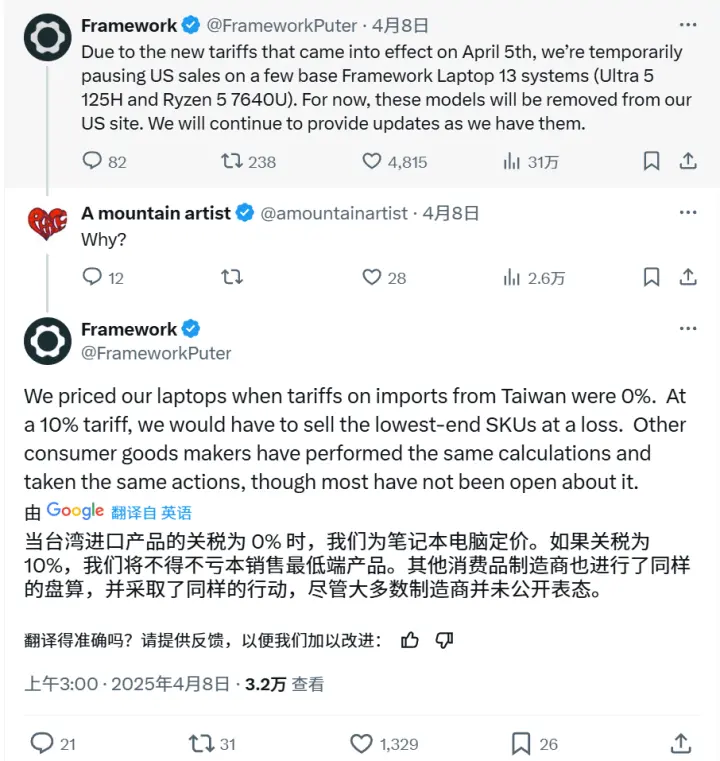

Some manufacturers, such as Razer and Framework, directly suspended sales in the US market. Framework even pointed out that the original pricing was set based on the standard of "0 tariffs" for imports from Taiwan, China, but due to the benchmark "reciprocal tariffs" of 10%, if its entry-level products continued to be sold, it would truly be "selling at a loss."

Image/X

According to the latest exemption policy, in addition to laptops, which occupy the absolute majority of the PC market and receive the most attention, core components of PC products, including processors, memory, hard drives, motherboards, etc., are also included in this exemption list.

Theoretically, if there are no major changes in the situation, the PC industry will return to a normal pace after the "two-week observation period." It goes without saying for HP and Dell, the two US manufacturers that ranked first and second in the US PC market share in 2024 (according to Canalys data), with 25.3% and 22.8% respectively, and they will certainly not give up.

As the PC brand with the largest global shipments, Lenovo is also the third-largest vendor in the US market and naturally cannot give up. Moreover, Lenovo not only has a core assembly plant in Hefei, China, but also has a Mexican plant serving the American market and a Hungarian plant serving the European market. Even in the worst-case scenario, it still has the opportunity to maintain a relative cost advantage.

Image/Lenovo

However, the arrival of the exemption policy undoubtedly gives Lenovo, HP, Dell, Acer, ASUS, and many ODM manufacturers such as Compal, Wistron, Quanta, Foxconn, etc., a valuable window of opportunity. The upstream of the industry chain is therefore "unshackled" to a certain extent.

On the other hand, what the US does not want to see is not only the crazy surge in the prices of complete machines but also a comprehensive surge in the IT procurement costs of enterprise service providers such as Microsoft and Google—these costs will ultimately be "passed on" to consumers and enterprise services, ultimately overwhelming the US economy.

The Chip Industry Takes a "Reassurance Pill," with Intel Being the Exception

Finally, there is the most inseparable part of this game: chips. This round of exemptions does not directly involve semiconductor design companies (such as Nvidia, Qualcomm, AMD) or chip foundries (such as TSMC, Samsung, SMIC), but it includes two key items: "semiconductor equipment" and "processors."

This means that the US may intentionally "clear" the circulation of chips in complete machines while also wanting to avoid a disruption in the supply of indispensable components such as equipment and motherboards due to tax increases.

The US certainly wants to continue encouraging chip manufacturers to build factories in the US, but it remains a challenge. Just before the US exempted some electronic products from "reciprocal tariffs," the China Semiconductor Industry Association suddenly issued a statement in the morning of April 11, citing relevant regulations of the General Administration of Customs, stating that the place of "tape-out" of "integrated circuits" is considered the place of origin. The association also suggested that when declaring the place of origin for imported integrated circuits, enterprises should declare based on the location of the "wafer tape-out factory."

Image/China Semiconductor Industry Association

In fact, except for a few chip manufacturers such as Intel, Micron, and Texas Instruments that have wafer fabs in the US, the advanced process chips of chip giants such as Apple, Nvidia, AMD, and Qualcomm are all taped out and mass-produced at TSMC (primarily in Taiwan fabs) or Samsung (primarily in Korean fabs), and are not affected by the recent surge in tariffs.

Relatively speaking, this also significantly increases the resistance for US chip design companies to "return to US manufacturing." Once they return to local tape-outs, they will be recognized as US products by China and thus face punitive tariffs several times higher than the normal tax rate, which will directly affect the cost of products made in China such as the iPhone. But if they continue to entrust TSMC in Taiwan, China, or Samsung in South Korea for foundry services, they can still enter the huge Chinese market with lower tariffs.

For domestic consumers, the chip costs of Apple, Qualcomm, Nvidia, and AMD will not be directly affected by punitive tariffs. Specifically, mobile phones (including domestic and iPhone) and PCs made in China will not experience significant price fluctuations due to chip costs. The same applies to the US consumer market.

However, the situations for the two major vendors, Intel and Micron, are relatively special. Especially for Intel, which has a significant impact (considering only currently operating factories), besides commissioning TSMC for tape-outs and production of Ultra 200V, it has 3 wafer fabs in the US and 1 in Ireland and 2 in Israel overseas (with the Irish fab planning to mass-produce 3nm this year, and originally there was a planned fab in Israel using the most advanced process, which was suspended last year). This means that many of Intel's chips currently imported to China will still be affected by "reciprocal tariffs."

Final Thoughts

Undoubtedly, the introduction of the exemption policy is a concession or retreat by the Trump administration, providing a "breather" for most affected manufacturers. But it's only a "breather," after all, there is still a "sword of Damocles" hanging over everyone's hearts, namely:

No one knows what else will happen in this "farce" led by the Trump administration.

Therefore, before the results of "reciprocal tariffs" are finalized, we still need to prepare for everything we need to prepare for and then face the challenges. Trump's wave of "crazy operations" has at least made us more aware of our bottom line. Regardless of whether he and the US government "admit defeat" (in fact, they have already lost), regardless of how this wave of tariff farce ends, we must strive to "do our own thing" in order to remain unchanged in the face of change.

Source: Lei Technology