"Taobao Flash Buy" Launches Surprise Takeout Offensive, Revealing Ambitions Behind Early Full-Scale Launch

![]() 05/06 2025

05/06 2025

![]() 556

556

After a decade, the second iteration of the takeout war has commenced.

On one side, Meituan and JD.com engage in fierce competition, while on the other, the industry and consumers eagerly await Ele.me's move. However, they were surprised to receive not only Ele.me's major announcement of "over RMB 10 billion in subsidies" but also the joint launch of "Taobao Flash Buy" by Taobao and Ele.me on the eve of May Day.

What's more noteworthy is that the news on April 30, stating "Taobao Flash Buy will launch in 50 cities on its first day and expand nationwide on May 6," hinted at Taobao and Ele.me joining the takeout fray.

Then, on the morning of May 2, just two days after the official announcement of "Taobao Flash Buy," the original business timeline suddenly accelerated. Taobao's official Weibo account declared: "Taobao Flash Buy is launched nationwide ahead of schedule. Users across the country can now receive large red envelopes through the Taobao Flash Buy entry to purchase takeout."

This information began to give the takeout war a new dimension. The "winning combination" of "versatile Taobao + reliable and punctual Ele.me" started to unveil different ambitions and market potential.

Now, looking back at the inception of this war, why did it take Ele.me so long to enter the field? And what does the collaboration with Taobao signify?

It seems that everything is no longer as straightforward as "who will deliver this takeout order."

[The Warfare Stems from the Underlying Logic of E-commerce]

With the emergence of "Taobao Flash Buy" and the joint entry of Ele.me and Taobao, the underlying commercial rationale behind this melee becomes increasingly clear.

On the surface, it's about takeout subsidies that are almost dirt cheap, but what consumers overlook is that "Ele.me's supply is fully open to Taobao Flash Buy," which is an even more significant layout.

Taobao Flash Buy allows consumers to enjoy both Taobao's prices and rich product categories and Ele.me's delivery efficiency when shopping.

Obviously, Taobao and Ele.me aim to achieve not just traditional food delivery but instant delivery services encompassing a wide range of items, from alcoholic beverages, supermarket goods, gifts, and flowers to clothing, 3C digital products, and more, now available on Taobao Flash Buy.

This instant retail mindset of "everything can be delivered" is the root cause of the current takeout war.

According to the "2024 China Instant Delivery Industry Research Report" released by iResearch, the market size of the instant delivery industry was about RMB 341 billion in 2023 and is projected to exceed RMB 810 billion by 2028, making it one of the few sectors with sustained double-digit annual growth.

In the past, far-field e-commerce and near-field e-commerce were relatively independent, but as instant retail becomes the future, friction in their core interests is inevitable, making melee an inevitability.

Besides the collaboration between Taobao and Ele.me, Meituan and JD.com also have their strategies in place.

The former has continuously expanded into diversified categories in recent years and launched "Meituan Flash Buy" this year. The latter is gradually expanding into offline supermarkets, Dada, and other areas, and this year directly entered the takeout business.

However, Taobao and Ele.me don't need to go through the same "trouble" as Meituan and JD.com.

For Ele.me, it can naturally leverage Taobao's brand e-commerce merchant advantages and new traffic. Taobao, in turn, gains access to Ele.me's mature takeout ecosystem. This effectively avoids losses from internal friction and competition.

As early as July last year, Ele.me had already begun in-depth cooperation with "Hour Reach," the precursor to Taobao Flash Buy. In less than a year, Taobao Hour Reach has provided millions of new consumers to Ele.me.

In such a system, this pair of Alibaba siblings can naturally maintain their composure.

[Composure Stems from a Solid Business Foundation]

Understanding the underlying logic of this war helps to comprehend why Taobao and Ele.me can maintain their composure amidst the "war of words."

Why engage in a "war of words"?

The reason is simple: new players need visibility and a certain scale of new customers.

However, today's e-commerce industry is already relatively mature, and there are almost no new users to reach, while old users already have relatively stable consumption habits.

For Taobao and Ele.me, whether far-field or near-field, they already have enough established users, and the "war of words" is actually difficult to sway these groups.

Moreover, even if the "war of words" can have an impact for a while, the core of long-term competition in the takeout industry still needs to return to the true foundation of the enterprise – better services and a mutually beneficial and win-win stable relationship between merchants, users, and riders.

Therefore, don't be fooled by their apparent quietness; in fact, they have been quietly enhancing their internal strength and laying a solid business foundation for months.

On the user side, Ele.me has launched the Yangtze River Delta Local Life Low-Altitude Delivery Service Project and the "Holographic Shield" system.

The former breaks through the traffic bottleneck of the delivery area for takeout riders in the past and can bring users a faster and better new logistics experience.

The latter utilizes AI technology to more efficiently identify risk points such as brand infringement, illegal products, and fake stores, achieving the goal of timely detection and disposal, and allowing users to consume with greater peace of mind.

On the merchant side, Ele.me has introduced the "AI Onboarding Smart Manager" for new merchants. This AI-based smart assistant not only supports natural language conversational services but can also guide merchants through the onboarding process in one stop, enabling merchants to complete processes such as data submission and pre-review in as little as 5 minutes.

On the rider side, Ele.me has launched the rider AI assistant "Xiaoe," which, through large model technology, can comprehensively cover riders' delivery scenarios, improving riders' efficiency and experience, making it easier and safer for riders to complete orders.

Especially regarding the issue of "rider protection" at the forefront of the "war of words," Ele.me has invested heavily.

So far, from users to merchants and then to riders, Ele.me's performance in AI technology applications has been extremely rapid in just a few months, and it is fully prepared for cooperation and alliance, just waiting for the right opportunity.

[Only by Adhering to Strategic Layout Can We Seize the Opportunity for Battle]

"Fighting also requires strategy. The reason why Taobao and Ele.me didn't rush in when the other two were fighting fiercely is that they didn't want to get dragged into it."

Having already experienced a takeout war, Ele.me obviously has a deeper understanding of this new round of battle.

After all, there are no winners in a "war of words." While voice and traffic are certainly desirable, they still bring about controversies such as the "either-or" game and "delivery delays."

Now that the "war of words" has gradually subsided, consumers are gradually returning to their ultimate consumption experience.

It is feared that before officially entering the field, Ele.me had already begun to conduct preliminary probes into consumer sentiment.

Just three days before "Ele.me's subsidies exceeding RMB 10 billion," the trending topic "Ele.me is so cheap after using coupons that I dare not order" surged to the top, and it is evident that the official timing for entry was data-driven.

On one hand, both platforms have laid a solid business foundation, and it is the best time to capitalize on the situation.

On the other hand, summer is the peak season for the takeout industry, so launching the summer battle in June has become the norm for Ele.me, which can fully tap into the traffic of the takeout war and take the initiative to advance a bit.

Looking back now, it is reasonable that the emergence of Taobao Flash Buy was scheduled for April 30.

After all, even if Alibaba has ample funds, they need to be used effectively to achieve the best results and ensure the stability of long-term strategic layouts across different platforms, avoiding self-disruption due to sudden melees.

In fact, this style of "wanting both" can already be seen in previous financial reports.

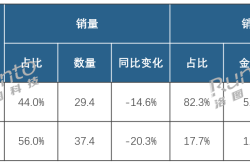

In FY2022, local life losses (adjusted EBITA) were as high as RMB 22 billion, but by FY2023, losses had narrowed to RMB 13.1 billion, and in FY2024, they further narrowed to RMB 9.8 billion, showing a clear stepped decline.

It neither blindly focused on reducing losses at the expense of growth and market share nor expanded losses in pursuit of growth.

And in the third-quarter financial report (October 1 - December 31) for FY2025 released on February 20, driven by order growth from Ele.me and Gaode, the local life group's year-on-year revenue increased by 12%, and losses adjusted for EBITA narrowed significantly from RMB 2.068 billion in the same period last year to RMB 596 million.

It is evident that under the robust operating rhythm and clear strategic direction of Alibaba's local life business, the business cycle has reached an inflection point towards profitability.

At this juncture, encountering a takeout war after a decade is actually an opportunity for Ele.me.

It seems that in the upcoming transformation of the new takeout landscape of far-field + near-field, Taobao and Ele.me are already well-prepared.

Disclaimer

This article involves content related to listed companies and is based on personal analysis and judgment by the author, utilizing information (including but not limited to temporary announcements, periodic reports, and official interaction platforms) publicly disclosed by listed companies in accordance with legal requirements. The information or opinions in the article do not constitute any investment or other business advice, and Market Value Observation does not assume any responsibility for any actions taken as a result of adopting this article.

——END——